MicroBots and Diagnostics Market Size (2023 - 2030)

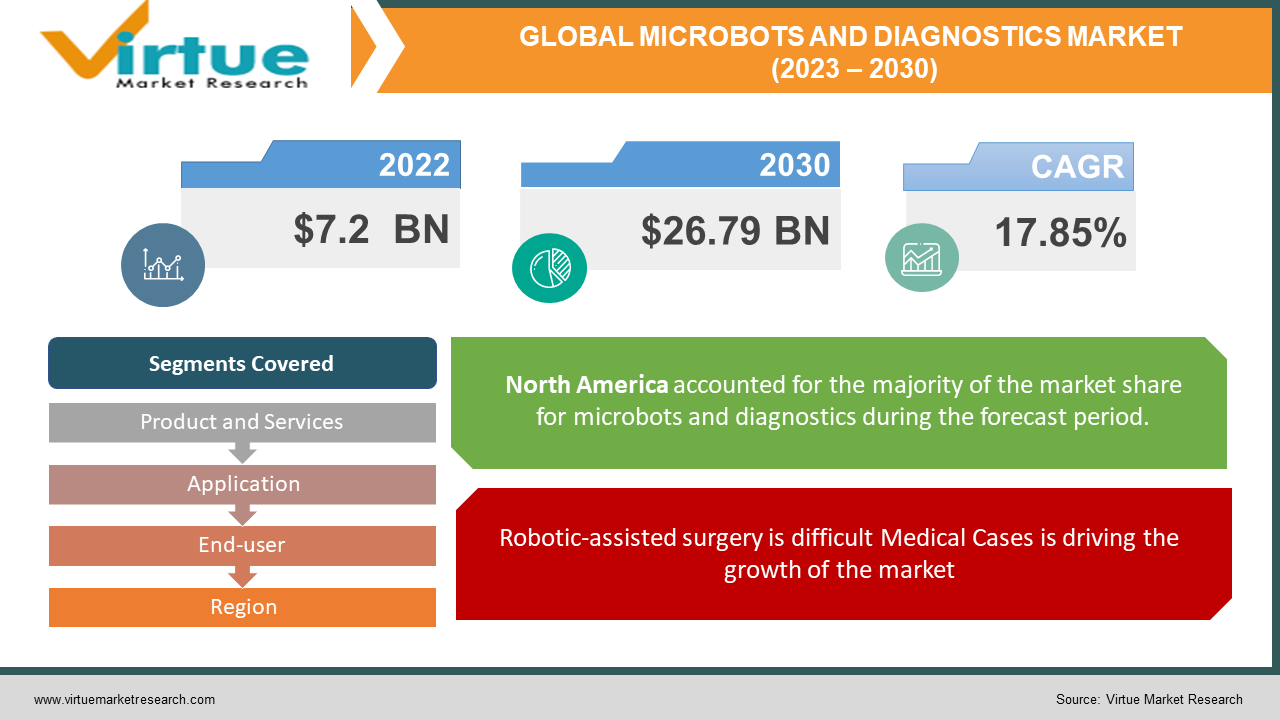

As per our research report, the global MicroBots and Diagnostics Market size was USD 7.2 billion in 2022 and is estimated to grow to USD 26.79 billion by 2030. This market is witnessing a healthy CAGR of 17.85% from 2023 - 2030. Robotic-assisted surgery and robot-assisted training in rehabilitation therapy, technological advancements in robotic systems, Improving reimbursement scenarios, the increasing adoption of surgical robots, and the increase in funding for medical robot research options are majorly driving the growth of the industry.

Industry Overview:

Consumer perceptions of the use of medical robots in retirement homes have changed better these days. Robotic care can reduce the number of visits to the emergency room due to an unexpected fall and make home care more accessible and affordable. Electronic devices such as smartphones require precise manufacturing in order to perform work with attention to detail, and the adoption of microrobots is rapidly increasing.

