Middle East & Africa Food Preservatives Market Size (2024-2030)

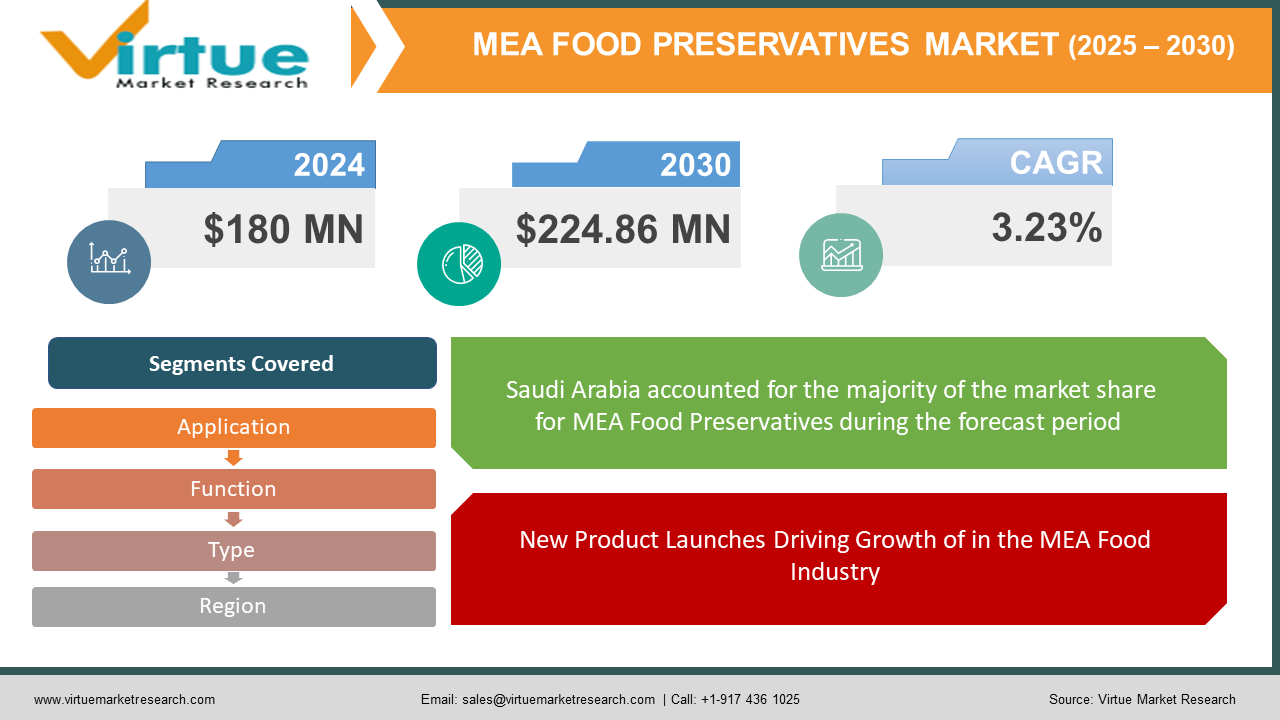

Middle East & Africa food preservatives market was valued at USD 180 million in 2023 and is projected to reach a market size of USD 224.86 million by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 3.23%.

Food preservatives are substances added to prevent food from spoiling, extend its life, and maintain its quality and safety. These additives prevent the growth of bacteria, yeast, mold, and other organisms that cause food spoilage. One type of food preservative is antioxidants, which prevent fats and oils from going rancid when exposed to oxygen. Another is an antibacterial substance that prevents the growth of bacteria and fungi. Salt and sugar are the oldest preservatives and are used to preserve meat, fruits, and vegetables by methods such as curing and pickling. Antibiotics such as benzoates and sulfites are also commonly used to prevent microbial growth in processed foods. Although antibiotics help ensure food safety and availability year-round, there are still concerns about their health benefits, including links to allergic reactions and some diseases. Balancing food protection needs with consumer health concerns remains an ongoing challenge for the food industry.

Key Market Insights:

- The region's food and beverage business is growing, which is supported by factors including rising disposable incomes, population expansion, and more consumer awareness. Product innovation and technological developments help to further speed up market expansion.

- Economic and financial aspects provide difficulties since preservative prices might influence consumer choices. Negative customer views and health-related issues can impede market expansion.

