Middle East and Africa Bakery Product Market Size (2024-2030)

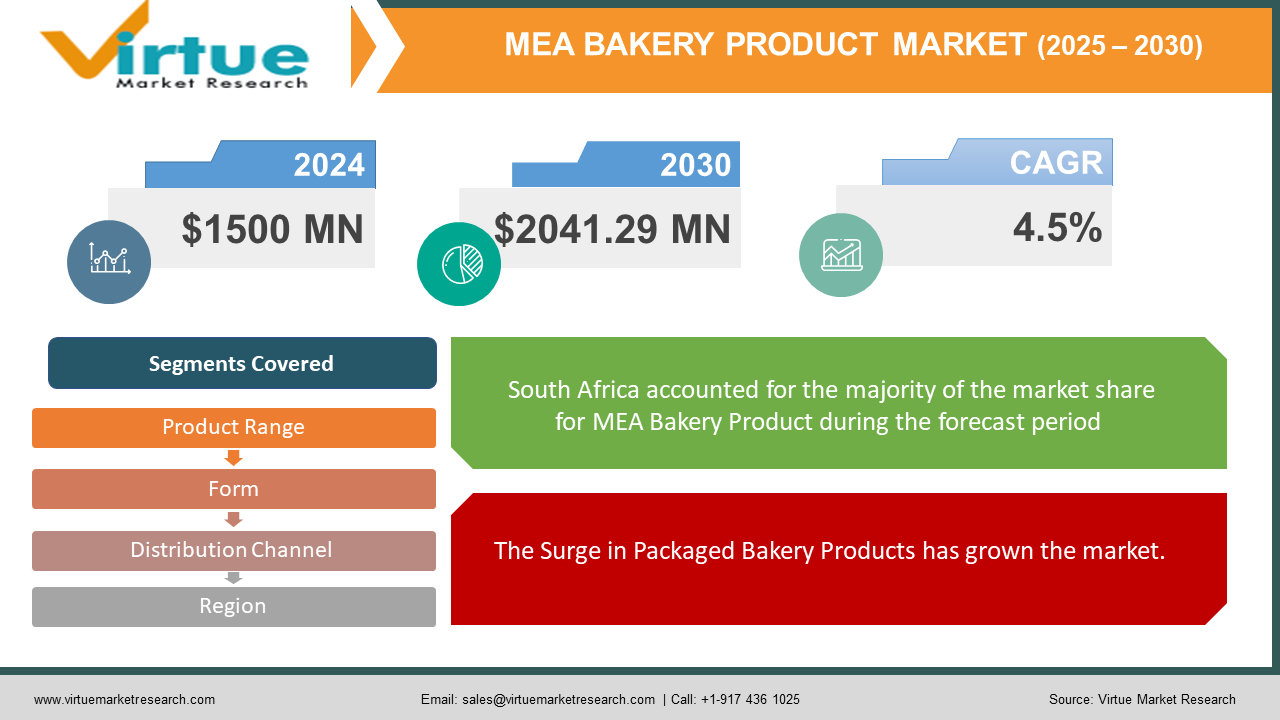

The Middle East and Africa Bakery Product Market was valued at USD 1500 million and is projected to reach a market size of USD 2041.29 million by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 4.5 % between 2024 and 2030.

The consumption of bakery goods has seen a remarkable increase, both in formal establishments and informal settings, ranging from bread and rolls to pies, cereals, and cakes. With roots dating back thousands of years, baking carries a deep historical significance, and its demand has steadily grown over time. Initially, these products were crafted within households and sold on local streets. However, the evolution of specialized bakeries has reshaped the landscape, catering to the needs of homes and businesses alike. In the Middle East and Africa, the bakery product market is heavily influenced by the rising preference for healthy lifestyles, natural nutrition, and organic options. Despite this trend, the market encounters challenges such as strong brand loyalty and substantial capital requirements, limiting entry for new players. Nevertheless, the expanding confectionery sector provides avenues for innovation and growth within the region's bakery market. Overall, the bakery product market in the Middle East and Africa mirrors a dynamic interplay of historical heritage, evolving consumer tastes, and emerging market forces. As the region adapts to modern consumer demands and competitive pressures, the bakery industry continues to evolve, innovate, and seize new opportunities for expansion and advancement.

Key Market Insights:

- The increasing demand for convenient bakery products stems from factors such as bustling lifestyles, urbanization, and the expanding middle class. While consumers are gravitating towards healthier options incorporating nuts, fruits, and whole grains, the allure of indulgent treats like cookies remains steadfast. In Africa, packaged bakery goods are gaining momentum due to their convenience, alongside the thriving traditional markets and modern supermarkets. Bread remains a dietary staple, with flatbreads especially favored in Africa, while leavened varieties dominate the Middle East.

