Microfiltration Ceramic Membrane Market Size (2023 - 2030)

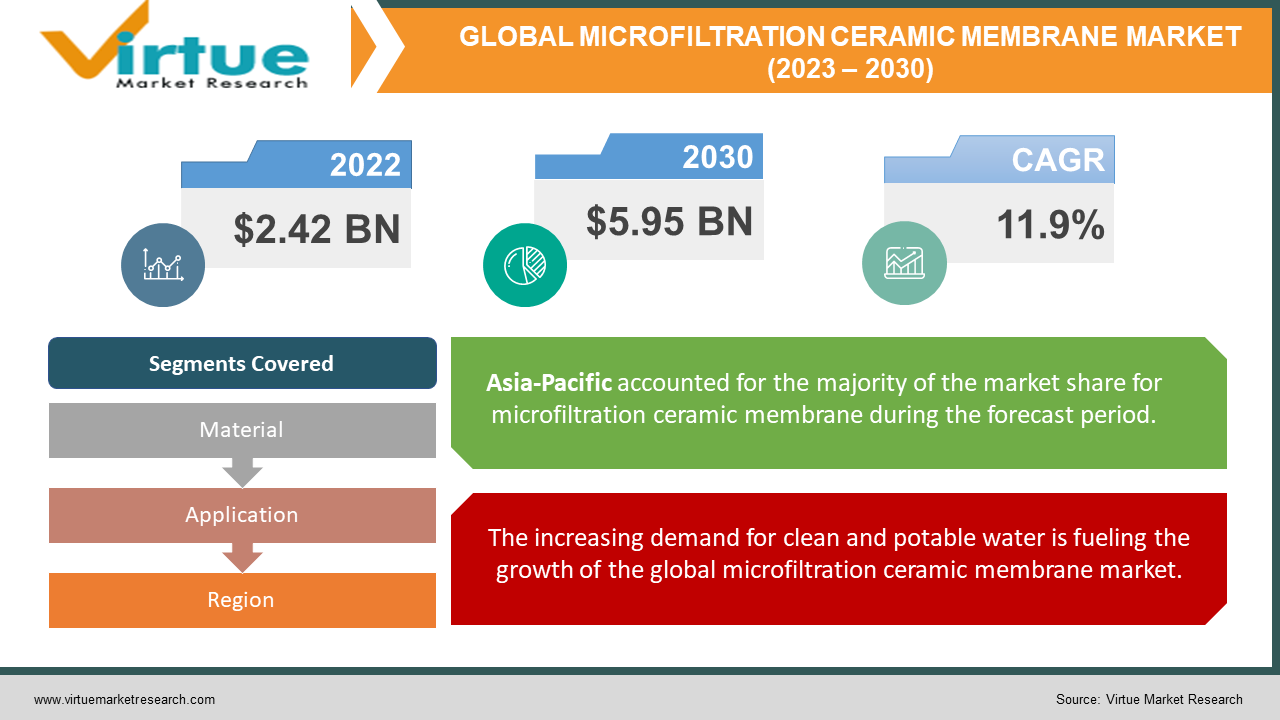

The Global Microfiltration Ceramic Membrane Market is estimated to be worth USD 2.42 Billion in 2022 and is projected to reach a value of USD 5.95 Billion by 2030, growing at a compound annual growth rate (CAGR) of 11.9% during the forecast period 2023-2030.

