Microcrystalline Cellulose (MCC) Market Size (2024 – 2030)

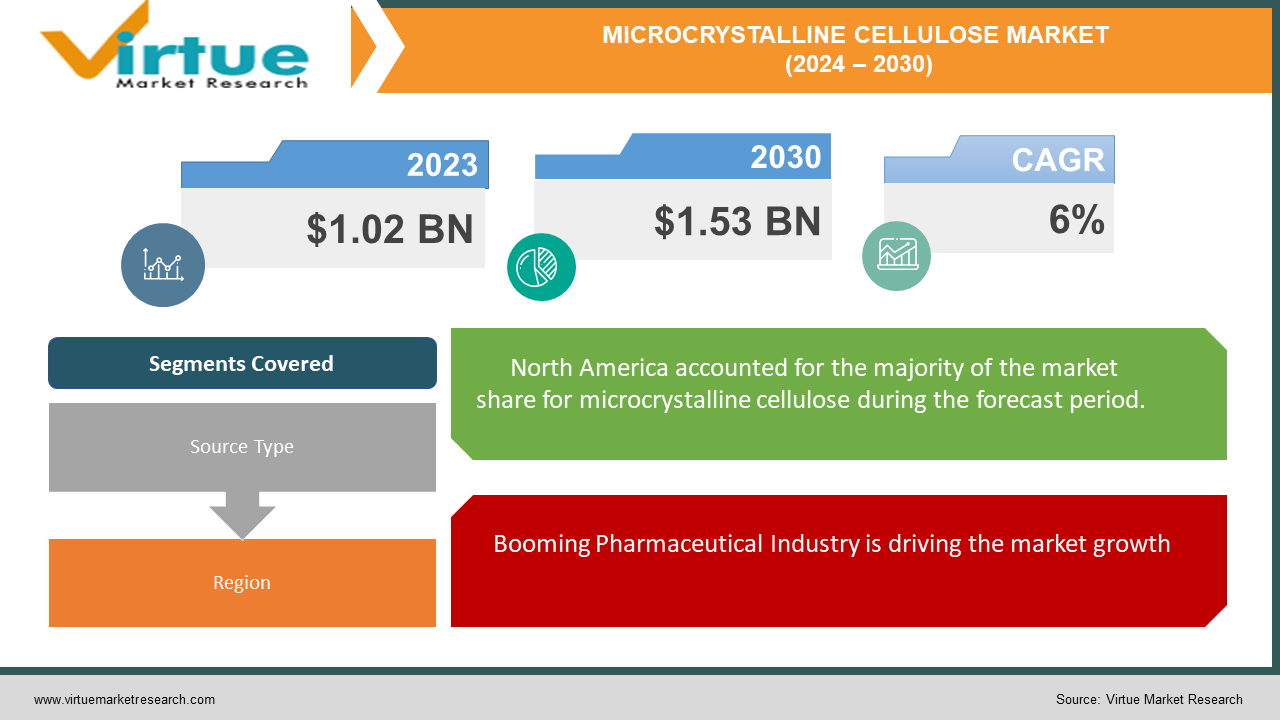

The Global Microcrystalline Cellulose (MCC) Market was valued at USD 1.02 billion in 2023 and will grow at a CAGR of 6% from 2024 to 2030. The market is expected to reach USD 1.53 billion by 2030.

This growth is fueled by several factors. First, the rising demand for processed food and beverages creates a strong market for MCC's bulking and texturizing properties.

Key Market Insights:

The pharmaceutical industry heavily relies on MCC as a disintegrant, binder, and other excipients, and this segment is expected to hold the largest market share by 2036.

Additionally, growing health consciousness is boosting demand for fat-reduced foods and fiber-rich personal care products, both of which benefit from MCC's applications.

Finally, research into cost-effective production methods using non-wood sources like agricultural waste is making MCC more affordable, further accelerating market expansion.

