Middle East & Africa Hydroponics Market Size (2023-2030)

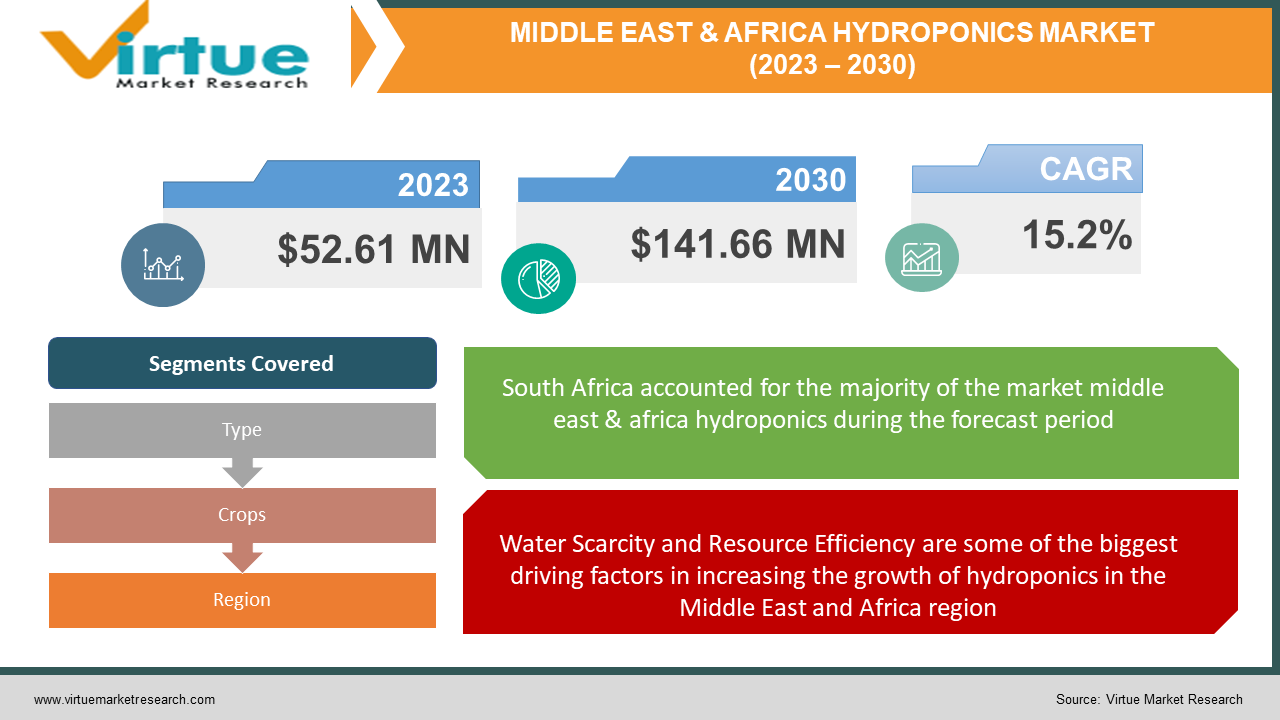

Middle East and Africa Hydroponics Market was valued at USD 52.61 million and is projected to reach a market size of USD 141.66 million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 15.2%.

Hydroponics, a soilless farming technique, offers efficient water usage and controlled environments for crop cultivation, making it particularly suitable for arid regions. The Middle East and Africa hydroponics market is experiencing significant growth and transformation, driven by increasing interest in sustainable agriculture practices and the need to address water scarcity and extreme climatic conditions in the region. The market is witnessing expansion in greenhouse and vertical farming setups, with a focus on high-value crops like vegetables and herbs. Government initiatives promoting food security and self-sufficiency, along with the adoption of advanced technologies and the rising popularity of locally grown produce, contribute to the market's positive outlook in the Middle East and Africa.

