Middle East and Africa Wellness Supplements Market Size (2024-2030)

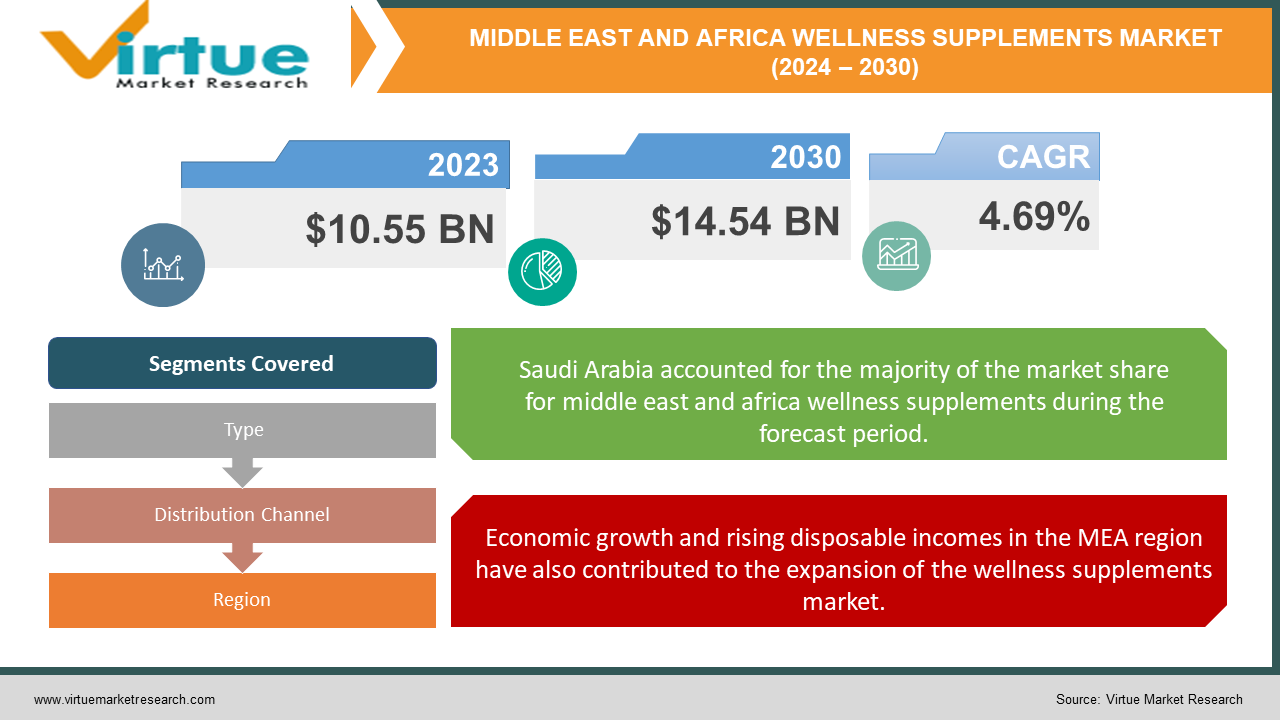

The Middle East and Africa Wellness Supplements Market was valued at USD 10.55 Billion in 2023 and is projected to reach a market size of USD 14.54 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.69%.

The Middle East and Africa's wellness supplement market has grown significantly due to changes in dietary habits and lifestyle brought about by the MEA region's economic growth and urbanization, the prevalence of illnesses including diabetes and obesity has increased. The desire for supplements that may help lessen these negative effects is being driven by the trend toward increasingly sedentary lives and unhealthy eating habits that frequently accompany urbanization. Despite the growth prospects, the MEA wellness supplements market faces several challenges. These include economic disparities, varying levels of consumer awareness, and access to healthcare. Additionally, there are logistical challenges in reaching remote areas, and the high cost of supplements can be a barrier for lower-income consumers.

Key Market Insights:

Over 55% of consumers in the MEA region report being willing to pay a premium for natural and organic wellness supplements.

The increasing prevalence of chronic diseases such as diabetes and heart disease is driving demand for functional supplements in the MEA region.

Sales of weight management supplements are expected to reach over USD 2 billion by 2027, fueled by growing concerns about obesity and weight management.

The demand for immunity-boosting supplements like Vitamin C and Zinc surged by over 70% in the MEA region during the COVID-19 pandemic.

E-commerce platforms are capturing a growing share of the MEA wellness supplements market, with online sales projected to reach over USD 4 billion by 2026.

