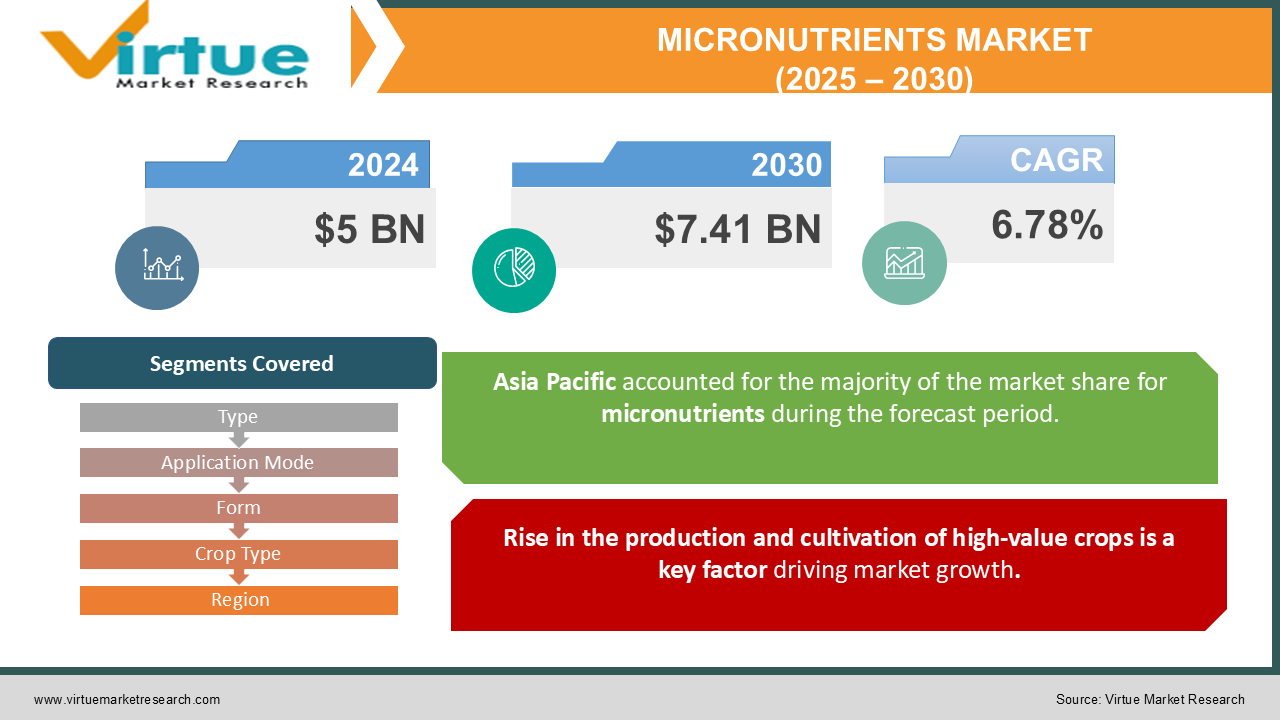

Micronutrients Market Size (2025 – 2030)

The Micronutrients Market was valued at USD 5 billion in 2024. Over the forecast period of 2025-2030, it is projected to reach USD 7.41 billion by 2030, growing at a CAGR of 6.78%.

Micronutrients are vital dietary components that organisms need in different amounts to manage the physiological functions of cells and organs. These micronutrients contribute to the overall health and well-being of organisms throughout their lifespan.

For human nutrition, the daily requirements for micronutrients typically do not exceed 100 milligrams, while macronutrients are needed in grams each day. A lack of sufficient micronutrient intake often leads to malnutrition.

The increasing demand for higher crop yields to meet the growing global food requirements, soil degradation, and the escalating micronutrient deficiency in soils, all of which contribute to low agricultural productivity, are significant drivers of market revenue growth. The need for micronutrients in agriculture is expected to rise as efforts to enhance crop quality and expand cultivated areas intensify.

The growing focus on consumer health, along with rising levels of malnutrition and micronutrient deficiencies, is further fueling the demand for micronutrients in the food and beverage sector.

The expansion of the micronutrients market is also driven by the incorporation of essential micronutrients into food and beverage products such as dairy, infant formula, and dietary supplements.

