Metaverse in Education Market Size (2025-2030)

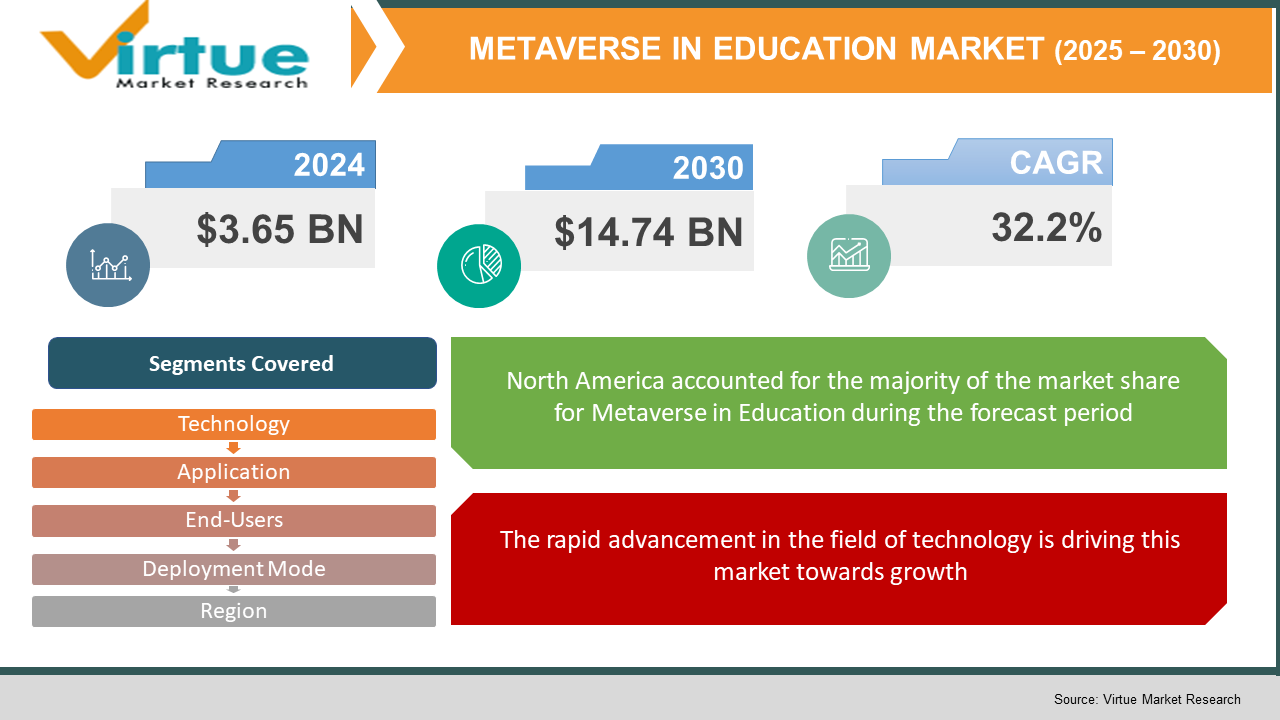

The Global Metaverse in Education Market was valued at USD 3.65 billion and is projected to reach a market size of USD 14.74 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 32.2%.

Continuous developments in XR hardware, VR headsets under USD 400, and enterprise-grade AR glasses with expanded fields of view and the integration of AI-driven personalization and 5 G-enabled low-latency streaming are driving this quick rise. The post-COVID turnaround toward hybrid learning has deepened demand for immersive platforms that simulate campus interactions practically, while crucial skill gaps in engineering, healthcare, and production push businesses up via metaverse simulations. Underwriting big pilots, government initiatives in China, India, and the European Union are lowering financial obstacles and confirming educational theory. Rising models like micro-AR bite-sized courses and cooperative virtual laboratories will democratize access even if obstacles, including technical difficulty, digital edge concerns, and implementation costs ranging from USD 150K–250K, exist. The metaverse is set to become a cornerstone pillar of worldwide education thanks to standards such as OpenXR gaining momentum and NFT-backed accreditations guaranteeing verifiable success, therefore transforming how students interact and study across nations.

