Microencapsulation Market Size (2025-2030)

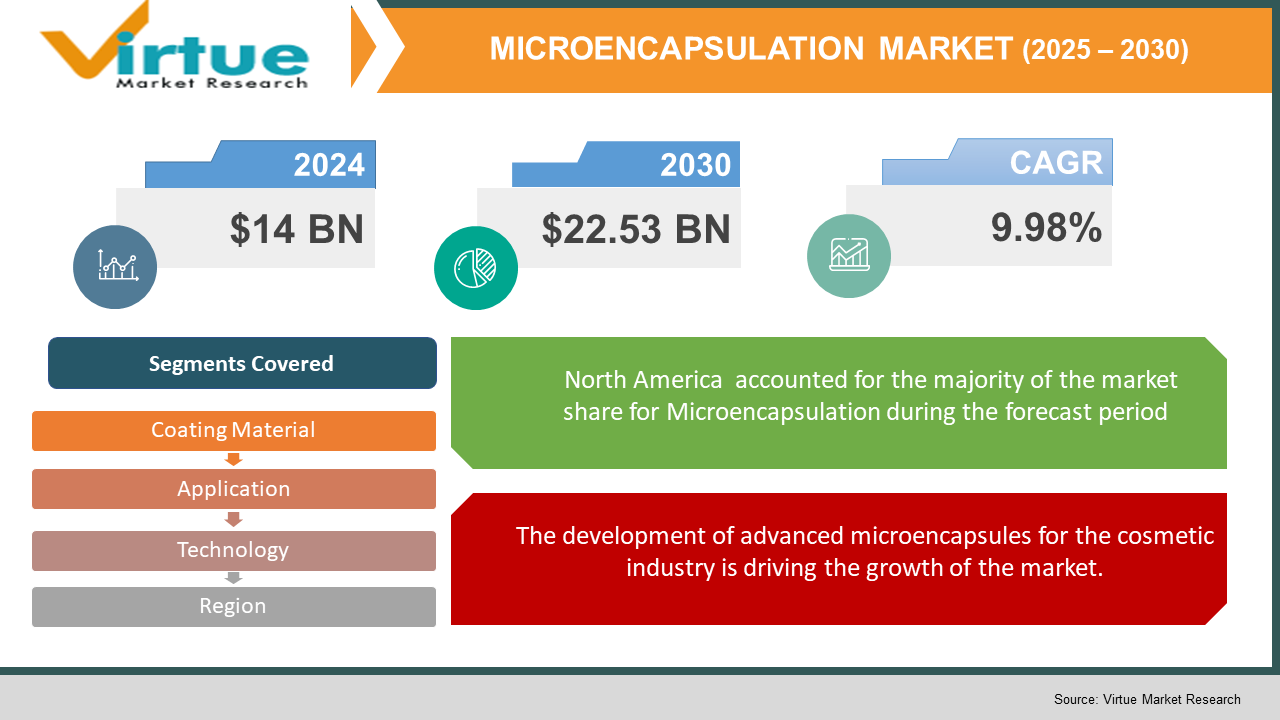

The Microencapsulation Market was valued at USD 14 billion in 2024. Over the forecast period of 2025-2030, it is projected to reach USD 22.53 billion by 2030, growing at a CAGR of 9.98%.

Microencapsulation is a process in which tiny particles or droplets that contain active substances, such as medications, nutrients, or flavors, are enclosed within a protective coating or shell. The resulting microcapsules vary in size, typically ranging from micrometers to millimeters. The primary purposes of microencapsulation are to enable the controlled release of pharmaceutical compounds, shield delicate materials from environmental elements like moisture, oxygen, and heat, and facilitate the targeted delivery of active ingredients to specific areas in the body or systems. This technology has extensive uses across various sectors, including food, pharmaceuticals, agriculture, and cosmetics, offering benefits like enhanced stability, prolonged shelf life, and increased effectiveness of the encapsulated substances. Additionally, microencapsulation allows for the masking of unwanted tastes or odors, providing consumers with a more favorable sensory experience.

Key Market Insights:

- The market is being driven by several factors, including the rising demand for fortified food products with improved shelf life and controlled nutrient release, the increasing product demand in the personal care and cosmetics sectors, and the growing need for phase change materials (PCMs).

