Middle East and Africa Bottled Water Market Size (2024-2030)

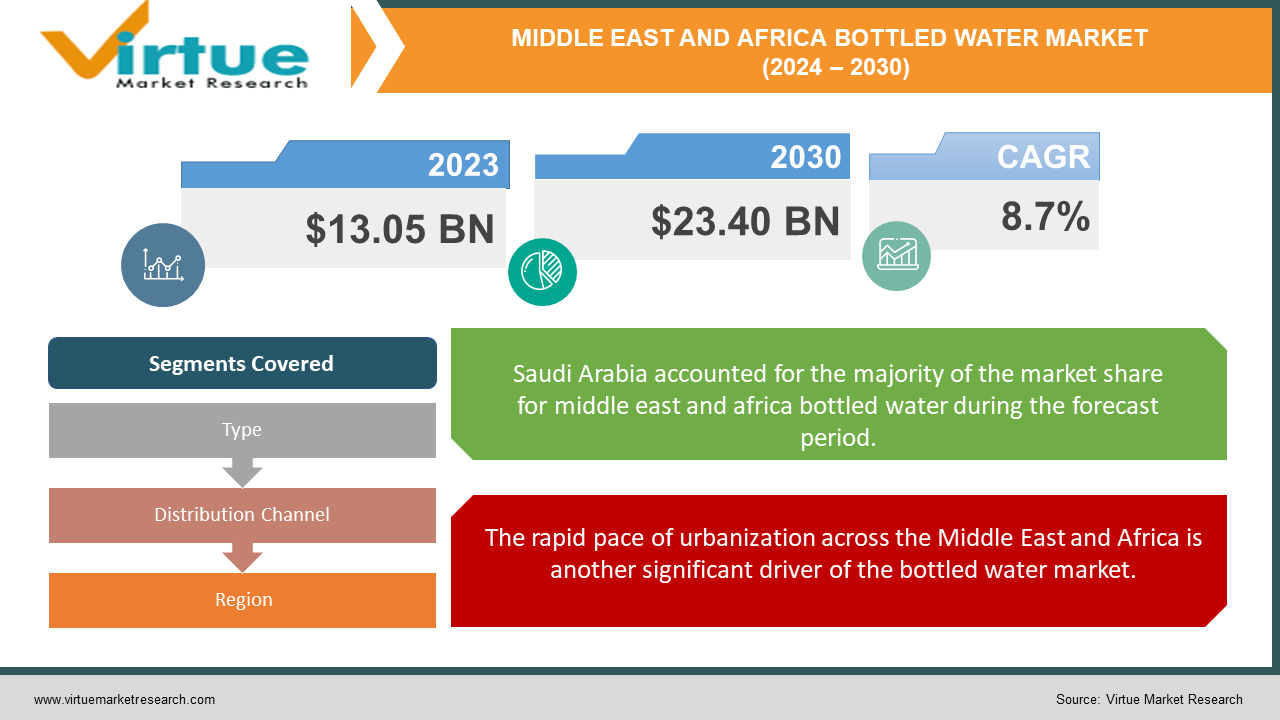

The Middle East and Africa Bottled Water Market was valued at USD 13.05 Billion in 2023 and is projected to reach a market size of USD 23.40 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 8.7%.

The Middle East and Africa's bottled water market is a dynamic, quickly changing one, influenced by both local and global trends. Due to shifting customer tastes, growing health consciousness, and worries about water quality, this industry has seen significant expansion in recent years. The use of bottled water has increased dramatically in some Middle Eastern nations, including Saudi Arabia, the United Arab Emirates, and Qatar. Innovative water solutions have long been required in the region due to its dry environment and scarce freshwater supplies in many areas. In metropolitan areas where infrastructure upgrades have not kept up with fast expansion, bottled water has become a popular and safer substitute for tap water. The bottled water market in Africa offers a more varied environment. For many urban customers in North African nations like Egypt and Morocco, bottled water has become a need. Although historically depending more on outside water supplies, Sub-Saharan Africa is gradually moving toward bottled water, particularly in larger cities and among the expanding middle class.

Key Market Insights:

The average annual growth rate of bottled water sales in Africa is estimated at 10% from 2023 to 2030.

In 2023, Egypt’s bottled water market reached a value of USD 1.2 billion. Nigeria is projected to see a 12% CAGR in bottled water consumption from 2023 to 2030.

In 2023, the total volume of bottled water consumed in South Africa was approximately 1.8 billion liters.

The GCC countries collectively represent about 35% of the Middle East bottled water market.

