Microencapsulated butyric (MEB) Acid Market Size (2023 – 2030)

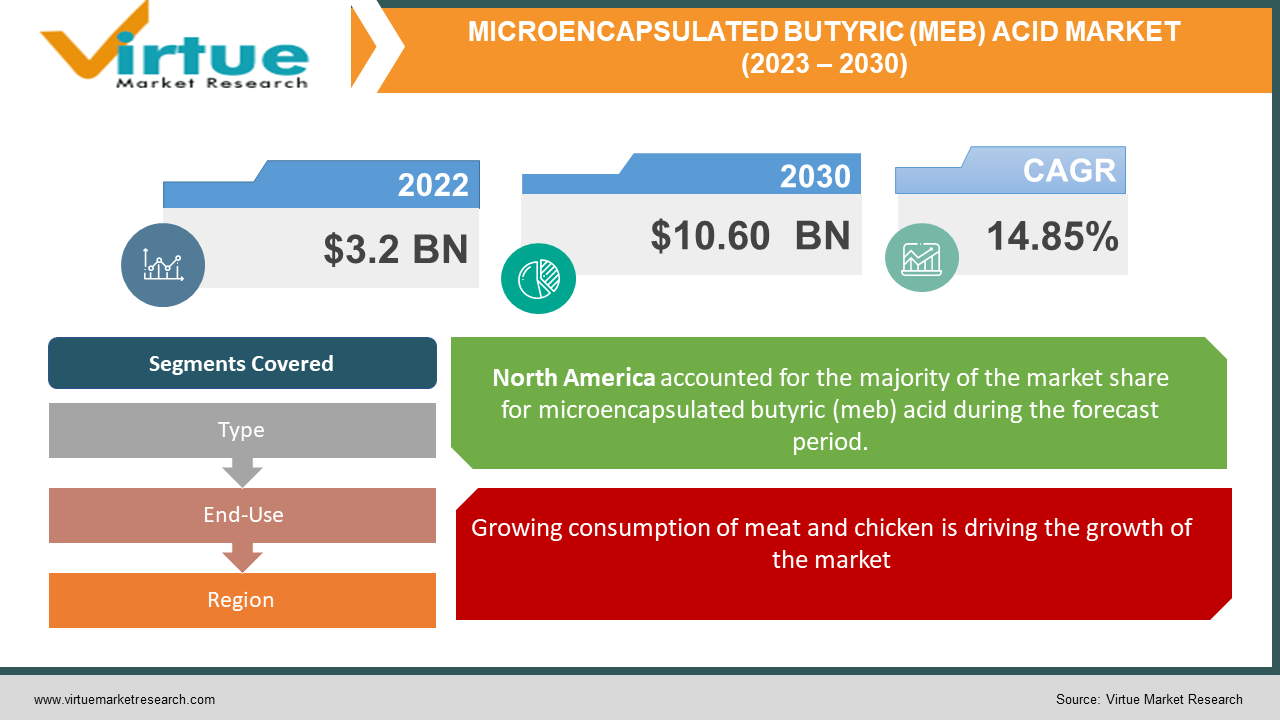

The global Microencapsulated butyric (MEB) Acid Market size is estimated to grow from USD 3.2 billion by 2022 to USD 10.60 billion in 2030. This market is witnessing a healthy CAGR of 14.85% from 2023 - 2030. The growing demand for renewable butyric acid in the food & flavor & pharmaceuticals sector, an upsurge in the number of consumers of meat, and a ban on consumption of antibiotics in animal feed in some countries are majorly driving the growth of the industry.

Industry Overview:

Butyric acid is a carboxylic acid, additionally recognized as butanoic acid. The product has an acrid style and is typically discovered in the milk of farm animals such as goats, cows, buffalo, and sheep. The rising demand for distinctiveness chemical substances in a number of end-use industries such as pharmaceutical, animal feed, meals & beverage, and private care industries are riding the market boom all through the forecast period. Starch is a tasteless powder that is without problems insoluble in bloodless water, alcohol, or different solvents.