- The market for food preservatives has a lot of room to grow, which is fueling the development of natural preservatives. Preservative product innovation and diversification are made possible by the region's growing food and beverage sector.

- Supply networks, industrial dynamics, and consumer behavior have all been profoundly impacted by the epidemic. However, as consumers gave priority to making health-conscious decisions, the crisis also increased demand for natural preservatives.

- Preservatives generated from plant extracts are being included in food producers' reformulation efforts as a result of recent developments, such as the increased desire for natural and clean products. Along with a dedication to sustainability and environmental responsibility in packaging and manufacturing procedures, there's also an emphasis on innovation and increasing technology in food preservation processes.

Middle East & Africa Food Preservatives Market Drivers:

New Product Launches Driving Growth of in the MEA Food Industry

The food and beverage industry in the Middle East and Africa is growing rapidly, driven by factors such as population growth, increased disposable income, and consumer awareness. The expanding food and beverage industry has created a demand for food preservatives as manufacturers look for ways to extend product shelf life and meet regulatory standards. The food preservatives industry in the Middle East and Africa region continues to expand with the growth of food products and the introduction of new products.

Technological advancements and product innovation accelerate market growth.

Technological advancement and continuous research in food science have led to the development of new food preservatives with improved performance and safety. Manufacturers are investing in research and development activities to develop disinfectants to meet the growing demand for natural and clean products that will meet customer preferences. In addition, advances in food packaging technology, such as air-conditioning packaging and active packaging systems, increase the use of food preservatives by extending shelf life and freshness. These technological advances support business growth by providing solutions that meet customer needs and regulatory requirements in the Middle East and Africa region.

Middle East & Africa Food Preservatives Market Restraints and Challenges:

Cost considerations and economic factors prove to be challenges in driving the market forward.

The cost of food preservatives can be an important factor affecting the purchasing decisions of companies in the Middle East and Africa region. Although preservatives are important to extend the shelf life and ensure the stability of products, they can increase production costs. Changes in raw material prices and economic conditions such as currency devaluation or inflation will further impact companies, especially small businesses, on their ability to pay for goods. Balancing the need for efficiency with cost-effectiveness is a challenge for stakeholders seeking to be efficient while remaining competitive in the marketplace.

Health concerns and negative perceptions hinder market growth.

Although food preservatives are widely used, they are sometimes associated with health concerns and negative perceptions among consumers. Some people may be hesitant to eat foods with synthetic ingredients due to perceived health risks or possible allergies. Additionally, media coverage and misinformation regarding the safety of certain vaccines may increase consumer concerns. Addressing these issues and educating consumers about the safety and suitability of food products is a challenge for those involved in the MEA food industry.

Middle East & Africa Food Preservatives Market Opportunities:

The Middle East and Africa (MEA) food preservative industry is poised for growth and expansion. The increasing demand for clean and healthy food products in the region is a great opportunity. The market for natural preservatives derived from plant extracts, herbs, and spices is growing as consumers become more health-conscious and seek products with fewer synthetic additives. Additionally, the growing food and beverage industry in the Middle East and Africa region offers ample opportunities for food retailers and distributors. With the rapid increase in population, increasing disposable income, and changing diets, the demand for processed and convenient foods that require storage methods for quality and safety is increasing. Moreover, as regulatory bodies in the region continue to focus on enhancing food safety standards, there is a need for innovative preservative solutions that meet regulatory requirements while addressing consumer preferences. Overall, MEA's food preservative market has been successful, providing companies with opportunities to innovate, diversify products, and capitalize on new products.

MIDDLE EAST & AFRICA FOOD PRESERVATIVES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024- 2030 |

|

CAGR |

3.23% |

|

Segments Covered |

By Type, Function, application, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Mexico, Brazil, Argentina, Chile, and Rest of Latin America |

|

Key Companies Profiled |

Elantas GmbH (Germany), Axalta Coating Systems (the U.S.), Von Roll Holdings AG (Switzerland), Hitachi Chemicals Company Ltd. (Japan), 3M Company (the U.S.), and Kyocera Corporation (Japan) |

Middle East & Africa Food Preservatives Market Segmentation:

Middle East & Africa Food Preservatives Market Segmentation by Type:

- Natural Preservatives

- Synthetic Preservatives

The synthetic preservatives segment accounts for the largest share. Synthetic preservatives are compounds designed to prevent bacterial growth in foods. Examples include benzoates, sulfites, sorbates, and propionates. Despite concerns about the safety of synthetic materials, they are widely used in the food industry, especially in food products and packaging. On the other hand, natural preservatives are expected to witness the fastest growth during the forecasting period as consumers become more health-conscious and seek products with fewer synthetic additives.