In 2023, Algeria’s bottled water market saw a growth rate of 7%. Kenya’s bottled water market is expected to reach USD 500 million by 2025.

The bottled water market in Turkey is projected to grow at a CAGR of 6% from 2023 to 2030. The bottled water segment in Ethiopia is expected to grow at a rate of 9% annually from 2023 to 2030.

The market share of sparkling water in the Middle East and Africa was approximately 10% in 2023.

The market for flavored bottled water in the Middle East and Africa is projected to grow at a CAGR of 11% from 2023 to 2030.

Middle East and Africa Bottled Water Market Drivers:

The surge in health consciousness across the Middle East and Africa has emerged as a pivotal driver for the bottled water market.

The increasing understanding of the value of staying hydrated is at the heart of this demand driven by health concerns. Customers are shifting away from sugary beverages and toward healthier options as they become more aware of the importance of water in leading a healthy lifestyle. Younger people and urban populations, who are more exposed to global health trends through social media and outside influences, are the groups experiencing this transition the most. A major element influencing the use of bottled water is the belief that it is a safer and purer alternative to tap water. Concerns over the safety and quality of municipal water sources are still present in many regions of the Middle East and Africa.

The rapid pace of urbanization across the Middle East and Africa is another significant driver of the bottled water market.

Cities are growing at a rate that has never been seen before in many of these areas' nations. Alongside this urbanization trend are rising disposable incomes and a move toward faster-paced, more contemporary lives. All of these elements work together to fuel the growing need for portable, on-the-go hydration options, of which bottled water is a leading example. Urban customers like the ease that bottled water offers since they frequently balance hectic work schedules with social life. The convenience of getting a bottle of water from a vending machine or neighboring business fits in well with the fast-paced urban lifestyle. This convenience element is especially important in nations where it may be difficult to find or carry drinkable water otherwise.

Middle East and Africa Bottled Water Market Restraints and Challenges:

The rising environmental concern about plastic waste is one of the biggest issues confronting the bottled water business. Severe environmental damage has resulted from the widespread use of single-use plastic bottles, especially in areas with inadequate waste disposal infrastructure. In many African nations, where recycling facilities are scarce or non-existent, this problem is especially serious. Environmentalists and customers alike are alarmed by the buildup of plastic trash in landfills, streams, and seas, and this has put pressure on bottled water firms to develop more environmentally friendly packaging options. Water shortage is a major topic that is especially pertinent in the Middle East. This area has several of the world's most water-stressed nations. Water extraction for bottling poses moral dilemmas and may spark disputes with nearby populations, particularly in regions with few water supplies. The contradictory position where the industry's expansion possibly exacerbates the same problem it tries to alleviate is further exacerbated by the fact that some of the fastest-growing markets for bottled water are in areas where water shortage is most acute.

Middle East and Africa Bottled Water Market Opportunities:

A notable opportunity may be found in the expanding trend of health and well-being. Demand for improved and functional waters is rising as people become more health conscious. This creates opportunities for creating goods that are more than just hydration. A market for waters enhanced with natural extracts, vitamins, or minerals that provide certain health advantages is probably not too far off. For example, waters intended to strengthen immunity, facilitate better digestion, or increase cognitive performance may establish specialized markets within the larger bottled water industry. Another area that is worth investigating is the potential for premiumization. There is a growing rich elite in Middle Eastern and some African cities prepared to pay premium amounts for luxury water products of superior quality. Numerous African countries are experiencing significant urbanization, which presents chances for growth and market penetration. Convenient and secure drinking water solutions are in greater demand as more people live modern lifestyles in cities. Businesses may see significant development if they can successfully enter this urban market through focused marketing and smart distribution networks.

MIDDLE EAST AND AFRICA BOTTLED WATER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024- 2030 |

|

CAGR |

8.7% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Kingdom of Saudi Arabia, UAE, Israel, Rest of GCC countries, South Africa, Ethiopia, Kenya, Egypt, Sudan, Rest of MEA |

|

Key Companies Profiled |

Nestle Waters (Perrier, S.Pellegrino, Acqua Panna), The Coca-Cola Company (Dasani, Bonaqua), PepsiCo Inc, (Aquafina, Lipton Iced Tea), Danone (Evian), The National Company for Bottled Water (Saudi Arabia), Agthia Group (UAE), Hayat Holding (UAE), Coca-Cola Beverages Africa (various brands across Africa), Orascom Construction Industries (Egypt), Dana Springs (Jordan), Beyti (Morocco), Aquafina (South Africa), Bluewater (Nigeria), Safi (Ethiopia). |

Middle East and Africa Bottled Water Market Segmentation:

Middle East and Africa Bottled Water Market Segmentation: By Types:

- Still Water

- Sparkling Water

- Flavoured Water

- Functional Water

- Alkaline Water

- Mineral Water

- Purified Water

The market's most dominating category is still Water. Most customers choose still water that doesn't have any carbonation for regular hydration. Its flavor is neutral, and many consider it to be the purest bottled water, which contributes to its appeal. Still, water holds a market share of more than 70% in some Middle Eastern nations where bottled water is distributed.

