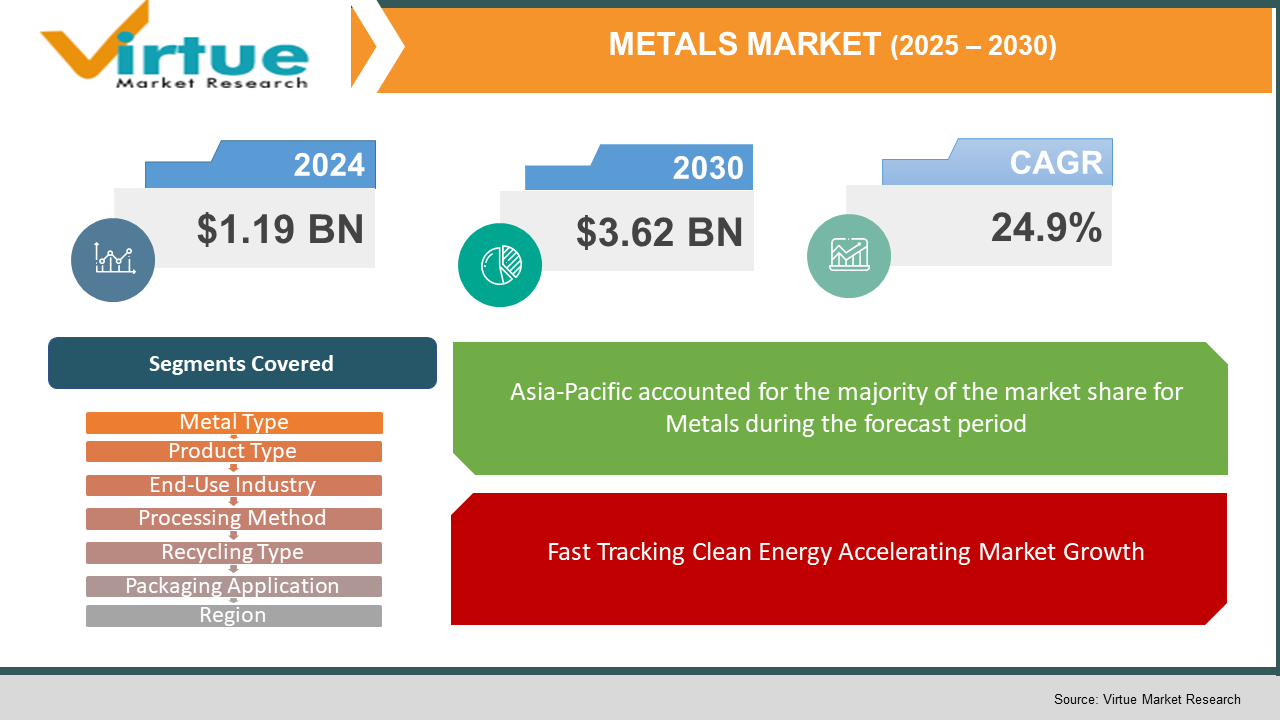

Metals Market Size (2025-2030)

The Metals Market was valued at $1.19 billion in 2024 and is projected to reach a market size of $3.62 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 24.9%.

Metals are elements or alloys that we find in nature, known for being strong and good conductors of heat and electricity. They're crucial for building things like infrastructure, technology, and manufacturing products. We get metals from ores in the Earth's crust using methods like mining and refining. For example, we usually extract iron in blast furnaces, while aluminum is processed using electrolysis. Once we've got the metals, they play a key role in various industries, such as construction, transportation, electronics, and energy. As we push for more sustainable practices, the metals industry is changing a lot. There's a big rise in demand for metals like lithium, cobalt, and nickel, mainly because of electric vehicles and renewable energy. But we still need traditional metals like steel, copper, and aluminum for basic needs in construction and manufacturing. To tackle supply chain issues and reduce risk from global politics, there’s a trend toward sourcing metals locally and exploring different mining options. Technology also matters here—smart sensors and AI are helping companies keep an eye on their equipment and make better maintenance decisions. This not only improves efficiency but also helps cut down on downtime. As the industry embraces automation and data systems, it’s evolving to meet modern demands. Overall, the metals market is becoming essential for sustainable growth and economic stability.

Key Market Insights:

There's a big push for clean energy worldwide, and as more electric vehicles are made, the demand for important metals like lithium, cobalt, nickel, and rare earth elements is expected to jump by over 30%. This is all about meeting the growing need for energy storage and batteries.

