Microgrid Simulation Software Market Size (2024 – 2030)

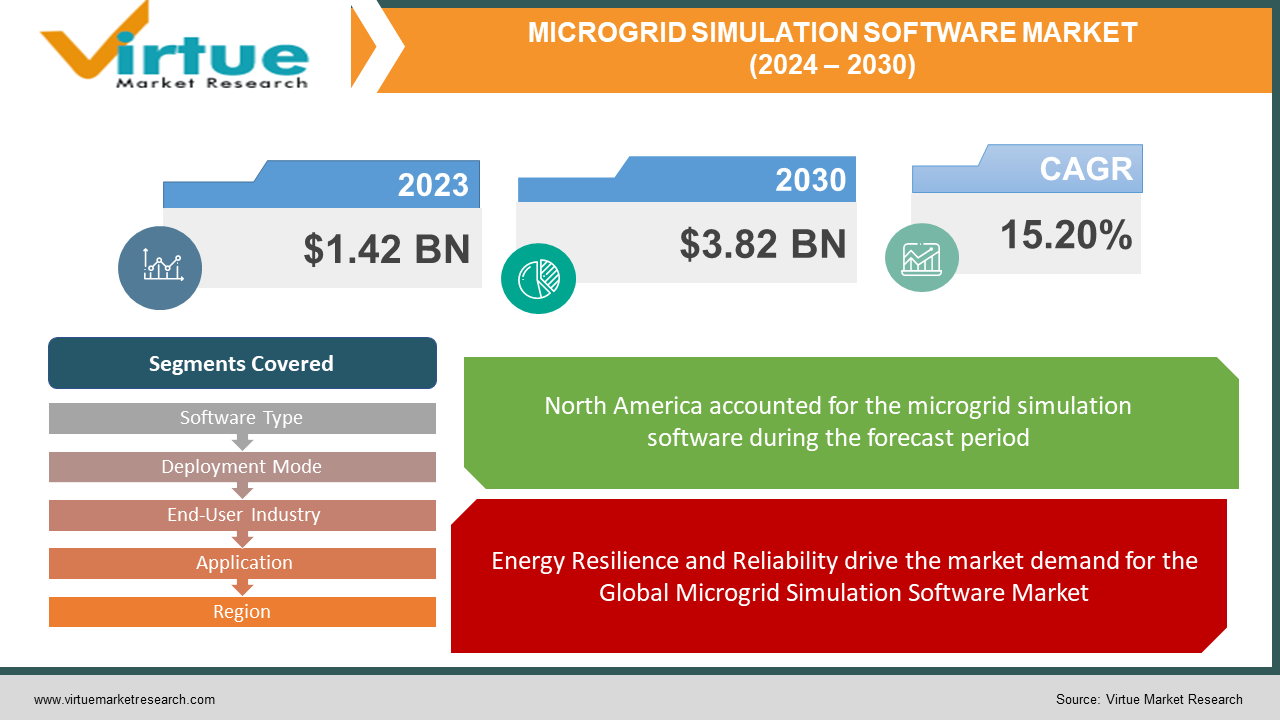

The Global Microgrid Simulation Software Market is valued at USD 1.42 Billion and is projected to reach a market size of USD 3.82 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 15.20%.

The global microgrid simulation software market is shaped by a combination of long-term drivers, COVID-19 impacts, short-term drivers, opportunities, and emerging trends. Despite challenges posed by the pandemic, the market continues to evolve and grow, driven by the increasing demand for resilient and sustainable energy solutions. By capitalizing on emerging opportunities, addressing evolving market needs, and embracing technological advancements, software vendors can position themselves for success in the dynamic and rapidly evolving microgrid market landscape.

Key Market Insights:

An opportunity in the market lies in the integration of artificial intelligence (AI) and machine learning (ML) technologies into microgrid simulation software. AI and ML algorithms can analyze vast amounts of data from sensors and other sources in real time, enabling predictive modeling, autonomous control, and dynamic optimization of microgrid operations. By leveraging AI-driven simulation software, organizations can enhance the resilience, efficiency, and cost-effectiveness of their microgrid systems, paving the way for more intelligent and adaptive energy infrastructure.