Key Market Insights:

- More than 60% of colleges worldwide have tried metaverse-based virtual classrooms, thereby raising student participation by 45%.

- Fortune 500 companies comprising 55% intend to include metaverse simulations in staff training by 2027.

- In 2024, EdTech project financing for metaverse companies climbed 120 percent year-over-year to $850 million.

- Driven by official digital education projects, the share of Asia‑Pacific climbed from 15% to 28%.

Metaverse in Education Market Drivers:

The rapid advancement in the field of technology is driving this market towards growth.

Rapid innovation in XR hardware and software is driving down costs and boosting accessibility. Next‑generation VR headsets such as Meta Quest 3 and Pico 4 now retail under USD 400, compared to over USD 1,000 five years ago. Next‑generation VR headsets such as Meta Quest 3 and Pico 4 now retail under USD 400, compared to over USD 1,000 five years ago. Meanwhile, AR glasses like Microsoft HoloLens 2 and Magic Leap 2 provide wider fields of view and enterprise-grade durability. Improvements in haptic feedback, including TeslaSuit's full-body haptic suits and Ultraleap's mid-air haptics, enable realistic tactile learning, which is vital for medical and technical training. These devices offer superior resolution (up to 4K per eye), inside‑out tracking, and built‑in audio, therefore eliminating the need for external sensors and PCs. As hardware becomes more affordable and user‑friendly, institutions can scale up immersive metaverse experiences, thereby speeding up adoption across K‑12, higher education, and corporate sectors.

The demand for remote learning has increased immensely, especially after the pandemic, driving the growth of the market.

Post-COVID's move to hybrid and remote learning models has permanently increased demand for answers, virtually replicating human interaction. With 68% investigating XR to improve online engagement, an EDUCAUSE study from 2024 discovered 82% of colleges intend to keep hybrid programs. Metaverse systems, like Virbela and Engage, offer virtual campuses with avatar socializing, group projects, and lecture attendance for pupils. By providing spatial audio, lifelike motions, and shared virtual whiteboards, these settings help to alleviate "Zoom fatigue". Immersive metaverse classrooms give schools and universities a competitive advantage as they strive to distinguish their online programs by maintaining high enrollment and activity levels even when physical participation is restricted.

Due to a skill gap in the workforce, the demand for this market has increased.

Metaverse simulations are being used by industries with a severe need for personnel, such as advanced manufacturing, healthcare, and engineering, to quickly upskill workers. Using VR-based simulations, Boeing reports a 45% reduced training time for aircraft maintenance; Siemens gained a 50% better retention of technical procedures via MR overlays on actual equipment. Using VR surgical simulations, medical institutions like Johns Hopkins train residents on difficult techniques free from danger to patients, hence increasing first-try success by 38 percent. These concrete ROI numbers drive corporate investment: International Data Corporation (IDC) projects enterprise spending on XR for workforce training to hit USD 12 billion by 2027, underlining metaverse solutions as crucial means to enhance operational readiness and close skills gaps.

The increased government investment and initiatives taken by them are helping the market to grow.

Metaverse pilot initiatives all around the world are benefiting greatly from national digital education plans using lots of public money. Under China's "Digital Campus" strategy, RMB 8 billion (USD 1.1 billion) will be invested in VR/AR lab installations in over 1,000 universities by 2025. India's New Education Policy includes grants for EdTech startups developing metaverse content, aiming at 100 model smart schools by 2026. The European Commission's Horizon Europe program earmarks €300 million for XR‑based education research and pilot deployments across member states. Government projects speed up market development and broad acceptance of immersive learning technologies by lowering financial obstacles and encouraging public–private partnerships, therefore supporting infrastructure expenses and justifying metaverse pedagogy with large‑scale studies. Sourcing infrastructure expenditures and validating metaverse pedagogy through big studies, these initiatives help to reduce financial roadblocks and drive public–private partnerships, therefore helping to accelerate market development and wide adoption of immersive learning technologies.