Ceramic membranes are water treatment membranes commonly used for liquid filtration in industries requiring strong resistance to aggressive media, including acids and solvents. They are made from inorganic materials like alumina, silica, titania, and zirconium oxides. Additionally, their excellent thermal stability makes them useful for membrane operations at high temperatures. Similar to polymeric membranes, they can either be porous or dense. Numerous research studies demonstrate that ceramic membranes have potential applications in wastewater treatment, gas separation, and membrane reactors. They have a longer lifespan than polymeric membranes, but their high production cost has restricted their widespread usage. Ceramic membranes come in a variety of configurations like tubular dead-end membranes, cross-flow membranes, and flat sheet membranes. Microfiltration ceramic membranes are a specific type of ceramic membrane, commonly made from alumina and zirconia, that are designed to filter particles and microorganisms from liquids at a microscopic level. These membranes have a pore size range of approximately 0.1-10 microns, allowing them to effectively remove bacteria, viruses, and other microorganisms, as well as fine particles and colloidal material. Pharmaceuticals, biotechnology, food and beverage processing, and water treatment are all common applications for microfiltration ceramic membranes. They offer high permeability, chemical and thermal stability, and resistance to fouling and degradation. As a result of these advantages, the global microfiltration ceramic membrane market is estimated to have a fast CAGR during the forecasted period.

Global Microfiltration Ceramic Membrane Market Drivers:

The increasing demand for clean and potable water is fueling the growth of the global microfiltration ceramic membrane market.

As the population rises, the requirement for clean and potable drinking water also rises. Ceramic membranes serve as an efficient water filtration system that aims to generate purified and clean tap water by removing impurities, such as bacteria and protozoa (including cryptosporidium), and turbidity present in raw water from river systems and well water. Ceramic membranes have tiny pores that can capture impurities while allowing only clean water to pass through. When water is pushed through the ceramic membrane, the impurities are left behind, resulting in clean and safe water that can be used for various purposes. In addition, ceramic membranes with microfiltration technology can handle harsh chemicals and high temperatures, making them suitable for treating water with complex compositions. Therefore, this factor drives the demand for microfiltration ceramic membranes.

The increasing demand for ceramic membranes in the pharmaceutical industry is another factor contributing to the growth of the global microfiltration ceramic membrane market.

Microfiltration ceramic membranes are used in the pharmaceutical industry for various applications, including drug purification, filtration of organic solvents, wastewater separation, retention of bacteria and viruses, dye separation, oil-water separation, and milk fractioning, owing to their superior properties. Ceramic membranes are useful as they have the ability to enhance product quality, reduce contamination risk, and enhance production process efficiency.

Global Microfiltration Ceramic Membrane Market Challenges:

The global microfiltration ceramic membrane market is encountering challenges, primarily in terms of high initial investment for manufacturing ceramic membranes and performance issues due to the brittleness of ceramic membranes. In order to remove contaminants from wastewater, water treatment facilities require membrane systems. However, the number of fully-fledged installations of ceramic membranes in the water treatment industries is extremely low due to the high capital investment required for the installation of ceramic membranes with microfiltration technology in contrast to other membranes of similar types. Moreover, microfiltration ceramic membranes are composed of small porous substrates that provide support for the thin, dense membranes. These membranes can have subcritical cracks, despite having a number of good properties like chemical and thermal stability. It has been observed that the microfiltration ceramic membranes behave as a very brittle component in particular sensitivity, allowing for an increase in the development of cracks within them. Because of differences in thermal expansion, ceramic membranes can be highly brittle substances. Thus, these challenges inhibit the growth of the global microfiltration ceramic membrane market.

Global Microfiltration Ceramic Membrane Market Opportunities:

Technological advancements in microfiltration ceramic membranes present lucrative opportunities in the global microfiltration ceramic membrane market. Given the limitations of microfiltration ceramic membranes, such as brittleness, low ductility, and high cost, major microfiltration ceramic membrane manufacturing companies can stand to gain significantly from this opportunity by developing new and improved ceramic membrane materials, configurations, and manufacturing processes, to broaden their customer base and boost their overall revenue.

COVID-19 Impact on the Global Microfiltration Ceramic Membrane Market:

The outbreak of the COVID-19 pandemic substantially impacted the global microfiltration ceramic membrane market. The implementation of strict lockdowns, traveling restrictions, and social distancing measures across several nations hindered many companies' manufacturing capacities and caused a shortage of skilled workforce. The pandemic caused disruptions in supply chains and distribution of goods and services, which highly affected the production and distribution of ceramic membranes. Moreover, the pandemic forced several businesses to shut down or operate at reduced capacity due to the worldwide lockdown restrictions, which further reduced the demand for ceramic membranes in numerous industries. These factors negatively impacted the growth of the global microfiltration ceramic membrane market. Despite these challenges, the global microfiltration ceramic membrane market is projected to recover and grow in the coming years.