One trend observed in the industry is the growing emphasis on interoperability and standardization in microgrid simulation software. As microgrid deployments become more widespread and diverse, there is a growing need for software solutions that can seamlessly integrate with different hardware components, communication protocols, and control systems. Standardization efforts such as the development of common data models, communication standards, and interoperability frameworks are gaining traction, enabling greater compatibility, flexibility, and scalability in microgrid deployments. This trend reflects the industry's maturation and the increasing focus on collaboration and ecosystem development to drive innovation and growth in the microgrid market

Global Microgrid Simulation Software Market Drivers:

Energy Resilience and Reliability drive the market demand for the Global Microgrid Simulation Software Market.

The increasing frequency of extreme weather events, natural disasters, and grid failures has underscored the importance of energy resilience and reliability. Microgrid simulation software enables developers and operators to design, test, and optimize microgrid systems for enhanced resilience against grid disturbances. As organizations seek to mitigate the impact of disruptions and ensure continuous power supply, the demand for simulation software that can accurately model and simulate microgrid behavior under different conditions is expected to grow.

Renewable Energy Integration has boosted the market for Global Microgrid Simulation Software Market.

The transition towards a more sustainable and decarbonized energy landscape has led to a significant increase in the deployment of renewable energy sources such as solar photovoltaic (PV) and wind turbines. Microgrids offer an ideal platform for integrating renewable energy resources and optimizing their use in combination with energy storage systems and conventional generation sources. Simulation software plays a critical role in assessing the feasibility, performance, and economic viability of renewable energy integration within microgrid systems, driving the adoption of such software among project developers and operators.

Cost Savings and Efficiency drive the market demand for Global Microgrid Simulation Software Market.

Microgrid simulation software helps optimize the design, operation, and control of microgrid systems, leading to cost savings and improved efficiency. By accurately modeling energy flows, demand patterns, and system configurations, simulation software enables stakeholders to identify opportunities for load management, peak shaving, and demand response, thereby reducing energy costs and enhancing overall system efficiency. As organizations strive to optimize their energy usage and maximize return on investment in microgrid projects, the demand for simulation software that can deliver actionable insights and drive cost-effective decision-making is expected to increase.

Regulatory Support and Incentives have boosted the market for the Global Microgrid Simulation Software Market.

Government policies, regulations, and incentives aimed at promoting energy security, sustainability, and grid resilience are driving the adoption of microgrid solutions across various sectors. Regulatory frameworks that support decentralized energy generation, grid modernization, and microgrid development create favorable market conditions for simulation software vendors. Additionally, financial incentives such as grants, tax credits, and subsidies for microgrid projects incentivize investment in simulation software tools that can help developers assess project feasibility, optimize system design, and secure financing.

Global Microgrid Simulation Software Market Restraints and Challenges:

Developing and deploying microgrid systems involves dealing with complex technical and engineering challenges. Microgrid simulation software requires specialized knowledge and technical expertise to operate effectively. This can be a barrier for smaller organizations or those with limited resources to adopt and utilize simulation software to its full potential.

The upfront cost of acquiring and implementing microgrid simulation software can be significant, especially for small and medium-sized enterprises (SMEs) or organizations with constrained budgets. Additionally, the cost of training personnel to use the software effectively adds to the overall investment, posing a challenge for potential adopters.

The lack of standardized protocols and interoperability standards for microgrid simulation software can hinder seamless integration with other software tools, hardware components, and communication networks. This lack of standardization may lead to compatibility issues, data inconsistency, and limited scalability, thereby impeding the adoption and deployment of simulation software across different microgrid projects and applications.

Global Microgrid Simulation Software Market Opportunities:

The shift towards decentralized energy generation and grid modernization initiatives is creating opportunities for microgrid solutions to play a more prominent role in the energy ecosystem. Microgrid simulation software enables stakeholders to design and optimize microgrid systems that can operate autonomously or in coordination with the main grid, enhancing energy resilience, reliability, and flexibility. Microgrid solutions offer unique advantages for remote communities, off-grid regions, and emerging markets with limited access to reliable electricity infrastructure. Microgrid simulation software enables stakeholders to design, deploy, and operate cost-effective and sustainable microgrid systems tailored to the specific needs and conditions of these regions.

The ongoing digital transformation and Industry 4.0 initiatives are driving demand for advanced simulation and modeling tools across various industries, including energy and utilities. The ongoing research and development (R&D) activities in renewable energy, energy storage, grid optimization, and smart grid technologies are driving innovation and creating new opportunities for microgrid simulation software.

