Microarray-based Non-Invasive Prenatal Testing (NIPT) Market Size (2024 – 2030)

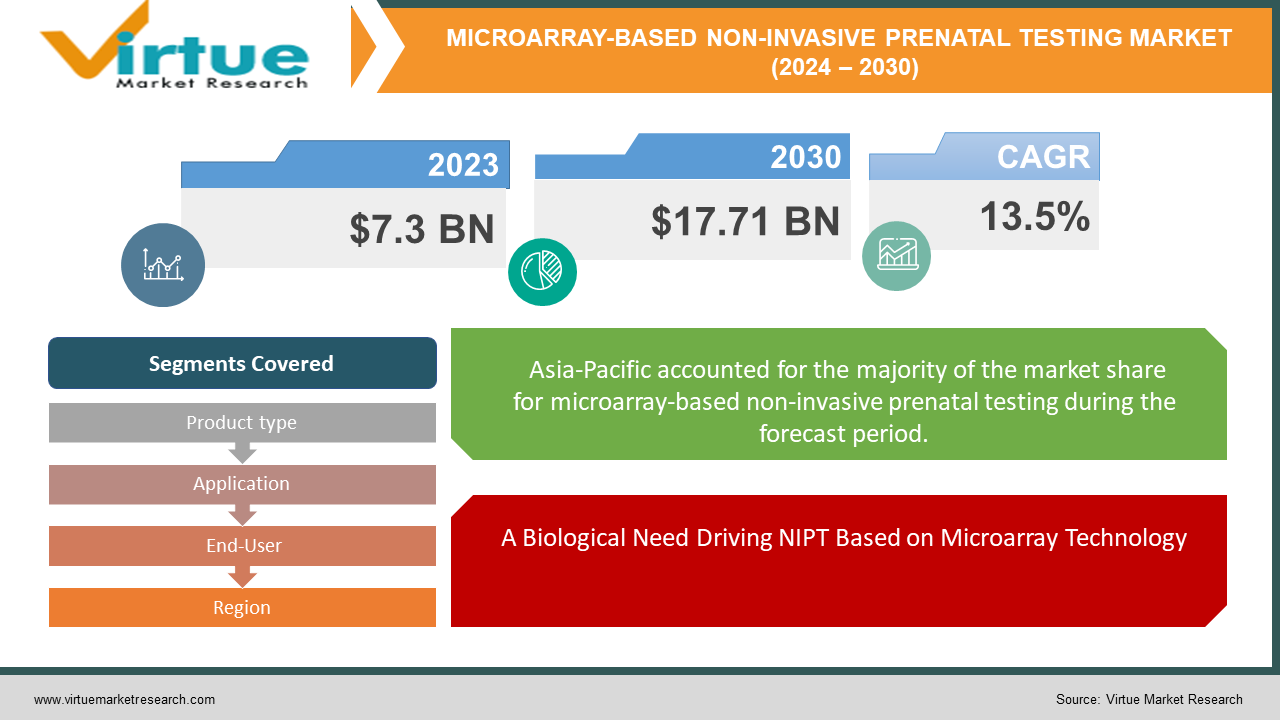

The Global Microarray-based Non-Invasive Prenatal Testing (NIPT) Market was valued at USD 7.3 billion in 2023 and is projected to reach a market size of USD 17.71 billion by 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 13.5%.

For expectant mothers, microarray-based non-invasive prenatal testing (NIPT) provides a secure and educational screening choice. To determine the likelihood of chromosomal abnormalities in the foetus, it examines cell-free foetal DNA that is circulating in the mother's blood. In contrast to conventional techniques that may result in miscarriage, NIPT is a blood test. With a detection rate for Down syndrome that is above 99%, this extremely reliable test yields findings in less than a week. In comparison to earlier techniques, it can even test for a wider spectrum of disorders. However, NIPT is only a screening tool and not a conclusive diagnosis. It could require more testing to be confirmed. It might not be appropriate for all pregnancies, and the cost and insurance coverage can differ.

Key Market Insights:

Although NGS and microarray are both included in NIPT, NGS is presently the most advanced method since it can identify a broader spectrum of chromosomal abnormalities and microdeletions. Nonetheless, because of its benefits—such as reduced costs and quicker turnaround times—microarray-based NIPT continues to have a sizable market share.