Metaverse in Education Market Restraints and Challenges:

The cost of implementation in the initial stages is very high, hampering the growth of the market.

A total metaverse solution, including XR hardware, network upgrades, and custom content, could cost around USD 150K–250K per campus. Even bigger universities experience multi-year payback periods, slowing procurement processes and restricting metaverse adoption outside well-funded academic institutions. Smaller K-12 schools and community colleges, operating on tight budgets, find it difficult to justify these upfront investments without an obvious short-term return on investment. High-end VR labs need several headsets (USD 400–600), dedicated workstations (USD 1,200+), and spatial tracking sensors or 5G connectivity. Custom educational content development (3D models, interactive scenarios), which often costs USD 50K–100K per course module.

The technology used in this market is complex, which gives rise to compatibility issues.

Metaverse settings that are effective combine virtual reality, artificial reality, mixed reality, cloud-streaming, and AI services—each with unique APIs and performance criteria. Integrating these tools into current LMS systems calls for substantial IT knowledge. Compatibility problems arise among various headsets (Oculus, Vive, HoloLens), operating systems, and networking standards. Many businesses lack on‑staff XR experts, so they must depend on expensive external installers. Ongoing maintenance—firmware upgrades, cross‑platform content testing, and network optimization—adds operational overhead, discouraging schools and companies from scaling pilot programs into full deployments.

The growing concerns related to the safety and security of personal data are a hurdle for the market.

Breaches in XR systems could expose student identities or personal interactions. Metaverse platforms collect extensive behavioral data: gaze tracking, gesture logs, spatial movement, and voice communications. Protecting this sensitive information requires end‑to‑end encryption, GDPR/FERPA‑compliant data handling, and secure authentication (SSO, MFA). 68% of educational IT leaders cite data privacy as their greatest barrier to XR adoption as of 2024. To guarantee safe virtual environments, institutions must deploy network segmentation, regular security audits, and content moderation—criteria that many lack the experience or financial resources to fulfill.

The existence of the digital divide globally restricts the adoption of the technology, affecting the market reach.

Though only 42% of rural schools worldwide reach the minimum 50 Mbps standard for high-quality VR streaming, 85% of developed country urban schools say their broadband is sufficient. Headsets cost more than annual per-student IT expenditures in many countries, and XR devices are still far too expensive in low-income areas. Without targeted subsidies, inexpensive XR solutions, or offline metaverse models, inclusive deployment across various geographies is still out of reach. This gap leaves underserved communities unable to gain from immersive learning, risking a two‑tier education system.

Metaverse in Education Market Opportunities:

Microlearning in the metaverse is seen as a great opportunity for the market to expand further.

Using smartphones, bite-sized, gamified AR modules can transcend emerging market device and bandwidth restrictions. Platforms like zSpace's AR apps and Mursion's wallet-VR simulations demand just a mid-range smartphone (USD 150–200) and an inexpensive AR viewer (USD 20), hence lowering entry hurdles. Sized three to five minute interactive lessons, microlearning segments fall within normal mobile data allowances (~500 MB per month) and correspond with average attention spans. By using available mobile phones and snackable content, service providers can quickly expand metaverse instruction in areas without high‑end XR equipment. A 2024 study discovered 72% of pupils in India and Brazil favored micro-AR modules over hour‑long VR sessions.

The emergence of virtual labs is presenting an opportunity to boost research and collaboration.

