Middle East and Africa Baby Food Market Size (2024-2030)

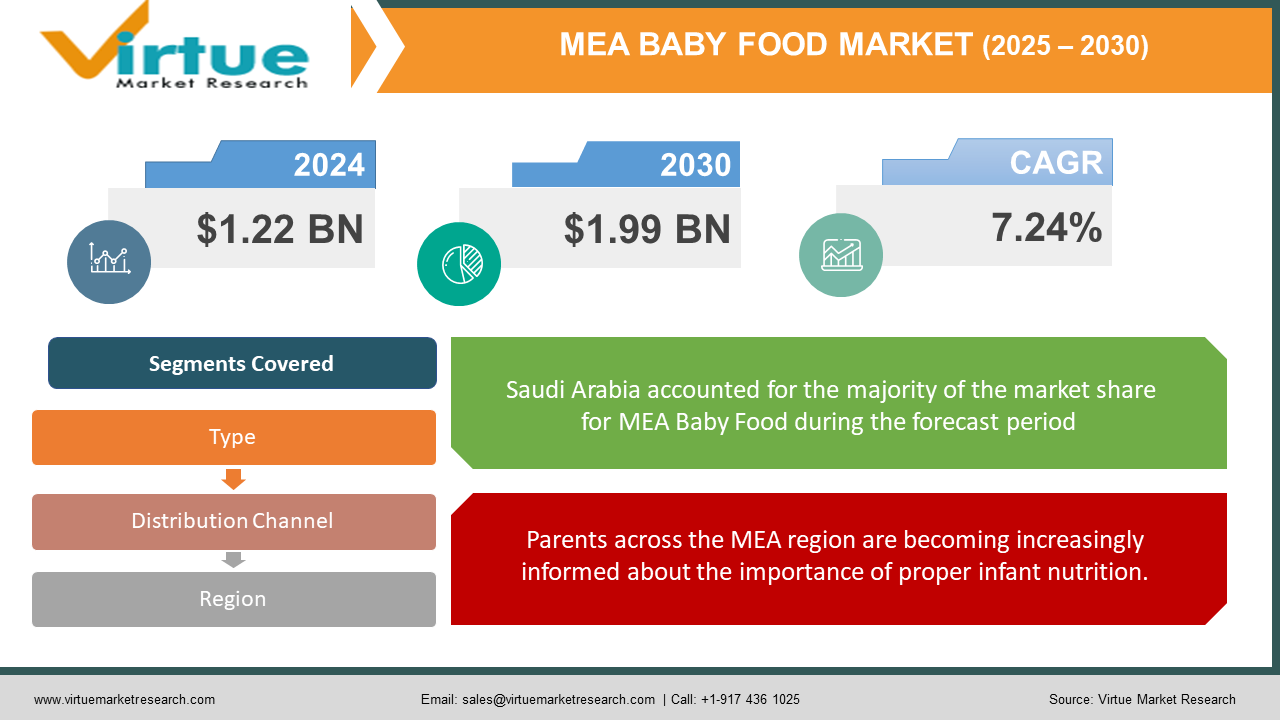

The Middle East and Africa Baby Food Market was valued at USD 1.22 Billion in 2023 and is projected to reach a market size of USD 1.99 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7.24%.

The Middle East and Africa have a thriving baby food sector with plenty of room for expansion. The Gulf area has high-income nations, whereas sub-Saharan Africa has low-income nations, making up the Middle East and Africa (MEA) region's diverse economic landscape. Cultural customs have a big impact on eating habits and food preferences. This necessitates a tailored approach to product development that considers local weaning practices and taste preferences. The influx of international brands intensifies competition. Standing out through brand recognition, product innovation, and catering to local preferences will be crucial. While disposable income is rising, the price remains a concern for some consumers. Balancing quality with affordability will be essential for wider market penetration. Saudi Arabia relies heavily on imported baby food. Encouraging domestic production of high-quality baby food can enhance self-sufficiency and potentially lower costs.

Key Market Insights:

- Saudi Arabia accounted for 26.5% of the $821.5 million sales, or the biggest portion of the infant food market in the Middle East and Africa.