The excessive occurrence of health-related problems such as diabetes, anxiety, obesity, and others are additionally helping the market increase for butyric acid. The developing fowl enterprise alongside the developing consumption of fowl globally is propelling the market demand. The developing demand for choice and biofuels in the car and aerospace industries is one of the essential using elements for butyric acid. The altering lifestyle and upward thrust in working ladies in creating countries lead to extra utilization of cosmetics which is in addition riding the market growth. However, fluctuating uncooked cloth expenditures and fitness dangers related to butyric acid are probable to impede the market boom for the duration of the forecast period. The developing demand for renewable butyric acid in the meals & taste and prescribed drugs region is predicted to power the butyric acid over the anticipated years. Also, the rising demand for packaged meals due to altering traits amongst buyers and an upsurge in the wide variety of shoppers of meat expects an enhancement to the market in the coming years.

Additionally, the ban on the consumption of antibiotics in animal feed in some nations and the growing demand in end-use industries are envisioned to gasoline the market over the forecasted period. There are sure restraints and challenges confronted which can avert the market growth. Factors such as fluctuating uncooked substances and related fitness risks and the disagreeable odor of butyric acid are probably to act as market restraints.

COVID-19 impact on the Microencapsulated butyric (MEB) Acid Market

The COVID-19 pandemic is impacting one-of-a-kind industries; one of the few industries that have been generally hit to some extent was once the chemical industry.

The world lockdown has impacted the transportation device which similarly impacted the provide chain operations. Transportation gasoline demand has diminished since March 2021 due to decreased monetary recreation and lockdown to prevent the unfold of coronavirus disease. The demand for the meals processing & beverage enterprise is average in the course of the covid-19 crisis. The meals & beverage enterprise is viewed underneath imperative goods, so many governments throughout the globe gave leisure to this specific industry.

MARKET DRIVERS:

Growing consumption of meat and chicken is driving the growth of the market

Butyric acid finds its utilization in the manufacturing of animal feed which is used for animal boom and a healthful diet. According to the facts posted by way of the U.S. Department of Agriculture (USDA), Americans devour about 274 kilos of meat per yr on average. They also cited the U.S. is the world’s second-highest patron of pork and buffalo after Argentina. Based on the statics posted by means of the U.S. Census records and Simmons National Consumer Survey (NHCS) determined that around 268 million Americans ate bacon in 2021.

Growing demand in the pharmaceuticals industry will also drive the market

The pharmaceutical enterprise performs an essential position in each developed and growing nation's economies. The altering purchaser ingesting habits alongside developing many fitness troubles such as indigestion, gastric, and irritable bowel syndrome are aiding the market increase for butyric acid. According to the data proven by means of IQVIA Institute for Human Data Science, the Chinese pharmaceutical enterprise has registered an excessive increase in fees over the preceding years. The China prescription drugs enterprise proved round 4% increase in 2019, and Japan's prescription drugs additionally registered a 4% increase in price in 2021.

MARKET RESTRAINTS:

Health Hazards related to the chemicals are restraining the growth of the market

Butyric acid is one of the outstanding elements used in quite a number industries such as the Food & beverage, pharmaceutical, and private care sectors. Butyric acid is used in the manufacturing of a number of butyrate esters. Acid reasons countless fitness hazards. Inhaling butyric acid can irritate the nose, throat, and lungs. The acid reasons pores and skin burns when they are without delay in contact with the skin. The employees are given defensive clothing, eye protection, face safety shields, and protecting gloves when the employees are dealing with butyric acid.

