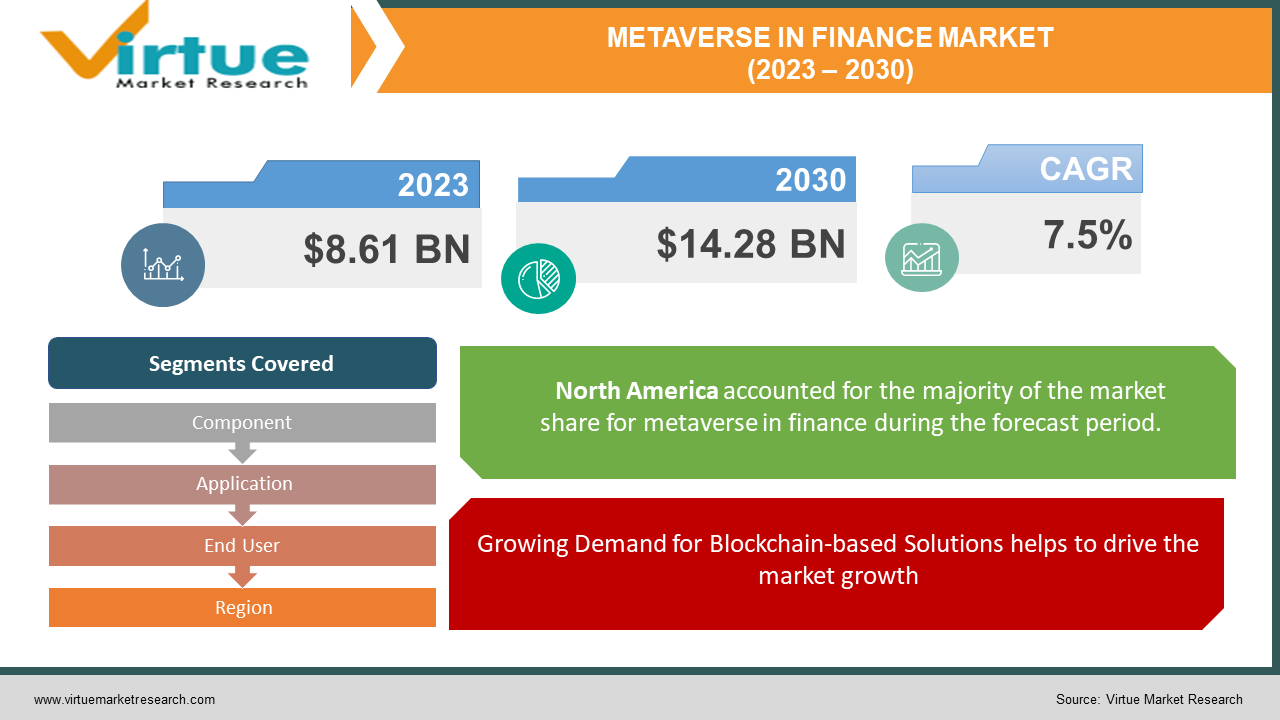

Metaverse in Finance Market Size (2023 - 2030)

The Global Metaverse in Finance Market was valued at USD 8.61 billion and is projected to reach a market size of USD 14.28 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7.5%.

As Metaverse is a comparatively unprecedented technology in the finance industry, its market size is still in the early stages of development. However, with increasing interest and investment in blockchain & distributed ledger technology, Metaverse in the finance market is projected to evolve importantly in the coming years. Market size will be affected by factors such as technological advancements, increasing demand for digital financial services, & regulatory developments in multiple regions.

Industry Overview:

The Metaverse in finance is a relatively new concept that is gaining traction in the financial industry. Metaverse refers to a virtual reality world that is created & maintained by its users. Metaverse is being used in the financial industry to create a digital financial ecosystem that allows users to access a range of financial services and products. This digital financial ecosystem can include virtual banks, insurance companies, investment firms, & other financial institutions. The Metaverse in finance is projected to overturn the way people access financial services & products. It provides a level of comfort that is not available with traditional financial institutions. Users can access financial services & products from anywhere in the world using a computer or mobile device. This has the potential to increase financial inclusion, especially for those who are currently underserved by traditional financial institutions. However, the Metaverse in finance also poses new challenges & risks. As with any digital platform, there is the risk of cybersecurity threats, fraud, & other malicious activities. The use of virtual currencies & assets also raises regulatory & legal issues that need to be addressed. Despite these challenges, the Metaverse in finance is projected to continue to grow & evolve. As technology advances & more financial institutions enter the space, the Metaverse in finance is likely to become an increasingly important part of the financial industry.