With a market share of more than 50%, North America presently leads the NIPT industry, followed by Europe.

In the upcoming years, the Asia Pacific area is anticipated to have the greatest CAGR because of variables including growing disposable income, growing public awareness of NIPT, and a sizable patient pool.

A few important components are coming together to create a thriving industry for non-invasive prenatal diagnostics. An important contributing factor is the ageing of mothers, which statistically raises the risk of chromosomal abnormalities in the developing foetus.

Global Microarray-based Non-Invasive Prenatal Testing (NIPT) Market Drivers:

A Biological Need Driving NIPT Based on Microarray Technology

The increased trend of women delaying childbearing is a major driver of the global microarray-based NIPT market. This is especially true in developed nations where societal factors and career aspirations often push back the average maternal age. Unfortunately, this has a biological consequence: as a woman ages, her risk of chromosomal abnormalities in the foetus, such as Down syndrome, increases. This heightened risk creates a strong demand for accurate and early detection methods, which microarray-based NIPT perfectly fills by providing a non-invasive prenatal screening that can identify potential issues early in pregnancy, giving expectant parents and healthcare professionals valuable information. The ability to detect problems early has fueled the growth of the NIPT market.

Turning the Tide The market for microarray-based NIPT is growing due to the emergence of safer options.

Prenatal testing is changing significantly because of people's increasing demand for safer procedures. Historically, techniques like amniocentesis and chorionic villus collection were used for prenatal screening for chromosomal disorders. Although these invasive treatments are beneficial, there is a little but worrisome possibility that the mother would miscarry. As a result, non-invasive prenatal testing (NIPT) based on microarray technology has become more common. NIPT is a non-invasive blood test that examines circulating cell-free foetal DNA in the mother's blood, in contrast to its invasive equivalents. This non-invasive procedure gives pregnant moms peace of mind during a crucial period by removing the danger of miscarriage associated with previous methods. Because of this obvious benefit and its high accuracy, NIPT is becoming the method of choice for many families, which is fueling the market for microarray-based NIPT to rise.

Global Microarray-based Non-Invasive Prenatal Testing (NIPT) Market Restraints and Challenges:

Certain chromosomal abnormalities cannot be detected by technology alone, which may call for further testing. The expense of NIPT can also be a deterrent since insurance coverage differs widely. Even when the results are good, the NIPT is only a screening tool, and appropriate genetic counselling is necessary to manage the emotional fallout and figure out what to do next. In certain places, access to this kind of counselling may be restricted. Furthermore, since NIPT might reveal foetal sex, which may be problematic in communities where gender prejudice is prevalent, ethical issues come into play. Tests may occasionally provide unanticipated results, creating doubt and necessitating more analysis. The regulatory environment around NIPT is still developing, and the lack of standardised protocols in some areas may influence the interpretation and accuracy of the test. To fully realise the promise of microarray-based NIPT and provide equal access to this important prenatal tool, these restrictions must be addressed by technical developments, better insurance coverage expanded access to counselling, and uniform legislation.

Global Microarray-based Non-Invasive Prenatal Testing (NIPT) Market Opportunities:

Technological developments might possibly include next-generation sequencing (NGS) for even more thorough examination, improving detection rates for a greater variety of chromosomal problems. NIPT may be used for purposes other than trisomy diagnosis, such as early detection of preeclampsia, aberrant foetal growth, and other pregnancy-related issues. Targeted education campaigns for the public and medical professionals can greatly increase knowledge of NIPT and provide pregnant parents with the knowledge they need to make wise decisions. A wider population may be able to receive NIPT through better insurance coverage and cost-cutting measures, which may be attained through cooperation between lawmakers, insurance companies, and healthcare providers. An increasing emphasis on NIPT-assisted early identification and risk management can open the door to earlier treatments and better pregnancy outcomes.