MICROENCAPSULATED BUTYRIC (MEB) ACID MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

14.85% |

|

Segments Covered |

By Type, End-Use, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Eastman Chemical Company, Oxea GmbH, Blue Marble Biomaterials LLC, Tokyo Chemical Industry Co. Ltd., Perstorp Holding AB, Snowco Industrial Co. Ltd., Beijing Huamaoyuan Fragrance Flavor Co. Ltd., |

Microencapsulated butyric (MEB) Acid Market - By Type:

-

Synthetic

-

Bio-Based

On the basis of Type, The bio-based segments accounted for about 60% of the market share in 2021 and are estimated to develop at a tremendous CAGR at some stage in the forecast period. The patron inclination toward bio-based merchandise is riding the market increase for butyric acid. Bio-based butyric acid is produced from herbal merchandise such as corn husk, sugar, and different herbal sources. The effortless availability of these uncooked substances and their low value are aiding the market boom for the bio-based segment.

The meals & beverage enterprise is adopting bio-based butyric acids for manufacturing meal additives, animal feed, and flavoring dealers amongst others. The artificial kind section is estimated to develop notably all through the forecast period. Synthetic butyric acid is developed by means of chemical synthesis. The chemical synthesis worried in the oxidation of butyraldehyde, received from propylene derived which is extracted from crude oil by means of oxo synthesis.

Microencapsulated butyric (MEB) Acid Market - By End-Use:

-

Food and beverage

-

Pharmaceuticals

-

Personal care

-

Paints and coatings

-

agriculture

-

others

On the basis of End-Use, The meals & beverage phase accounted for greater than 35% of the market share in 2021 and is estimated to develop extensively throughout the forecast period. The developing populace globally is one of the primary elements using the market for the meals & beverage segment. Butyric acid is used as a meal additive and flavoring agent in the meal processing industry. The developing penetration of the essential meals chain firms such as KFC and McDonald’s is helping the market growth. The private care and pharmaceutical enterprise occupied the 2nd role in phrases of share and income in the world butyric market. The developing customer spending on splendor merchandise alongside a make bigger in infectious illnesses are helping the non-public care and pharma industry. According to the lookup paper PepsiCo., Tyson Foods and Nestle are the pinnacle three businesses running in the U.S. meals & beverage market. The agencies generated about USD 204.8 Billion in income in 2019.

Microencapsulated butyric (MEB) Acid Market - By Region:

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

The Middle East

-

Africa

Geographically, North America's vicinity held the biggest share in the butyric acid market in 2021 up to 38%, owing to the speedy boom in the meals & beverage area in the region. The presence of well-developed international locations such as the U.S. and Canada are using the market boom in the region. The presence of key meals & beverage businesses such as Nestle, Tyson Foods, PepsiCo, Coca-Cola, STARBUCKS CORP, and others are using the demand for Butyric Acids.

According to the records posted by way of the U.S. Poultry and Egg Association, about 16,585 licensed natural farms are there in the United States. They additionally point out that the fee of broilers produced in the USA all through 2021 was once $21.7 billion. The Asia Pacific area is anticipated to register an excessive boom fee at some stage in the forecast length (2021-2026). The fast increase in population, developing quantity of working individuals, and boom in profits tiers are some of the fundamental elements using the regional market. Abundant bio-based uncooked fabric sources and availability of staff additionally assist the regional demand.

Microencapsulated butyric (MEB) Acid Market Share by Company

-

Eastman Chemical Company

-

Oxea GmbH

-

Blue Marble Biomaterials LLC

-

Tokyo Chemical Industry Co. Ltd.

-

Perstorp Holding AB

-

Snowco Industrial Co. Ltd.

-

Beijing Huamaoyuan Fragrance Flavor Co. Ltd.

These Major Players have adopted various organic as well as inorganic growth strategies such as mergers & acquisitions, new product launches, expansions, agreements, joint ventures, partnerships, and others to strengthen their position in this market.

Recently, Society Corp., a major processor of remediated THC hemp extract, said in May 2019 that it had acquired Blue Marble Biomaterials, a manufacturer of natural and sustainable specialty compounds for the worldwide food, fragrance, and cosmetics industries.