Middle East & Africa Food Preservatives Market Segmentation by Function:

- Antimicrobial

- Antioxidants

- Chelating Agents

- pH Control Agents

- Others

Based on their function, antimicrobials are the largest and fastest-growing category. Antimicrobial preservatives prevent the growth of bacteria, yeast, mold, and other organisms in foods, prolonging the shelf life of food and preserving its freshness. This segment includes preservatives such as sorbates, benzoates, and propionates, which are commonly used in many foods and beverages.

Middle East & Africa Food Preservatives Market Segmentation by Application:

- Bakery and Confectionery

- Beverages

- Dairy and Frozen Foods

- Meat, Poultry, and Seafood

- Others

Meat, poultry, and seafood share the largest portion and account for more than 35% of the market. Preservatives are important for maintaining the freshness and safety of meat, poultry, and seafood, especially in the tropical climate of the Middle East and Africa. Ingredients such as sodium nitrite and citric acid are added to processed meats, canned foods, and seafood to prevent contamination, control oxidation, and extend shelf life. The demand for food preservatives in drinks is anticipated to expand at the fastest rate during the projected period due to the growth of the beverage sector. Chemicals known as preservatives are added to drinks to stop microorganisms from growing and spoiling them. They might be artificial or natural. A major component of the beverage sector is preservatives. They prevent the growth of mold, yeast, and bacteria, among other microbes. If ingested, these microbes may cause spoilage, strange flavors, and even pose health hazards. Moreover, preservatives can aid in preventing or delaying spoilage brought on by yeast, mold, bacteria, or fungi. They can also postpone rancidity, preserve freshness, and slow or stop changes in the food's color, flavor, or texture.

Middle East & Africa Food Preservatives Market Segmentation: Regional Analysis:

- United Arab Emirates (UAE)

- Saudi Arabia

- Qatar

- Israel

- South Africa

- Nigeria

- Kenya

- Egypt

- Rest of MEA

Saudi Arabia is one of the largest markets. Saudi Arabia has a large and growing food and beverage industry, driven by a young population and increasing disposable income. Food preservatives are widely used in Saudi Arabia to maintain the shelf life of staple foods such as bread, dairy products, and canned goods. The Saudi Arabian market is characterized by a mix of domestic and international suppliers, with an increasing focus on hygienic labels and halal-certified products. The UAE is the fastest-growing market. Due to its robust economic foundation and variety, this region has a wide range of consumers. Food preservation consumption in the UAE is driven by the expatriate community from many countries and the wealthy residents of the UAE. Imported food preservative brands from Europe, the United States, and Australia are popular among consumers. Qatar's food industry is driven by its affluent population and robust tourism sector. Food preservatives are important to keep food fresh and safe in Qatar, especially in supermarkets and hospitality establishments. The Qatar market is characterized by a preference for the highest quality food preservatives, food safety management, and increasing demand for organic and natural alternatives.

COVID-19 Impact Analysis on the Middle East & African Food Preservatives Market:

The COVID-19 pandemic has had a significant impact on the Middle East and Africa (MEA) food preservatives industry, changing consumer behavior, supply chains, and industry dynamics. During the global pandemic, demand for packaged and processed products increased as consumers stocked shelf-stable products during quarantines and restrictions. The increasing demand for preserved foods has led to increased sales of preserved foods in the Middle East and Africa. However, the pandemic has also disrupted supply chains and created logistical challenges and shortages for food retailers. Travel restrictions and border closures have hindered the movement of goods, disrupted food supplies, and led to supply disruptions. In addition, the economic crisis caused by the pandemic affected the purchasing power of consumers and led to changes in consumption patterns and preferences. Demand for natural preservatives is increasing in the Middle East and Africa as consumers become more health-conscious and seek natural and clean products.

Latest Trends/ Developments:

The food industry in the Middle East and Africa (MEA) has experienced significant growth and development in recent years, reflecting the trajectory of the market and its impact on consumers. One of the most important factors contributing to this is the increasing demand for natural and clean products, driven by the health awareness of consumers in the region. As consumers seek healthier, more natural, and organic options, food manufacturers have responded by reformulating their products with preservatives derived from plant extracts, herbs, and spices.