When it comes to base metals like steel, copper, and aluminum, they're still important for construction and industry, making up nearly 45% of the metal used globally. Emerging economies are driving a lot of new infrastructure projects, which keeps the demand high.

With the rise of Industry 4.0 tech—like smart sensors and real-time monitoring—metal processing is becoming more efficient, cutting down time and improving production by about 25%.

Countries in Asia-Pacific, Latin America, and Africa are likely to contribute around 50% to the growth in global metal use, as they invest in mining and local manufacturing.

Because of supply chain issues and geopolitical challenges, many countries are looking to diversify where they get their metals. Some regions are boosting domestic production by about 20%, which helps make the supply chain more resilient and keeps the market steady.

Metals Market Key Drivers:

Fast Tracking Clean Energy Accelerating Market Growth.

There's a big push for clean energy around the world, and it's ramping up the need for key metals. Electric vehicles, battery storage, and renewable energy setups like wind turbines and solar panels rely on metals like lithium, nickel, cobalt, copper, and rare earth elements. For example, lithium demand could jump by more than 40 times by 2040, mainly due to electric vehicles and battery storage.

Shifting Supply Chains During Global Tensions.

Recent global issues, especially China’s export controls on rare earth elements, have thrown a wrench in supply chains. This has hit sectors like automotive and electronics hard since China produces about 90% of the world’s rare earths. In response, places like the European Union are working to find new sources of these materials outside of China, looking to cut back on reliance on their exports and strengthen supply chains.

Tech Progress and Recycling Trends.

On the tech front, new advancements are making it easier to extract and process metals, while also pushing for more recycling. Better mining technology helps process lower-quality reserves and boosts recovery rates. Plus, the metal recycling market is expected to grow steadily, mainly because of the rising demand from the clean energy sector and the push for more sustainable options. These changes not only help with increased demand but also aim to lessen the environmental harm linked to metal production.

Metals Market Restraints and Challenges:

Challenges Facing the Global Metals Market Due to Geopolitical Issues and Environmental Concerns.

The global metals market is dealing with a bunch of tough challenges right now, mainly from geopolitical issues, environmental worries, and complicated rules. China's grip on rare earth elements is a big deal, controlling about 90% of the world's production. This has led to export restrictions that mess with supply chains for industries like automotive and electronics. As a result, manufacturers that depend on these key materials are facing production delays and rising costs. On top of that, the drive for clean energy technologies has ramped up the competition for metals like lithium, cobalt, and nickel, which are in short supply and have fluctuating prices. The Democratic Republic of Congo, a key source of cobalt, is dealing with political instability and human rights issues, which makes it tricky to source these materials ethically. Environmental regulations are getting stricter, pushing mining companies to adopt more sustainable practices and tech to cut down on carbon emissions and lessen environmental damage. But these changes can be pricey and come with their tech challenges. Plus, new mining projects take a long time to develop—often over ten years—making it hard for the industry to keep up with the rising demand. To tackle these interconnected challenges, companies need to plan carefully, invest in sustainable tech, and diversify their supply sources to build a stronger and more ethical metals market.

Metals Market Opportunities:

Opportunities in the Global Metals Market During the Clean Energy Shift.

The global metals market is growing rapidly, thanks to the push for clean energy, new technologies, and changing industrial needs. There's a big rise in electric vehicles (EVs), renewable energy systems, and energy storage, leading to higher demand for important metals like lithium, cobalt, nickel, and rare earth elements. For example, lithium demand could shoot up over 40 times by 2040 because of EVs and battery storage needs. Likewise, copper use is expected to jump from 25.5 million tonnes in 2022 to 39.7 million tonnes by 2050, with green energy projects making up 82% of this increase. At the same time, industries like construction and manufacturing are still major users of base metals like steel, aluminum, and copper, especially in growing areas like Asia-Pacific. India's plans to boost its steel production really show the rising need for iron ore imports, pointing to the region's development. To tackle supply chain issues and geopolitical tensions, the European Union is working on new projects for critical raw materials to diversify sources and lessen reliance on a few big suppliers. Technology is also changing the game, with better sensors, data analytics, and wireless communication helping with real-time monitoring and maintenance. AI and machine learning can analyze past data to foresee equipment problems, which improves performance and cuts maintenance costs. Cloud computing is making it easier to store and access machine data, leading to smarter maintenance strategies. All these changes are modernizing how the metals industry operates, promoting automation, and boosting efficiency as the market adjusts to a more sustainable future while dealing with supply and environmental challenges.

