Meteorological Satellite Market Size (2024 - 2030)

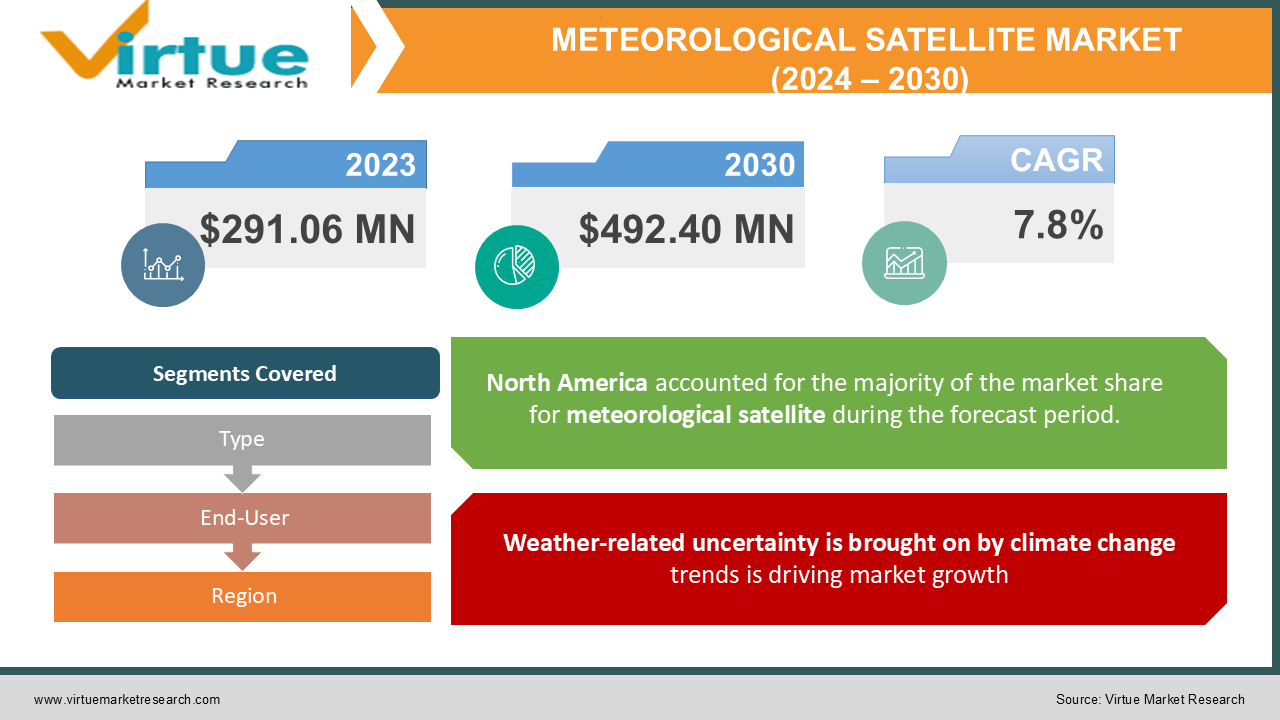

Global Meteorological Satellite Market is valued at USD 291.06 Million in 2023 and is projected to reach a market size of USD 492.40 Million by 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7.8%.

INDUSTRY OVERVIEW

A particular class of Earth observation satellite known as a weather satellite or meteorological satellite is used primarily to track the planet's weather and climate. There are two types of satellites: geostationary and polar-orbiting, which cover the whole Earth asynchronously (hovering over the same spot on the equator). Applications for meteorological satellite observation systems may be found in a range of fields, including defence, environment and natural resource monitoring, location-based services, and many more. Application sectors that support market expansion include those disaster management, global positioning systems, marine industry, and others. As meteorological satellites are positioned in orbit and keep an eye on the globe, data collected from them provides a distinct and varied perspective that allows us to make wise judgments. Additionally, the use of earth observation systems in marine, power & energy, and other industries has led to a consistent need for them throughout geographies.

Meteorological satellites can detect a variety of phenomena, including city lights, fires, the effects of pollution, auroras, sand and dust storms, snow cover, ice mapping, the boundaries of ocean currents, and energy flows, in addition to their primary use of detecting the development and movement of storm systems and other cloud patterns. The use of weather satellites allows for the collection of additional environmental data. Monitoring the Mount St. Helens volcanic ash cloud and other volcanoes' activities, such as Mount Etna, was made possible thanks to weather satellite pictures. Additionally, smoke from fires in the western US, such as those in Colorado and Utah, has been observed. Global market expansion is anticipated to be aided by factors such as the rise in demand for big data analytics-based weather forecasting, climate change, and uncertainty surrounding rainfall. But throughout the anticipated term, market growth is anticipated to be constrained by the difficulties associated with weather forecasting procedures and forecast-related uncertainties.

