Micro Irrigation Systems Market Size (2024 – 2030)

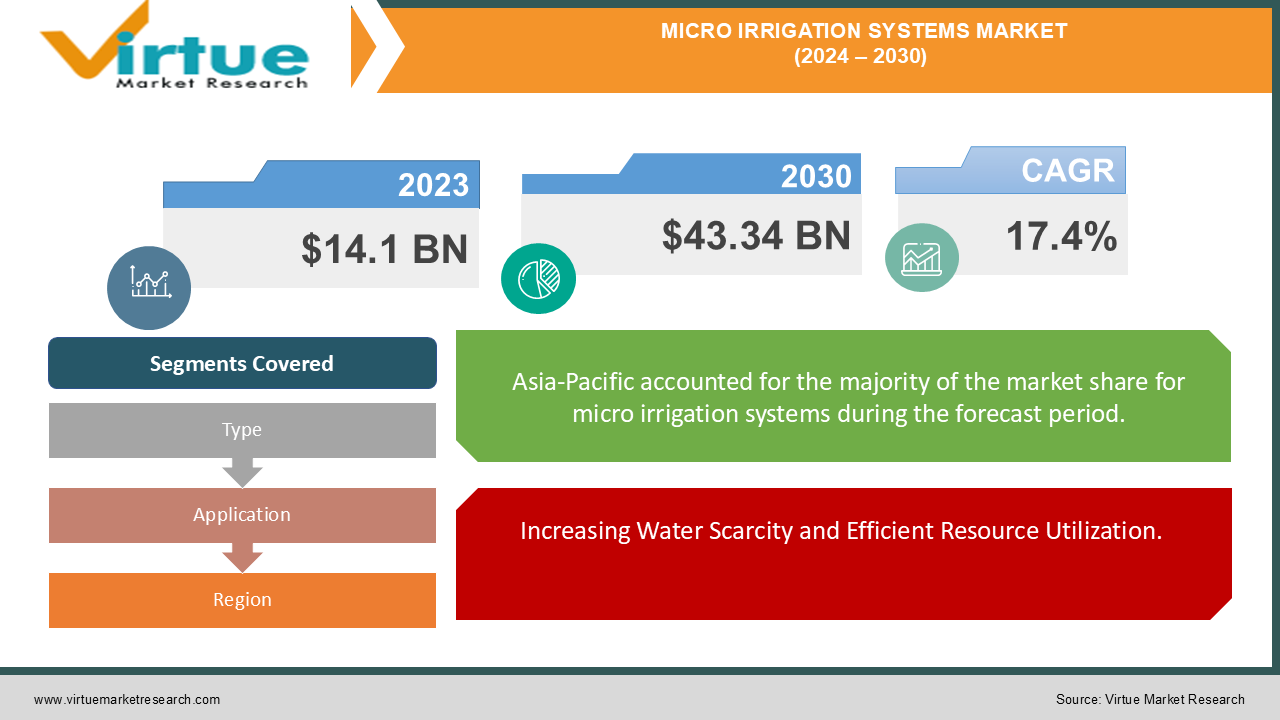

The Global Micro Irrigation Systems Market was valued at USD 14.1 billion in 2023 and is projected to reach a market size of USD 43.34 billion by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 17.4% between 2024 and 2030.

The Global Micro Irrigation Systems Market is witnessing substantial growth as the demand for efficient water management in agriculture intensifies, driven by the need to optimize water usage in the face of rising water scarcity and growing food demand. These systems, which include drip and sprinkler irrigation, offer precise water delivery directly to plant roots, reducing wastage and enhancing crop yield. The increasing adoption of micro irrigation systems is also fueled by government incentives, technological advancements, and a rising awareness of sustainable farming practices. In addition, the market is expanding due to the growing trend of mechanized farming and the need to improve productivity in both developed and developing regions. As farmers and agricultural enterprises seek to mitigate the impacts of climate change and unpredictable weather patterns, micro irrigation systems are becoming an indispensable tool for maintaining crop health and ensuring food security. The market's growth is further supported by the development of smart irrigation technologies, which integrate IoT and automation, providing farmers with real-time data and control over water usage. Consequently, the Global Micro Irrigation Systems Market is poised for continued expansion as it plays a critical role in the future of sustainable agriculture.

Key Market Insights:

Drip irrigation dominates with over 80% market share in the micro irrigation systems market.

The adoption of micro irrigation systems can reduce water usage by up to 70% compared to traditional methods.

Asia-Pacific is the fastest-growing region, expected to grow at a CAGR of over 15% from 2023 to 2028.

