Middle East & Africa Caviar Market Size (2024-2030)

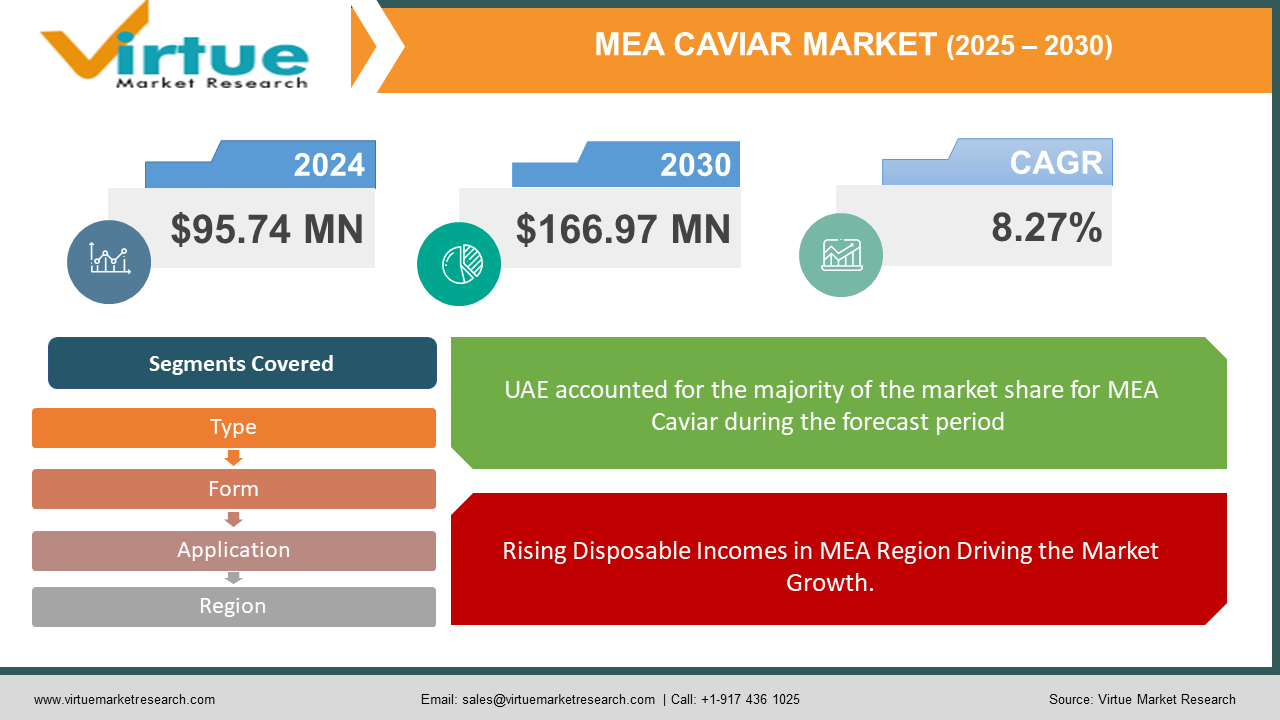

Middle East & Africa caviar market was valued at USD 95.74 million in 2023 and is projected to reach a market size of USD 166.97 million by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 8.27%.

Caviar, often associated with luxury and fine dining, is a food made from processed, salted fish roe. Its history dates back to ancient Persia, where sturgeon eggs were collected and consumed by kings. At the same time, caviar became popular in Europe, especially in Russia, where it became a symbol of wealth and prestige. Traditionally, Caviar refers to the roe of wild sturgeon, found only in the Caspian and Black Seas. However, due to concerns about fisheries and the environment, regulations to protect sturgeon stocks have been implemented, which has led to the emergence of caviar farming worldwide. Preparing caviar requires carefully removing the roe from the fish and gently salting it to enhance and preserve its flavor. The quality of caviar depends on factors such as the type of sturgeon, the size and color of the eggs, and the processing method. Today, caviar is still a coveted delicacy that can be enjoyed on its own or as a luxurious addition to gourmet foods.

Key Market Insights:

- The caviar industry in the Middle East and Africa presents an opulent culinary legacy, captivating customers with its extensive background and superior-quality products. Diverse alternatives are available on the market, ranging from inventive dried caviar powders to classic favorites like Beluga.

- To fulfill the increasing demand for caviar while protecting natural resources, producers are adopting sustainable techniques despite legislative obstacles and environmental problems. This industry's drive for customer satisfaction is shown in its commitment to ethical farming and transparent supply chains.