Global Microcrystalline Cellulose Market Drivers:

Booming Pharmaceutical Industry is driving the market growth

Microcrystalline cellulose (MCC), a crucial component in pharmaceutical formulations, is experiencing a surge in demand due to the booming global pharmaceutical industry, particularly in emerging economies like China and India. MCC's versatility as an excipient makes it ideal for various drug delivery formats. Its binding properties ensure tablets maintain their structure, while its disintegrating function allows for quick drug release upon ingestion. MCC also enhances the gliding properties of drug powders, preventing them from sticking during processing and ensuring smooth capsule filling. Furthermore, it acts as a diluent, enabling formulators to achieve the desired dosage volume or bulk required for low-dose drugs. As a carrier, MCC can encapsulate active ingredients, facilitating targeted delivery to specific areas within the body. This confluence of factors – MCC's functionality, the expanding pharmaceutical landscape, and the rise of emerging markets – positions MCC as a key player in the future of drug formulation.

Growing Demand for Processed Food Products is driving the market

The surge in consumer preference for convenient, shelf-stable processed foods is a boon for the MCC market. As busy lifestyles drive demand for these time-saving options, MCC's versatility proves invaluable to food manufacturers. It acts as a thickener, enhancing the texture of products like yogurt and dressings. MCC also stabilizes these foods, preventing separation and ensuring a consistent eating experience. Furthermore, it can be used as a fat replacer, allowing manufacturers to reduce calorie content without sacrificing taste or texture. This ability to cater to consumer desires for convenience, extended shelf life, and potentially healthier options makes MCC a key ingredient for food producers, propelling market growth for this multi-functional ingredient.

Rising Focus on Natural Ingredients is driving the market

The clean-label movement, prioritizing natural and recognizable ingredients, is driving a significant rise in demand for MCC across food, cosmetics, and pharmaceuticals. MCC's origin story resonates with health-conscious consumers, as it's derived from plants, often from wood pulp or cotton. This natural composition positions it as a safe and sustainable alternative to synthetic ingredients that may raise concerns. In the food industry, MCC can replace artificial thickeners and stabilizers, ensuring consumers can indulge in products like yogurt and salad dressings without hidden additives. For cosmetics manufacturers, MCC offers a natural solution for thickening lotions and creams, aligning with the desire for clean beauty products. Even the pharmaceutical industry benefits from MCC's clean-label appeal. Here, MCC serves as a versatile excipient, binding tablets, promoting disintegration for faster drug release, and acting as a carrier for targeted drug delivery. This ability to replace potentially synthetic components while maintaining product functionality makes MCC a game-changer for manufacturers seeking to cater to the growing demand for clean-label products. As consumer preferences continue to prioritize natural ingredients, MCC is poised to experience significant growth across various industries.

Global Microcrystalline Cellulose (MCC) Market challenges and restraints:

High Raw Material Costs and Complex Production is restricting market growth

High production costs are a double-edged sword for the MCC market. The primary culprit is the raw material itself. Wood pulp, the traditional source for MCC, can be expensive to obtain and requires significant processing. MCC production is far from a one-step process. It typically involves acid hydrolysis to break down cellulose, followed by rigorous washing, bleaching, and drying steps to achieve the desired purity and particle size. Each stage adds to the overall cost. This complexity also translates to high energy consumption, driving up operational expenses. Unfortunately, these costs ultimately inflate the final price of MCC products. This can be a barrier for some manufacturers, especially in cost-sensitive industries like food. However, there's a ray of hope. Research into alternative, non-wood sources like agricultural waste offers the potential for cheaper raw materials. Additionally, advancements in continuous processing technologies aim to streamline production and reduce energy consumption. If successful, these innovations could bring down the overall cost of MCC, making it more accessible across various industries.

Environmental Regulations is restricting market growth

The growing focus on environmental sustainability through government regulations presents a complex challenge for the MCC market. Stringent regulations might restrict the use of wood pulp, the traditional raw material for MCC. These restrictions could stem from concerns about deforestation or the environmental impact of harvesting trees for industrial purposes. Additionally, regulations might target the use of harsh chemicals or high-energy processes involved in conventional MCC production. Such limitations could disrupt the current supply chain and potentially force manufacturers to adopt alternative, but potentially less efficient, methods. This shift could lead to production slowdowns and higher costs.