Flavoured Water is one of the fastest-growing segments in the bottled water market. Flavored waters, often with no or low calories, appeal to consumers looking for more interesting taste profiles without the sugar content of traditional flavored beverages. Fruit-flavored waters are particularly popular, with local flavors like pomegranate or dates finding favor in Middle Eastern markets.

Middle East and Africa Bottled Water Market Segmentation: By Distribution Channel:

- Supermarkets and Hypermarkets

- Traditional Grocery Stores and Markets

- Convenience Stores

- Online Retail

Supermarkets and Hypermarkets remain the most dominant distribution channels for bottled water in urban areas. The wide variety of brands and types available in these stores makes them a preferred choice for many consumers. In countries like Saudi Arabia and the UAE, supermarkets account for over 50% of bottled water sales.

Online Retail is the fastest-growing distribution channel, particularly in more digitally advanced markets. The convenience of home delivery and the ability to purchase in bulk are driving this growth. The COVID-19 pandemic has accelerated the shift towards online purchasing of bottled water.

Middle East and Africa Bottled Water Market Segmentation: Regional Analysis:

- United Arab Emirates

- Saudi Arabi

- South Africa

- Egypt

- Israel

- Qatar

- Nigeria

- Kenya

- Rest of MEA

With a dominating 22% market share, Saudi Arabia is the market leader for bottled water in the Middle East and Africa. This dominance may be ascribed to several special elements that have helped the kingdom rise to the top of the sector. Over the past ten years, the Saudi Arabian market for bottled water has grown remarkably thanks to several important factors. First and foremost, there are few freshwater resources and a dry environment in the nation. Since the majority of the kingdom is made up of desert, getting access to safe drinking water has never been easy. Because it is so scarce, bottled water is in high demand as a dependable and practical source of hydration.

Kenya is the nation with the quickest rate of growth in the bottled water market in the Middle East and Africa, however, Saudi Arabia still maintains its leading position. Kenya's bottled water sector, which now holds a 6% market share, is growing at a faster rate than its regional competitors. A confluence of variables that have fostered industrial expansion is responsible for the bottled water market's rapid ascent in Kenya. Kenya's rapidly urbanizing population and growing middle class are the driving forces behind this expansion. Convenient, secure, and high-quality drinking water is in high demand as more Kenyans relocate to cities and have more money to spend.

COVID-19 Impact Analysis on the Middle East and Africa Bottled Water Market:

A greater consciousness of cleanliness measures was sparked by the epidemic. Bottled water served as a barrier against the unseen threat because it was seen as a reliable and accessible supply of clean drinking water. This demand spike was especially noticeable in areas where access to clean tap water is scarce. Imagine homes on the other side of the MEA piled high with crates of bottled water, a sign of renewed faith in its capacity to protect health. Major venues for the consumption of bottled water, restaurants, and cafés, were forced to close due to lockdowns and social distancing measures. But an increase in demand for homes negated this. Because more people are spending more time indoors, bottled water has emerged as a practical choice that is always available for hydration needs. The surge in e-commerce witnessed during COVID-19 extended to bottled water deliveries. Consumers, wary of venturing out, increasingly relied on online platforms to have their bottled water needs met at their doorsteps. This trend fueled the growth of delivery services and online retailers catering to the bottled water market. The pandemic heightened the focus on health and well-being. Bottled water companies responded by introducing functional water options enriched with essential vitamins and minerals or infused with immunity-boosting ingredients like ginger or lemon.