Systems like Labster VR and Virbela's campus offer totally simulated biology, chemistry, and engineering labs where up to 50 users can work in real time. This allows student teams from various universities and countries to perform shared experiments without actually traveling. By lowering consumables costs by 90% and eradicating schedule conflicts, this model allows organizations in Europe, North America, and Asia to co‑author research projects smoothly. Joint digital lab efforts—including the EU's Horizon XR Lab initiative report a 60% rise in cross‑border student publications, underscoring the potential for worldwide academic partnerships.

The establishment of specialized skill academies is an opportunity for the market to expand its reach in various areas.

Premium subscription (USD 1,500–3,000 annually) can be offered by niche metaverse platforms concentrating on high‑value vocational training, such as Osso VR for surgery, ForgeFX for industrial machinery, and Strivr for safety compliance. Validated by professional bodies, these academies provide hyper-realistic simulations with measurable return on investment: 40% faster credentialing times, medical institutions claim; 35% fall manufacturers note among on-the-job errors. Driven by proven performance improvements and certification credentials employers acknowledge, demand for these specialized XR training academies is expected to rise at a 48% CAGR till 2030 as industries struggle with critical skills shortages.

The integration with the AI-driven tutors is helping in creating personalized learning paths.

Systems such as Squirrel AI's adaptive engine and Carnegie Learning's AI coach are now integrated into XR platforms, analyzing real‑time performance data (gesture accuracy, decision paths) to adjust difficulty, recommend targeted practice, and offer instant verbal feedback. Combining AI-driven tutoring with immersive metaverse environments produces adaptive, personalized learning pathways. Early pilots at Stanford and Tsinghua universities showed a 25% uplift in mastery of complex subjects (e.g., organic chemistry) compared to static XR lessons. As AI models such as OpenAI’s GPT-4 become more capable of contextual dialogue, AI‑tutor avatars will drive deeper engagement and accelerate learning outcomes across K‑12, higher education, and corporate upskilling programs.

METAVERSE IN EDUCATION MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

32.2% |

|

Segments Covered |

By technology, application, end user, deployment mode, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Meta, Microsoft, NVIDIA, HTC Vive, Unity Technologies, Engage XR, EON Reality , Labster, Virbela, zSpace |

Metaverse in Education Market Segmentation:

Metaverse in Education Market Segmentation: By Technology

- Virtual Reality

- Augmented Reality

- Mixed Reality

VR segment is the dominant one, with mature hardware ecosystems (Oculus, Vive) and extensive content libraries, VR is the go-to tool for immersive learning. Head-mounted displays enable access to fully immersive 3D environments suitable for virtual campuses and simulated labs. The MR segment is the fastest-growing segment; MR's acceptance for hands-on cooperation is being propelled fast by new devices (HoloLens 2) and corporate alliances. Blends actual and virtual components, letting users interact with holograms in their real environment. Rising for collaborative group projects.

Used for interactive textbooks and on‑site field trips, Augmented Reality (AR) overlays digital content via tablets or AR glasses onto the physical world.

Metaverse in Education Market Segmentation: By Application

- Virtual Classrooms

- Immersive Simulations

- Remote Lab

- Collaborative Projects

The virtual classrooms segment is the dominant one, and the immersive simulations segment is the fastest-growing. Post-pandemic, there is an urgent need to recreate lecture halls online. Virtual auditoriums hosted by avatars will help thousands of pupils. Hands-on digital training draws investment from proven 40% improvement in retention of skills.

Science or engineering labs that are remotely accessible anywhere, in full operation, come under the remote labs segment. The collaborative projects segment includes solving problems by teams using shared virtual environments.

Metaverse in Education Market Segmentation: By End-Users

- K-12 Schools

- Higher Education

- Corporate Training

The education segment holds dominance in this market, and the corporate training segment is the fastest-growing segment. Extensive XR deployments are fueled by research requirements and big budgets. University pilots of research labs and virtual campuses come under this segment. Rapid incorporation of the metaverse results from a critical need to close skills gaps. Employee upskilling through scenario-based XR modules comes under this.