Government subsidies cover up to 50% of the installation costs for micro irrigation systems in many developing countries.

Over 40% of global agricultural land is expected to be irrigated using micro irrigation systems by 2030.

Global Micro Irrigation Systems Market Drivers:

Increasing Water Scarcity and Efficient Resource Utilization.

The growing concern over water scarcity is one of the primary drivers of the Global Micro Irrigation Systems Market. As water resources become increasingly scarce due to climate change, population growth, and urbanization, the need for efficient water management solutions has surged. Micro irrigation systems, such as drip and sprinkler irrigation, provide a targeted and efficient method of watering crops, reducing water wastage significantly compared to traditional irrigation methods. These systems ensure that water is delivered directly to the root zone of plants, minimizing evaporation and runoff. As a result, farmers are increasingly adopting micro irrigation systems to maximize crop yield with minimal water usage, which is critical in regions facing severe water shortages. This focus on sustainable water use is propelling the demand for micro irrigation systems globally.

Government Initiatives and Subsidies Promoting Adoption.

Government initiatives and subsidies are playing a crucial role in the widespread adoption of micro irrigation systems. Many governments, particularly in water-stressed regions, are actively promoting the use of these systems through financial incentives, subsidies, and technical support. For instance, governments in countries like India and Israel have launched schemes to encourage farmers to adopt micro irrigation practices. These initiatives aim to enhance agricultural productivity while conserving water resources. Additionally, international organizations and NGOs are collaborating with governments to promote sustainable irrigation practices, further driving the market. As a result, the favorable regulatory environment and financial support from governments are significantly boosting the growth of the Global Micro Irrigation Systems Market.

Global Micro Irrigation Systems Market Restraints and Challenges:

Despite the promising growth prospects, the Global Micro Irrigation Systems Market faces several restraints and challenges. One of the primary challenges is the high initial cost of installation and maintenance, which can be a significant barrier for small and marginal farmers, especially in developing regions. The sophisticated nature of micro irrigation systems requires technical expertise for installation and ongoing maintenance, which may not be readily available in all areas. Additionally, the lack of awareness and understanding of the long-term benefits of micro irrigation can hinder adoption, particularly in regions where traditional irrigation practices are deeply ingrained. Another challenge is the variability in water quality, which can lead to clogging of emitters and pipes, reducing the efficiency of these systems. Furthermore, inadequate access to financing and credit facilities for farmers can limit their ability to invest in these advanced irrigation solutions. These challenges underscore the need for increased education, financial support, and technological advancements to make micro irrigation systems more accessible and cost-effective for all farmers. Addressing these restraints is crucial for the sustained growth of the market and for maximizing the benefits of micro irrigation in enhancing agricultural productivity and water conservation.

Global Micro Irrigation Systems Market Opportunities:

The Global Micro Irrigation Systems Market is poised for significant opportunities driven by technological advancements and the growing emphasis on sustainable agriculture. Innovations in micro irrigation technology, such as the integration of IoT (Internet of Things) and automation, are enhancing the efficiency and precision of these systems, making them more attractive to farmers. These advancements allow for real-time monitoring and control of water usage, optimizing irrigation schedules, and reducing waste. Additionally, the rising demand for high-value crops, which require precise irrigation for optimal yield, is creating new market opportunities. As consumers increasingly prioritize organic and locally grown produce, farmers are turning to micro irrigation systems to meet these demands efficiently. Furthermore, the expansion of government programs and subsidies aimed at promoting sustainable agricultural practices presents a substantial opportunity for market growth. With global concerns about food security and water conservation intensifying, there is a growing market for micro irrigation systems in regions experiencing water stress. These systems offer a viable solution for improving crop productivity while conserving vital water resources. As awareness of the environmental and economic benefits of micro irrigation grows, the market is expected to see robust expansion, particularly in emerging economies.

MICRO IRRIGATION SYSTEMS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

17.4% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Netafim Ltd., The Toro Company, Jain Irrigation Systems Ltd., Lindsay Corporation, Rain Bird Corporation, Valmont Industries, Inc., Hunter Industries, Rivulis Irrigation Ltd., DripWorks, Inc., T-L Irrigation Co. |