- Egypt is predicted to develop at the quickest rate in the area, with a compound annual growth rate (CAGR) of 11.4% for the baby food market.

- In the Middle East and Africa, where their market share is expected to increase from 22% in 2023 to 35% by 2028, the demand for organic and plant-based baby food products is expected to soar.

- It is projected that the Middle East and Africa baby food market will employ more than 120,000 people by 2028, mostly in the production and distribution sectors.

- Large companies are investing in the Middle East and African baby food market; throughout the last three years (2021–2023), these companies have invested more than $900 million in plans for expansion and R&D.

Middle East and Africa Baby Food Market Drivers:

The Impact of Rapid Urbanization in the MEA Region on Baby Food Consumption Patterns and Changing Family Dynamics Drives the Market Growth

Smaller living quarters and hectic schedules are common outcomes of urban living. There is not as much time for elaborate meal preparation for parents, especially working women. Packed baby food is a quick and easy way to ensure that their babies are getting the nutrition they need. Cities serve as hubs for influences from throughout the world. Growing exposure to Western lifestyles has led to an increased awareness of the purported advantages of professionally prepared baby food. This may cause a change in the custom of making homemade infant meals. For working women, juggling childcare and job obligations can be difficult. In addition to saving moms time while preparing meals, baby food offers a convenient and wholesome alternative that guarantees their infants get the nutrition they need.

Parents across the MEA region are becoming increasingly informed about the importance of proper infant nutrition.

More and more parents are realizing how important healthy eating is to a child's early growth. They look for baby food options that are fortified with vital vitamins, minerals, and prebiotics to promote cognitive development and healthy growth. There are still areas of the MEA region where malnutrition is an issue. Fortified baby food items appeal to parents who want to make sure their kids get the nutrients they need to avoid malnutrition-related problems. The global trend towards organic food is finding fertile ground in the MEA region. Parents concerned about the use of pesticides and artificial ingredients are seeking organic baby food options. This market segment is expected to see significant growth in the coming years. Baby food fortified with essential vitamins, minerals, and prebiotics caters to specific needs and concerns. For example, baby food with added iron can address potential iron deficiency, while prebiotics can promote gut health and digestion.

Middle East and Africa Baby Food Market Restraints and Challenges:

A significant portion of the MEA population falls within a low-to-mid-income bracket. This creates a strong emphasis on affordability, making price a crucial factor influencing purchase decisions. Premium baby food options might be out of reach for many consumers. The economic landscape across the MEA region is diverse. While some countries boast rapid economic growth, others grapple with poverty and limited resources. This disparity translates to varying levels of disposable income and access to quality baby food products. In some regions, particularly rural areas, there might be a lack of awareness about the benefits of commercially prepared baby food. Traditional practices of breastfeeding and homemade food alternatives might dominate, hindering market penetration. The infrastructure for storage and transportation in some African countries can be underdeveloped. This can lead to spoilage and limited accessibility of baby food products, particularly in remote areas. Maintaining a proper cold chain is crucial for certain baby food products, especially those containing fresh ingredients or requiring specific storage temperatures. Deficiencies in cold chain infrastructure can compromise product quality and safety.

Middle East and Africa Baby Food Market Opportunities:

Disposable income levels differ significantly between countries. This necessitates a tiered approach, offering budget-friendly options alongside premium choices for wealthier segments. Dietary restrictions and cultural preferences play a crucial role. Halal certification is essential in many Muslim-majority countries, while traditional weaning practices might influence product demand. Health-conscious parents are increasingly seeking organic baby food perceived as free from harmful chemicals and pesticides. This trend is expected to gain further traction, particularly in urban areas. Baby food fortified with vitamins, minerals, and probiotics is gaining popularity. This caters to parents seeking products that support their child's overall development and immune system health. The rise of online shopping platforms presents a new avenue for distribution. This allows parents to access a wider variety of baby food options and benefit from convenient home delivery. Developing culturally appropriate and convenient baby food options catering to diverse dietary needs. This could involve incorporating local ingredients, creating stage-specific formulas, and offering halal-certified products.

