Metamaterials Market Size (2025 – 2030)

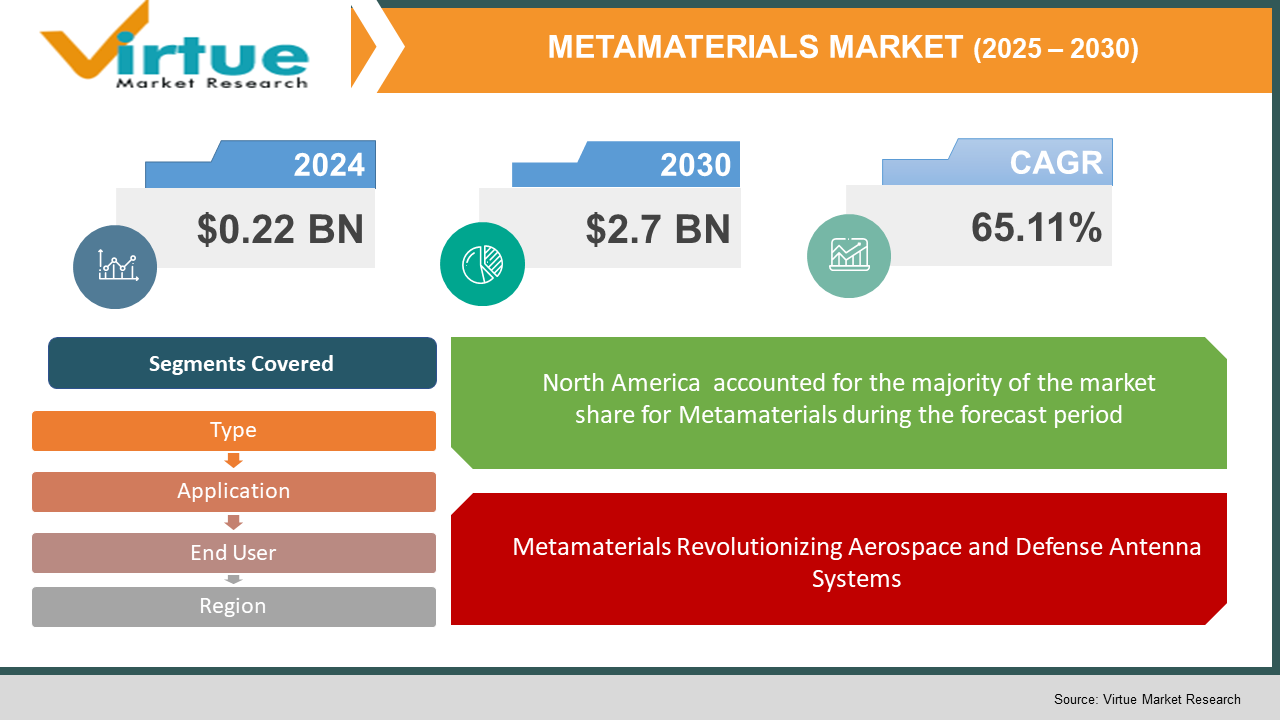

The Global Metamaterials Market was valued at USD 0.22 billion in 2024 and is projected to reach a market size of USD 2.7 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 65.11%.

Metamaterials are man-made materials with rare and unique properties resulting from the structure of the material and not their chemical composition. The building blocks are variable in size, shape, geometry, and orientation. These building blocks can be structured in any fashion, which impacts the electromagnetic radiation of the produced metamaterial differently and provides the metamaterial unique characteristics such as negative permeability and permittivity that would otherwise not be possible using common materials. Because of their enhanced electromagnetic characteristics, metamaterials are also employed in other end-use applications such as automotive, consumer electronics, medical, and others. The growing use of metamaterials in consumer electronics and healthcare is also expected to drive market revenue growth.

Key Market Insights:

- In September 2024, KEF, a speaker brand, launched Q speakers incorporating metamaterial absorption technology that will suppress 99% of background noise and distortions for an unadulterated sound, defining the future of consumer electronics with metamaterial.

- In August 2024, Nissan, an automobile manufacturing firm, launched a new car paint that uses metamaterial to lower temperature in vehicles parked under direct sun.

- In May 2024, Los Alamos National Laboratory and Tel Aviv University among other researchers developed a mechanical metamaterial capable of remembering the work done on it that was termed Chaco.

- In April 2024, Huawei, a production firm, introduced MateBook X Pro which employs the world's first 3D metamaterial antenna to boost speed by 40-50%.

- In January 2024, Imperial College was awarded GBP 7.7 million funding by Engineering and Physics Sciences Research Council to produce the future generation of metamaterials.