- Additionally, the rise of specialty bakeries offering unique flavors contributes to market diversity. Despite numerous regional players and local brands, the bakery sector is witnessing a trend toward consolidation through mergers and acquisitions. This push for market share expansion fosters heightened competition and drives innovation in the industry. As consumer preferences evolve and economic landscapes shift, the bakery market in Africa and the Middle East is poised for dynamic growth and abundant opportunities.

Middle East and Africa Bakery Product Market Drivers:

Bakery Products in MEA: Evolving to Meet Modern Consumer Demands

In today's fast-paced world, characterized by busy lifestyles, rapid urbanization, and a burgeoning middle class, consumer preferences are shifting towards convenient and healthy food options. Bakery products have emerged as the perfect solution, providing on-the-go breakfasts, quick snacks, and delightful treats that cater to the needs of busy individuals. Moreover, consumers are becoming more health-conscious, showing a growing interest in nutritious ingredients such as whole grains, nuts, and fruits. Bakeries are adapting to these changing preferences by incorporating these healthy ingredients into their products, thereby aligning with the evolving dietary needs of their customers. This adaptation not only satisfies the demand for convenient food choices but also reflects a broader trend toward wellness and mindful eating in today's society. As a result, bakery products are increasingly becoming the go-to option for consumers seeking a balance between convenience and health in their everyday food choices.

The Surge in Packaged Bakery Products has grown the market.

The market for packaged bakery products is experiencing rapid growth, fueled by the ascent of modern retail and heightened accessibility to these convenient items, particularly in Africa. This trend reflects the evolving preferences of consumers seeking convenience and longer shelf life in their food choices. Packaged bakery goods offer the dual advantage of convenience and durability, making them an attractive option for busy individuals juggling hectic schedules. With modern retail channels expanding across the region, consumers now have increased access to a wide array of packaged bakery products, ranging from bread and pastries to snacks and desserts. This accessibility, coupled with the convenience factor, has propelled the demand for packaged bakery items, driving market growth and reshaping the bakery industry landscape in Africa and beyond. As consumer lifestyles continue to evolve, packaged bakery products are poised to remain a staple in the market, catering to the needs of a growing demographic of time-conscious consumers.

Middle East and Africa Bakery Product Market Restraints and Challenges:

The bakery industry, particularly in terms of large-scale production, faces significant barriers to entry, primarily due to brand loyalty and capital investment requirements. Established bakery brands enjoy strong consumer loyalty, making it challenging for new entrants to establish themselves in the market. Additionally, the substantial capital investment necessary for equipment, facilities, and ingredients poses a formidable obstacle for aspiring businesses. Furthermore, the industry contends with fluctuating raw material prices, particularly for essential ingredients like flour, sugar, and oils, which can be influenced by various external factors such as weather conditions, political instability, and global market trends. These price fluctuations can exert pressure on profit margins and hinder the ability of bakery businesses to maintain stable pricing for consumers, further complicating entry into the market.

Middle East and Africa Bakery Product Market Opportunities:

As consumer preferences continue to shift towards healthier options and unique culinary experiences, the bakery industry is presented with opportunities for innovation and diversification. There is a rising demand for bakery products that offer both nutritional benefits and functionality, such as those enriched with whole grains, nuts, seeds, and protein. Moreover, catering to specific dietary needs, such as gluten-free or sugar-free options, can carve out a niche market segment. Additionally, there is growing interest in localized flavors and ingredients, with consumers seeking bakery items that incorporate regional fruits, spices, or grains to create distinct and appealing products. Combining traditional bakery recipes with popular international flavors further enhances the appeal and marketability of these offerings, reflecting a fusion of cultures and culinary creativity within the bakery landscape.

MIDDLE EAST ANDAFRICA BAKERY PRODUCT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.5% |

|

Segments Covered |

By Product RANGE, Form, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Kingdom of Saudi Arabia, UAE, Israel, Rest of GCC countries, South Africa, Ethiopia, Kenya, Egypt, Sudan, Rest of MEA |

|

Key Companies Profiled |

Bimbo QSR, Modern Bakery LLC , Agthia , Anat Foods, Almarai Group |

Middle East and Africa Bakery Product Market Segmentation:

Middle East and Africa Bakery Product Market Segmentation By Product Range :