Global Microfiltration Ceramic Membrane Market Recent Developments:

In January 2023, Membrion, Inc., a US-based manufacturer specializing in ceramic desalination membranes, and W.L. Gore & Associates, a US-based multinational manufacturing company specializing in products derived from fluoropolymers, unveiled their collaboration to create ultra-thin ceramic ion exchange membranes for energy-efficient desalination of severe wastewater streams.

- In September 2022, Veolia water technologies, a France-based water treatment company, expands its line of CeraMem ceramic membrane technology. The latest silicon carbide membrane lineup can operate under a complete pH range of 0 to 14. The membranes facilitate the regular use of harsh cleaning procedures, such as the utilization of caustic soda. The stability of the CeraMam silicon carbide membrane in water enhances the effectiveness of processes that deal with oily wastewater, such as the deoiling of oilfield-produced water, the treatment of desalter bottoms, and metalworking fluids treatment.

- In December 2020, LiqTech, a Denmark-based water treatment solutions provider, launched an ultra-filtration membrane with ceramic material, called Hybrid Technology Membrane (HTM). The recently introduced hybrid technology membrane comprises silicon carbide and zirconium dioxide and exhibits a pore size of 60 nm, which can filter liquids more precisely than before.

MICROFILTRATION CERAMIC MEMBRANE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

11.9% |

|

Segments Covered |

By Material, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

3M Company (United States), Pall Corporation (United States), Alfa Level AB (Sweden), METAWATER Co., Ltd. (Japan), Veolia Water Technologies (France), Atech Innovations GmbH (Germany), Nanostone Water, Inc. (United States), Aquaporin A/S (Denmark), TAMI Industries (France), Lenntech BV (Netherlands) |

Global Microfiltration Ceramic Membrane Market Segmentation: By Material

-

Alumina

-

Silica

-

Titania

-

Zirconium Oxide

-

Others

In 2022, the alumina segment held the highest market share. The growth can be attributed to the use of alumina in a number of applications, including water and wastewater treatment, pharmaceuticals, and food and beverages, as they not only provide high efficiency but also ensure high quality and purity. In addition, alumina consists of superior properties, such as high-temperature resistance and chemical resistance, which further propels the segment's growth. Due to the increasing demand for materials with enhanced thermal tolerance, chemical resistance, and the ability to break down organic pollutants through photocatalysis that are beneficial in water and wastewater treatment applications, the titania segment is anticipated to expand at the fastest rate over the forecast period.

Global Microfiltration Ceramic Membrane Market Segmentation: By Application

-

Water & Wastewater Treatment

-

Food & Beverages

-

Biotechnology

-

Chemical Processing

-

Pharmaceuticals

-

Others

In 2022, the water and wastewater treatment segment held the highest market share. The growth can be attributed to the increasing demand for clean and potable water and increasing investments by several governments regarding wastewater treatment. Ceramic membranes have the ability to resist chemical agents during cleaning and exhibit a lower fouling rate in municipal wastewater treatment. Due to the increasing installation of ceramic membranes in anti-biotic drug processing systems to isolate residual matter from process liquors, and the increasing requirement of ceramic membranes for organic solvent nanofiltration, the pharmaceuticals segment is anticipated to expand at the fastest rate over the forecast period.