Latest Trends/ Developments:

Bottled water fortified with calcium and magnesium can cater to bone health concerns, while options with added probiotics can promote gut health. This personalization caters to a growing segment of health-conscious consumers seeking targeted benefits from their beverages. Artificially flavored water is being challenged by options infused with natural fruits, herbs, or spices. Think of refreshing cucumber-mint-infused water or sparkling water with a hint of watermelon for a touch of natural sweetness without artificial additives. Online grocery shopping platforms allow consumers to order bottled water along with other household staples, eliminating the need for multiple store visits, especially in scorching temperatures. Subscription services that deliver bottled water to homes or offices at regular intervals are emerging. Imagine a service that automatically replenishes your water supply, ensuring you never run dry. Natural spring water sourced from local aquifers is gaining popularity. This taps into a growing consumer preference for supporting local businesses and enjoying the water with a unique taste profile specific to the region's geography.

Key Players:

- Nestle Waters (Perrier, Pellegrino, Acqua Panna)

- The Coca-Cola Company (Dasani, Bonaqua)

- PepsiCo Inc. (Aquafina, Lipton Iced Tea)

- Danone (Evian)

- The National Company for Bottled Water (Saudi Arabia)

- Agthia Group (UAE)

- Hayat Holding (UAE)

- Coca-Cola Beverages Africa (various brands across Africa)

- Orascom Construction Industries (Egypt)

- Dana Springs (Jordan)

- Beyti (Morocco)

- Aquafina (South Africa)

- Bluewater (Nigeria)

- Safi (Ethiopia)

Chapter 1. Middle East and Africa Bottled Water Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Middle East and Africa Bottled Water Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Middle East and Africa Bottled Water Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Middle East and Africa Bottled Water Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Middle East and Africa Bottled Water Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Middle East and Africa Bottled Water Market– By Type

6.1. Introduction/Key Findings

6.2. Still Water

6.3. Sparkling Water

6.4. Flavoured Water

6.5. Functional Water

6.6. Alkaline Water

6.7. Mineral Water

6.8. Purified Water

6.9. Y-O-Y Growth trend Analysis By Type

6.10. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Middle East and Africa Bottled Water Market– By Distribution Channel

7.1. Introduction/Key Findings

7.2. Supermarkets and Hypermarkets

7.3. Traditional Grocery Stores and Markets

7.4. Convenience Stores

7.5. Online Retail

7.6. Y-O-Y Growth trend Analysis By Distribution Channel

7.7. Absolute $ Opportunity Analysis By Distribution Channel , 2024-2030

Chapter 8. Middle East and Africa Bottled Water Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Middle East & Africa

8.1.1. By Country

8.1.1.1. United Arab Emirates (UAE)

8.1.1.2. Saudi Arabia

8.1.1.3. Qatar

8.1.1.4. Israel

8.1.1.5. South Africa

8.1.1.6. Nigeria

8.1.1.7. Kenya

8.1.1.8. Egypt

8.1.1.9. Rest of MEA

8.1.2. By Type

8.1.3. By Distribution Channel

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Middle East and Africa Bottled Water Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Nestle Waters (Perrier, Pellegrino, Acqua Panna)

9.2. The Coca-Cola Company (Dasani, Bonaqua)

9.3. PepsiCo Inc. (Aquafina, Lipton Iced Tea)

9.4. Danone (Evian)

9.5. The National Company for Bottled Water (Saudi Arabia)

9.6. Agthia Group (UAE)

9.7. Hayat Holding (UAE)

9.8. Coca-Cola Beverages Africa (various brands across Africa)

9.9. Orascom Construction Industries (Egypt)

9.10. Dana Springs (Jordan)

9.11. Beyti (Morocco)

9.12. Aquafina (South Africa)

9.13. Bluewater (Nigeria)

9.14. Safi (Ethiopia)

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The scorching temperatures and arid climates across much of the Middle East and Africa make staying hydrated a constant necessity. Bottled water offers a convenient and readily available solution for on-the-go hydration, particularly in regions with limited access to safe drinking water

The massive amount of plastic waste generated by single-use bottled water containers is a major environmental concern. This can lead to pollution of landfills, oceans, and waterways, harming wildlife and ecosystems.

Nestle Waters (Perrier, S.Pellegrino, Acqua Panna), The Coca-Cola Company (Dasani, Bonaqua), PepsiCo Inc, (Aquafina, Lipton Iced Tea), Danone (Evian), The National Company for Bottled Water (Saudi Arabia), Agthia Group (UAE), Hayat Holding (UAE), Coca-Cola Beverages Africa (various brands across Africa), Orascom Construction Industries (Egypt), Dana Springs (Jordan), Beyti (Morocco), Aquafina (South Africa), Bluewater (Nigeria), Safi (Ethiopia).

The market is dominated by Saudi Arabia, which commands a market share of around 22%.

With a market share of about 6%, Kenya is expanding the quickest.