Global Micro Irrigation Systems Market Segmentation: By Type

-

Drip Irrigation

-

Sprinkler Irrigation

In 2023, based on market segmentation by Type, Drip Irrigation had the highest share of the Global Micro Irrigation Systems Market. Drip irrigation has become a cornerstone of modern agriculture due to its exceptional water efficiency, nutrient delivery capabilities, and precision control. By delivering water directly to the root zone, drip irrigation significantly reduces water loss through evaporation and runoff, making it a highly effective solution in regions grappling with water scarcity. This targeted approach not only conserves water but also enhances crop health by ensuring that plants receive water exactly where it's needed most. Additionally, drip irrigation systems facilitate the efficient application of fertilizers, allowing nutrients to be delivered directly to the root zone, which promotes optimal nutrient uptake by plants. This method of fertigation not only boosts crop yields but also improves the quality of the produce. The precision control offered by drip irrigation enables farmers to fine-tune water and nutrient application, maximizing productivity while minimizing waste. Although drip irrigation is particularly advantageous for high-value crops like fruits, vegetables, and nuts, its versatility extends to a wide range of agricultural applications, including field crops. These factors have driven the widespread adoption of drip irrigation systems across various agricultural sectors globally, as farmers seek to enhance efficiency, sustainability, and crop performance in an increasingly resource-constrained world.

Global Micro Irrigation Systems Market Segmentation: By Application

-

Field Crops

-

Horticulture

-

Vineyards

-

Greenhouses

In 2023, based on market segmentation by Application, Field Crops had the highest share of the Global Micro Irrigation Systems Market. In 2023, the Global Micro Irrigation Systems Market continued to see a strong preference for high-value crops such as fruits, vegetables, and nuts, which have historically dominated the market due to their need for precision watering and nutrient management. These crops benefit greatly from micro irrigation systems, particularly drip irrigation, which provides targeted water and nutrient delivery directly to the root zone, enhancing crop yield and quality. While there has been a growing trend toward using micro irrigation for field crops like cereals, grains, and pulses, primarily driven by concerns over water scarcity and the push for sustainable agriculture, these crops have not yet overtaken high-value crops in terms of market share. The adoption of micro irrigation for field crops is increasing, especially in regions facing severe water shortages and where governments are promoting sustainable farming practices through subsidies and awareness campaigns. However, the higher initial costs and the scalability challenges associated with micro irrigation systems for large-scale field crops mean that high-value crops continue to hold the largest share of the market. The ongoing expansion of micro irrigation for field crops is promising, but high-value crops remain the primary application driving the market in 2023.

Global Micro Irrigation Systems Market Segmentation: By Component

-

Pipes and Tubing

-

Emitters

-

Filters

-

Controllers

In 2023, based on market segmentation by Component, Pipes and Tubing had the highest share of the Global Micro Irrigation Systems Market. Pipes and tubing are fundamental to the functionality and effectiveness of micro irrigation systems, serving as the infrastructure backbone that supports the entire system. They play a crucial role in water distribution by efficiently channeling water from the main supply to various parts of the field, ensuring that each plant receives adequate hydration. The durability and longevity of high-quality pipes and tubing are essential, as they must withstand harsh environmental conditions such as extreme temperatures, UV exposure, and physical stress, thereby providing reliable performance over many years. Additionally, these components offer compatibility with a wide range of emitters, filters, and controllers, allowing for flexible and customized irrigation solutions tailored to specific crop needs and field conditions. While emitters and controllers are also integral to the micro irrigation system, pipes and tubing represent a significant investment for farmers and growers due to their critical role in water management and system reliability. Their quality directly impacts the efficiency of the irrigation system and the overall success of crop cultivation, making them a pivotal consideration in the planning and implementation of micro irrigation systems.

Global Micro Irrigation Systems Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

In 2023, based on market segmentation by Region, Asia-Pacific had the highest share of the Global Micro Irrigation Systems Market. The Asia-Pacific region presents a dynamic landscape for the micro irrigation systems market, driven by several key factors. The region's vast agricultural sector, encompassing numerous small-scale farms and large-scale plantations, necessitates efficient irrigation solutions to maximize productivity and resource management. Water scarcity is a significant concern in many parts of Asia-Pacific, making the adoption of micro irrigation systems crucial for conserving water and ensuring reliable crop growth. In response, governments across the region have introduced various policies and programs to promote the use of these systems, offering incentives and support to encourage widespread adoption. Additionally, increasing awareness among farmers about the benefits of micro irrigation—such as enhanced water efficiency, reduced wastage, and improved crop yields—has fueled market growth. Countries like China, India, and Indonesia have emerged as major contributors to the expansion of the micro irrigation systems market due to their large agricultural sectors and pressing water management challenges. These factors combined underscore the pivotal role of micro irrigation systems in addressing water scarcity and boosting agricultural productivity in the Asia-Pacific region.

COVID-19 Impact Analysis on the Global Micro Irrigation Systems Market.