COVD-19 IMPACT ON THE METEOROLOGICAL SATELLITE MARKET

The entire space sector has been badly impacted by the ongoing COVID-19 outbreak. Numerous companies in this area had hitherto unheard-of difficulties as a result of the fast spread of the coronavirus, including stagnant production and postponed satellite initiatives. Activities for the Soyuz launch, which were scheduled to begin in mid-March, were halted by the Guiana Space Centre. The Soyuz rocket manufacturer, Samara Space Centre, put a halt to manufacturing as a result of this epidemic that would interfere with launch plans. 52 Soyuz rockets have been produced by the business, however, 12 are still in the spaceport waiting to be launched. Due to the COVID-19 effect, the U.S. Space Force postponed the launch of the Falcon 9 GPS satellite by two months. Thus, the space sector was significantly damaged by delays in production processes, supply networks, and ongoing contracts.

MARKET DRIVERS:

Weather-related uncertainty is brought on by climate change trends is driving market growth

The total amount, seasonal distribution, and unpredictability of global precipitation have all been impacted by climate change. Arid and semiarid regions, where the availability of water is of utmost significance in determining agricultural output, are significantly impacted by variations in rainfall patterns. These elements call for precise weather forecasting to study the intricate seasonal rainfall patterns across various locations, and meteorological satellites serve as a trustworthy instrument in foretelling the weather conditions that are driving market progress. Moreover, even in the most industrialised nations, warnings for extreme weather are only delivered a few days in advance. For effective evacuation preparations in the event of floods or cyclones, notice must be given at least one week in advance. Short droughts require many weeks' warnings to allow modifications to a specific area's planting and harvesting schedules. Long droughts need early warnings so that drought-tolerant crops may be chosen and water and fodder storage can be made guaranteed. The demand for precise weather forecasting has risen and is anticipated to continue to expand throughout the projection period as unpredictability in rainfall influences the operational operations of weather-sensitive industries such as agricultural, marine, renewables, and aviation, among others.

Meteorological satellites aid in improving the precision of long-range weather predictions is boosting the market size

The people in flood-prone areas, which also frequently have great agricultural production, might suffer catastrophically from a lack of trustworthy and relatively accurate information about constantly changing meteorological conditions. To effectively anticipate the occurrence of floods and droughts in these areas, long-range weather forecasting is crucial. Long-range weather forecasting has seen several breakthroughs that entail the use of several cutting-edge technologies, such as big data analytics and artificial intelligence, increasing the accuracy of this sort of prediction. Long-range, highly accurate, and trustworthy weather forecasting offers several economic advantages that are anticipated to boost a variety of industries throughout the world, from agriculture to transportation. Throughout the projected period, this aspect is anticipated to present a potential opportunity for the market for meteorological satellites.

The launch of the 5G network will boost market expansion

The introduction of 5G services improved user experience since they provide new apps and services at faster speeds. It raises a communication network's performance and dependability. In comparison to 4G, 5G decreases latency and greatly boosts data speeds. High data rates were given to terrestrial wireless networks in urban and suburban regions through satellite communication and high-altitude platform systems (HAPS). Additionally, 5G would advance the Internet of Things (IoT) and smart cities by putting electricity sensors in both urban and rural locations. The expansion of the meteorological satellite market is being driven by its multiple uses in the power industry, defence, energy, smart grids, agriculture and other industries.

MARKET RESTRAINTS:

Government regulations are too strict and are limiting growth in space launch programs

The space sector is subject to several limitations from international and domestic governmental organisations. Every state is required by the International Space Law to register its space objects with the global registry to alert and monitor space objects. Internationally, there are five United Nations Treaties about space. They are the Moon Agreement, the Outer Space Treaty, the Rescue Agreement, the Liability Convention, and the Registration Convention. Furthermore, the state must give its consent and regulate any operations carried out by non-governmental organisations.

Meteorological Satellites are expensive, this may impede the market growth

In addition to being costly, infrastructure requirements for earth observation systems are intricate, and highly qualified personnel is necessary. Employees should be skilled in big data, data science, and other relevant subjects in addition to having a high level of programming language proficiency because data obtained from space is encrypted. For businesses in this industry to remain competitive, they must invest a lot of money. One restriction that could somewhat limit the possibility of earth observation is this one.