There is also a focus on advancing technology and innovation in food preservation processes due to the need to improve food safety, extend shelf life, and meet specific requirements. Manufacturers are exploring new preservation technologies such as high performance, irradiation, and advanced packaging techniques to increase product quality and freshness while minimizing the use of synthetic materials.

Additionally, MEA markets are increasingly committed to sustainability and environmental responsibility. Consumers are increasingly aware of the environmental impacts of food production and packaging, leading to increased demand for environmentally friendly solutions and sustainable packaging.

Key Players:

- DSM

- BASF SE

- Brenntag Ingredients, Inc.

- Hawkins Watts Limited

- Kemin Industries, Inc.

- Corbion N.V.

- Kalsec Inc.

- Kerry Group plc

- Novozymes

- Jungbunzlauer Ag

In February 2024, Kemin Industries announced its acquisition of GLF Ingredienti Alimentari S.r.l., based in Parma, Italy. This acquisition strengthens the position of Kemin Food Technologies in the meat industry in EMEA by adding functional blends and yield enhancement technology with a high level of application know-how and technical service to its product offerings.

In September 2022, Brenntag announced a multi-year cooperation with Salesforce aimed at delivering effortless, data-driven, and personalized user experiences for its customers and supply partners.

Chapter 1. Middle East & African Food Preservatives Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Middle East & African Food Preservatives Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Middle East & African Food Preservatives Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Middle East & African Food Preservatives Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Middle East & African Food Preservatives Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Middle East & African Food Preservatives Market– By Type

6.1. Introduction/Key Findings

6.2. Natural Preservatives

6.3. Synthetic Preservatives

6.4. Y-O-Y Growth trend Analysis By Type

6.5. Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Middle East & African Food Preservatives Market– By Application

7.1. Introduction/Key Findings

7.2 Bakery and Confectionery

7.3. Beverages

7.4. Dairy and Frozen Foods

7.5. Meat, Poultry, and Seafood

7.6. Others

7.7. Y-O-Y Growth trend Analysis By Application

7.8. Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 8. Middle East & African Food Preservatives Market– By Function

8.1. Introduction/Key Findings

8.2. Antimicrobial

8.3. Antioxidants

8.4. Chelating Agents

8.5. pH Control Agents

8.6. Others

8.7. Y-O-Y Growth trend Analysis By Function

8.8. Absolute $ Opportunity Analysis By Function , 2024-2030

Chapter 9 . Middle East & African Food Preservatives Market, By Geography – Market Size, Forecast, Trends & Insights

9 .1. Middle East and Africa

9 .1.1. By Country

9 .1.1.1. Saudi Arabia

9 .1.1.2. Qatar

9 .1.1.3. UAE

9 .1.1.4. Israel

9 .1.1.5. South Africa

9 .1.1.6. Nigeria

9 .1.1.7. Kenya

9 .1.1.9 . Egypt

9 .1.1.9 . Rest of the Middle East

9.1.2. By Type

9.1.3. By Application

9.1.4. Function

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Middle East & African Food Preservatives Market– Company Profiles – (Overview, Type Type Portfolio, Financials, Strategies & Developments)

10.1. DSM

10.2. BASF SE

10.3. Brenntag Ingredients, Inc.

10.4. Hawkins Watts Limited

10.5. Kemin Industries, Inc.

10.6. Corbion N.V.

10.7. Kalsec Inc.

10.8. Kerry Group plc

10.9. Novozymes

10.10. Jungbunzlauer Ag

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

Middle East & Africa food preservatives market was valued at USD 180 million in 2023 and is projected to reach a market size of USD 224.86 million by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 3.23%.

The segments under the Middle East & Africa food preservatives market based on type are natural preservatives and synthetic preservatives.

Saudi Arabia is dominant in the Middle East & Africa food preservatives market.

Brenntag Ingredients, Inc., Hawkins Watts Limited, Kemin Industries, Inc., Corbion N.V., and Kalsec Inc. are the major players in this market

The COVID-19 pandemic has had a significant impact on the Middle East and Africa (MEA) food preservatives industry, changing consumer behavior, supply chains, and industry dynamics. During the global pandemic, demand for packaged and processed products increased as consumers stocked shelf-stable products during quarantines and restrictions. The increasing demand for preserved foods has led to increased sales of preserved foods in the Middle East and Africa