- The Middle East and Africa's caviar industry is expected to expand and innovate in the future because of its potential for expansion into other uses and nations. The sector is expected to have a prosperous future as the region's economy grows and eating habits change, with caviar continuing to be associated with refinement and culinary expertise.

Middle East & Africa Caviar Market Drivers:

Rising Disposable Incomes in MEA Region Driving the Market Growth.

Rising economic and disposable incomes in the Middle East and Africa have led to increased demand for luxury goods, including caviar. The market for high-end delicacies in food products, such as caviar, is also growing as more consumers can afford quality food. This trend is particularly evident among wealthy individuals in major cities and emerging economies in the Middle East and Africa, where there is a healthy appetite for luxury goods and experiences.

Cultural influences and status symbols associated with caviar are boosting the market.

Caviar has long been associated with prestige and luxury in many cultures around the world, including the MEA. In the Middle East and Africa, where health and wealth are culturally important, caviar is often seen as a status symbol and a symbol of wisdom. The desire to demonstrate social standing leads to the demand for caviar among wealthy customers who want to have a unique and prestigious culinary experience.

The diversification of culinary preferences is accelerating the growth rate.

The MEA region has a diverse culinary scene influenced by various cultures, traditions, and histories. Although caviar is traditionally associated with European cuisine, there is a growing trend towards culinary fusion and regional experimentation. Chefs and food lovers have incorporated caviar into new dishes that combine traditional flavors with modern cooking techniques. This diversity in culinary preferences could help expand the caviar market in the Middle East and Africa region, attracting more customers with different tastes and preferences.

Middle East & Africa Caviar Market Restraints and Challenges:

Environmental concerns and regulations prove to be a challenge.

One of the key issues facing the MEA caviar market is the environmental impact of caviar production, especially for wild sturgeon. Overfishing and habitat destruction have led to a decline in sturgeon populations in the Caspian and Black Seas, which are traditionally rich in caviar. As a result, regulatory agencies have established strict regulations for wild sturgeon hunting to protect animals, which in turn affects the supply chain and market prices.

High production costs and limited supply hinder market growth.

Caviar production is a laborious and resource-intensive process that requires specialized facilities, equipment, and expertise. Farming sturgeon for caviar production requires investment in infrastructure and technology, as well as regular feeding, care, and labor. Additionally, sturgeon farming is a time-consuming process, as sturgeon species mature slowly and require a long gestation period before producing eggs suitable for caviar harvesting. These conditions lead to high production costs and limited supplies of caviar, causing prices to rise and market exclusion.

Competition from alternative luxury foods restrains market growth.

The Middle East and Africa region has a rich culinary tradition and is home to many wonderful foods and nutritional products. While caviar has a reputation in the luxury food industry, it faces competition from other luxury foods and gourmet ingredients that benefit discerning shoppers and consumers. Products such as truffles, foie gras, and premium seafood varieties are highly comparable and entertaining, offering caviar producers a competitive market with competition from different products. Additionally, the availability of quality substitutes and other expensive products may limit the growth of the caviar market in the Middle East and Africa region.

Middle East & Africa Caviar Market Opportunities:

The Middle East and Africa (MEA) caviar market is growing, and many opportunities are emerging. As the economy grows and cities develop across the region, more and more wealthy people are increasing their purchasing power and seeking exclusive cooking experiences. This demographic shift not only increased the demand for luxury goods but also paved the way for the growth of high-end delicacies such as caviar. In addition, MEA's rich landscape provides fertile ground for innovative cuisines where chefs and food lovers can try caviar, mix it into dishes, or create fusion cuisine that appeals to different palates. In addition, the growing importance of sustainability and ethics provides a unique opportunity for caviar producers to differentiate themselves by using eco-farming practices with an environmentally friendly and transparent supply chain, thus supporting the consumer environment. Finally, as the Middle East and Africa region become the center of the luxury and hospitality industry, the demand for fine dining continues to grow, with caviar becoming a treat in the luxury of luxury hotels, resorts, and restaurants.