MICROGRID SIMULATION SOFTWARE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

15.20% |

|

Segments Covered |

By Software Type, Deployment Mode, End-User Industry, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

ABB Ltd., Siemens AG, Schneider Electric SE, General Electric Company, Eaton Corporation, Honeywell International Inc., Power Analytics Corporation, Opus One Solutions, DNV GL AS, ETAP/Operation Technology Inc., Homer Energy, Grid Solutions, Power World Corporation, RTDS Technologies Inc., Energy Exemplar., GSES India Pvt. Ltd., GEMS, RTDS Technologies, DER-CAM, Guguan Technology Co., Ltd. |

Global Microgrid Simulation Software Market Segmentation: By Software Type

-

Standalone Software

-

Integrated Software Suites

The largest segment in the global microgrid simulation software market is integrated software suites. These suites offer comprehensive solutions that incorporate various simulation capabilities, such as modeling, optimization, analysis, and visualization, into a single integrated platform. Integrated software suites provide users with a seamless and cohesive workflow for designing, simulating, and optimizing microgrid systems, making them popular among organizations seeking comprehensive simulation solutions. With integrated software suites, users can streamline their simulation workflows, improve collaboration, and gain deeper insights into microgrid performance, leading to more informed decision-making and enhanced system efficiency and reliability.

The fastest-growing segment in the market is standalone software. Standalone software refers to individual simulation tools or applications that focus on specific aspects of microgrid simulation, such as modeling, analysis, or optimization. Standalone software offers flexibility and customization options, allowing users to select and deploy the specific tools they need for their simulation tasks. This modular approach appeals to users who require specialized simulation capabilities or prefer a more tailored solution to meet their specific requirements. Additionally, standalone software can be easily integrated with existing software systems or combined with other simulation tools to create customized simulation workflows, providing users with greater flexibility and versatility in their simulation projects.

Global Microgrid Simulation Software Market Segmentation: By Deployment Mode

-

On-Premises Deployment

-

Cloud-Based Deployment

The largest segment in the global microgrid simulation software market is cloud-based deployment. Cloud-based solutions offer scalability, flexibility, and accessibility, making them increasingly popular among organizations seeking cost-effective and convenient software deployment options. With cloud-based deployment, users can access simulation software from any location with an internet connection, enabling collaboration, remote access, and real-time data sharing. This segment's dominance is driven by the growing adoption of cloud computing technologies across industries and the benefits of cloud-based solutions in terms of reduced upfront costs, simplified maintenance, and enhanced scalability.

On the other hand, the fastest-growing segment in the market is on-premises deployment. While cloud-based solutions have gained traction in recent years, some organizations, particularly those with stringent data security and compliance requirements or limited internet connectivity, prefer to deploy microgrid simulation software on-premises. On-premises deployment offers greater control over data, customization options, and integration with existing IT infrastructure, making it a preferred choice for certain industries and applications. The segment's growth is driven by the continued demand for on-premises solutions among organizations seeking to maintain data sovereignty, comply with regulatory requirements, and address specific business needs.

Global Microgrid Simulation Software Market Segmentation: By End-User Industry

-

Energy & Utilities

-

Healthcare

-

Manufacturing

-

Government & Defense

-

Others

Among the various end-user industries, the largest segment in the global microgrid simulation software market is the energy & utilities sector. Energy & utilities companies are at the forefront of adopting microgrid solutions to enhance grid resilience, optimize energy management, and integrate renewable energy sources into their operations. Microgrid simulation software plays a critical role in enabling energy & utility companies to design, simulate, and optimize microgrid systems tailored to their specific needs and requirements. The segment's dominance is driven by the increasing investments in grid modernization, renewable energy integration, and distributed energy resources (DERs) management by energy & utilities companies worldwide.

On the other hand, the fastest-growing segment in the market is the healthcare sector. Healthcare facilities, including hospitals, clinics, and medical centers, are increasingly deploying microgrid solutions to ensure reliable and resilient power supply for critical medical equipment, patient care, and life-saving operations. Microgrid simulation software enables healthcare facilities to assess energy demand, simulate grid outages, and optimize microgrid configurations to maintain uninterrupted power supply during emergencies. The segment's growth is fueled by the rising demand for energy resilience solutions in the healthcare sector, driven by increasing awareness of the importance of reliable power supply for patient safety, regulatory compliance, and operational continuity.