Key Market Insights:

Due to the predominantly arid climate in Gulf Cooperation Council (GCC) countries, approximately 90% of the food consumed in the region relies on imports, incurring a cost of approximately $53.1 billion in 2020. This heavy dependence on food imports exposes the region to vulnerabilities such as supply shocks and price spikes, as witnessed during the COVID-19 pandemic.

There has been a substantial surge in both foreign land acquisitions and domestic hydroponic farms, driven by the need for food security. Hydroponic farming, in particular, proves to be well-suited for these regions due to water scarcity issues.

The United Arab Emirates (UAE) has demonstrated significant adoption of hydroponics, boasting over 200 farms. As a result, locally grown produce accounts for more than 20% of the total fruit and vegetable sales in the UAE.

Middle East & Africa Hydroponics Market Drivers:

Water Scarcity and Resource Efficiency are some of the biggest driving factors in increasing the growth of hydroponics in the Middle East and Africa region.

Water scarcity is a pressing concern in many parts of the Middle East and Africa, making traditional soil-based agriculture unsustainable. Hydroponics offers a water-efficient alternative, as it can use significantly less water compared to conventional farming methods. The ability to recirculate and control the nutrient solution in hydroponic systems reduces water wastage and aligns with the region's efforts to conserve precious water resources.

Hydroponics help in eradicating the climate challenges and extreme temperatures faced by the Middle East and Africa, further helping in sustainable and controlled farming.

The Middle East and parts of Africa experience harsh and extreme climatic conditions, including high temperatures and limited arable land. Hydroponics allows for precise control of environmental factors such as temperature, humidity, and light, enabling year-round crop production in controlled environments like greenhouses. This capability is particularly valuable in regions with extreme weather conditions, promoting consistent and reliable harvests regardless of external factors.

Middle East & Africa Hydroponics Market Restraints and Challenges:

High initial investment costs associated with hydroponics could pose a challenge in their adoption.

Establishing hydroponic systems, especially advanced ones with automation and climate control, requires a significant upfront investment. The cost of infrastructure, equipment, specialized lighting, and nutrient solutions can be prohibitive for small-scale farmers and new entrants. This poses a barrier to adoption, particularly in regions where access to financing and capital is limited.

A growth limiting factor in this market is a lack of technical expertise and training.

Hydroponics is a technology-intensive farming method that requires specialized knowledge and skills. Many regions in the Middle East and Africa may lack a sufficient pool of trained professionals and agricultural experts with expertise in hydroponics. This shortage of technical know-how can hinder the successful implementation and operation of hydroponic systems, leading to suboptimal yields and increased operational risks for farmers and businesses. Educational and training programs are essential to address this challenge and promote wider adoption.

Middle East & Africa Hydroponics Market Opportunities:

The Middle East and Africa hydroponics market present promising opportunities driven by the growing awareness of sustainable agriculture, increasing water scarcity concerns, and the region's ambition to enhance food security. Hydroponics offers an efficient and resource-conserving method of crop cultivation, making it well-suited for arid climates. The rising demand for high-value crops, such as fresh vegetables and herbs, coupled with government initiatives to promote self-sufficiency in food production, positions hydroponics as a viable solution. Additionally, the expanding urban population and the desire for locally grown, pesticide-free produce create a favorable landscape for the expansion of hydroponic farming in the Middle East and Africa.

MIDDLE EAST & AFRICA HYDROPONICS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

15.2% |

|

Segments Covered |

By Type, Crops, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Saudi Arabia, Qatar, Israel, South Africa, Nigeria, Kenya, Egypt. Rest of MEA |

|

Key Companies Profiled |

Aero Farma, Madar Farms, Crop One Holdings Inc, Hydroponics Africa, Kobus Vertical Farming, Green Terrace, Smart Farming Technologies CC, Urbanization Cultivation International. H, RedSea |

Middle East & Africa Hydroponics Market Segmentation:

Middle-East and Africa Hydroponics Market Segmentation: By Type:

- Aggregate Systems

- Liquid Systems

Aggregate systems hold the largest segment in the Middle East & Africa hydroponics market accounting for approximately 55% market share, due to their long-established presence and suitability for arid climates. These systems, which use inert growing mediums like perlite or coconut coir, are well-suited for the region's conditions as they offer better aeration and drainage, reducing the risk of overwatering and root diseases which are important considerations in areas with water scarcity and extreme temperatures. Their reliability and efficiency have made them the preferred choice for hydroponic growers, particularly in the early stages of hydroponic adoption in the region.

Liquid systems are the fastest-growing segment in the Middle East & Africa hydroponics market growing at a CAGR of 10.1%, primarily driven by their efficiency and adaptability. Liquid-based hydroponic systems, such as nutrient film technique (NFT) and deep-water culture (DWC), use nutrient-rich water solutions to deliver essential elements directly to plant roots. This approach conserves water resources, a critical factor in water-scarce regions. Additionally, liquid systems can be easily integrated into vertical farming and greenhouse setups, making them suitable for controlled environment agriculture, which is gaining traction in the region.

Middle-East and Africa Hydroponics Market Segmentation: By Crops:

- Tomatoes

- Lettuce

- Peppers

- Cucumbers

- Herbs

- Others

Tomatoes hold the position of the largest segment in the Middle East & Africa hydroponics market having a share of more than 35%. Tomatoes are a staple ingredient in various regional cuisines, making them a high-demand crop. They are well-suited for hydroponic cultivation, with the controlled environment offering optimal conditions for their growth. Additionally, the ability to produce year-round, regardless of external climate conditions, is especially valuable in regions with extreme temperatures and limited arable land, contributing to the popularity of hydroponically grown tomatoes.

Lettuce emerges as the fastest-growing segment, anticipated to register a CAGR of 23%. Lettuce is a key component of salads and a versatile ingredient in many dishes, aligning with the increasing consumer demand for fresh and healthy foods. Lettuce has a relatively short growth cycle, allowing for multiple harvests in a year within hydroponic systems, making it an attractive option for growers seeking quick returns on investment. Lettuce's lower space requirements and adaptability to vertical farming techniques make it a favored choice for urban and space-constrained environments, contributing to its rapid growth within the hydroponics market.

Middle-East and Africa Hydroponics Market Segmentation: Regional Analysis:

- Saudi Arabia

- Qatar

- Israel

- South Africa

- Nigeria

- Kenya

- Egypt

- Rest of MEA

South Africa represents the largest segment in the Middle East and Africa hydroponics market having a revenue share of 22%, due to its well-established agricultural sector and strong commercial interest in hydroponic farming. The country's advanced infrastructure, favorable climate, and availability of skilled labor make it conducive for hydroponics. South Africa's focus on sustainable agriculture, the growing demand for fresh produce year-round, and its export-oriented approach to agriculture contribute to the prominence of hydroponics as a preferred method for efficient and high-quality crop cultivation, solidifying its position as a leading player in the regional hydroponics market.

Saudi Arabia emerges as the fastest-growing segment among these regions in the Middle East and Africa hydroponics market. This growth is primarily attributed to Saudi Arabia’s increasing focus on commercial hydroponic farming for high-value crops such as vegetables and herbs. The country benefits from the growing urban population's demand for fresh produce, and efforts to reduce post-harvest losses.

COVID-19 Impact Analysis on the Middle East & Africa Hydroponics Market:

The COVID-19 pandemic had a mixed impact on the Middle East & Africa hydroponics market. While disruptions in supply chains and logistical challenges affected the availability of equipment and inputs, the pandemic underscored the importance of local and sustainable food production. This led to increased interest in hydroponics as a means of achieving food security and reducing dependence on imports. Government initiatives to promote self-sufficiency in food production and consumer’s heightened focus on fresh and safe produce further accelerated the adoption of hydroponics in the region. However, economic uncertainties and financial constraints in some countries posed challenges to market growth, highlighting the need for targeted support and investment in the sector.