Convenience stores and pharmacies remain key distribution channels for wellness supplements in the MEA region, particularly in underbanked areas.

Increasing urbanization and busy lifestyles are leading to a demand for convenient and portable wellness supplement options.

Over 55% of consumers in the MEA region report being willing to pay a premium for natural and organic wellness supplements.

Sales of weight management supplements are expected to reach over USD 2 billion by 2027, fueled by growing concerns about obesity and weight management.

The demand for immunity-boosting supplements like Vitamin C and Zinc surged by over 70% in the MEA region during the COVID-19 pandemic.

E-commerce platforms are capturing a growing share of the MEA wellness supplements market, with online sales projected to reach over USD 4 billion by 2026.

Middle East and Africa Wellness Supplements Market Drivers:

The growing awareness of health and wellness among consumers is a primary driver of the wellness supplements market in the MEA region.

Governments, non-governmental organizations, and health advocacy groups have all launched health education and awareness initiatives that have been essential in informing the public about the advantages of wellness supplements. These advertisements stress the value of a healthy diet, consistent exercise, and the use of supplements to correct nutritional gaps. Wellness supplements are being more and more recommended by medical professionals—such as physicians, dietitians, and nutritionists—to their patients as part of all-encompassing health management programs. This support from medical experts gives wellness supplements more legitimacy and promotes their usage. People are starting to take proactive steps to avoid diseases instead of only treating them after they arise, which is a clear movement in the direction of preventive healthcare.

Economic growth and rising disposable incomes in the MEA region have also contributed to the expansion of the wellness supplements market.

Lifestyles and eating habits have changed significantly as a result of urbanization. The hectic schedules of many urbanites cause them to consume more processed and convenient meals, which frequently lack vital nutrients. To make up for dietary deficits, this has led to a need for health supplements. Access to knowledge via digital platforms has increased in tandem with the rise in disposable incomes. Supplements for well-being are among the health and wellness items about which consumers are increasingly more aware. Supplements that might promote a healthy lifestyle are in greater demand as a result of this growing awareness. The willingness of consumers to spend on supplements and other health and wellness items is increasing as disposable incomes grow. They see these goods as investments in their overall health and welfare.

Middle East and Africa Wellness Supplements Market Restraints and Challenges:

Economic inequality and differing degrees of access to healthcare are two major obstacles facing the MEA region's wellness supplement market. There are places with substantial economic growth, but there are also areas with high rates of poverty and restricted access to medical care. Due to economic disparity, a large percentage of people cannot purchase health supplements, which are frequently regarded as luxuries. There is minimal space for discretionary expenditure on supplements in low-income communities because the primary priorities there are providing for fundamental requirements like food, housing, and healthcare. Another obstacle to the market expansion for wellness supplements is the restricted availability of healthcare services in rural and isolated locations.

Middle East and Africa Wellness Supplements Market Opportunities:

There is a lot of unexplored development potential for wellness supplements in the many rising markets in the MEA area. Businesses may investigate these markets by creating distribution networks and focused marketing plans that address the unique requirements and inclinations of customers in these areas. Spending on health and wellness items is on the rise in developing nations due to rising disposable incomes. These markets' customers are growing more health-conscious and prepared to spend money on supplements that can improve their overall health and well-being. A sizable market potential exists in the rising demand for natural and sustainable wellness supplements. Products that are ethically sourced, natural, and kind to the environment are becoming more and more popular. Personalized nutrition involves creating customized supplement plans based on an individual's health status, lifestyle, and genetic makeup. This approach can enhance the effectiveness of supplements and provide more significant health benefits. Companies can leverage data and technology to offer personalized supplement solutions.

MIDDLE EAST AND AFRICA WELLNESS SUPPLEMENTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.69% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Kingdom of Saudi Arabia, UAE, Israel, Rest of GCC countries, South Africa, Ethiopia, Kenya, Egypt, Sudan, Rest of MEA |

|

Key Companies Profiled |

Pfizer Inc. (US), GlaxoSmithKline Plc. (UK), Nestlé S.A. ( Switzerland), Bayer AG (Germany), Hikma Pharmaceuticals PLC (Jordan), The Arab Company for Drug Industries and Medical Supplies (Egypt), Marcy Laboratory LLC (Saudi Arabia), Gulf Pharmaceutical Industries (UAE), Herbalife Nutrition (US), Amway Corporation (US), Nature's Way Products, Inc. (US), Solgar Vitamin and Herb (US), GNC Holdings LLC (US). |