Market Opportunities:

The MCC market presents exciting opportunities for growth across several key areas. Firstly, the burgeoning pharmaceutical industry, particularly in developing nations, demands high-quality excipients like MCC for effective drug delivery. Secondly, innovation in MCC production like spherical MCC offers enhanced functionalities like controlled drug release, opening doors for targeted therapies. Thirdly, the growing demand for plant-based and clean-label products creates a space for MCC to replace synthetic additives in food and cosmetics. MCC's thickening, stabilizing, and fat-replacing properties in food can cater to health-conscious consumers seeking convenient options. Similarly, in cosmetics, MCC can act as a natural thickener for lotions and creams, aligning with the clean beauty movement. Furthermore, advancements in research hold promise for unearthing novel applications of MCC in industries like composites and 3D printing, expanding its market reach. By capitalizing on these opportunities through targeted research, strategic product development, and effectively addressing consumer preferences for natural ingredients, MCC manufacturers can navigate a promising future within an ever-evolving market landscape.

The pharmaceutical industry currently reigns supreme. MCC's functionality as a binding, disintegrating, and drug delivery agent in tablets, capsules, and other pharmaceutical formulations makes it a critical ingredient. This dominance is likely to continue as the global demand for pharmaceuticals keeps rising. Food and Beverage holds strong potential for future growth, driven by the increasing popularity of processed foods and dietary supplements that utilize MCC's thickening, stabilizing, and fat-replacing properties. Cosmetics and Personal Care also offer promise, but the market size is currently smaller compared to the other two segments.

MICROCRYSTALLINE CELLULOSE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6% |

|

Segments Covered |

By Source Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Asahi Kasei Corporation, FMC Corporation, JRS Pharma LP, METabolic Explorer, Blanver, Christofer Group, Imspeco, PenCel Cellulose, Borregaard AS, Weihua Group |

Microcrystalline Cellulose (MCC) Market Segmentation: By Source Type

-

Wood-Based

-

Non-Wood Based

The MCC market has been dominated by wood-based MCC, derived from various wood pulps. However, there's a growing shift towards non-wood based MCC due to sustainability concerns. This segment utilizes agricultural waste or other non-wood sources for MCC production, offering an eco-friendly alternative to the traditional method.

Microcrystalline Cellulose (MCC) Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The global MCC market is a geographically diverse landscape with distinct leaders and growth trajectories. While North America and Europe hold significant market shares due to established pharmaceutical and food industries, the fastest growth is expected in the Asia-Pacific region. This surge is driven by several factors. Firstly, the burgeoning middle class in countries like China and India is creating a strong demand for processed and convenience foods, a key application area for MCC. Secondly, the rapidly growing pharmaceutical industries in these regions are fueling the demand for MCC as an excipient. Finally, rising disposable incomes are leading to increased consumer interest in health and wellness products, which often utilize MCC for its bulking and texturizing properties. This confluence of factors positions Asia-Pacific as the dominant and fastest growing region in the global MCC market.

COVID-19 Impact Analysis on the Global Microcrystalline Cellulose (MCC) Market

The COVID-19 pandemic produced a mixed impact on the global MCC market. Initially, during the height of lockdowns and social distancing measures in 2020, there was a noticeable dip in demand across various sectors. Disruptions in supply chains and a general reluctance towards non-essential purchases in some industries like food services impacted MCC consumption. However, this was countered by a surge in demand from the pharmaceutical sector. The heightened focus on healthcare during the pandemic led to increased production of drugs and medications, consequently driving up the need for MCC as a crucial excipient. Additionally, the rise in e-commerce purchases for essential goods, including MCC-containing personal hygiene products and dietary supplements, provided some stability to the market. Overall, while the initial stages of the pandemic brought challenges, the MCC market exhibited resilience. As the world transitioned to a "new normal," the demand for MCC is expected to return to a steady growth trajectory, fueled by factors like the ongoing expansion of the pharmaceutical industry and the growing consumer preference for natural ingredients. The long-term outlook for the MCC market remains positive, with opportunities for further exploration in areas like novel drug delivery systems and clean-label applications in food and cosmetics.

Latest trends/Developments

The MCC market is buzzing with exciting developments! One key trend is the focus on innovation in MCC production. Development of novel forms like spherical MCC offers enhanced functionalities like controlled drug release, opening doors for targeted therapies and improved patient outcomes in the pharmaceutical sector. Another trend is the growing emphasis on sustainability. Manufacturers are exploring ways to utilize non-wood sources like agricultural waste for MCC production, reducing environmental impact and potentially lowering production costs. This aligns perfectly with the clean-label movement, where consumers are increasingly seeking natural and eco-friendly ingredients. This trend extends beyond sustainability, with MCC finding applications as a natural thickener and fat replacer in food, and a thickener in cosmetics, catering to the demand for clean-label products. Furthermore, research is exploring the potential of MCC in various emerging applications. These include using MCC as a reinforcing agent in composite materials and as a binder in filaments for 3D printing, showcasing the vast potential of this versatile ingredient. By capitalizing on these trends through innovation, sustainability initiatives, and exploring new applications, the MCC market is poised for significant growth and expansion into exciting new territories.