MIDDLE EAST & AFRICA CAVIAR MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8.27% |

|

Segments Covered |

By Type, Form, Application, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Kingdom of Saudi Arabia, UAE, Israel, Rest of GCC countries, South Africa, Ethiopia, Kenya, Egypt, Sudan, Rest of MEA |

|

Key Companies Profiled |

Caviar House & Prunier, Marky's Caviar, Petrossian, Beluga SA, Sturgeon AquaFarms, Caviar de Neuvic, Gourmet House Caviar, Attilus Caviar, Kaluga Queen, Royal Belgian Caviar |

Middle East & Africa Caviar Market Segmentation:

Middle East & Africa Caviar Market Segmentation by Form

- Fresh

- Dried

- Pasteurized

- Pressed

- Others

The fresh segment dominates the MEA market, accounting for more than 55% of the market. Fresh caviar is prized for its texture, rich taste, and premium quality, making it the first choice of customers looking for authentic caviar. In addition, fresh caviar is often associated with luxury and exclusive products, strengthening its appeal to affluent consumers in the Middle East and Africa. Dried caviar is the fastest-growing segment. Caviar eggs are dried and then powdered, a product commonly referred to as caviar powder. Dried caviar may be used like spices or pepper to season dishes, and it is simpler to combine with traditional caviar. It's adaptable and can elevate culinary pursuits, whether they're for big gatherings or little get-togethers.

Middle East & Africa Caviar Market Segmentation by Type:

- Beluga Caviar

- Osetra Caviar

- Sevruga Caviar

- Siberian Caviar

- Others

Sevruga caviar is the largest growing type. Customers choose these caviar species because of their great flavor and texture. Furthermore, it is expected that these species' low cost in comparison to salmon and osetra will continue to support the segment's growth for the foreseeable future. The Osetra caviar segment is the fastest-growing category. Osetra caviar is prized for its unique flavor profile and medium to large eggs, often containing nutty or buttery notes. It has a large market due to its popularity among both chefs and consumers.

Middle East & Africa Caviar Market Segmentation by Application:

- Restaurant

- Household

The restaurant is the largest and fastest-growing application. This includes high-end restaurants, fine dining establishments, and gourmet eateries that include caviar on their menus as a luxurious ingredient or standalone dish. Caviar is often used as an appetizer, side dish, or garnish for gourmet meals, enhancing the eating experience and attracting people keen on finding exquisite gourmet delicacies.

Middle East & Africa Caviar Market Segmentation: Regional Analysis:

- United Arab Emirates (UAE)

- Saudi Arabia

- Qatar

- Israel

- South Africa

- Nigeria

- Kenya

- Egypt

- Rest of MEA

The United Arab Emirates (UAE) is the largest market for caviar products in the MEA. The UAE has a very successful food industry due to its wealthy population and status as an international trade and tourism center. In addition to being popular among locals and tourists, caviar is also in demand in upscale restaurants, luxury hotels, and food markets in cities such as Dubai and Abu Dhabi. Saudi Arabia is the fastest-growing market. The growing economy and affluent consumers have created a huge demand for luxury goods, including caviar. Caviar is enjoyed by wealthy Saudi Arabians and foreigners and sold in upscale restaurants, luxury hotels, and specialty food stores in cities such as Riyadh, Jeddah, and Dammam.

COVID-19 Impact Analysis on the Middle East & Africa Caviar Market:

The COVID-19 pandemic has had a major impact on the Middle East and Africa's (MEA) caviar market, creating challenges and opportunities for marketers. The early stages of the pandemic caused disruptions in international shipping, affecting imports and exports of caviar products in the Middle East and Africa. Travel restrictions, border closures, and shipping issues are affecting the movement of products, causing shipment delays and increasing transportation costs for caviar producers and suppliers. Additionally, the closure of restaurants, bars, and eateries during the quarantine resulted in a decline in demand for luxury foods such as caviar, as consumers paid attention to the balanced purchasing and spending of resources. But as countries in the Middle East and Africa gradually reopen their markets and ease restrictions, people are growing interested in new foods, including caviar. Manufacturers and retailers are shifting their businesses by focusing on online sales, home delivery services, and new marketing strategies to reach customers and support their needs after the pandemic. Overall, while the COVID-19 pandemic has caused a temporary challenge in the MEA caviar market, it has also contributed to changes in consumer consumption and market behavior, creating innovation and growth in the food industry.

Latest Trends/ Developments:

Some important trends and developments have shaped the Middle East and Africa's (MEA) caviar market recently. One of the most important of these is the focus of caviar producers and consumers on sustainability and ethics. As awareness of environmental protection and animal husbandry increases, the demand for caviar from sustainable and certified farms continues to increase. Manufacturers have invested in environmentally friendly agriculture, transparent supply chains, and certifications to meet the expectations of consumers in the Middle East region and Africa. There is also increasing interest in new caviar products and flavors due to changing consumer preferences and cooking patterns. Chefs and food lovers have experimented with different types of caviar, combinations of different flavors, and creative cooking presentations to offer new gastronomic experiences. These trends reflect the strength of the MEA caviar market and the continued growth of the industry to meet the demands of the changing business environment.