COVID-19 Impact on the Metaverse in Finance Market:

The COVID-19 pandemic has had a momentous impact on the global Metaverse in the finance market. As more people shifted toward the online mode of working and became the norm. Almost all sectors embraced the integration of advanced technologies during the pandemic, expanding the scope of the global Metaverse in the finance market.

Market Drivers:

Growing Demand for Blockchain-based Solutions helps to drive the market growth:-

The adoption of blockchain-based solutions in the finance industry has been increasing rapidly, as it provides a secure & transparent way of managing transactions. Metaverse, with its blockchain technology, is well-positioned to cater to this demand and offer a more efficient & secure solution.

Increasing Investments in Digital Assets helps to drive the market growth:-

With the rise of digital assets, such as cryptocurrencies & non-fungible tokens (NFTs), the demand for a reliable & secure platform to manage these assets has also increased. Metaverse's digital asset management platform provides a secure & decentralized solution for managing digital assets, which is operating its adoption in the finance market.

Market Restraints:

The Metaverse in Finance Market's growth is being stifled by a Lack of regulatory framework:

The regulative framework for Metaverse in the Finance Market is not yet fully developed, which is a momentous control on its growth. The lack of regulations creates doubt among investors, which can direct the government to a lack of acceptance of Metaverse in the Finance Market. The lack of clear guidelines on data privacy, security, & transparency can also impede the growth of Metaverse in the Finance Market.

The Metaverse in Finance Market's growth is being stifled by limited awareness and understanding:

The lack of awareness & understanding of Metaverse in the Finance Market is another momentous restraint on its growth. Many potential investors & users are still not familiar with the concept of Metaverse in the Finance Market, which can limit adoption. The lack of understanding can also lead to misconceptions about the technology, which can further hinder adoption. As a result, education & awareness-building initiatives are essential to address this discipline.

METAVERSE IN FINANCE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

7.5% |

|

Segments Covered |

By Component, Application, End User and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Ethereum, Binance Smart Chain, Solana, Polygon (previously Matic Network), Cardano, Polkadot, Avalanche, Chainlink, Algorand, Cosmos |

This research report on the global Metaverse in Finance Market has been segmented based on Component, Application, End-user, and Region.

Metaverse in Finance Market – By Component

-

Hardware

-

Software

-

Services

Metaverse in the financial market has seen momentous developments & growth in its hardware, software, & services components. The hardware segment in the financial market is projected to develop speedily in the coming years as hardware technology continues to evolve & improve. The software segment is also projected to see momentous growth due to the increasing adoption of software solutions in the financial sector. Additionally, the services segment, which includes consulting, integration, & support services, is projected to see momentous development as businesses look to leverage the benefits of Metaverse technology while decreasing risk. In terms of market insights & developments, many key players in the Metaverse in Finance market are focused on developing new & innovative hardware, software, & service offerings that can meet the evolving needs of the financial sector. For example, some companies are developing blockchain-based solutions that can enhance security & transparency in financial transactions, while others are creating more advanced hardware & software platforms that can back up complex financial operations. As the market continues to grow & evolve, it is likely that we will see continued innovation and investment in these areas.

Metaverse in Finance Market – By Application

-

Digital identity

-

Digital assets

-

Smart contracts

-

Payments and settlements

-

Others

Digital identity & digital assets have become popular use cases of Metaverse in finance, with the emergence of blockchain-based digital identity solutions & the growing demand for secure & efficient digital asset management. Smart contracts are also gaining popularity as they enable self-executing & tamper-proof agreements between parties, improving the efficiency & transparency of financial transactions. Additionally, the use of Metaverse in finance for payments & settlements is on the rise, driven by the growing need for faster & more secure payment processing. Other applications of Metaverse in finance, such as supply chain finance & trade finance, are also gaining traction, with the potential to streamline & enhance supply chain operations & cross-border trade. As the technology continues to evolve and new use cases emerge, the demand for Metaverse in finance is projected to grow, with increased adoption across various industries and regions.