Middle East and Africa Wellness Supplements Market Segmentation:

Middle East and Africa Wellness Supplements Market Segmentation: By Types:

- Vitamins and minerals

- Herbal supplements

- Protein and amino acids

- Probiotics

The most common category of wellness supplements in the MEA market is vitamins and minerals. These supplements are necessary to avoid deficiencies and to maintain general health. They are essential for many biological processes, such as the creation of energy, strong bones, and immunological support. The widespread use and indispensability of vitamins and minerals account for their dominance. These supplements are beneficial to almost everyone, from adults seeking to maintain optimal health to toddlers in need of vital nutrients for growth and development.

In the MEA wellness supplement industry, herbal supplements are the category with the quickest rate of growth. The growing popularity of natural health remedies and growing knowledge of the advantages of conventional care are the main causes of the growth rate. The market for herbal goods is growing as consumers look for supplements made of plants rather than synthetic ones. Because consumers are becoming more and more interested in natural and plant-based products, herbal supplements are becoming more and more popular. These supplements, which provide several health advantages like increased immunity, less stress, and improved digestion, are made from herbs and botanicals.

Middle East and Africa Wellness Supplements Market Segmentation: By Distribution Channel:

- Supermarkets, hypermarkets and Retail stores

- online platforms

- direct-to-consumer sales

The retail sector, which includes supermarkets, health food shops, and specialized supplement stores, is a major wellness supplement distribution channel. These shops serve customers seeking convenience and same-day purchases by providing a wide range of items. Customers may explore and compare various items at retail establishments, frequently with the help of trained staff. Customers who like to view and buy things in person choose this route.

The ease of online purchasing and the abundance of items available have made online platforms the distribution channel with the quickest rate of growth. It is simpler for customers to make educated purchase decisions when they have access to competitive pricing, comprehensive product information, and customer reviews from e-commerce websites and specialty supplement merchants.

Middle East and Africa Wellness Supplements Market Segmentation: Regional Analysis:

- United Arab Emirates (UAE)

- Saudi Arabia

- Qatar

- Israel

- South Africa

- Nigeria

- Kenya

- Egypt

- Rest of MEA

With an astonishing 22.4% share, Saudi Arabia has emerged as the most dominating participant in the MEA wellness supplements industry. In recent times, Saudi Arabia has experienced a notable transition towards healthier living. Growing rates of obesity, a rise in chronic illnesses, and a greater understanding of the need for preventative healthcare have all contributed to this trend. As a result, to correct nutritional deficiencies and support their health goals, consumers are increasingly turning to wellness supplements.

Kenya is now the fastest-growing nation in the MEA while having a minimal 4.5% market share for health supplements. Kenya's middle class is growing, which means that people have more money to spend on wellness and health items. Because of this change in demographics, the market for wellness supplements is expanding. Kenya's fast urbanization has resulted in substantial lifestyle changes, such as an increase in the consumption of processed foods and sedentary behaviors. As a result, there is now a greater understanding of the necessity of nutritional supplements to preserve general health.

COVID-19 Impact Analysis on the Middle East and Africa Wellness Supplements Market:

A robust immune system is crucial, and the epidemic provided a sobering reminder of this. Customers in the MEA area became particularly conscious of their health and well-being as a result of the threat posed by a unique virus. The demand for supplements that strengthen immunity, such as zinc, vitamin C, vitamin D, and elderberry, rises as a result. Sales of these supplements soared, with some studies indicating a 70% increase in sales at the height of the epidemic. Travel bans and lockdowns caused havoc with international supply chains, affecting the price and availability of raw ingredients needed to produce wellness supplements. The MEA area experienced price swings and shortages since it frequently depends on imports for certain ingredients. Several countries in the Middle East and Africa (MEA) area took action to stabilize the market for wellness supplements after realizing how crucial a healthy populace was to fight the epidemic. These actions supported local supplement manufacturing, streamlined regulatory procedures, and eased the import of necessary raw materials. By implementing these measures, supply chain interruptions were lessened, and increased accessibility to vital health items was guaranteed.