Global Microfiltration Ceramic Membrane Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

In 2022, the region of Asia-Pacific held the largest share of the global microfiltration ceramic membrane market. The growth can be attributed to the rising adoption of high-purity filtration components in various applications, including water and wastewater treatment, food and beverages, and pharmaceuticals, stringent regulations towards the concerns for wastewater treatment in developing nations, such as China and India, and the rising development of numerous end-use industries, including biotechnology industry and pharmaceutical industry. In addition, the region is home to several significant market players, including METAWATER Co., Ltd., Ion Exchange (India) Ltd., Unitech Water Solutions, Meidensha Corporation, and Toyobo Co., Ltd. Due to the increasing demand for clean and potable drinking water as a result of large and rapidly growing populations and the increasing industrialization and urbanization in developing nations, the Asia-Pacific region will continue to expand at the fastest rate over the forecast period.

Global Microfiltration Ceramic Membrane Market Key Players:

-

3M Company (United States)

-

Pall Corporation (United States)

-

Alfa Level AB (Sweden)

-

METAWATER Co., Ltd. (Japan)

-

Veolia Water Technologies (France)

-

Atech Innovations GmbH (Germany)

-

Nanostone Water, Inc. (United States)

-

Aquaporin A/S (Denmark)

-

TAMI Industries (France)

-

Lenntech BV (Netherlands)

Chapter 1. Microfiltration Ceramic Membrane Market – Scope & Methodology

1.1 Market Segmentation

1.2 Assumptions

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Microfiltration Ceramic Membrane Market – Executive Summary

2.1 Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.3 COVID-19 Impact Analysis

2.3.1 Impact during 2023 – 2030

2.3.2 Impact on Supply – Demand

Chapter 3. Microfiltration Ceramic Membrane Market – Competition Scenario

3.1 Market Share Analysis

3.2 Product Benchmarking

3.3 Competitive Strategy & Development Scenario

3.4 Competitive Pricing Analysis

3.5 Supplier - Distributor Analysis

Chapter 4. Microfiltration Ceramic Membrane Market - Entry Scenario

4.1 Case Studies – Start-up/Thriving Companies

4.2 Regulatory Scenario - By Region

4.3 Customer Analysis

4.4 Porter's Five Force Model

4.4.1 Bargaining Power of Suppliers

4.4.2 Bargaining Powers of Customers

4.4.3 Threat of New Entrants

4.4.4 .Rivalry among Existing Players

4.4.5 Threat of Substitutes

Chapter 5. Microfiltration Ceramic Membrane Market - Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Microfiltration Ceramic Membrane Market - By Material

6.1 Alumina

6.2 Silica

6.3 Titania

6.4 Zirconium Oxide

6.5 Others

Chapter 7. Microfiltration Ceramic Membrane Market - By Application

7.1 Water & Wastewater Treatment

7.2 Food & Beverages

7.3 Biotechnology

7.4 Chemical Processing

7.5 Pharmaceuticals

7.6 Others

Chapter 8. Microfiltration Ceramic Membrane Market – By Region

8.1 North America

8.2 Europe

8.3 Asia-Pacific

8.4 Latin America

8.5 The Middle East

8.6 Africa

Chapter 9. Microfiltration Ceramic Membrane Market – Key Players

9.1 3M Company (United States)

9.2 Pall Corporation (United States)

9.3 Alfa Level AB (Sweden)

9.4 METAWATER Co., Ltd. (Japan)

9.5 Veolia Water Technologies (France)

9.6 Atech Innovations GmbH (Germany)

9.7 Nanostone Water, Inc. (United States)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Microfiltration Ceramic Membrane Market is estimated to be worth USD 2.42 Billion in 2022 and is projected to reach a value of USD 5.95 Billion by 2030, growing at a CAGR of 11.9% during the forecast period 2023-2030.

The Global Microfiltration Ceramic Membrane Market Drivers are the Increasing Demand for Clean and Potable Water and the Increasing Demand for Ceramic Membranes in Pharmaceutical Industry.

Based on the Material, the Global Microfiltration Ceramic Membrane Market is segmented into Alumina, Silica, Titania, Zirconium Oxide, and Others.

China, India, and Japan are the most dominating countries in the region of Asia-Pacific for the Global Microfiltration Ceramic Membrane Market.

3M Company, Pall Corporation, and Alfa Level AB are the leading players in the Global Microfiltration Ceramic Membrane Market.