- A significant driver of the global market is the escalating demand for fortified food products that offer enhanced shelf life and controlled nutrient release. Additionally, the rising trends in wellness and health, along with increasing consumer awareness about the advantages of nutrient-dense foods, are further stimulating market growth. The growing need for advanced drug delivery systems within the pharmaceutical industry is also contributing to the market’s expansion. Moreover, the use of this technology in agrochemical delivery to protect active ingredients until their controlled release is helping optimize desired effects and supporting

- market growth. Furthermore, ongoing technological advancements and the development of new techniques are creating promising opportunities within the market. The emergence of sustainable and eco-friendly encapsulation methods, driven by the global push for sustainability and reducing environmental impact, is also fostering a positive outlook for the industry.

Microencapsulation Market Drivers:

The extensive application of microencapsulation in the food and pharmaceutical industries is fueling the expansion of the global microencapsulation market.

The increasing demand for microencapsulation in the food and pharmaceutical industries is a key factor driving the growth of the global microencapsulation market. In the food sector, microencapsulation enables the preservation of vitamins, essential oils, minerals, additives, and flavors, ensuring that these ingredients remain integrated and maintain their functional properties in food products. As a result, numerous companies within the food and beverage industry are increasingly adopting microencapsulation techniques.

In the pharmaceutical sector, microencapsulation plays a crucial role in masking the taste and odor of active pharmaceutical ingredients (APIs), which enhances the appeal of the medications. Additionally, microencapsulation helps protect APIs until they reach their targeted site of action, improving the effectiveness of drug delivery. These applications in both the food and pharmaceutical industries are significantly contributing to the expansion of the microencapsulation market.

The development of advanced microencapsules for the cosmetic industry is driving the growth of the market.

The cosmetic industry is increasingly incorporating microencapsulation technologies to improve the performance and targeted delivery of active ingredients, addressing specific skin concerns and fulfilling consumer demand for more effective skincare solutions. These technologies facilitate the gradual and controlled release of active ingredients, offering non-invasive treatment alternatives. For example, AINIA, a European technology company, is focusing on developing new materials for controlled release systems via microencapsulation. These advancements enhance the delivery of skincare ingredients, boosting the overall effectiveness of cosmetic products. As consumers seek more efficient and long-lasting skincare solutions, the demand for advanced microencapsulation technologies in the cosmetics industry is set to grow.

Microencapsulation Market Restraints and Challenges:

The high cost associated with research and development in microencapsulation is hindering the growth of the market.

Microencapsulation is widely used across various industries to encapsulate active ingredients, but this technique requires extensive research to identify the appropriate materials for coating these ingredients. Major companies within the microencapsulation market invest heavily in research and development to find suitable coating materials, which increases the overall cost of the process. As a result, the high costs associated with these complex research efforts make it difficult for small and medium-sized enterprises (SMEs) to adopt microencapsulation techniques in their operations, hindering the market’s growth.

Additionally, in some cases, microencapsulation may not provide the necessary protection for active ingredients due to factors such as ingredient stability and fluctuating environmental conditions. This limitation is expected to further impede the growth of the microencapsulation market in the future.

Microencapsulation Market Opportunities:

The emergence of biodegradable and sustainable materials is creating new opportunities in the microencapsulation market.

The rising demand for eco-friendly and biodegradable encapsulation materials, such as polylactic acid (PLA) and plant-based polymers, presents a significant growth opportunity for the microencapsulation market. These sustainable materials are gaining traction due to their environmental benefits and ability to meet regulatory requirements for more sustainable production processes.

For instance, in December 2021, Givaudan introduced PlanetCaps, a biodegradable and bio-sourced fragrance encapsulation technology designed for fabric softeners. This innovation provides a long-lasting fragrance while ensuring the encapsulation system is environmentally friendly, catering to consumer demand for sustainable products. As the emphasis on sustainability continues to grow across industries such as food, cosmetics, and pharmaceuticals, the demand for biodegradable microencapsulation technologies is expected to increase, offering substantial growth potential for the market.

MICROENCAPSULATION MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

9.98% |

|

Segments Covered |

By Coating material, application, tchnology, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BASF, Syngenta Crop Protection , Royal Friesland, Campina Givaudan, Koninklijke DSM International Flavors & Fragrances , Tastetech Encapsulation Solutions, Firmenich, Sensient Technologies, Sphera Encapsulation, and Microtek |

Microencapsulation Market Segmentation:

Microencapsulation Market Segmentation By Coating Material:

- Gums & Resins

- Carbohydrates

- Polymers

- Lipids

- Proteins

The polymer segment holds a dominant position in the microencapsulation market due to its versatility in encapsulating a wide variety of materials, including active pharmaceutical ingredients and food additives. Polymers are highly preferred for their ability to precisely control the release rate of active ingredients, which enhances the therapeutic efficacy of pharmaceutical products. The ongoing development of new and advanced polymers further propels the growth of this segment.