Latest Trends/ Developments:

One of the most significant trends in the MEA wellness supplements market is the exponential growth of e-commerce platforms. Consumers, particularly in urban areas, are increasingly turning to online retailers for convenient access to a vast array of wellness supplements. This shift presents a unique opportunity for both established brands and innovative newcomers to reach a wider audience and cater to diverse preferences. Customers are showing an increasing interest in customized supplement regimens and are moving past the idea of a "one-size-fits-all" approach to well-being. The market for nutraceuticals, or goods that mix the benefits of medicine and food, is growing as a result of this trend. The market for MEA health supplements is being impacted by the growing acceptance of plant-based diets. Due to dietary restrictions and ethical concerns, consumers are searching for supplements that are suitable for vegans and vegetarians. The user experience can be further improved, and supplement regimen adherence encouraged by new technologies such as wearable nutrient level monitors or smart packaging that tracks consumption and sends refill reminders.

Key Players:

-

- Pfizer Inc. (US)

- GlaxoSmithKline Plc. (UK)

- Nestlé S.A. (Switzerland)

- Bayer AG (Germany)

- Hikma Pharmaceuticals PLC (Jordan)

- The Arab Company for Drug Industries and Medical Supplies (Egypt)

- Marcy Laboratory LLC (Saudi Arabia)

- Gulf Pharmaceutical Industries (UAE)

- Herbalife Nutrition (US)

- Amway Corporation (US)

- Nature's Way Products, Inc. (US)

- Solgar Vitamin and Herb (US)

- GNC Holdings LLC (US)

Chapter 1. Middle East and Africa Wellness Supplements Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Middle East and Africa Wellness Supplements Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Middle East and Africa Wellness Supplements Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Middle East and Africa Wellness Supplements Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Middle East and Africa Wellness Supplements Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Middle East and Africa Wellness Supplements Market– By Type

6.1. Introduction/Key Findings

6.2. Vitamins and minerals

6.3. Herbal supplements

6.4. Protein and amino acids

6.5. Probiotics

6.6. Y-O-Y Growth trend Analysis By Type

6.7. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Middle East and Africa Wellness Supplements Market– By Distribution Channel

7.1. Introduction/Key Findings

7.2. Supermarkets, hypermarkets and Retail stores

7.3. online platforms

7.4. direct-to-consumer sales

7.5. Y-O-Y Growth trend Analysis By Distribution Channel

7.6. Absolute $ Opportunity Analysis By Distribution Channel , 2024-2030

Chapter 8. Middle East and Africa Wellness Supplements Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Middle East & Africa

8.1.1. By Country

8.1.1.1. United Arab Emirates (UAE)

8.1.1.2. Saudi Arabia

8.1.1.3. Qatar

8.1.1.4. Israel

8.1.1.5. South Africa

8.1.1.6. Nigeria

8.1.1.7. Kenya

8.1.1.8. Egypt

8.1.1.9. Rest of MEA

8.1.2. By Type

8.1.3. By Distribution Channel

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Middle East and Africa Wellness Supplements Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Pfizer Inc. (US)

9.2. GlaxoSmithKline Plc. (UK)

9.3. Nestlé S.A. (Switzerland)

9.4. Bayer AG (Germany)

9.5. Hikma Pharmaceuticals PLC (Jordan)

9.6. The Arab Company for Drug Industries and Medical Supplies (Egypt)

9.7. Marcy Laboratory LLC (Saudi Arabia)

9.8. Gulf Pharmaceutical Industries (UAE)

9.9. Herbalife Nutrition (US)

9.10. Amway Corporation (US)

9.11. Nature's Way Products, Inc. (US)

9.12. Solgar Vitamin and Herb (US)

9.13. GNC Holdings LLC (US)

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

Growing economies and a burgeoning middle class in many MEA countries are leading to higher disposable incomes. This allows consumers to prioritize preventative healthcare and invest in their well-being through wellness supplements

Navigating the complex and sometimes fragmented regulatory environment across different MEA countries can be challenging for manufacturers. Ensuring compliance with often stringent safety and labeling regulations requires ongoing vigilance and adaptation.

Pfizer Inc. (US), GlaxoSmithKline Plc. (UK), Nestlé S.A. ( Switzerland), Bayer AG (Germany), Hikma Pharmaceuticals PLC (Jordan), The Arab Company for Drug Industries and Medical Supplies (Egypt), Marcy Laboratory LLC (Saudi Arabia), Gulf Pharmaceutical Industries (UAE), Herbalife Nutrition (US), Amway Corporation (US), Nature's Way Products, Inc. (US), Solgar Vitamin and Herb (US), GNC Holdings LLC (US).

The market is dominated by Saudi Arabia, which commands a market share of around 22.4%.

With a market share of about 4.5%, Kenya is the nation that is expanding the fastest.