MIDDLE EAST AND AFRICA BABY FOOD MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024- 2030 |

|

CAGR |

7.24% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Saudi Arabia, Qatar, UAE, Israel, South Africa, Nigeria, Kenya, Egypt, Rest of the Middle East |

|

Key Companies Profiled |

Nestlé S.A, Danone Nutricia, Abbott Laboratories, The Baby Food Company , Saipro Biotech Private Limited, Orchard Baby Food , Tiger Brands , Bumbles Baby Food, Danone SA |

Middle East and Africa Baby Food Market Segmentation:

Middle East and Africa Baby Food Market Segmentation: By Type:

- Infant Milk Formula

- Prepared Baby Food

- Dried Baby Food

- Organic Baby Food

The Infant Milk Formula (40-45%) segment remains the undisputed leader, particularly in countries with lower disposable income levels and a strong tradition of formula feeding. It caters to infants who are not breastfed or whose mothers require supplementation. In some regions, formula feeding is a deeply ingrained practice, often influenced by societal expectations or perceived benefits. Limited access to lactation consultants or insufficient maternity leave policies can hinder breastfeeding success, leading some mothers to turn to formula. For budget-conscious consumers, formula might seem like a more affordable option compared to some organic or stage-specific baby food products.

Prepared baby food is the fastest-growing segment in the MEA market, capturing an estimated 25-30% share and experiencing a meteoric rise. Prepared baby food often undergoes rigorous quality control measures, offering parents peace of mind regarding hygiene and safety. The premium pricing of some prepared baby food options can be a barrier for budget-conscious consumers. The use of packaging materials in prepared baby food raises concerns about environmental sustainability. Companies are looking for eco-friendly alternatives to address this growing concern.

Middle East and Africa Baby Food Market Segmentation: By Distribution Channel:

- Supermarkets & Hypermarkets

- Convenience Stores

- Pharmacies

- Online Retailers

Supermarkets & Hypermarkets (50-55%) channel remains the dominant force, offering a wide variety of brands, product types, and convenient one-stop shopping experiences. Supermarkets and hypermarkets frequently run promotions and loyalty programs, attracting price-conscious consumers seeking deals on baby food products. The one-stop shopping experience allows parents to purchase baby food alongside other groceries and household necessities, saving them time and effort.

Online retail is the fastest-growing distribution channel in the MEA baby food market, capturing an estimated 5-10% share and experiencing a meteoric rise. Online platforms allow parents to browse and purchase baby food from the comfort of their homes, saving them valuable time and eliminating the need for physical store visits. Online platforms provide detailed product descriptions, nutritional information, and customer reviews, empowering parents to make informed choices.

Middle East and Africa Baby Food Market Segmentation: Regional Analysis:

- United Arab Emirates

- Saudi Arabia

- Qatar

- Israel

- South Africa

- Nigeria

- Kenya

- Egypt

- Rest of MEA

Saudi Arabia stands out as the most dominant country in the MEA baby food market, driven by its large population, increasing urbanization, and rising disposable incomes. The kingdom's strong economic growth and government initiatives aimed at promoting maternal and child health have further fueled the demand for baby food products. Saudi Arabia accounts for approximately 25% of the total MEA baby food market, making it the undisputed leader in the region. The country's robust economic performance, fueled by its oil-based economy, has led to an increase in disposable incomes among Saudi households. This has enabled families to allocate more resources towards premium and specialized baby food products.

While Saudi Arabia dominates the MEA baby food market, Egypt emerges as the fastest-growing country in the region. Driven by its large population, increasing birth rates, and rising consumer awareness, Egypt's baby food market is witnessing rapid expansion and attracting significant investments from domestic and international players. Egypt's baby food market is projected to grow at a compound annual growth rate (CAGR) of approximately 12-15% over the next five years, outpacing the regional average. Despite economic challenges, Egypt has witnessed a gradual increase in disposable incomes among certain segments of the population. This has enabled more families to invest in premium and specialized baby food products, contributing to market growth.