METEOROLOGICAL SATELLITE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.8% |

|

Segments Covered |

By Type, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BAE SYSTEM, AIRBUS, BALL CORPORATION, BLACKSKY GLOBAL, DIGITAL GLOBE, MAXAR TECHNOLOGIES, L3HARRIS TECHNOLOGIES, CAPELLA SPACE, ICEYE, PLANET LABS, THE BOEING COMPANY, EARTHDAILY ANALYTICS, SATELLOGIC, SURREY SATELLITE TECHNOLOGY LTD., LOCKHEED MARTIN CORPORATIONO, HB SYSTEM, THALES GROU |

METEOROLOGICAL SATELLITE MARKET – BY TYPE

-

Polar Orbiting

-

Geostationary

Based on the type, the Meteorological satellite market is segmented into Polar Orbiting and Geostationary Satellite. Geostationary weather satellites travel 35,880 kilometers above the equator in their orbits around the planet (22,300 miles). They can continually record or transmit images of the whole hemisphere below thanks to their orbit, which keeps them fixed about the revolving Earth. This is made possible by the visible light and infrared sensors on board. The geostationary photographs are used by the news media to create movie loops or single images for their daily weather presentations.

Weather satellites in polar orbit travel continuously around the planet at an average altitude of 850 kilometers (530 miles), passing over the poles as they go from north to south (or vice versa). Due to their sun-synchronous orbits and the nearly constant local solar time, polar-orbiting weather satellites may watch every point on Earth and will see every site twice daily with the same overall illumination conditions. Due to their proximity to the Earth, polar-orbiting weather satellites have far higher resolution than their geostationary counterparts. The NOAA series of polar-orbiting meteorological satellites, now NOAA-15, NOAA-18 and NOAA-19 (POES), and NOAA-20 are owned and operated by the United States (JPSS). The EUMETSAT-operated Metop-A, Metop-B, and Metop-C satellites are located in Europe. Russian satellites include the Meteor and RESURS series. A, B, and C are FYs in China. Additionally, India has satellites in polar orbit.

METEOROLOGICAL SATELLITE MARKET – BY END-USER

-

Government and Defence

-

Archaeology and Civil Infrastructure

-

Energy and Natural Resources

-

Agriculture

-

Forestry

-

Maritime and Fishery

-

Others

Based on the end-user, the Meteorological satellite market is segmented into Government and Defence, Archaeology and Civil Infrastructure, Energy and Natural Resources, Agriculture, Forestry, Maritime and Fishery and Others. The market for satellite Earth observation is projected to be dominated by end-users in the government and defence sectors because of the rising need for accurate weather forecasts, images of Earth, and other related services. It is possible to identify pollution, whether it is caused by nature or by humans. The visible and infrared images depict the global consequences of pollution from the corresponding regions. Condensation trails and pollutants from rockets and aircraft can also be seen. Predicting the coverage and movement of an oceanic oil spill requires knowledge about ocean currents and low-level winds, which may be obtained from satellite photographs. The meteorological satellite market is growing because information on trends in wildlife, land use, tracking biodiversity, and managing natural resources, among other things, may be found in data and services. These capabilities also help to support social, environmental, and economic sustainability.

METEOROLOGICAL SATELLITE MARKET - BY REGION

-

North America

-

Europe

-

The Asia Pacific

-

Latin America

-

The Middle East

-

Africa

By region, the Meteorological Satellite market is grouped into North America, Europe, Asia Pacific, Latin America, The Middle East and Africa. The dominant region for earth observation systems in North America. By the end of the forecast period, North America is anticipated to hold more than a quarter of the market share. Numerous causes, including developments in space technology like reusable rockets and others, are to blame for this domination. Additionally, as former US President Donald Trump has formally said, the government provides significant assistance to the aircraft industry. The U.S. Armed Services' Space Force has elevated this region's profile and is anticipated to create prosperous prospects for companies that make earth observation systems.

Throughout the forecast period, Asia - pacific is anticipated to have a sizable CAGR. Countries like China and Japan have made substantial contributions to and have helped this field expand. The increase in the usage of satellite antennas in the communications, IT, aerospace, and automotive industries is to blame for the regional market's growth during the predicted time.

Europe is anticipated to grow at the second-fastest rate due to the modernization of its infrastructure and the rise in tourists participating in marine and coastal tourism. The need for Low Earth Orbit (LEO) satellites to provide backhaul networks for remote or inaccessible places has increased as a result of the expansion of 5G installations across the nation. In addition to the technical developments in geostationary (GEO) satellites that enable high throughput and increased durability, LEO spacecraft also provide shorter latency in Satcom.

METEOROLOGICAL SATELLITE MARKET - BY COMPANIES

Some of the major players operating in the Meteorological Satellite market include:

-

BAE SYSTEM

-

AIRBUS

-

BALL CORPORATION

-

BLACKSKY GLOBAL

-

DIGITAL GLOBE

-

MAXAR TECHNOLOGIES

-

L3HARRIS TECHNOLOGIES

-

CAPELLA SPACE

-

ICEYE

-

PLANET LABS

-

THE BOEING COMPANY

-

EARTHDAILY ANALYTICS

-

SATELLOGIC

-

SURREY SATELLITE TECHNOLOGY LTD.