METALS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

24.9% |

|

Segments Covered |

By Product Type, Metal type, end user industry, processing method, recycling type, packaging application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Glencore Plc, BHP Group Ltd., Rio Tinto Group, China Baowu Steel Group Corporation Limited, Aluminum Corporation of China Limited (Chalco), Vale S.A., Jiangxi Copper Co., Ltd., Anglo American plc, CMOC Group Limited (formerly China Molybdenum Co., Ltd.), Tata Steel Group |

Metals Market Segmentation:

Metals Market Segmentation: By Metal Type

- Precious Metals

- Base Metals

- Minor Metals

The metals market is seeing rapid growth in minor metals and aluminum. Minor metals like lithium, cobalt, and rare earth elements are in high demand for their use in electric vehicles, renewable energy, and electronics. At the same time, aluminum is growing, especially in Series 1 and Series 2 grades, thanks to its lightweight and recyclable nature, making it perfect for the automotive, construction, and packaging sectors. As sustainability becomes more important, aluminum is becoming essential in many industries.

Base metals and precious metals remain the largest segments of the metals market. Base metals, including copper, aluminum, nickel, and zinc, are widely used in construction and manufacturing. Copper's role in electrical wiring and construction solidifies its importance. Aluminum also plays a big role as one of the most common metals after iron. Precious metals like gold, silver, platinum, and palladium still hold value for investment and jewelry. Gold has seen high demand and record prices, driven by factors like demand from China and global tensions. These metals not only store value but also contribute significantly to industrial processes.

Metals Market Segmentation: By Product Type

- Raw and Processed Metals

- Fabricated Metal Products

The fabricated metal products sector is growing fast, largely due to rising demand in different industries. In 2023, it was worth $21.4 billion and is expected to hit $34.1 billion by 2031, with a growth rate of 9.7%. This growth is fueled by the need for strong yet lightweight materials in the automotive and aerospace fields and by improvements in fabrication methods like automation and 3D printing. Key uses include structural parts, hand tools, and fasteners, which are essential for the construction, manufacturing, and energy sectors.

Raw and processed metals are still the backbone of the global metals market, including iron, steel, aluminum, and copper. In 2023, processed nonferrous metals made up about 36.78% of the market, highlighting their vital role in various industrial uses. Even with the rise of fabricated metal products, raw and processed metals remain crucial for making a wide range of goods and infrastructures.

Metals Market Segmentation: By End-Use Industry

- Construction

- Manufacturing

- Automotive

- Aerospace

- Energy

- Medical

- Consumer Goods

The global metals market is seeing a boom in the energy sector, especially with renewable energy and electric vehicles (EVs) leading the way. As we shift to clean energy, the need for key metals like lithium, cobalt, nickel, and copper is skyrocketing. For example, lithium demand could grow by more than 40 times by 2040, mainly due to the rise of EVs and battery storage. Copper, which is vital for renewable systems like wind turbines and solar panels, will also see a big jump because these technologies use much more copper than traditional systems. This trend is further fueled by better energy storage tech and a worldwide move toward reducing carbon emissions.

On the other hand, the construction industry remains the biggest user of metals, making up over 32% of the market. This is mostly due to the heavy use of steel, aluminum, and copper in building projects. Rapid urban growth, especially in developing countries, and major investments in smart city projects are driving the demand for the construction of metals. Aluminum is popular for its strength and resistance to corrosion, making it great for windows and doors; while copper is essential for wiring and plumbing. The ongoing growth in construction ensures it stays at the top of metal consumption.

Metals Market Segmentation: By Processing Method

- Forging

- Machining

- Casting

- Stamping

- Rolling

- Extrusion

Stamping is quickly becoming the go-to method for metal processing because of its speed and efficiency in high-volume production. It works by placing flat metal sheets in a stamping press, where tools shape them as needed. It's widely used in the automotive world for making parts like doors and hoods. The technique’s ability to create complex parts accurately makes it great for mass production. Plus, improvements in technology have cut production times and costs, helping it spread to different industries.

On the other hand, extrusion is the leading method in metal forming because it's versatile and efficient for creating items with uniform shapes. This process pushes heated metal through a die to make rods, tubes, and other profiles. It’s popular for materials like aluminum and copper, which are common in construction and automotive sectors. Its ability to produce long sections with consistent quality and little waste makes it a smart choice for manufacturers, and it works well with various metals, keeping it at the top in metal forming.