In addition, the increasing adoption of robotic technology in the medical field will further drive market growth. However, limited energy storage and complex manufacturing processes can hinder the market growth. Microrobots are very small robots and are useful in different applications in different end-use industries. Their size ranges from a fraction of a millimeter to a millimeter.

Microrobots can autonomously perform many production steps and manage micrometer-sized components. Autonomous microrobots have their own built-in (onboard) processing units that control the robot and operate it without human intervention. In addition, robots can use lightweight batteries or collect/seek energy from the environment in the form of light energy or vibration. In addition, the microrobot can also be operated via a wireless connection such as WiFi. This allows the host microrobot to work with nearby microrobots to complete more complex tasks.

COVD-19 impact on MicroBots and Diagnostics Market

The outbreak of COVID19 has upset many lives and businesses on an unprecedented scale. Pandemics have a negative impact on the medical robot market. The pandemic temporarily banned elective surgery around the world and stopped it around the world.

Approximately 28 million surgeries worldwide were canceled during the 12-week turmoil of the COVID 19 pandemic, according to a report released by researchers at CovidSurg Collaborative. The decline in surgery led to a decline in revenue in the medical robot market, as it was unable to generate revenue from sales of the instruments and accessories segment. Intuitive Surgical reported a 20% reduction in DaVinci surgery performed in the second quarter of 2020 compared to the second quarter of 2019. The prevalence of COVID 19 is increasing in various regions and is expected to decline further in the third quarter.

In addition, capital markets and economies around the world have been adversely affected by the COVID 19 pandemic, which could lead to widespread regional and global recessions. Such economic turmoil can have a negative impact on medical robot manufacturers, as the current pandemic has had a tremendous financial impact on medical facilities, reducing capital and overall spending. Most hospitals have also postponed the current purchase of capital goods. Demand for medical robots is expected to return to pre-COVID-19 levels in early 2022.

MARKET DRIVERS:

Robotic-assisted surgery is difficult Medical Cases is driving the growth of the market

The demand for minimally invasive surgery (MIS) is increasing primarily due to the benefits associated with these procedures, including Smaller incisions, fewer incisions, less scarring, less pain, higher safety, faster recovery time, and significant cost savings. Minimally invasive robotic surgery contributes to these benefits by ensuring higher accuracy and reproducibility, as well as better control and efficiency. Robotic surgery also provides the surgeon with advanced visualization capabilities that provide a superior view of the surgical field by visualizing the structure to the microscopic level using an HD camera. These systems provide greater dexterity than the human hand. With its ability to rotate 360 degrees and excellent maneuverability, the robot makes it possible for surgeons to reach hard-to-reach places.

Robot-assisted training in rehabilitation therapy is also driving the growth of the market

Stroke is the leading cause of severe long-term disability in the United States. Disorders caused by a stroke include fatigue, hemiplegia, and difficulty walking. To avoid secondary complications such as osteoporosis and heart disease, it is important for stroke patients to regain their ability to actively participate in the rehabilitation process. The most important advantage of using robotic techniques in rehabilitation interventions is the ability to perform high-dose and high-intensity training. This property makes robotic therapy a promising new technology for the rehabilitation of patients with movement disorders caused by stroke and spinal cord disease. Research in the field of rehabilitation robotics is growing rapidly, and the number of therapeutic rehabilitation robots has increased dramatically over the last two decades.

MARKET RESTRAINTS:

High Price of Robotics system is Hampering the Growth of the Market

Robot-assisted surgery is much more expensive than minimally invasive surgery. The American College of Obstetrics and Gynecology recommends robotic hysterectomy only for abnormal and complex clinical conditions. The association states that the introduction of robotic surgery for all hysterectomies will increase the annual cost of hysterectomy in the United States by an estimated USD 960 million. One of the most commonly used robotic systems, the DaVinci system, costs between USD 1.5 million and USD 2.5 million, while the

CyberKnife radiation surgery robot system costs about USD 4 million to USD 700 per unit. It's USD 10,000. Similarly, the average price of a Lokomat rehab robot is about USD 380,000. In addition, the annual maintenance cost of the robot is about USD 125,000, which adds to the already high cost of robotic surgery. A research letter published in the Journal of the American Medical Association (JAMA) in August 2018 estimates the cost of each robotic surgery to be USD 3,568. Therefore, the increased cost of surgery due to the use of robotic systems could curb the growth of the medical robot market.