Metaverse in Finance Market – By End User

-

Banking

-

Insurance

-

Securities and investment services

-

Others

The Metaverse in Finance market is finding momentous growth, with the increasing adoption of blockchain technology in financial applications. In terms of end-users, the banking sector is the leading contributor to the increment of the Metaverse in the Finance market. Banks are leveraging the Metaverse in Finance technology to cut down costs & streamline their operations. The insurance sector is also adopting technology for claims processing, policy management, and fraud detection. Moreover, securities and investment services companies are also exploring the potential of the Metaverse in Finance for trading, settlement, and asset management. The demand for Metaverse in Finance is also growing in other industries, such as supply chain management, healthcare, and real estate. The increasing use of Metaverse in Finance in these industries is projected to drive market growth. As more companies continue to adopt blockchain-based solutions, the demand for Metaverse in Finance is projected to increase in the coming years.

Metaverse in Finance Market – By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

Metaverse in the finance market is projected to grow importantly in the forecast period, with North America being the dominant region in terms of market share. The increasing adoption of precocious technologies such as blockchain, virtual reality, & augmented reality, coupled with the presence of major players in the region, is controlling the growth of the market. The Asia Pacific region is projected to show authoritative growth during the forecast period, owing to the increasing adoption of these technologies in the financial sector & the growing number of start-ups in the region. Europe is also anticipated to exhibit substantial growth, with the presence of key players in the region and the increasing use of virtual currencies. Markets in the Middle East & Africa are projected to grow in moderation, with the increasing adoption of blockchain technology in the financial sector. South America is also projected to exhibit moderate growth, with the increasing adoption of advanced technologies in the region. Overall, the Metaverse in the financial market is projected to see momentous growth globally, driven by the increasing adoption of advanced technologies in the financial sector.

Major Key Players in the Market:

-

Ethereum

-

Binance Smart Chain

-

Solana

-

Polygon (previously Matic Network)

-

Cardano

-

Polkadot

-

Avalanche

-

Chainlink

-

Algorand

-

Cosmos

Market Insights and Developments:

-

In March 2021, IBM announced the launch of its new blockchain-powered financial services platform, IBM Cloud for Financial Services. The platform is designed to help financial institutions & their technology providers build & deploy cloud-based applications & services that comply with industry-specific regulations & security standards. This development is projected to operate the adoption of Metaverse technology in the financial sector, as it provides a secure & compliant environment for the deployment of blockchain-based solutions.

-

In June 2020, Metaverse denoted the launch of its new decentralized finance (DeFi) platform, Metaverse DeFi. This development is projected to boost the adoption of Metaverse technology in the finance sector, as it offers a more accessible and transparent alternative to traditional financial services.

Chapter 1. Metaverse in Finance Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Metaverse in Finance Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. Metaverse in Finance Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. Metaverse in Finance Market - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Metaverse in Finance Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Metaverse in Finance Market - By Component

6.1 Hardware

6.2 Software

6.3 Services

Chapter 7. Metaverse in Finance Market - By Application

7.1 Digital identity

7.2 Digital assets

7.3 Smart contracts

7.4 Payments and settlements

7.5 Others

Chapter 8. Metaverse in Finance Market – By End User

8.1 Banking

8.2 Insurance

8.3 Securities and investment services

8.4 Others

Chapter 9. Metaverse in Finance Market - By Region

9.1 North America

9.2 Europe

9.3 Asia-Pacific

9.4 Rest of the World

Chapter 10. Metaverse in Finance Market - Key Players

10.1 Ethereum

10.2 Binance Smart Chain

10.3 Solana

10.4 Polygon (previously Matic Network)

10.5 Cardano

10.6 Polkadot

10.7 Avalanche

10.8 Chainlink

10.9 Algorand

10.10 Cosmos

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Metaverse in finance refers to the use of virtual reality and augmented reality technology to create immersive, interactive financial experiences.

Metaverse technology is used in finance to create virtual trading floors, investment analysis tools, and other financial applications that allow users to interact with financial data in a more engaging and intuitive way.

The benefits of using Metaverse technology in finance include increased engagement and understanding of financial data, improved decision-making, and the ability to simulate financial scenarios in a risk-free environment.

Industries that are adopting Metaverse technology in finance include investment banking, asset management, insurance, and fintech.

The future of Metaverse in finance is projected to be bright, with the continued adoption of immersive technologies in financial services and the development of more advanced Metaverse applications for financial analysis and decision-making.