- Cakes

- Pastries

- Bread and Rolls

- Cookies

- Biscuits

- Pretzels

- Tortillas

- Coffee and Specialty Drinks

- Catering and Deliveries

The Middle East and Africa Bakery Product Market is Segmented by Product Range, and Biscuits held the largest market share last year and is poised to maintain its dominance throughout the forecast period. The biscuit sector stands out as one of the most rapidly expanding markets within the realm of fast-moving consumer goods (FMCG). Among the diverse array of biscuit varieties, sweet biscuits emerge as the clear frontrunner, commanding both popularity and swift growth on a global scale. With an increasing number of consumers opting for sweet biscuits alongside other biscuit varieties, it's anticipated that sweet biscuits will assert dominance over the global market. This encompasses a broad spectrum of sweet biscuit categories, including assortment cookies, butter cookies, chocolate cookies, cream-filled cookies, plain cookies, wafer cookies, artisanal cookies, in-store bakery cookies, and egg cookies. As consumer preferences continue to evolve and demand for indulgent treats persists, the sweet biscuits segment is poised to maintain its trajectory of rapid growth, shaping the future landscape of the global biscuit market. The diversification of sweet biscuit offerings, coupled with their widespread appeal, ensures that they remain a key driver of growth and innovation within the industry, catering to the diverse tastes and preferences of consumers worldwide.

Middle East and Africa Bakery Product Market Segmentation By Distribution Channel:

- Offline

- Stores

- Online

The Middle East and Africa Bakery Product Market is Segmented by Distribution Channel, online held the largest market share last year and is poised to maintain its dominance throughout the forecast period. The widespread adoption of smartphones and internet connectivity is propelling rapid growth in online sales channels, a trend expected to persist in the forecasted period. In the competitive landscape of the Bake-Off Bakery industry, local small businesses find themselves contending not only with major brands but also with nimble internet start-ups that demonstrate creativity and agility. The surge in online retailing over the past decade has posed challenges for brick-and-mortar establishments, which are struggling to adapt to this evolving consumer behavior. However, amidst this digital transformation, there lies an opportunity for bakeries to leverage e-commerce platforms. By embracing online retailing, bakeries can tap into a broader market reach, cater to changing shopping preferences, and potentially thrive in a competitive environment. The ability to establish an online presence could empower bakeries to capitalize on shifting consumer trends and capitalize on the convenience and accessibility offered by e-commerce channels. As the industry navigates this transition, embracing e-commerce could prove instrumental in sustaining growth and relevance for Bake-Off Bakery businesses in the digital age.

Middle East and Africa Bakery Product Market Segmentation By Form:

- Organic

- Gluten-free

- Sugar-free

- Low calories

- Other

The Middle East and Africa Bakery Product Market is Segmented by Form, Low Calories held the largest market share last year and is poised to maintain its dominance throughout the forecast period. In recent years, there has been a discernible surge in demand for low-calorie bakery goods, leading to a substantial increase in market size and valuation. Particularly influenced by the health-conscious preferences of the millennial demographic, high-fiber and multigrain bakery items have emerged as the trendiest choices. These products resonate with the growing emphasis on health and fitness, driving the expansion of the low-calorie bakery segment. Furthermore, the rising awareness of calorie-free alternatives has fueled demand for low-calorie cakes, offering consumers a guilt-free option to satisfy their cravings without compromising on dietary goals. This heightened awareness and preference for healthier bakery options have propelled the global market for low-calorie bakery products to witness significant growth and development. As consumers increasingly prioritize health and wellness, the low-calorie bakery segment is poised to continue its expansion, catering to the evolving tastes and dietary preferences of individuals seeking nutritious yet indulgent baked treats. Embracing this trend offers opportunities for innovation and market differentiation within the bakery industry, ensuring its continued relevance in the dynamic consumer landscape.

Middle East and Africa Bakery Product Market Segmentation By Region:

- UAE

- Saudi Arabia

- Qatar

- Israel

- South Africa

- Nigeria

- Kenya

- Egypt

- Rest of MEA

The Middle East and Africa Bakery Product Market is Segmented by Region, South Africa held the largest market share last year and is poised to maintain its dominance throughout the forecast period. A regional analysis of the Middle East and Africa bakery product market underscores significant growth drivers, notably the consumer preference for conveniently packaged food options, which has led to an expansion in packaged food consumption across the region. This trend is particularly prominent in the Middle East and Africa, where convenience plays a crucial role in consumer food choices. Additionally, the burgeoning middle class in Africa contributes substantially to market growth, fueled by rising disposable incomes. Turkey stands out as a pivotal market within the region, witnessing strong demand for bakery products from both domestic and international markets thanks to its strategic location and rich culinary heritage. As these trends persist, the Middle East and Africa bakery market promise continued expansion and opportunities for industry stakeholders.