MICROBOTS AND DIAGNOSTICS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

17.85% |

|

Segments Covered |

By Product and Services, Application, End-user, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Intuitive Surgical, TransEnterix Surgical, Inc., Auris Health, Inc. (Hanssen), Verb Surgical Inc., MICROBOT MEDICAL INC., Zimmer Biomet, Stryker, Accuray Incorporated, Ekso Bionics, Hocoma, Aethon, InTouch Technologies, Inc |

This research report on the global MicroBots and Diagnostics Market has been segmented and sub-segmented based on Product and Services, Application, End-user, and region.

MicroBots and Diagnostics Market - By Product and Services:

- Instrument & Accessories

- Services

- Robotic Systems

Based on products and services, the medical robot market is divided into robot systems, equipment and accessories, and services. The musical instruments and accessories segment had the largest market share in 2019. Growth at the highest CAGR of 18.5% is also expected in this segment of the forecast period. The large share and high growth rate of this segment are primarily due to regular purchases of equipment and accessories, as opposed to robotic systems, which are a one-time investment. Robotic systems require a high amount of investment which is what it is not among popular ones. They also have maintenance costs.

MicroBots and Diagnostics Market - By Application:

-

Laparoscopy

-

Orthopedic Surgery

-

Pharmacy Applications

-

Physical Rehabilitation

-

External Beam Radiation Therapy

-

Neurosurgery

-

Other Applications

Based on the application, the medical robot market is divided into laparoscopy, orthopedics, pharmaceutical applications, physical rehabilitation, external beam radiotherapy, neurosurgery, and other applications. As laparoscopic surgery is performed more and more around the world and surgical robots are used more and more, the application segment of laparoscopy is expected to occupy the largest share during the forecast period. Orthopedics surgery is also growing at a high rate due to a higher number of bone-related diseases which is why this is highest among the others present on the list.

MicroBots and Diagnostics Market - By End-User:

-

Hospitals

-

Rehabilitation Centers

-

Ambulatory Surgery Centers

-

Other End Users

Based on End-User, Microrobotics are emerging technologies that play an important role in many end-use industries. With the rapid development and introduction of capsule microrobots, cells and drugs are easily encapsulated and released into the target area of the human body for diagnostic or biopsy purposes, replacing invasive tubes. This can deliver the right amount of drug to the target area and reduce cell damage. It is also used in a variety of applications such as automatic underwater vehicles, spy robots, and automatic ground vehicles for mapping inaccessible areas. In addition, in rescue operations after natural disasters such as earthquakes, microrobots are used to detect living people.

MicroBots and Diagnostics Market - By Region:

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

The Middle East

-

Africa

Geographically, The size of the medical robot market in North America is expected to grow from USD 3.27 billion in 2022 to USD 8.12 billion in 2030, growing at a CAGR of 19.91%. The North American medical robot market is expected to have the largest market share in the global market during the forecast period. The key factors behind the growth of the European medical robot market are the practice of robot rehabilitation therapy and the promotion of capital for medical robot research around the world, technological advances in anesthesia monitoring, and medical use. Announcing IPOS by a robot company.

The European medical robot market is divided by type, application, and region. The medical robot market covers market quotes for different segments, both in quantity and value, as well as data for different business customers that are essential to manufacturers.

Increasing demand for advanced healthcare infrastructure systems in the Asia Pacific region is expected to record healthy growth during the forecast period.

China occupies most of the market share in the region. China's demand for medical robots is driven primarily by the increasing adoption of equipment-based services. Demand is also supported by other factors such as B. Lack of qualified physiotherapists and caregivers.