The COVID-19 pandemic had a mixed impact on the Global Micro Irrigation Systems Market. Initially, the market faced disruptions due to lockdowns, supply chain interruptions, and labor shortages, which slowed down the production and installation of micro irrigation systems. Many agricultural projects were delayed, and farmers faced financial uncertainties, limiting their ability to invest in new technologies. However, as the pandemic highlighted the importance of food security and sustainable agricultural practices, there was a renewed focus on efficient water management systems. Governments and international organizations emphasized the need for resilient agricultural systems, leading to increased interest in micro irrigation as a solution to optimize water use and ensure consistent crop production. Additionally, the shift towards digitalization in agriculture accelerated the adoption of smart irrigation systems, which can be managed remotely, reducing the need for physical labor. While the initial impact of COVID-19 posed challenges to the market, the long-term effects have underscored the importance of micro irrigation systems in building a more resilient and sustainable agricultural sector. This has led to a gradual recovery and an optimistic outlook for the market’s growth post-pandemic.

Latest trends / Developments:

The Global Micro Irrigation Systems Market is experiencing significant trends and developments driven by technological innovation and the increasing need for sustainable agriculture. One of the key trends is the integration of smart technology into micro irrigation systems, such as the use of IoT (Internet of Things) sensors and AI-driven analytics. These advancements allow farmers to monitor soil moisture levels, weather conditions, and crop needs in real time, optimizing water usage and enhancing crop yields. Another notable development is the growing adoption of solar-powered micro irrigation systems, which offer an eco-friendly and cost-effective alternative, particularly in remote or off-grid areas. Additionally, there is a rising demand for micro irrigation in high-value crops like fruits, vegetables, and nuts, where precision irrigation is crucial for maximizing quality and yield. The market is also witnessing increased investments in R&D to develop more efficient and affordable systems, making micro irrigation accessible to a broader range of farmers, including those in developing regions. Furthermore, the expansion of government initiatives and subsidies aimed at promoting water-efficient practices is driving the adoption of micro irrigation systems globally. These trends indicate a robust and evolving market, with a strong emphasis on sustainability and technological advancement.

Key Players:

-

Netafim Ltd.

-

The Toro Company

-

Jain Irrigation Systems Ltd.

-

Lindsay Corporation

-

Rain Bird Corporation

-

Valmont Industries, Inc.

-

Hunter Industries

-

Rivulis Irrigation Ltd.

-

DripWorks, Inc.

-

T-L Irrigation Co.

Chapter 1. Micro Irrigation Systems Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Micro Irrigation Systems Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Micro Irrigation Systems Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Micro Irrigation Systems Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Micro Irrigation Systems Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Micro Irrigation Systems Market – By Application

6.1 Introduction/Key Findings

6.2 Field Crops

6.3 Horticulture

6.4 Vineyards

6.5 Greenhouses

6.6 Y-O-Y Growth trend Analysis By Application

6.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 7. Micro Irrigation Systems Market – By Type

7.1 Introduction/Key Findings

7.2 Drip Irrigation

7.3 Sprinkler Irrigation

7.4 Y-O-Y Growth trend Analysis By Type

7.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 8. Micro Irrigation Systems Market – By Component

8.1 Introduction/Key Findings

8.2 Pipes and Tubing

8.3 Emitters

8.4 Filters

8.5 Controllers

8.6 Y-O-Y Growth trend Analysis By Component

8.7 Absolute $ Opportunity Analysis By Component, 2024-2030

Chapter 9. Micro Irrigation Systems Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Application

9.1.3 By Type

9.1.4 By Component

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Application

9.2.3 By Type

9.2.4 By Component

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Application

9.3.3 By Type

9.3.4 By Component

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Application

9.4.3 By Type

9.4.4 By Component

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Application

9.5.3 By Type

9.5.4 By Component

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Micro Irrigation Systems Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Netafim Ltd.

10.2 The Toro Company

10.3 Jain Irrigation Systems Ltd.

10.4 Lindsay Corporation

10.5 Rain Bird Corporation

10.6 Valmont Industries, Inc.

10.7 Hunter Industries

10.8 Rivulis Irrigation Ltd.

10.9 DripWorks, Inc.

10.10 T-L Irrigation Co.

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

By 2023, the Global Micro Irrigation Systems market is expected to be valued at US$ 14.1 billion.

Through 2030, the Micro Irrigation Systems market is expected to grow at a CAGR of 17.4 %.

By 2030, the Global Micro Irrigation Systems Market is expected to grow to a value of US$ 43.34 billion.

Asia-Pacific is predicted to lead the Global Micro Irrigation Systems market.

The Global Micro Irrigation Systems Market has segments By Application, Component, Type, and Region.