Global Microgrid Simulation Software Market Segmentation: By Application

-

Grid Resilience and Reliability Analysis

-

Renewable Energy Integration Optimization

-

Energy Management and Optimization

-

Emergency Response and Disaster Recovery Planning

The largest segment in the global microgrid simulation software market is renewable energy integration optimization. This application involves optimizing the integration of renewable energy sources, such as solar, wind, and hydropower, into microgrid systems. With the increasing adoption of renewable energy technologies worldwide, there is a growing need for simulation tools that can accurately model, analyze, and optimize the performance of microgrids with diverse renewable energy resources. Simulation software in this segment helps stakeholders assess the feasibility of renewable energy integration, optimize system design and configuration, and maximize the utilization of renewable energy to enhance energy efficiency and sustainability in microgrid deployments.

The fastest-growing segment in the market is emergency response and disaster recovery planning. This application involves using simulation software to model and simulate various emergency scenarios, grid disturbances, and natural disasters, such as hurricanes, earthquakes, and wildfires, to develop effective emergency response and disaster recovery plans for microgrid systems. With the increasing frequency and severity of extreme weather events and grid disruptions, there is a growing emphasis on enhancing the resilience and reliability of microgrid systems to withstand emergencies and ensure continuous power supply to critical infrastructure and essential services. Simulation software in this segment enables stakeholders to assess system vulnerabilities, identify mitigation measures, and develop proactive strategies to minimize downtime, restore operations, and safeguard community resilience in the face of emergencies and disasters.

Global Microgrid Simulation Software Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The largest member in the global microgrid simulation software request in North America. This region has been at the van of microgrid development and relinquishment, driven by factors similar to grid modernization enterprise, adding investments in renewable energy, and a strong emphasis on energy adaptability and sustainability. North America is home to a large number of leading microgrid inventors, serviceability, exploration institutions, and technology providers, creating a robust ecosystem for the development and deployment of microgrid results. With a mature request and established nonsupervisory fabrics supporting microgrid deployments, North America remains a crucial request for microgrid simulation software, offering significant openings for software merchandisers to serve a different range of stakeholders across colorful diligence and operations.

The fastest-growing member in the request is Asia- Pacific. This region is passing rapid-fire profitable growth, urbanization, and industrialization, driving the demand for dependable, effective, and sustainable energy results. Asia-Pacific countries, such as China, India, Japan, South Korea, and Australia, are decreasingly investing in microgrid systems to address energy security enterprises, expand access to electricity in remote areas, and integrate renewable energy sources into their energy systems. With favorable government programs, impulses, and investments supporting microgrid development, Asia-Pacific presents significant growth openings for microgrid simulation software merchandisers. Also, the region's growing focus on smart metropolises, decentralized energy generation, and clean energy transitions further accelerates the relinquishment of microgrid results and simulation tools, driving the growth of the microgrid simulation software request in Asia-Pacific.

COVID-19 Impact Analysis on Global Microgrid Simulation Software Market:

The pandemic disrupted global supply chains, leading to delays in the production and distribution of hardware components, software licenses, and other materials essential for microgrid simulation software development and deployment. These supply chain disruptions impacted the availability of software solutions and hindered project timelines for microgrid deployments.

The economic downturn resulting from the pandemic led to budget constraints, funding cuts, and project cancellations in many sectors, including energy and utilities. As organizations faced financial challenges and uncertain market conditions, they reevaluated their investment priorities, leading to a slowdown in microgrid deployments and software purchases.

The transition to remote work arrangements posed challenges for software vendors, developers, and end-users alike. Collaboration, training, and support activities were disrupted, impacting productivity, communication, and customer service. Additionally, remote work arrangements highlighted the importance of cloud-based solutions and remote access capabilities in enabling continuity and resilience in software operations

Latest Trends/ Developments:

There is a growing trend towards the integration of AI and ML technologies into microgrid simulation software. AI and ML algorithms can analyze large volumes of data generated by microgrid systems in real-time, enabling predictive modeling, autonomous control, and dynamic optimization of microgrid operations. By leveraging AI-driven simulation software, stakeholders can enhance the resilience, efficiency, and sustainability of microgrid systems, leading to improved performance and cost savings.

The proliferation of distributed energy resources, such as solar PV, wind turbines, energy storage systems, and electric vehicles, is driving the need for advanced simulation tools that can effectively manage DERs within microgrid systems. Microgrid simulation software is being enhanced to support the integration, optimization, and control of diverse DERs, enabling stakeholders to maximize the value of distributed energy assets, optimize energy usage, and reduce operational costs.