Global Metamaterials Market Drivers:

Metamaterials Revolutionizing Aerospace and Defense Antenna Systems.

Better antenna technology is required for efficient military, aerospace, and defense communications. Real-time, effective, and reliable communications are necessary for network-centric operations on the digital battlefield to provide accurate information to the right people. A vital, though sometimes forgotten, component of defense, aerospace, and military systems is the antenna. Military antennas are also used by radars to offer missile guidance for accurate target tracking. The military antenna market is expected to be driven by heightened border penetration, terrorism, global conflicts, and attack-vulnerable borders, which are likely to boost demand for metamaterials in aerospace and defense applications. All countries have also been spending on their defense sectors to ensure peace and security. In addition, governments also have a particular sum for the defense industry of the country in their annual budgets. The defense and space industry is currently in a "supercycle" partly owing to huge backlogs of orders that could spur the production within the industry within the next decade. The requirement of metamaterials from the defense and aerospace industry is growing due to all the above points. This need will be one of the pivotal market drivers within the latter phases of the expected timeframe.

The use of antennas for communication is one of the reason behind market growth.

The telecommunication field has recently paid more attention to microwave applications. Metamaterials can be engineered to generate exotic electromagnetic signals. Such materials exhibit different refractive properties such as negative refractive index (NRI) and left-handed material (LHM). This is why the materials are important for the generation of microwave devices as well as the design and fabrication of efficient antennas. In MI communication systems, loop antennas are wrapped in a negatively permeable metamaterial shell. Theoretically, it is feasible to achieve a communication range of approximately 20 meters using metamaterial-enhanced SR communication systems and a small loop antenna with decent data rates. Hence, using these materials in remote locations can definitely impact the connection. It is possible for one to focus six times beyond the diffraction limit at 0.38 m with metamaterials in antennas. Cell phones' antennas with these metamaterials are five times smaller in size and enjoy a bandwidth between 700 MHz and 2.7 GHz. Researchers are now conducting research on wide-angle impedance matching (WAIM) technology. Phased array antennas have been shown to be benefited with better wide-angle impedance from metamaterials. Metamaterials are increasingly being utilized in 5G antennas also. All the above-discussed factors, such as the application of metamaterial-based antennas in antimissile systems, ocean surveillance systems, space surveillance, aircraft anti-collision systems, and air-defense systems, are anticipated to propel the market for metamaterials over the forecast period.

Global Metamaterials Market Restraints and Challenges:

As the market is growing the cost of synthetization of metamaterials is also increasing.

The process of manufacturing metamaterials involves equipment that can create design structures that are extremely three-dimensional micro and nanoscale and contain several constituent materials in the same structure. These processes are extremely capital intensive and need high levels of investment in R&D. The manufacturing of such highly characterized structures needs cutting-edge machinery and equipment. Thus, synthetization of the metamaterial is a slow and critical process. In the modern era, additive manufacturing is also being explored as a possible production route.Apart from that, raw materials for metamaterial production consist of several nanoparticles, which are extremely expensive. EPD utilizes electric fields to deposit charged nanoparticles from an electrolyte on a substrate. Because of its few uses, mass production of metamaterials is yet to take off. As a result of costly manufacturing, firms globally are involved in small to medium-scale synthetization of metamaterials. Consequently, there is a shortage of low-cost technologies to manufacture different metamaterials in industrially significant amounts, hindering the metamaterials market from realizing its full potential.

Global Metamaterials Market Opportunities:

The need for wireless mobile communication systems has grown during the last ten years. Ever since the International Telecommunications Union approved IMT-Advanced (IMT-A) standards in 2010, the fourth generation (4G) of wireless communication has been rolled out globally. According to the Internet Protocol Architecture of 4G communication networks, the quantity of intelligent and heterogeneous wireless devices connected to the internet is predicted to grow exponentially with the continuous growth of internet traffic. The use of metamaterials in wireless communication networks provides higher spectral efficiency and energy efficiency. Fifth-generation (5G) wireless communication technologies are at the stage of advanced development and are to be deployed in 2021. But, due to the COVID-19 pandemic, the deployment may be delayed. 5G communication systems are to provide much greater transmission rates than 4G systems, varying up to 10 Gbps peak data rates in 8~10 bps/Hz/cell. As the telecommunication industry expands, there is likely to be a new generation of communicating devices coming through with the 5G network technology going commercially available. Metamaterials are finding increased application in components for 5G technology, including the use of metamaterial design in the case of massive MIMO communication systems in the form of large-scale antennas. Reflectors made of metamaterial are also utilized for 5G signal propagation enhancement.