Additionally, market revenue growth is anticipated to increase due to the wider adoption of biofortification techniques, which involve enhancing the nutrient content of crops through traditional breeding methods. This approach is particularly prevalent in developing countries, especially in rural regions where access to nutrient-rich foods is limited, helping to address micronutrient deficiencies.

Key Market Insights:

-

The agricultural micronutrient sector accounts for more than 50% of the market share in micronutrient consumption.

-

Zinc is the most widely used micronutrient in fertilizers, accounting for 30% of the global market share.

-

Micronutrient deficiencies lead to nearly 3.1 million deaths annually, mainly due to issues such as stunting and anemia.

-

The fortified food sector in the micronutrient market has grown by 10% in the last five years.

-

The demand for iron supplements has risen by 6% year-on-year due to increasing awareness of iron deficiency anemia.

-

Micronutrient malnutrition costs the global economy over USD 1 trillion annually due to lost productivity.

Micronutrients Market Drivers:

Rise in the production and cultivation of high-value crops is a key factor driving market growth.

High-value crops such as fruits, vegetables, turf, and ornamentals are major consumers of micronutrient fertilizers due to the rising consumer demand for premium-quality produce. These crops generate significantly higher agricultural output and net returns. To enhance the agriculture industry and boost the production of high-value crops, various government initiatives, such as the Indian government's Mission for Integrated Development of Horticulture (MIDH), have been established. These programs offer financial support to farmers to improve crop productivity and quality.

Micronutrients are essential for ensuring high-quality yields in fruits and vegetables, and as a result, the adoption of micronutrient products by farmers is expected to rise, driving global market growth. Additionally, the cultivation of turf grasses, aimed at enhancing the aesthetic value of sports fields, landscapes, and residential areas, has grown considerably in recent years.

Micronutrients Market Restraints and Challenges:

Limited access to government services and the imposition of high taxes on micronutrients are expected to hinder market growth.

For example, in India, only 700 out of 1,454 soil testing facilities offer services for detecting micronutrient deficiencies. As a result, approximately 140 million farmers in the country lack access to essential laboratory services and resources.

Various climatic factors, such as temperature fluctuations, increased carbon dioxide levels, rising sea levels, and climate-related disasters, also affect crop yields. These changes in climate impact the uptake of micronutrients by crops, ultimately influencing both their nutritional value and overall yield.

Research from the Harvard Chan School has shown that elevated levels of carbon dioxide can reduce the micronutrient content in several crops. For instance, crops like wheat, corn, rice, and soy lose 10% of their zinc, 5% of their iron, and 8% of their protein content when exposed to higher carbon dioxide levels.

Micronutrients Market Opportunities:

The growing emphasis on soil health and the increasing popularity of home gardening are expected to create significant opportunities for market growth.

Farmers and agricultural producers are placing greater emphasis on soil health, recognizing its critical role in influencing crop production rates. For example, the Food and Agriculture Organization (FAO) reports that ecological soil management could boost food production by up to 58%. As healthy, productive soils lead to higher yields, there has been a growing demand for agricultural inputs such as soil amendments and micronutrients.

In addition to the focus on soil health, home gardening has become increasingly popular worldwide. Home gardeners often prioritize cultivating horticultural crops due to their nutritional benefits. The COVID-19 pandemic has further accelerated this trend, with more individuals seeking to grow their own food. As a result, the rising popularity of home gardening, combined with the growing focus on soil health, is expected to drive the global agricultural micronutrients market growth.

MICRONUTRIENTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

6.78% |

|

Segments Covered |

By Type, Application Mode, Form, Crop Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Israel Chemicals Ltd., Nutrien Ltd., Coromandel International, Indian Farmers Fertiliser Cooperative Limited (IFFCO) , Yara International ASA, Koch Agronomic Services, LLC , Haifa Group, Grupa Azoty Zakłady Chemiczne Police Group , Nouryon Chemicals Holdings B.V., Marubeni Corporation (Helena Agri-Enterprises, LLC |

Micronutrients Market Segmentation: By Type

-

Zinc

-

Iron

-

Manganese

-

Boron

-

Molybdenum

-

Others

The zinc segment holds the largest market share, mainly due to the widespread zinc deficiencies observed in soils around the world. The selection of micronutrients is largely influenced by the specific crop and soil conditions. Moreover, since micronutrients are typically available in smaller quantities compared to traditional fertilizers, the amounts needed are lower.