Latest Trends/ Developments:

Many companies are increasingly adopting vertical farming as part of their hydroponic systems. Vertical farming maximizes space utilization and allows for multi-layered cultivation, which is particularly valuable in urban settings with limited land availability. By integrating vertical farming into hydroponic setups, companies can optimize yields and offer a wide range of crops while conserving space and resources.

Tailoring nutrient solutions to specific crop requirements is becoming more prevalent. Companies are investing in research and development to create customized nutrient formulations that address the unique needs of various crops. These solutions optimize plant growth, improve yields, and enhance the overall quality of the harvested produce, making them a valuable selling point for hydroponic growers.

Key Players:

- Aero Farma

- Madar Farms

- Crop One Holdings Inc

- Hydroponics Africa

- Kobus Vertical Farming

- Green Terrace

- Smart Farming Technologies CC

- Urbanization Cultivation International. H

- RedSea

In March 2023, Saudi AgTech firm RedSea Farms, originally established in the Saudi desert, and expanded its hydroponics technology offerings. RedSea Farms, founded by immigrants, entered into a Memorandum of Understanding (MoU) with Saudi Downtown Company (SDC), a fully-owned subsidiary of the Public Investment Fund (PIF). This collaborative venture focuses on the investment, construction, and operation of RedSea greenhouses within SDC premises, to advance hydroponic technologies for the benefit of the industry.

Chapter 1. Middle East & Africa Hydroponics Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Middle East & Africa Hydroponics Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Middle East & Africa Hydroponics Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Middle East & Africa Hydroponics Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Middle East & Africa Hydroponics Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Middle East & Africa Hydroponics Market– By Type

6.1. Introduction/Key Findings

6.2. Aggregate Systems

6.3. Liquid Systems

6.4. Y-O-Y Growth trend Analysis By Type

6.5. Absolute $ Opportunity Analysis By Type , 2023-2030

Chapter 7. Middle East & Africa Hydroponics Market– By Crops

7.1. Introduction/Key Findings

7.2. Tomatoes

7.3. Lettuce

7.4. Peppers

7.5. Cucumbers

7.6. Herbs

7.7. Others

7.8. Y-O-Y Growth trend Analysis By Crops

7.9. Absolute $ Opportunity Analysis By Crops , 2023-2030

Chapter 8. Middle East & Africa Hydroponics Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Middle East & Africa

8.1.1. By Country

8.1.1.1. United Arab Emirates (UAE)

8.1.1.2. Saudi Arabia

8.1.1.3. Qatar

8.1.1.4. Israel

8.1.1.5. South Africa

8.1.1.6. Nigeria

8.1.1.7. Kenya

8.1.1.8. Egypt

8.1.1.9. Rest of MEA

8.1.2. By Type

8.1.3. By Crops

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Middle East & Africa Hydroponics Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Aero Farma

9.2. Madar Farms

9.3. Crop One Holdings Inc

9.4. Hydroponics Africa

9.5. Kobus Vertical Farming

9.6. Green Terrace

9.7. Smart Farming Technologies CC

9.8. Urbanization Cultivation International. H

9.9. RedSea

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The Middle East & Africa Hydroponics Market was valued at USD 45.67 Million and is projected to reach a market size of USD 141.66 Million by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 15.2%.

Water Scarcity and Resource Efficiency along with climate challenges and extreme temperatures are drivers of the Middle East & Africa Hydroponics market.

Based on technology type, the Middle East & Africa Hydroponics Market is segmented into aggregate systems and liquid systems

South Africa is the most dominant region for the Middle East & Africa Hydroponics Market

Aero Farma, Madar Farms, Crop One Holdings Inc., and Hydroponics Africa are a few of the key players operating in the Middle East & Africa Hydroponics Market.