METAMATERIALS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

65.11% |

|

Segments Covered |

By Type, application, end user, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Echodyne Corp., Evolv Technologies Inc., Kymeta Corporation, JEM Engineering LLC, Metashield LLC, Multiwave Technologies AG |

Global Metamaterials Market Segmentation:

Metamaterials Market Segmentation: By Type

- Electromagnetic

- Terahertz

- Tunable

- Photonic

- FSS

- Others

By type, the market for metamaterials globally consists of Electromagnetic, Terahertz, Tunable, Photonic, FSS, and Others (Chiral, Nonlinear, etc.). The Electromagnetic segment holds the largest market share and is expected to grow at a CAGR of 31.9% over the forecast period. Electromagnetic metamaterials are man-made materials consisting of structures whose electromagnetic characteristics are specially designed to provide a variety of responses that cannot or are challenging to provide in naturally occurring materials or composites. Some key features of metamaterials are a negative index of refraction (where both magnetic and electric responses are simultaneously negative), perfect (sub-wavelength) lensing, and electromagnetic invisibility cloaks. These features are responsible for driving segment growth.

Metamaterials Market Segmentation: By Application

- Antenna & Radar

- Sensors

- Cloaking Devices

- Super lens

- Light & Sound Filtering

- Others

By application, the worldwide metamaterials market encompasses Antenna & Radar, Sensors, Cloaking Devices, Super Lens, Light & Sound Filtering, and Others (Solar, Absorbers, etc.). The Antenna & Radar market has the biggest market share and is projected to grow at a CAGR of 31.8% for the forecast period. One of the most critical applications of metamaterials is as an antenna. The antenna performance parameters are enhanced through the exploitation of the unique property of metamaterials. Metamaterial coatings have been utilized to upgrade the radiation and coordination abilities of electrically unimportant and visually appealing dipole reception devices. The creation of metamaterial surface antennas (MSA-T) belongs to a new class of receiving device development. It can rapidly and precisely drive a radiofrequency bar through a wide range of positions without incorporating moving components or costly stage moving segments. Due to the above-mentioned reasons, the demand for metamaterials in radar and antenna is likely to expand during the forecast period.

Metamaterials Market Segmentation: By End User

- Healthcare

- Telecommunication

- Aerospace & Defense

- Electronics

- Others

By end-user, the market for metamaterials worldwide comprises Healthcare, Telecommunication, Aerospace & Defense, Electronics, and Others. The Aerospace & Defense segment has the highest market share and is projected to register a CAGR of 34% through the forecast period. Reliable military, defense, and aerospace communications require advanced antenna technologies. dependable, effective, and real-time communications are crucial for network-centric warfare to achieve success on the digital battlefield and to provide right information to the right individual at the right moment. The antenna is a pivotal component of defense, aerospace, and military systems, though often overlooked. Furthermore, military antennas are employed in radars for missile guidance purposes to enable target tracking accurately. The increase in border penetration, terrorist operations, inter-nation conflicts, and attack-susceptible borders will push the demand for military antennas. This, in turn, fuels the demand for metamaterials.

Metamaterials Market Segmentation: Regional Analysis:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

The world market for metamaterials is dominated by North America, fueled by aggressive government and private investments in aerospace, defense, telecommunications, and healthcare, with the U.S. as a hotbed of R&D and innovation. Europe is a close second, spurred by research programs and government funding for automotive, energy, and medical device applications, with Germany, the UK, and France leading the pack. The Asia-Pacific region is a fast-expanding market, driven by 5G, defense, and consumer electronics technology growth in China, Japan, South Korea, and India. Its share is lower in South America, with Brazil driving adoption in telecommunications and aerospace, with the prospect of future growth opportunities through infrastructure and defense modernization. The Middle East & Africa also are experiencing continuous growth, with Saudi Arabia and the UAE investing in stealth, radar, and communications technologies. North America and Europe lead the market, but Asia-Pacific is fast becoming a significant player, and the growing global demand for next-generation materials is projected to fuel further growth in all regions.

COVID-19 Impact Analysis on the Global Metamaterials Market:

The COVID-19 pandemic negatively affected the international market for metamaterials by impacting supply chains, postponing research and development activities, and hindering production across industries. Lockdown and curbs contributed to reduced demand from prominent industries including aerospace, automotive, and consumer electronics, which are substantial users of metamaterials. The pandemic, however, also hastened healthcare application innovations, with metamaterials being researched for new medical imaging, sensing, and diagnostic devices. Government spending on 5G infrastructure and defense technologies also helped maintain market expansion. As the economies picked up, demand for metamaterials also recovered as applications in telecommunications, biomedical devices, and energy-efficient technologies continued to grow. The post-pandemic world is seeing increased emphasis on sustainability and cutting-edge material science, adding to the growth of the metamaterials sector.