The chemical company Oxea, which is part of the Oman Oil Company & Orpic Group, will join eight other companies in forming a new, integrated energy company known as OQ. OQ aspires to be a global leader in the energy sector, seizing and profiting from a larger share of the global hydrocarbon value chain.

NOTABLE HAPPENINGS IN THE GLOBAL MICRO-ENCAPSULATED BUTYRIC(MEB) ACID MARKET IN THE RECENT PAST:

Acquisition - In Aug 2021, Evonik and Swedish manufacturer, Perstorp, expanded the sales and distribution of ProPhorce SR 130 to the Indian subcontinent (India, Nepal, Sri Lanka, Bangladesh, and Pakistan). ProPhorce SR 130 is a butyric acid product that is a safe, easy to handle, and cost-efficient solution for in-feed application in livestock management

Chapter 1. Microencapsulated butyric (MEB) Acid Market– Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Microencapsulated butyric (MEB) Acid Market– Executive Summary

2.1 Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Microencapsulated butyric (MEB) Acid Market– Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Microencapsulated butyric (MEB) Acid Market- Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Microencapsulated butyric (MEB) Acid Market- Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Microencapsulated butyric (MEB) Acid Market- BY TYPE

6.1 Introduction/Key Findings

6.2 Synthetic

6.3 Bio-Based

6.4 Y-O-Y Growth trend Analysis BY TYPE

6.5 Absolute $ Opportunity Analysis BY TYPE, 2023-2030

Chapter 7. Microencapsulated butyric (MEB) Acid Market - BY END-USE

7.1 Introduction/Key Findings

7.2 Online

7.3 Offline

7.4 Y-O-Y Growth trend Analysis BY END-USE

7.5 Absolute $ Opportunity Analysis BY END-USE, 2023-2030

Chapter 8. Microencapsulated butyric (MEB) Acid Market, By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.2 BY TYPE

8.3 BY END-USE

8.4 Countries & Segments - Market Attractiveness Analysis

8.5 Europe

8.5.1 By Country

8.5.1.1 U.K.

8.5.1.2 Germany

8.5.1.3 France

8.5.1.4 Italy

8.5.1.5 Spain

8.5.1.6 Rest of Europe

8.6 BY TYPE

8.7 BY END-USE

8.8 Countries & Segments - Market Attractiveness Analysis

8.9 Asia Pacific

8.9.1 By Country

8.9.1.1 China

8.9.1.2 Japan

8.9.1.3 South Korea

8.9.1.4 India

8.9.1.5 Australia & New Zealand

8.9.1.6 Rest of Asia-Pacific

8.10 BY TYPE

8.11 BY END-USE

8.12 Countries & Segments - Market Attractiveness Analysis

8.13 South America

8.13.1 By Country

8.13.1.1 Brazil

8.13.1.2 Argentina

8.13.1.3 Colombia

8.13.1.4 Chile

8.13.1.5 Rest of South America

8.14 BY TYPE

8.15 BY END-USE

8.16 Countries & Segments - Market Attractiveness Analysis

8.17 Middle East & Africa

8.17.1 By Country

8.17.1.1 United Arab Emirates

8.17.1.2 Saudi Arabia

8.17.1.3 Qatar

8.17.1.4 Israel

8.17.1.5 South Africa

8.17.1.6 Nigeria

8.17.1.7 Kenya

8.17.1.8 Egypt

8.17.1.9 Rest of MEA

8.18 BY TYPE

8.19 BY END-USE

8.20 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Microencapsulated butyric (MEB) Acid Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Eastman Chemical Company

9.2 Oxea GmbH

9.3 Blue Marble Biomaterials LLC

9.4 Tokyo Chemical Industry Co. Ltd.

9.5 Perstorp Holding AB

9.6 Snowco Industrial Co. Ltd.

9.7 Beijing Huamaoyuan Fragrance Flavor Co. Ltd.

Download Sample

Choose License Type

2500

4250

5250

6900