MICROARRAY-BASED NON-INVASIVE PRENATAL TESTING (NIPT) MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

13.5% |

|

Segments Covered |

By Product type, Application, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Agilent Technologies (U.S.), Ariosa Diagnostics (Roche) (Switzerland), BGI Group (China), Eurofins LifeCodexx GmbH (Germany), Illumina (U.S.), Laboratory Corporation of America (U.S.), Myriad Genetics (U.S.), Natera (U.S.), PerkinElmer Inc. (U.S.), Quest Diagnostics (U.S.),, Sequenom (U.S.) |

Global Microarray-based Non-Invasive Prenatal Testing (NIPT) Market Segmentation: By Product Type

-

Microarray Kits & Consumables

-

Instruments & Analyzers

One may divide the worldwide market for microarray-based NIPT according to product type. Due to their frequent usage, microarray kits and consumables—which comprise necessary components like reagents and microarrays utilised in every test—are probably going to be the largest market. Though vital, instruments and analyzers—the devices that provide the data analysis—are a one-time investment for healthcare institutions, hence they make up a smaller market. Microarray Kits & Consumables have a significant potential for quicker growth because to the constantly changing technology and possible incorporation of Next-Generation Sequencing, which might lead to an increasing demand for these test components. However, the fastest growing category is difficult to forecast with certainty.

Global Microarray-based Non-Invasive Prenatal Testing (NIPT) Market Segmentation: By Application

-

Trisomy Detection

-

Microdeletion Syndromes

-

Other Applications

Due to its established function and the incidence of these disorders, trisomy detection, like Down syndrome screening, is now the leader in the worldwide microarray-based NIPT market when segmented by application. Although less prevalent, microdeletion disorders provide an additional use. The Other Applications group has the most interesting development potential. This market is expected to increase significantly as NIPT technology develops and new uses such as foetal development monitoring and preeclampsia screening appear. This growth will be fueled by both technical breakthroughs and an increasing awareness of these expanded NIPT capabilities.

Global Microarray-based Non-Invasive Prenatal Testing (NIPT) Market Segmentation: By End-User

-

Hospitals & Clinics

-

Independent Laboratories

One way to categorise the worldwide microarray-based NIPT market is based on the end users. With their well-established prenatal care sections, hospitals and clinics will probably continue to be the most common user group. Independent Laboratories, on the other hand, have a larger clientele and significant expansion potential for their NIPT services. The increased demand for NIPT, efforts to increase test accessibility through insurance coverage and increased availability, and the ease-of-use independent laboratories may provide patients with terms of perhaps reduced costs and quicker response times are the driving forces behind this.

Global Microarray-based Non-Invasive Prenatal Testing (NIPT) Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The worldwide NIPT market is doing well in a few places. Because of its sophisticated healthcare system, widespread use of prenatal testing, and emphasis on personalised therapy, North America presently holds the top spot. The Asia Pacific area, however, is expected to develop at the highest rate due to a growing middle class, rising disposable income, and more knowledge of NIPT. It is anticipated that Europe, a developed market with well-established firms, will continue to grow. Finally, due to advancements in healthcare infrastructure, growing public awareness, and growing investments in the field, South America and the Middle East & Africa, albeit at an earlier adoption stage, offer great promise.

COVID-19 Impact Analysis on the Global Microarray-based Non-Invasive Prenatal Testing (NIPT) Market:

Unquestionably, the COVID-19 pandemic had an impact on the healthcare industry, and this had an impact on the non-invasive prenatal testing (NIPT) business worldwide that relies on microarray technology. Although there were initial worries about a possible drop, the effect was unexpectedly small. Short-term obstacles included limited access to prenatal care during lockdowns, possible interruptions in the NIPT kit supply chain, and a reallocation of healthcare resources to the pandemic response. But an unanticipated advantage surfaced. Because expecting mothers were concerned about being exposed to COVID-19 in healthcare settings, the pandemic may have led them to choose non-invasive methods like NIPT. Furthermore, easier access to genetic counselling—a critical part of non-invasive prenatal testing—may have resulted from the growth of telemedicine consultations for prenatal care. According to studies, the pandemic had a little to somewhat unfavourable effect on the NIPT market overall. The market is expected to continue growing in the upcoming years, suggesting that its long-term growth trajectory is unaffected. It is anticipated that the NIPT market will not only recover but also grow as we go past the epidemic. The attention that accessibility is receiving at this moment could prompt greater attempts to boost insurance coverage and make NIPT more accessible to expectant moms.