The K-12 schools are increasingly adopting the metaverse for the purpose of virtual field trips and gamified lessons for students.

Metaverse in Education Market Segmentation: By Deployment Mode

- On-Premises

- Cloud-based

Cloud-based deployment mode is dominant here, and the on-premise mode is the fastest-growing. When it comes to cloud-based mode, the lower initial expenses and simple scalability fit the budget of an educational organization. Subscription-model platforms that can scale anywhere are used here. For the on-premises, strict sectors favor local servers and restricted networks; higher data-security standards in healthcare and defense sectors drive private installations.

Metaverse in Education Market Segmentation: By Region

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

North America holds the leading position here due to significant capital investment in R&D and great XR infrastructure. The Asia-Pacific region is considered the fastest-growing region as the government makes digital education necessary, and there is a large untapped student population.

High government funding and educational reforms, which are progressive in nature, are the reasons why the European region holds the second largest share in the market. Due to growing internet penetration and educational initiatives taken in South America and the MEA region is making them the emerging markets.

COVID-19 Impact Analysis on the Global Metaverse in Education Market:

The epidemic caused a sudden switch to remote teaching, bringing the flaws of conventional internet technologies into focus. Institutions rushed to replace uninspiring video lectures with immersive virtual labs and campuses, so XR platform deployments in education rose by 300% from 2020 to 2021. When VR/AR modules supplemented distance courses, 54% of teachers and 41% of parents found improved student participation. Even following the reopening of campuses, 70% of the universities surveyed promised to grow XR-based metaverse initiatives, therefore, hybrid XR learning is a fixed feature.

Latest Trends/ Developments:

Time- and style-sensitive personalized, AI-driven tutor avatars increase learning retention by 30% above static video classes. Using machine learning and natural language processing, these avatars produce instant feedback, exercises for correction, and motivational prompts to scale one-on-one tutoring.

5G network deployment allows for low-latency streaming of high-definition VR/AR educational material, therefore lowering session lag by 70% compared to 4 G. Real-time interaction in virtual labs and team simulations is made possible by this seamless delivery, hence even in bandwidth‑constrained environments, continuous, frictionless learning experiences are assured.

More than 20 colleges utilize decentralized diplomas and micro-credentials as NFTs across their metaverse campuses. Portable, unchanging qualifications help employers to simplify checking, improve security, and empower lifelong learners to highlight achievements throughout digital media.

40% of next-generation educational XR projects have embraced OpenXR, the open API standard for XR. Lowering development costs and speeding up the implementation of metaverse learning solutions, this standardization guarantees cross-device compatibility, allowing content created once to run on any OpenXR-compliant headset.

Key Players:

- Meta

- Microsoft

- NVIDIA

- HTC Vive

- Unity Technologies

- Engage XR

- EON Reality

- Labster

- Virbela

- zSpace

Chapter 1. METAVERSE IN EDUCATION MARKET– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources`

1.5. Secondary Sources

Chapter 2. METAVERSE IN EDUCATION MARKET– Executive Summary

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. METAVERSE IN EDUCATION MARKET– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. METAVERSE IN EDUCATION MARKET- Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. METAVERSE IN EDUCATION MARKET- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. METAVERSE IN EDUCATION MARKET– By Technology

6.1 Introduction/Key Findings

6.2 Virtual Reality

6.3 Augmented Reality

6.4 Mixed Reality

6.5 Y-O-Y Growth trend Analysis By Technology

6.6 Absolute $ Opportunity Analysis By Technology , 2025-2030

Chapter 7. METAVERSE IN EDUCATION MARKET– By Application

7.1 Introduction/Key Findings

7.2 Virtual Classrooms

7.3 Immersive Simulations

7.4 Remote Lab

7.5 Collaborative Projects

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. METAVERSE IN EDUCATION MARKET– By Deployment Mode