For example, Lubrizol introduced its Carbopol Polymers for nutraceutical applications. This innovative product, which has received EU food-grade approval, enables nutraceutical manufacturers to create differentiated products, driving growth in both the food and pharmaceutical sectors.

Meanwhile, proteins are expected to experience the highest compound annual growth rate (CAGR) during the forecast period. Proteins such as gelatin, gluten, and peptides are widely used in the microencapsulation of various pharmaceutical and food products. This growing use of proteins in microencapsulation is expected to contribute significantly to market expansion over the forecast period.

Microencapsulation Market Segmentation By Technology:

- Coating

- Emulsion

- Dripping Spray Technologies

- Others

Spray drying continues to be the most widely utilized technology in microencapsulation, owing to its scalability, efficiency, and cost-effectiveness. This technique is highly versatile, making it suitable for encapsulating a diverse range of materials, including flavors, vitamins, probiotics, and fragrances. Its ability to manage large production volumes while maintaining consistent quality provides a distinct advantage.

For instance, the Indian Council of Agricultural Research highlights that spray drying is a popular microencapsulation and drying method in both the food and pharmaceutical industries. Its flexibility, high efficiency, and ease of scale-up make it a preferred choice for commercial applications.

Microencapsulation Market Segmentation By Application:

- Food & Beverages

- Pharmaceutical & Healthcare Products

- Construction

- Home & Personal Care

- Agrochemicals

- Textile

- Others

The pharmaceutical and healthcare products segment continues to be the largest revenue generator in the microencapsulation market. This growth is primarily driven by the rising demand for controlled-release drug delivery systems, which enhance therapeutic outcomes by improving the bioavailability and stability of active ingredients. The rapid advancements in vaccines, biologics, and nutraceuticals—such as vitamins and omega-3 supplements—are further fueling this demand.

Additionally, the development of targeted delivery systems for vaccines, including mRNA-based therapies, heavily relies on microencapsulation techniques to ensure stable and controlled delivery. This expanded application is contributing to the continued growth of the pharmaceutical segment in the microencapsulation market.

Microencapsulation Market Segmentation- by region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

North America remains the leading region in the global microencapsulation market, fueled by rapid technological advancements and significant investments in microencapsulation technologies. The region benefits from the presence of key industry players such as Capsulae, LycoRed Group, and Microtek Laboratories, Inc., who continue to innovate and drive market growth.

Additionally, increased funding for research and development initiatives, particularly in controlled-release drug formulations, has further bolstered the demand for microencapsulation technologies. The pharmaceutical sector, in particular, benefits from these advancements, reinforcing North America's dominant position in the global market.

The Asia-Pacific region, on the other hand, is experiencing the highest growth rate in the microencapsulation market, registering the highest compound annual growth rate (CAGR). This growth is driven by significant advancements in the healthcare and cosmetics industries, especially the rising demand for controlled-release drug formulations to treat chronic diseases. Furthermore, growing health awareness in countries such as India, China, and Japan is substantially increasing the demand for functional foods and nutraceuticals, contributing to the region's rapid market expansion.

COVID-19 Pandemic: Impact Analysis

The effect of the COVID-19 pandemic acted as a catalyst for the growth of the microencapsulation market. This is largely due to the immunity-boosting properties of microencapsulation technology, which became increasingly important in response to the health crisis. The ability of microencapsulation to enhance the stability, bioavailability, and controlled release of nutrients and supplements has significantly contributed to its growing adoption, driving market expansion during the pandemic.

Latest Trends/ Developments:

May 2024 - Lubrizol Corporation, a leading specialty chemical company, introduced its LIPOFER microcapsules at Vitafoods Europe. These microcapsules are specifically designed to deliver iron with improved performance, addressing the rising demand for advanced nutritional delivery systems.

June 2024 - Microcaps, a company specializing in advanced microencapsulation technology, successfully raised CHF 9.3 million in funding. This investment will support the scaling up of its production capacity to meet the growing market demand for its innovative ethanol-free fine fragrance Perfume Pearls.