Key Players:

-

Asahi Kasei Corporation

-

FMC Corporation

-

JRS Pharma LP

-

METabolic Explorer

-

Blanver

-

Christofer Group

-

Imspeco

-

PenCel Cellulose

-

Borregaard AS

-

Weihua Group

Chapter 1. MICROCRYSTALLINE CELLULOSE (MCC) MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. MICROCRYSTALLINE CELLULOSE (MCC) MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. MICROCRYSTALLINE CELLULOSE (MCC) MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. MICROCRYSTALLINE CELLULOSE (MCC) MARKET Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. MICROCRYSTALLINE CELLULOSE (MCC) MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. MICROCRYSTALLINE CELLULOSE (MCC) MARKET – By Source Type

6.1 Introduction/Key Findings

6.2 Wood-Based

6.3 Non-Wood Based

6.4 Y-O-Y Growth trend Analysis By Source Type

6.5 Absolute $ Opportunity Analysis By Source Type, 2024-2030

Chapter 7. MICROCRYSTALLINE CELLULOSE (MCC) MARKET , By Geography – Market Size, Forecast, Trends & Insights

7.1 North America

7.1.1 By Country

7.1.1.1 U.S.A.

7.1.1.2 Canada

7.1.1.3 Mexico

7.1.2 By Source Type

7.1.3 Countries & Segments - Market Attractiveness Analysis

7.2 Europe

7.2.1 By Country

7.2.1.1 U.K

7.2.1.2 Germany

7.2.1.3 France

7.2.1.4 Italy

7.2.1.5 Spain

7.2.1.6 Rest of Europe

7.2.2 By Source Type

7.2.3 Countries & Segments - Market Attractiveness Analysis

7.3 Asia Pacific

7.3.1 By Country

7.3.1.1 China

7.3.1.2 Japan

7.3.1.3 South Korea

7.3.1.4 India

7.3.1.5 Australia & New Zealand

7.3.1.6 Rest of Asia-Pacific

7.3.2 By Source Type

7.3.3 Countries & Segments - Market Attractiveness Analysis

7.4 South America

7.4.1 By Country

7.4.1.1 Brazil

7.4.1.2 Argentina

7.4.1.3 Colombia

7.4.1.4 Chile

7.4.1.5 Rest of South America

7.4.2 By Source Type

7.4.3 Countries & Segments - Market Attractiveness Analysis

7.5 Middle East & Africa

7.5.1 By Country

7.5.1.1 United Arab Emirates (UAE)

7.5.1.2 Saudi Arabia

7.5.1.3 Qatar

7.5.1.4 Israel

7.5.1.5 South Africa

7.5.1.6 Nigeria

7.5.1.7 Kenya

7.5.1.8 Egypt

7.5.1.9 Rest of MEA

7.5.2 By Source Type

7.5.3 Countries & Segments - Market Attractiveness Analysis

Chapter 8. MICROCRYSTALLINE CELLULOSE (MCC) MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

8.1 Asahi Kasei Corporation

8.2 FMC Corporation

8.3 JRS Pharma LP

8.4 METabolic Explorer

8.5 Blanver

8.6 Christofer Group

8.7 Imspeco

8.8 PenCel Cellulose

8.9 Borregaard AS

8.10 Weihua Group

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Microcrystalline Cellulose (MCC) Market was valued at USD 1.02 billion in 2023 and will grow at a CAGR of 6% from 2024 to 2030. The market is expected to reach USD 1.53 billion by 2030.

Booming Pharmaceutical Industry, Rising Focus on Natural Ingredients these are the reasons which is driving the market.

Based on Application Type it is divided into three segments – Food and Beverage, Pharmaceuticals, Cosmetics and Personal Care

North America is the most dominant region for the Microcrystalline Cellulose (MCC) Market.

Imspeco, PenCel Cellulose, Borregaard AS, Weihua Group