Latest Trends/ Developments:

FirstEnergy Stadium deployed Evolv Technology's artificial intelligence-based weapons detection security screening systems to increase public safety and enhance fan experience. Evolv Technology (NASDAQ: EVLV) is a world leader in next-generation security screening, leveraging data and analytics for effective threat detection. Echodyne also signed a strategic partnership with Northrop Grumman Corporation (NYSE: NOC) to deploy its radar technology within Northrop Grumman's state-of-the-art defense and security solutions. This partnership looks to enhance defensive capabilities through Echodyne's advanced radar systems.

Key Players:

- Echodyne Corp.

- Evolv Technologies Inc.

- JEM Engineering LLC

- Fractal Antenna Systems Inc.

- Metamaterials Technologies Inc.

- Kymeta Corporation

- Multiwave Technologies Inc.

- Metashield LLC

Chapter 1. Metamaterials Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Metamaterials Market – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Metamaterials Market – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Application Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Metamaterials Market - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. Metamaterials Market - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Metamaterials Market – By Type

6.1 Introduction/Key Findings

6.2 Electromagnetic

6.3 Terahertz

6.4 Tunable

6.5 Photonic

6.6 FSS

6.7 Others

6.8 Y-O-Y Growth trend Analysis By Type :

6.9 Absolute $ Opportunity Analysis By Type :, 2025-2030

Chapter 7. Metamaterials Market – By Application

7.1 Introduction/Key Findings

7.2 Antenna & Radar

7.3 Sensors

7.4 Cloaking Devices

7.5 Super lens

7.6 Light & Sound Filtering

7.7 Others

7.8 Y-O-Y Growth trend Analysis By Application

7.9 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. Metamaterials Market – By End-User

8.1 Introduction/Key Findings

8.2 Healthcare

8.3 Telecommunication

8.4 Aerospace & Defense

8.5 Electronics

8.6 Others

8.7 Y-O-Y Growth trend Analysis End-User

8.8 Absolute $ Opportunity Analysis End-User , 2025-2030

Chapter 9. Metamaterials Market, BY GEOGRAPHY – MARKET SIZE, FORECAST, TRENDS & INSIGHTS

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By Application

9.1.3. By End-User

9.1.4. By Type

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By Application

9.2.3. By End-User

9.2.4. By Type

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.1. By Country

9.3.1.1. China

9.3.1.2. Japan

9.3.1.3. South Korea

9.3.1.4. India

9.3.1.5. Australia & New Zealand

9.3.1.6. Rest of Asia-Pacific

9.3.2. By Application

9.3.3. By End-User

9.3.4. By Type

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.1. By Country

9.4.1.1. Brazil

9.4.1.2. Argentina

9.4.1.3. Colombia

9.4.1.4. Chile

9.4.1.5. Rest of South America

9.4.2. By END-USER

9.4.3. By Application

9.4.4. By Type

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.1. By Country

9.5.1.1. United Arab Emirates (UAE)

9.5.1.2. Saudi Arabia

9.5.1.3. Qatar

9.5.1.4. Israel

9.5.1.5. South Africa

9.5.1.6. Nigeria

9.5.1.7. Kenya

9.5.1.8. Egypt

9.5.1.9. Rest of MEA

9.5.2. By END-USER

9.5.3. By Application

9.5.4. By Type

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Metamaterials Market – Company Profiles – (Overview, Product Type Portfolio, Financials, Strategies & Developments)

10.1 Echodyne Corp.

10.2 Evolv Technologies Inc.

10.3 JEM Engineering LLC

10.4 Fractal Antenna Systems Inc.

10.5 Metamaterials Technologies Inc.

10.6 Kymeta Corporation

10.7 Multiwave Technologies Inc.

10.8 Metashield LLC

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Metamaterials Market was valued at USD 0.22 billion in 2024 and is projected to reach a market size of USD 2.7 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 65.11%.

. The demand for aerospace and defense industry is increasing and also antennas are used for telecommunication.

Based on Service Provider, the Global Metamaterials Market is segmented in-to large Enterprises, Small and Medium Enterprises, Research Institutions and Universitites.

North America is most dominant region for the Global Metamaterials Market.

Echodyne Corp., Evolv Technologies Inc., Kymeta Corporation, JEM Engineering LLC, Metashield LLC, Multiwave Technologies AG are the key players operating in the Global Metamaterials Market.