COVID-19 Impact Analysis on the Middle East and Africa Baby Food Market:

The initial stages of the pandemic witnessed a surge in demand for baby food, particularly infant formula. Fear of stock shortages and supply chain disruptions triggered panic buying behavior. This led to temporary shortages of certain products, particularly in some regions with underdeveloped infrastructure or limited domestic production. Lockdowns and social distancing measures significantly impacted traditional brick-and-mortar retail channels. Consumers, hesitant to venture out, turned to online platforms for their baby food needs. This accelerated the growth of e-commerce platforms, forcing companies to adapt their distribution strategies and strengthen their online presence. The pandemic heightened concerns about hygiene and safety. Parents became more conscious of product sterilization and opted for brands with strong hygiene protocols. This trend presented an opportunity for companies to emphasize stringent sanitation measures throughout the production and distribution process. While initial panic buying inflated sales, the segment might have experienced a slowdown in some regions due to economic hardships caused by the pandemic.

Latest Trends/ Developments:

Transparency in sourcing and clean labeling practices are becoming key differentiators. The rise of smart packaging with integrated temperature sensors and expiry indicators can enhance food safety and provide valuable information to parents. Additionally, packaging made from sustainable materials is gaining traction, catering to environmentally conscious consumers. Products specifically formulated for different developmental stages (e.g., first stage, toddler meals) are increasingly popular. This caters to the evolving nutritional needs of babies as they grow, ensuring they receive the appropriate nutrients for each stage. Increased emphasis on the crucial role of proper nutrition during the first 1000 days of a child's life can create a demand for specialized baby food products formulated for this critical window in development.

Key Players:

- Nestlé S.A

- Danone Nutricia

- Abbott Laboratories

- The Baby Food Company

- Saipro Biotech Private Limited

- Orchard Baby Food

- Tiger Brands

- Bumbles Baby Food

- Danone SA

Chapter 1. Middle East and Africa Baby Food Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Middle East and Africa Baby Food Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Middle East and Africa Baby Food Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Middle East and Africa Baby Food Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Middle East and Africa Baby Food Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Middle East and Africa Baby Food Market– By Type

6.1. Introduction/Key Findings

6.2. Infant Milk Formula

6.3. Prepared Baby Food

6.4. Dried Baby Food

6.5. Organic Baby Food

6.6. Y-O-Y Growth trend Analysis By Type

6.7. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Middle East and Africa Baby Food Market– By Distribution Channel

7.1. Introduction/Key Findings

7.2. Supermarkets & Hypermarkets

7.3. Convenience Stores

7.4. Pharmacies

7.5. Online Retailers

7.6. Y-O-Y Growth trend Analysis By End Use

7.7. Absolute $ Opportunity Analysis By End Use, 2024-2030

Chapter 8. Middle East and Africa Baby Food Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Middle East & Africa

8.1.1. By Country

8.1.1.1. United Arab Emirates (UAE)

8.1.1.2. Saudi Arabia

8.1.1.3. Qatar

8.1.1.4. Israel

8.1.1.5. South Africa

8.1.1.6. Nigeria

8.1.1.7. Kenya

8.1.1.8. Egypt

8.1.1.9. Rest of MEA

8.1.2. By Type

8.1.3. By End Use

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Middle East and Africa Baby Food Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Nestlé S.A

9.2. Danone Nutricia

9.3. Abbott Laboratories

9.4. The Baby Food Company

9.5. Saipro Biotech Private Limited

9.6. Orchard Baby Food

9.7. Tiger Brands

9.8. Bumbles Baby Food

9.9. Danone SA

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The Middle East and Africa Baby Food Market was valued at USD 1.22 Billion in 2023 and is projected to reach a market size of USD 1.99 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7.24%.

Excessive dependence on formula feeding, especially when not medically necessary, can lead to potential health complications for infants. This concern is particularly relevant in regions with lower breastfeeding rates

Nestlé S.A, Danone Nutricia, Abbott Laboratories, The Baby Food Company,

Saipro Biotech Private Limited, Orchard Baby Food, Tiger Brands, Bumbles Baby

Food, Danone SA.

With 25% of the industry's total revenue, Saudi Arabia accounted for the highest portion of the market in the Middle East and Africa

Egypt is expected to be the fastest growing in the Middle East and Africa, with a projected compound annual growth rate (CAGR) of 15% over the forecast period.