COVID-19 Impact Analysis on the Middle East and Africa Bakery Product Market:

COVID-19 sent shockwaves through the Middle East and Africa's bakery scene. Lockdowns disrupted ingredient supplies and shuttered bakeries, especially smaller ones. Restaurant closures meant fewer sales channels, and hygiene concerns temporarily steered some consumers away. However, there were silver linings. Home baking boomed, driving up flour and yeast sales. The focus on health during the pandemic might have boosted demand for bakery items perceived as healthier, like those with nuts and whole grains. E-commerce also got a lift as restricted movement pushed consumers online. Looking ahead, the market is expected to bounce back, but with some lingering effects. Consumers might continue to bake at home alongside a preference for healthier options and online grocery shopping. Bakeries will likely prioritize stricter hygiene measures and transparent packaging to address lingering safety concerns. The rise of e-commerce could also reshape distribution, with online platforms playing a more prominent role in the future.

Latest Trends/ Developments:

Mondelez International Inc.'s acquisition of Chipita SA, a global baker renowned for its packaged cakes and pastries, marks a strategic move aimed at bolstering Mondelez's presence in the Central and Eastern European markets. With a diverse product portfolio encompassing croissants, bagel chips, cake bars, biscuits, and spreads, Chipita's brands such as 7Days, Chipicao, and Fineti complement Mondelez's existing offerings. Leveraging Chipita's well-established distribution network in the region, Mondelez aims to expand its regional reach while introducing its brands to new markets within Central and Eastern Europe and beyond. This acquisition aligns with Mondelez's growth strategy, enabling the company to tap into new consumer demographics and drive market penetration in key territories, thereby strengthening its position in the global bakery industry landscape.

Key players:

- Bimbo QSR

- Modern Bakery LLC

- Agthia

- Anat Foods

- Almarai Group

Chapter 1. Middle East and Africa Bakery Product Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Middle East and Africa Bakery Product Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Middle East and Africa Bakery Product Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Middle East and Africa Bakery Product Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Middle East and Africa Bakery Product Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Middle East and Africa Bakery Product Market– By Product Range

6.1. Introduction/Key Findings

6.2. Cakes

6.3. Pastries

6.4. Bread and Rolls

6.5. Cookies

6.6. Biscuits

6.7. Pretzels

6.8. Tortillas

6.9. Coffee and Specialty Drinks

6.10. Catering and Deliveries

6.11. Y-O-Y Growth trend Analysis By Product Range

6.12. Absolute $ Opportunity Analysis By Product Range, 2024-2030

Chapter 7. Middle East and Africa Bakery Product Market– By Distribution Channel

7.1. Introduction/Key Findings

7.2. Offline

7.3. Stores

7.4. Online

7.5. Y-O-Y Growth trend Analysis By Distribution Channel

7.6. Absolute $ Opportunity Analysis By Distribution Channel , 2024-2030

Chapter 8. Middle East and Africa Bakery Product Market– By Form

8.1. Introduction/Key Findings

8.2. Organic

8.3. Gluten-free

8.4. Sugar-free

8.5. Low calories

8.6. Other

8.7. Y-O-Y Growth trend Analysis By Form

8.8. Absolute $ Opportunity Analysis By Form , 2024-2030

Chapter 9 . Middle East and Africa Bakery Product Market, By Geography – Market Size, Forecast, Trends & Insights

9 .1. Middle East and Africa

9 .1.1. By Country

9 .1.1.1. Saudi Arabia

9 .1.1.2. Qatar

9 .1.1.3. UAE

9 .1.1.4. Israel

9 .1.1.5. South Africa

9 .1.1.6. Nigeria

9 .1.1.7. Kenya

9 .1.1.9 . Egypt

9 .1.1.9 . Rest of the Middle East

9.1.2. By Product Range

9.1.3. By Distribution Channel

9.1.4. Form

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Middle East and Africa Bakery Product Market– Company Profiles – (Overview, Product Range Type Portfolio, Financials, Strategies & Developments)

10.1. Bimbo QSR

10.2. Modern Bakery LLC

10.3. Agthia

10.4. Anat Foods

10.5. Almarai Group

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The Middle East and Africa Bakery Product Market was valued at USD 1500 million and is projected to reach a market size of USD 2041.29 million by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 4.5 % between 2024 and 2030.

Through 2030, the Middle East and Africa Bakery Product market is expected to grow at a CAGR of 4.5 %.

By 2030, the Middle East and Africa Bakery Product market is expected to grow to a value of USD 2041.29 billion

South Africa is predicted to lead the market for Middle East and Africa Bakery Products.

. The Middle East and Africa Bakery Product market has segments of Product Range, distribution, form, and Region.