Iron is in high demand among growers worldwide, as it is essential for healthy plant growth. Boron also sees significant usage, particularly in the South American region, due to the region's soil characteristics. Countries such as Brazil, Paraguay, Uruguay, and Bolivia often have leached soils that are nutrient-poor, acidic, and low in organic matter—conditions that are conducive to boron deficiency.

Micronutrients Market Segmentation: By Application Mode

-

Soil

-

Foliar

-

Fertigation

The soil application segment holds the largest market share, driven by its widespread popularity due to ease of use and cost-effectiveness. In the soil application method, fertilizers are spread across the surface of an entire field using high-capacity spreaders, making it a convenient choice for farmers. Additionally, the growing investments and initiatives aimed at developing new, advanced fertilizer spreaders with higher capacities are expected to further support market growth.

The foliar application segment is experiencing the fastest growth in terms of compound annual growth rate (CAGR) during the forecast period. This is primarily due to its increasing adoption by farmers, as it ensures a more uniform distribution of nutrients across crops. Foliar application serves as supplementary feeding, complementing soil fertilization, which helps enhance productivity. Furthermore, it can be applied at specific stages of crop development to optimize yield and improve crop quality.

Micronutrients Market Segmentation: By Form

-

Chelated

-

Non-chelated

The non-chelated segment currently holds a larger market share, while the chelated segment is expected to experience higher growth in terms of compound annual growth rate (CAGR) during the forecast period. The higher cost of chelated agricultural micronutrients is due to their complex formulation, where micronutrient ions such as zinc, copper, iron, and boron are encased in a larger molecule called a ligand or chelator. This ligand, which can be either a natural or synthetic chemical, binds with the micronutrient to form a chelated compound.

As awareness grows regarding the benefits of chelated fertilizers for plant growth, the demand for chelated agricultural micronutrients is increasing. To meet this rising demand, companies are expanding their distribution networks.

Micronutrients Market Segmentation: By Crop Type

-

Pulses & Oilseeds

-

Cereals

-

Fruits & Vegetables

-

Others

The cereals segment holds the largest market share, while the fruits and vegetables segment is expected to see significant growth during the forecast period. The dominance of cereal crops in the market can be attributed to their high yield and the vast agricultural areas dedicated to their cultivation, including crops such as wheat, maize, rice, and other cereals. Cereal grains are produced in larger quantities than any other crop and provide more food energy globally, making them vital staple crops in numerous regions. Their high yield and nutritional value are key factors in supporting food security worldwide.

Micronutrients Market Segmentation - by Region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

The Asia Pacific region leads the agricultural micronutrients market, primarily due to its significant role as a producer of staple crops, with countries like China and India being major contributors. According to the FAO, China accounts for about one-fourth of global grain production and feeds approximately one-fifth of the world's population, despite having only 10% of the world's arable land. Additionally, these countries are key exporters of high-quality agricultural produce. The scale of food production in this region directly impacts export values, with micronutrients playing a crucial role in ensuring optimal plant growth. Deficiencies in these nutrients can adversely affect trade, as seen in the example of boron deficiency, which can degrade the quality of mangoes. As noted by the National Institute of Health, a lack of essential micronutrients results in plant growth defects and reduced productivity.

North America is the fastest growing regions in the market. The rising awareness of micronutrient deficiencies in soil has led to proactive measures, such as soil nutrient assessments in the U.S. starting in the early 1980s. The vast agricultural landscape in the U.S. means that the adoption of micronutrients varies significantly across regions.

Europe is projected to hold a substantial revenue share in the global micronutrients market, driven by stringent regulations on soil health and environmental sustainability. Major contributors to the market in this region include Germany, France, and the United Kingdom. Germany, with its advanced agricultural practices and technological innovations, has a high demand for micronutrients to improve soil fertility and crop yields. The German government's emphasis on sustainable agriculture and organic farming further stimulates the market. Similarly, France, with its diverse agricultural sector, exhibits strong demand for micronutrients to enhance crop productivity

COVID-19 Pandemic: Impact Analysis

The fertilizers and agricultural micronutrients market experienced a notable slowdown in sales in 2020, largely due to the impact of the COVID-19 pandemic, and continued to face challenges into the first quarter of 2021. Disruptions in logistics and transportation across many countries significantly affected the market. In addition to these logistical challenges, the entire value chain of the agricultural micronutrients sector faced interruptions, from the supply of raw materials to manufacturing, packaging, and distribution, further hindering market performance.