Key Players:

- Caviar House & Prunier

- Marky's Caviar

- Petrossian

- Beluga SA

- Sturgeon AquaFarms

- Caviar de Neuvic

- Gourmet House Caviar

- Attilus Caviar

- Kaluga Queen

- Royal Belgian Caviar

In August 2023, Royal Caviar Club, an online caviar retailer, launched a new subscription service that provided them with an option to select curated caviar and educational resources delivered directly to customers' homes.

In June 2023, Beluga SA, a renowned caviar producer, launched a new line of infused caviar featuring innovative flavor combinations such as truffle, saffron, and vodka. These infused caviar variants offer a unique and sophisticated culinary experience for consumers seeking variety and flavor exploration.

In December 2022, Kaluga Queen, a leading producer of sustainable caviar from sturgeon raised in closed aquaculture systems, partnered with the Global Aquaculture Alliance (GAA) to promote responsible and sustainable caviar production practices. This partnership aims to raise awareness about sustainable caviar farming and educate consumers about ethical and environmentally friendly caviar choices.

Chapter 1. Middle East & Africa Caviar Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Middle East & Africa Caviar Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Middle East & Africa Caviar Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Middle East & Africa Caviar Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Middle East & Africa Caviar Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Middle East & Africa Caviar Market– By Form

6.1. Introduction/Key Findings

6.2. Fresh

6.3. Dried

6.4. Pasteurized

6.5. Pressed

6.6. Others

6.7. Y-O-Y Growth trend Analysis By Form

6.8. Absolute $ Opportunity Analysis By Form , 2024-2030

Chapter 7. Middle East & Africa Caviar Market– By Application

7.1. Introduction/Key Findings

7.2 Restaurant

7.3. Household

7.4. Y-O-Y Growth trend Analysis By Application

7.5. Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 8. Middle East & Africa Caviar Market– By Type

8.1. Introduction/Key Findings

8.2. Beluga Caviar

8.3. Osetra Caviar

8.4. Sevruga Caviar

8.5. Siberian Caviar

8.6. Others

8.7. Y-O-Y Growth trend Analysis By Type

8.8. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 9 . Middle East & Africa Caviar Market, By Geography – Market Size, Forecast, Trends & Insights

9 .1. Middle East and Africa

9 .1.1. By Country

9 .1.1.1. Saudi Arabia

9 .1.1.2. Qatar

9 .1.1.3. UAE

9 .1.1.4. Israel

9 .1.1.5. South Africa

9 .1.1.6. Nigeria

9 .1.1.7. Kenya

9 .1.1.9 . Egypt

9 .1.1.9 . Rest of the Middle East

9.1.2. By Type

9.1.3. By Application

9.1.4. Form

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Middle East & Africa Caviar Market– Company Profiles – (Overview, Form Type Portfolio, Financials, Strategies & Developments)

10.1. Caviar House & Prunier

10.2. Marky's Caviar

10.3. Petrossian

10.4. Beluga SA

10.5. Sturgeon AquaFarms

10.6. Caviar de Neuvic

10.7. Gourmet House Caviar

10.8. Attilus Caviar

10.9. Kaluga Queen

10.10. Royal Belgian Caviar

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

Middle East & Africa caviar market was valued at USD 95.74 million in 2023 and is projected to reach a market size of USD 166.97 million by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 8.27%.

The segments under the Middle East & Africa caviar market based on type are beluga caviar, osetra caviar, sevruga caviar, siberian caviar, and others

United Arab Emirates (UAE) is dominant in the Middle East & Africa caviar market

Caviar House & Prunier, Marky's Caviar, Petrossian, Beluga SA, Sturgeon, and AquaFarms are the major players in this market

The COVID-19 pandemic has had a major impact on the Middle East and Africa's (MEA) caviar market, creating challenges and opportunities for marketers. The early stages of the pandemic caused disruptions in international shipping, affecting imports and exports of caviar products in the Middle East and Africa. Travel restrictions, border closures, and shipping issues are affecting the movement of products, causing shipment delays and increasing transportation costs for caviar producers and suppliers.