October 2023 - Milliken & Company completed the acquisition of Encapsys, a leading microencapsulation company. This acquisition strengthens Milliken's capabilities in providing advanced encapsulation solutions across various industries.

Key Players:

These are top 10 players in the Microencapsulation Market :-

- BASF

- Syngenta Crop Protection

- Royal Friesland

- Campina Givaudan

- Koninklijke DSM

- International Flavors & Fragrances

- Tastetech Encapsulation Solutions

- Firmenich

- Sensient Technologies

- Sphera Encapsulation, and Microtek

Chapter 1. Microencapsulation Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Microencapsulation Market – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Microencapsulation Market – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & End User Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Microencapsulation Market - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. Microencapsulation Market - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Microencapsulation Market – By Coating Material

6.1 Introduction/Key Findings

6.2 Gums & Resins

6.3 Carbohydrates

6.4 Polymers

6.5 Lipids

6.6 Proteins

6.7 Y-O-Y Growth trend Analysis By Coating Material

6.8 Absolute $ Opportunity Analysis By Coating Material , 2025-2030

Chapter 7. Microencapsulation Market – By Technology

7.1 Introduction/Key Findings

7.2 Coating

7.3 Emulsion

7.4 Dripping Spray Technologies

7.5 Others Y-O-Y Growth trend Analysis By Technology

7.6 Absolute $ Opportunity Analysis By Technology , 2025-2030

Chapter 8. Microencapsulation Market – By Application

8.1 Introduction/Key Findings

8.2 Food & Beverages

8.3 Pharmaceutical & Healthcare Products

8.4 Construction

8.5 Home & Personal Care

8.6 Agrochemicals

8.7 Textile

8.8 Others

8.9 Y-O-Y Growth trend Analysis Application

8.10 Absolute $ Opportunity Analysis Application , 2025-2030

Chapter 9. Microencapsulation Market, BY GEOGRAPHY – MARKET SIZE, FORECAST, TRENDS & INSIGHTS

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By Technology

9.1.3. By Application

9.1.4. By Coating Material

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By Technology

9.2.3. By Application

9.2.4. By Coating Material

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.1. By Country

9.3.1.1. China

9.3.1.2. Japan

9.3.1.3. South Korea

9.3.1.4. India

9.3.1.5. Australia & New Zealand

9.3.1.6. Rest of Asia-Pacific

9.3.2. By Technology

9.3.3. By Application

9.3.4. By Coating Material

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.1. By Country

9.4.1.1. Brazil

9.4.1.2. Argentina

9.4.1.3. Colombia

9.4.1.4. Chile

9.4.1.5. Rest of South America

9.4.2. By APPLICATION

9.4.3. By Technology

9.4.4. By Coating Material

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.1. By Country

9.5.1.1. United Arab Emirates (UAE)

9.5.1.2. Saudi Arabia

9.5.1.3. Qatar

9.5.1.4. Israel

9.5.1.5. South Africa

9.5.1.6. Nigeria

9.5.1.7. Kenya

9.5.1.8. Egypt

9.5.1.9. Rest of MEA

9.5.2. By APPLICATION

9.5.3. By Technology

9.5.4. By Coating Material

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Microencapsulation Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 BASF

10.2 Syngenta Crop Protection

10.3. Royal FrieslandCampina

10.4. Givaudan

10.5 Koninklijke DSM

10.6 International Flavors & Fragrances

10.7. Tastetech Encapsulation Solutions

10.8. Firmenich

10.9 Sensient Technologies

10.10 Sphera Encapsulation, and Microtek

10.11 Ineos Group

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market is being driven by several factors, including the rising demand for fortified food products with improved shelf life and controlled nutrient release, the increasing product demand in the personal care and cosmetics sectors, and the growing need for phase change materials (PCMs).

The top players operating in the Microencapsulation Market are - Syngenta Crop Protection, Royal FrieslandCampina and Givaudan.

The effect of the COVID-19 pandemic acted as a catalyst for the growth of the microencapsulation market

May 2024 - Lubrizol Corporation, a leading specialty chemical company, introduced its LIPOFER microcapsules at Vitafoods Europe. These microcapsules are specifically designed to deliver iron with improved performance, addressing the rising demand for advanced nutritional delivery systems

Asia-Pacific is the Fastest growing region in the Microencapsulation Market.