Recent Trends and Developments in the Global Microarray-based Non-Invasive Prenatal Testing (NIPT) Market:

The industry for non-invasive prenatal testing (NIPT) using microarray technology is booming with new ideas. The incorporation of next-generation sequencing (NGS) is a major trend towards even improved accuracy and identification of a larger variety of chromosomal abnormalities, even though microarrays remain the primary method. NIPT is finding new uses outside of trisomy diagnosis, such as early preeclampsia detection, problems with foetal development, and even carrier screening for genetic disorders. The emphasis on early identification encourages a change in prenatal treatment towards preventative interventions and individualised risk management. The emergence of trustworthy non-invasive prenatal testing (NIPT) for twin pregnancies is an exciting advance that resolves an earlier issue caused by mixed foetal DNA. Artificial intelligence (AI) has great potential for enhancing test accuracy, spotting subtle trends, and customising risk assessments in the future.

Key Players:

-

Agilent Technologies (U.S.)

-

Ariosa Diagnostics (Roche) (Switzerland)

-

BGI Group (China)

-

Eurofins LifeCodexx GmbH (Germany)

-

Illumina (U.S.)

-

Laboratory Corporation of America (U.S.)

-

Myriad Genetics (U.S.)

-

Natera (U.S.)

-

PerkinElmer Inc. (U.S.)

-

Quest Diagnostics (U.S.)

-

Sequenom (U.S.)

Chapter 1. Microarray-based Non-Invasive Prenatal Testing (NIPT) Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Microarray-based Non-Invasive Prenatal Testing (NIPT) Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Microarray-based Non-Invasive Prenatal Testing (NIPT) Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Microarray-based Non-Invasive Prenatal Testing (NIPT) Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Microarray-based Non-Invasive Prenatal Testing (NIPT) Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Microarray-based Non-Invasive Prenatal Testing (NIPT) Market – By Product Type

6.1 Introduction/Key Findings

6.2 Microarray Kits & Consumables

6.3 Instruments & Analyzers

6.4 Y-O-Y Growth trend Analysis By Product Type

6.5 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Microarray-based Non-Invasive Prenatal Testing (NIPT) Market – By Application

7.1 Introduction/Key Findings

7.2 Trisomy Detection

7.3 Microdeletion Syndromes

7.4 Other Applications

7.5 Y-O-Y Growth trend Analysis By Application

7.6 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Microarray-based Non-Invasive Prenatal Testing (NIPT) Market – By End-User

8.1 Introduction/Key Findings

8.2 Hospitals & Clinics

8.3 Independent Laboratories

8.4 Y-O-Y Growth trend Analysis By End-User

8.5 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 9. Microarray-based Non-Invasive Prenatal Testing (NIPT) Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product Type

9.1.3 By Application

9.1.4 By By End-User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product Type

9.2.3 By Application

9.2.4 By End-User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product Type

9.3.3 By Application

9.3.4 By End-User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product Type

9.4.3 By Application

9.4.4 By End-User

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product Type

9.5.3 By Application

9.5.4 By End-User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Microarray-based Non-Invasive Prenatal Testing (NIPT) Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Agilent Technologies (U.S.)

10.2 Ariosa Diagnostics (Roche) (Switzerland)

10.3 BGI Group (China)

10.4 Eurofins LifeCodexx GmbH (Germany)

10.5 Illumina (U.S.)

10.6 Laboratory Corporation of America (U.S.)

10.7 Myriad Genetics (U.S.)

10.8 Natera (U.S.)

10.9 Natera (U.S.)

10.10 PerkinElmer Inc. (U.S.)

10.11 Quest Diagnostics (U.S.)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Microarray-based Non-Invasive Prenatal Testing (NIPT) Market size is valued at USD 7.3 billion in 2023.

The worldwide Global Microarray-based Non-Invasive Prenatal Testing (NIPT) Market growth is estimated to be 13.5% from 2024 to 2030.

Global Microarray-based Non-Invasive Prenatal Testing (NIPT) Market segmentation covered in the report is By Product Type (Microarray Kits & Consumables, Instruments & Analyzers); By Application (Trisomy Detection, Microdeletion Syndromes, Other Applications); By End-User (Hospitals & Clinics, Independent Laboratories) and by region.

NGS integration, broader applications, and an emphasis on early diagnosis in prenatal care are all promising developments for the NIPT business going forward.

The NIPT market had a little to moderate drop because of the COVID-19 epidemic, but it eventually recovered and continues to develop.