8.1 Introduction/Key Findings

8.2 Cloud-based

8.3 On-premises

8.4 Y-O-Y Growth trend Analysis Deployment Mode

8.5 Absolute $ Opportunity Analysis Deployment Mode , 2025-2030

Chapter 9. METAVERSE IN EDUCATION Market– By End-Use Industry

9.1 Introduction/Key Findings

9.2 K-12 Schools

9.3 Higher Education

9.4 Corporate Training

9.5 Y-O-Y Growth trend Analysis End-Use Industry

9.6 Absolute $ Opportunity Analysis End-Use Industry , 2025-2030

Chapter 10. METAVERSE IN EDUCATION MARKET, By Geography – Market Size, Forecast, Trends & Insights

10.1. North America

10.1.1. By Country

10.1.1.1. U.S.A.

10.1.1.2. Canada

10.1.1.3. Mexico

10.1.2. By Technology

10.1.3. By Deployment Mode

10.1.4. By Application

10.1.5. End-Use Industry

10.1.6. Countries & Segments - Market Attractiveness Analysis

10.2. Europe

10.2.1. By Country

10.2.1.1. U.K.

10.2.1.2. Germany

10.2.1.3. France

10.2.1.4. Italy

10.2.1.5. Spain

10.2.1.6. Rest of Europe

10.2.2. By Technology

10.2.3. By Deployment Mode

10.2.4. By Application

10.2.5. End-Use Industry

10.2.6. Countries & Segments - Market Attractiveness Analysis

10.3. Asia Pacific

10.3.1. By Country

10.3.1.2. China

10.3.1.2. Japan

10.3.1.3. South Korea

10.3.1.4. India

10.3.1.5. Australia & New Zealand

10.3.1.6. Rest of Asia-Pacific

10.3.2. By Technology

10.3.3. By End-Use Industry

10.3.4. By Application

10.3.5. Deployment Mode

10.3.6. Countries & Segments - Market Attractiveness Analysis

10.4. South America

10.4.1. By Country

10.4.1.1. Brazil

10.4.1.2. Argentina

10.4.1.3. Colombia

10.4.1.4. Chile

10.4.1.5. Rest of South America

10.4.2. By End-Use Industry

10.4.3. By Application

10.4.4. By Product Technology

10.4.5. Deployment Mode

10.4.6. Countries & Segments - Market Attractiveness Analysis

10.5. Middle East & Africa

10.5.1. By Country

10.5.1.4. United Arab Emirates (UAE)

10.5.1.2. Saudi Arabia

10.5.1.3. Qatar

10.5.1.4. Israel

10.5.1.5. South Africa

10.5.1.6. Nigeria

10.5.1.7. Kenya

10.5.1.10. Egypt

10.5.1.10. Rest of MEA

10.5.2. By Deployment Mode

10.5.3. By End-Use Industry

10.5.4. By Application

10.5.5. Technology

10.5.6. Countries & Segments - Market Attractiveness Analysis

Chapter 11. METAVERSE IN EDUCATION MARKET– Company Profiles – (Overview, Service End-Use Industry Product Technology Portfolio, Financials, Strategies & Developments)

11.1 Meta

11.2 Microsoft

11.3 NVIDIA

11.4 HTC Vive

11.5 Unity Technologies

11.6 Engage XR

11.7 EON Reality

11.8 Labster

11.9 Virbela

11.10 zSpace

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

Technological XR development, requirements for hybrid learning, and corporate upskilling demand are some of the factors behind the rapid growth of the Global Metaverse in Education Market.

With an expected 40% CAGR powered by government digital projects, the Asia-Pacific region is said to be the fastest-growing region for this market

Having 60% of the market share for scalability and lower first costs, the cloud-based deployment mode is said to be the dominant one in this market

By monitoring cost savings in physical resources, retention (35%), and engagement (45%), the ROI is calculated by the universities

Corporate training is expected to grow at a 55% CAGR and help to close skills gaps by means of practical simulations