Cloud-based deployment models are gaining traction in the microgrid simulation software market, driven by the benefits of scalability, flexibility, and accessibility offered by cloud computing technologies. Cloud-based simulation software allows users to access and utilize simulation tools from any location with an internet connection, enabling collaboration, remote access, and real-time data sharing. This trend reflects the increasing demand for cost-effective and convenient software deployment options that leverage the scalability and flexibility of cloud infrastructure.

Key Players:

-

ABB Ltd.

-

Siemens AG

-

Schneider Electric SE

-

General Electric Company

-

Eaton Corporation

-

Honeywell International Inc.

-

Power Analytics Corporation

-

Opus One Solutions

-

DNV GL AS

-

ETAP/Operation Technology Inc.

-

Homer Energy

-

Grid Solutions

-

Power World Corporation

-

RTDS Technologies Inc.

-

Energy Exemplar

-

GSES India Pvt. Ltd.

-

GEMS

-

RTDS Technologies

-

DER-CAM

-

Guguan Technology Co., Ltd.

Chapter 1. Microgrid Simulation Software Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Microgrid Simulation Software Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Microgrid Simulation Software Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Microgrid Simulation Software Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Microgrid Simulation Software Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Microgrid Simulation Software Market – By Software Type

6.1 Introduction/Key Findings

6.2 Standalone Software

6.3 Integrated Software Suites

6.4 Y-O-Y Growth trend Analysis By Software Type

6.5 Absolute $ Opportunity Analysis By Software Type, 2024-2030

Chapter 7. Microgrid Simulation Software Market – By Deployment Mode

7.1 Introduction/Key Findings

7.2 On-Premises Deployment

7.3 Cloud-Based Deployment

7.4 Y-O-Y Growth trend Analysis By Deployment Mode

7.5 Absolute $ Opportunity Analysis By Deployment Mode, 2024-2030

Chapter 8. Microgrid Simulation Software Market – By End-User Industry

8.1 Introduction/Key Findings

8.2 Energy & Utilities

8.3 Healthcare

8.4 Manufacturing

8.5 Government & Defense

8.6 Others

8.7 Y-O-Y Growth trend Analysis By End-User Industry

8.8 Absolute $ Opportunity Analysis By End-User Industry, 2024-2030

Chapter 9. Microgrid Simulation Software Market – By Application

9.1 Introduction/Key Findings

9.2 Grid Resilience and Reliability Analysis

9.3 Renewable Energy Integration Optimization

9.4 Energy Management and Optimization

9.5 Emergency Response and Disaster Recovery Planning

9.6 Y-O-Y Growth trend Analysis By Application

9.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 10. Microgrid Simulation Software Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Software Type

10.1.2.1 By Deployment Mode

10.1.3 By End-User Industry

10.1.4 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Software Type

10.2.3 By Deployment Mode

10.2.4 By End-User Industry

10.2.5 By Application

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Software Type

10.3.3 By Deployment Mode

10.3.4 By End-User Industry

10.3.5 By Application

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Software Type

10.4.3 By Deployment Mode

10.4.4 By End-User Industry

10.4.5 By Application

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Software Type

10.5.3 By Deployment Mode

10.5.4 By End-User Industry

10.5.5 By Application

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Microgrid Simulation Software Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 ABB Ltd.

11.2 Siemens AG

11.3 Schneider Electric SE

11.4 General Electric Company

11.5 Eaton Corporation

11.6 Honeywell International Inc.

11.7 Power Analytics Corporation

11.8 Opus One Solutions

11.9 DNV GL AS

11.10 ETAP/Operation Technology Inc.

11.11 Homer Energy

11.12 Grid Solutions

11.13 Power World Corporation

11.14 RTDS Technologies Inc.

11.15 Energy Exemplar

11.16 GSES India Pvt. Ltd.

11.17 GEMS

11.18 RTDS Technologies

11.19 DER-CAM

11.20 Guguan Technology Co., Ltd.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Microgrid Simulation Software Market is valued at USD 1.42 Billion and is projected to reach a market size of USD 3.82 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 15.20%.

Energy Resilience and Reliability, Renewable Energy Integration, Cost Savings Efficiency, and Regulatory Support are the market drivers of the Global Microgrid Simulation Software Market.

On-premises deployment and cloud-based Deployment are the segments under the Global Microgrid Simulation Software Market by Deployment Mode

North America is the most dominant region for the Global Microgrid Simulation Software Market.

Asia-Pacific is the fastest-growing region in the Global Microgrid Simulation Software Market.