-

LOCKHEED MARTIN CORPORATION

-

OHB SYSTEM

-

THALES GROUP

NOTABLE HAPPENING IN THE METEOROLOGICAL SATELLITE MARKET

-

PRODUCT LAUNCH- Airbus S.A.S. introduced a new lineup of earth observation satellites in February 2020, which includes the S250 optical and S250 radar.

-

COLLABORATION- August 2019 - The Canadian space agency granted MDA a contract to carry out the system design phase of a satellite that will monitor forest fires. The wildfires (WFS) mission's goal is to give Canada a space-based capacity to improve its ability to monitor wildland fires throughout the nation.

-

INVESTMENT- In April 2020, Lockheed Martin received a $5.8 million contract from the Defense Advanced Research Projects Agency (DARPA) for the Blackjack program, a satellite integration operation. DARPA's Blackjack project will place a constellation of 20 satellites in low Earth orbit by the year 2022 to provide high-speed communications around the world.

-

ACQUISITION- In March 2020, Rocket Lab, a private American aerospace manufacturer and small satellite launch service provider, agreed to buy Toronto-based satellite hardware producer Sinclair Interplanetary. Delivering dependable and adaptable satellite and launch systems is the goal of the purchase

Chapter 1. Meteorological Satellite Market– Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Meteorological Satellite Market– Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Meteorological Satellite Market– Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Meteorological Satellite Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Meteorological Satellite Market- Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Meteorological Satellite Market -BY TYPE

6.1 Introduction/Key Findings

6.2 Polar Orbiting

6.3 Geostationary

6.4 Y-O-Y Growth trend Analysis BY TYPE

6.5 Absolute $ Opportunity Analysis BY TYPE, 2024-2030

Chapter 7. Meteorological Satellite Market -BY END-USER

7.1 Introduction/Key Findings

7.2 Government and Defence

7.3 Archaeology and Civil Infrastructure

7.4 Energy and Natural Resources

7.5 Agriculture

7.6 Forestry

7.7 Maritime and Fishery

7.8 Others

7.9 Y-O-Y Growth trend Analysis BY END-USER

7.10 Absolute $ Opportunity Analysis BY END-USER, 2024-2030

Chapter 8. Meteorological Satellite Market, By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.2 BY TYPE

8.3 BY END-USER

8.4 Countries & Segments - Market Attractiveness Analysis

8.5 Europe

8.5.1 By Country

8.5.1.1 U.K.

8.5.1.2 Germany

8.5.1.3 France

8.5.1.4 Italy

8.5.1.5 Spain

8.5.1.6 Rest of Europe

8.6 BY TYPE

8.7 BY END-USER

8.8 Countries & Segments - Market Attractiveness Analysis

8.9 Asia Pacific

8.9.1 By Country

8.9.1.1 China

8.9.1.2 Japan

8.9.1.3 South Korea

8.9.1.4 India

8.9.1.5 Australia & New Zealand

8.9.1.6 Rest of Asia-Pacific

8.10 BY TYPE

8.11 BY END-USER

8.12 Countries & Segments - Market Attractiveness Analysis

8.13 South America

8.13.1 By Country

8.13.1.1 Brazil

8.13.1.2 Argentina

8.13.1.3 Colombia

8.13.1.4 Chile

8.13.1.5 Rest of South America

8.14 BY TYPE

8.15 BY END-USER

8.16 Countries & Segments - Market Attractiveness Analysis

8.17 Middle East & Africa

8.17.1 By Country

8.17.1.1 United Arab Emirates

8.17.1.2 Saudi Arabia

8.17.1.3 Qatar

8.17.1.4 Israel

8.17.1.5 South Africa

8.17.1.6 Nigeria

8.17.1.7 Kenya

8.17.1.8 Egypt

8.17.1.9 Rest of MEA

8.18 BY TYPE

8.19 BY END-USER

8.20 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Meteorological Satellite Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 BAE SYSTEM

9.2 AIRBUS

9.3 BALL CORPORATION

9.4 BLACKSKY GLOBAL

9.5 DIGITAL GLOBE

9.6 MAXAR TECHNOLOGIES

9.7 L3HARRIS TECHNOLOGIES

9.8 CAPELLA SPACE

9.9 ICEYE

9.10 PLANET LABS

9.11 THE BOEING COMPANY

9.12 EARTHDAILY ANALYTICS

9.13 SATELLOGIC

9.14 SURREY SATELLITE TECHNOLOGY LTD.

9.15 LOCKHEED MARTIN CORPORATION

9.16 OHB SYSTEM

9.17 THALES GROUP

Download Sample

Choose License Type

2500

4250

5250

6900