Latest Trends/ Developments:

Grupa Azoty unveiled its strategy for 2021-2030, with the Green Azoty project as its flagship initiative. The project aims to focus on decarbonization, reducing carbon emissions, and implementing research and development (R&D) projects aligned with the European Green Deal. Additionally, the company plans to introduce new environmentally friendly solutions, concentrating on climate neutrality and the development of new micronutrient formulas derived from utilized waste streams.

Key Players:

These are top 10 players in the Micronutrients Market :-

-

Israel Chemicals Ltd.

-

Nutrien Ltd.

-

Coromandel International

-

Indian Farmers Fertiliser Cooperative Limited (IFFCO)

-

Yara International ASA

-

Koch Agronomic Services, LLC

-

Haifa Group

-

Grupa Azoty Zakłady Chemiczne Police Group

-

Nouryon Chemicals Holdings B.V.

-

Marubeni Corporation (Helena Agri-Enterprises, LLC

Chapter 1. Micronutrients Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Micronutrients Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Micronutrients Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Micronutrients Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Micronutrients Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Micronutrients Market – By Type

6.1 Introduction/Key Findings

6.2 Zinc

6.3 Iron

6.4 Manganese

6.5 Boron

6.6 Molybdenum

6.7 Others

6.8 Y-O-Y Growth trend Analysis By Type

6.9 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Micronutrients Market – By Form

7.1 Introduction/Key Findings

7.2 Chelated

7.3 Non-chelated

7.4 Y-O-Y Growth trend Analysis By Form

7.5 Absolute $ Opportunity Analysis By Form, 2024-2030

Chapter 8. Micronutrients Market – By Application

8.1 Introduction/Key Findings

8.2 Soil

8.3 Foliar

8.4 Fertigation

8.5 Y-O-Y Growth trend Analysis By Application

8.6 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 9. Micronutrients Market – By Crop Type

9.1 Introduction/Key Findings

9.2 Pulses & Oilseeds

9.3 Cereals

9.4 Fruits & Vegetables

9.5 Others

9.6 Y-O-Y Growth trend Analysis By Crop Type

9.7 Absolute $ Opportunity Analysis By Crop Type, 2024-2030

Chapter 10. Micronutrients Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Type

10.1.2.1 By Form

10.1.3 By By Application

10.1.4 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Type

10.2.3 By Form

10.2.4 By By Application

10.2.5 By By Crop Type

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Type

10.3.3 By Form

10.3.4 By By Application

10.3.5 By By Crop Type

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Type

10.4.3 By Form

10.4.4 By By Application

10.4.5 By By Crop Type

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Type

10.5.3 By Form

10.5.4 By By Application

10.5.5 By By Crop Type

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Micronutrients Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Israel Chemicals Ltd.

11.2 Nutrien Ltd.

11.3 Coromandel International

11.4 Indian Farmers Fertiliser Cooperative Limited (IFFCO)

11.5 Yara International ASA

11.6 Koch Agronomic Services, LLC

11.7 Haifa Group

11.8 Grupa Azoty Zakłady Chemiczne Police Group

11.9 Nouryon Chemicals Holdings B.V.

11.10 Marubeni Corporation (Helena Agri-Enterprises, LLC

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The increasing demand for higher crop yields to meet the growing global food requirements, soil degradation, and the escalating micronutrient deficiency in soils, all of which contribute to low agricultural productivity, are significant drivers of market revenue growth.

The top players operating in the Micronutrients Market are - Israel Chemicals Ltd., Nutrien Ltd., Coromandel International, Indian Farmers Fertiliser Cooperative Limited (IFFCO) and Yara International ASA.

The fertilizers and agricultural micronutrients market experienced a notable slowdown in sales in 2020, largely due to the impact of the COVID-19 pandemic, and continued to face challenges into the first quarter of 2021.

The Food and Agriculture Organization (FAO) reports that ecological soil management could boost food production by up to 58%. As healthy, productive soils lead to higher yields, there has been a growing demand for agricultural inputs such as soil amendments and micronutrients.

North America is the fastest-growing region in the market.