MicroBots and Diagnostics Market Share by company

- Intuitive Surgical

- TransEnterix Surgical, Inc.

- Auris Health, Inc. (Hanssen)

- Verb Surgical Inc.

- MICROBOT MEDICAL INC.

- Zimmer Biomet

- Stryker

- Accuray Incorporated

- Ekso Bionics

- Hocoma

- Aethon

- InTouch Technologies, Inc

Genesis Healthcare has launched the Xenex robot which is used to kill bacteria and other harmful germs using xenon ultraviolet light. Xenon is clinically effective against the most harmful bacteria and its capabilities have attracted the attention of many investment companies around the world. Xenex can cycle and operate for five-minute cycles without needing to warm up or cool down. Therefore, Xenon's ability to do its job in less time and with less time before or after surgery has contributed to the success of this technology.

Genesis Xenex is expected to have a positive impact on the global medical robot market and drive its growth in the coming years. Artificial Intelligence Technology Solutions, Inc. has announced that its wholly-owned subsidiary Robotic Assist Devices (RAD) has received orders from 20 companies. The world's leading medical device company with approximately 50,000 employees for what RAD expects to be the first of several HSO (Health Screening Options) units to be deployed at one of its manufacturing facilities. of their customers.

NOTABLE HAPPENINGS IN THE MICROBOTS AND DIAGNOSTICS MARKET IN THE RECENT PAST:

- Product Launch - In April 2020, Accuray (US) launched the CyberKnife S7 System a next-generation CyberKnife platform with advanced precision, and real-time artificial intelligence (AI)-driven motion tracking and synchronization treatment delivery for all stereotactic radiosurgery (SRS) and stereotactic body radiation therapy (SBRT) treatments.

- Collaboration - In April 2020, Artificial Intelligence Technology Solutions, Inc. announced that its wholly-owned subsidiary Robotic Assistance Devices (RAD) had received an order from the global top 20 medical devices company with around 50,000 employees for what RAD expects as the first of several HSO (Health Screening Option) units to be deployed at one of their client’s manufacturing facilities.

- Product Integration - In early 2020 ReWalkRobotics, a manufacturer of robotic medical devices for individuals with lower limb disabilities, announced that the US Food and Drug Administration had cleared its ReStoresoft exo-suit system for sale to rehabilitation centers across the United State

Chapter 1. Micro-bots And Diagnostics Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Micro-bots And Diagnostics Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. Micro-bots And Diagnostics Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. Micro-bots And Diagnostics Market Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Micro-bots And Diagnostics Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Micro-bots And Diagnostics Market – By Product and Services

6.1 Instrument & Accessories

6.2 Services

6.3 Robotic Systems

Chapter 7. Micro-bots And Diagnostics Market – By End-User

7.1 Hospitals

7.2 Rehabilitation Centers

7.3 Ambulatory Surgery Centers

7.4 Other End Users

Chapter 8. Micro-bots And Diagnostics Market – By Application

8.1 Laparoscopy

8.2 Orthopedic Surgery

8.3 Pharmacy Applications

8.4 Physical Rehabilitation

8.5 External Beam Radiation Therapy

8.6 Neurosurgery

8.7 Other Applications

Chapter 9. Micro-bots And Diagnostics Market- By Region

9.1. North America

9.2. Europe

9.3. Asia-Pacific

9.4. Latin America

9.5. The Middle East

9.6. Africa

Chapter 10. Micro-bots And Diagnostics Market – Company Profiles – (Overview, Product Portfolio, Financials, Developments)

10.1 Intuitive Surgical

10.2 TransEnterix Surgical, Inc.

10.3 Auris Health, Inc. (Hanssen)

10.4 Verb Surgical Inc.

10.5 MICROBOT MEDICAL INC.

10.6 Zimmer Biomet

10.7 Stryker

10.8 Accuray Incorporated

10.9 Ekso Bionics

10.10 Hocoma

10.11 Aethon

10.12 InTouch Technologies, Inc

Download Sample

Choose License Type

2500

4250

5250

6900