Metals Market Segmentation: By Recycling Type

- Ferrous Metals

- Non-Ferrous Metals

- Scrap Types (Old Scrap, New Scrap)

Non-ferrous metals, especially aluminum, are quickly growing in the recycling market. Aluminum is popular because it can be recycled many times without losing its quality. Industries like automotive, aerospace, construction, and packaging are driving demand. Recycling aluminum is also energy-efficient, saving up to 95% of the energy used to make new aluminum. Efforts are underway to reach nearly 100% recycling rates for aluminum cans by 2050, boosting this segment. The mix of eco benefits, cost savings, and improved recycling tech is making aluminum the fastest-growing part of the non-ferrous metal recycling market.

On the other hand, ferrous metals like iron and steel lead the recycling industry, mainly due to their use in construction, automotive, and manufacturing. Old scrap from things like cars, appliances, and buildings makes up most ferrous metal recycling. Its cost-effectiveness and benefits, like cutting greenhouse gas emissions and saving resources, keep it at its top. New sorting and processing technologies also help make recycling old ferrous scrap more efficient, ensuring it stays important in the recycling scene.

Metals Market Segmentation: Packaging Application

- Cans

- Caps & Closures

- Barrels & Drums

- Materials Used (Aluminum, Steel)

Aluminum cans are the top choice in the metal packaging world, especially for food and drinks. They’re popular because they’re lightweight, resist rust, and are easily recyclable. Aluminum keeps out light, oxygen, and moisture, which helps keep products fresh longer. This makes them ideal for soda, energy drinks, and canned foods, securing a big slice of the global market. Plus, their ability to recycle endlessly fits well with sustainability goals, which boosts their popularity.

Caps and closures are quickly becoming the fastest-growing part of metal packaging. Their main job is to keep products safe and fresh. The rising demand for convenience and tamper-proof features has led to more advanced caps in industries like food, drinks, medicine, and cosmetics. Features like easy-open ends and resealable options improve user experience while using aluminum and steel makes them durable and recyclable. The growth in this area is also driven by the booming packaged goods market and new closure technologies that align with what consumers want.

Metals Market Segmentation: By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

The global metals market shows clear regional differences in production and use, shaped by how developed industries are, available resources, and technology. The Asia-Pacific region leads, making up about 61% of the market, due to rapid growth in places like China and India. North America and Europe followed with around 15% and 13%, backed by solid manufacturing and tech advancements. Latin America contributes about 6%, using its rich minerals from countries like Chile and Peru. The Middle East and Africa together hold about 5%, with ongoing investment in mining and infrastructure.

COVID-19 Impact Analysis on the Metals Market:

The COVID-19 pandemic really shook up the global metals market. First, lockdowns and factory closures cut demand for metals like copper and aluminum, causing prices to drop by 10% to 25% in early 2020. Mine closures added to supply issues, creating a lot of market ups and downs. But as economies started bouncing back, especially in China, demand picked up again thanks to spending on infrastructure and a focus on green energy. This surge pushed metal prices up, with copper and iron ore hitting record highs by mid-2021. The pandemic also sped up trends like electric vehicles and renewable energy, boosting the need for battery metals like nickel and cobalt. Still, the metals market faces ongoing challenges like supply chain issues and geopolitical tensions, keeping prices unstable.

Trends/Developments:

In February 2025, Advanced Technology Services, Inc. rolled out a new guarantee offering a 3x return on investment for its Reliability 360 Machine Health Monitoring service, showing its dedication to reducing downtime through predictive analytics.

In July 2024, I-care Group purchased assets and licenses from Sensirion AG's predictive maintenance line, strengthening its position in industrial maintenance while supporting Sensirion's previous customers.

In June 2024, SPM Instrument AB took over Status Pro Maschinenmesstechnik GmbH in Germany, boosting its reach there and improving customer support in condition monitoring.

In March 2024, KCF Technologies introduced Piezo Sensing in its SMARTsensing suite, delivering detailed data and advanced fault detection to spot problems early across different industries.

In November 2023, SKF added to its condition monitoring lineup with the SKF Enlight Collect IMx-1-EX sensor, a wireless tool that helps catch machine faults before they cause downtime.

Key Players:

- Glencore Plc

- BHP Group Ltd.

- Rio Tinto Group

- China Baowu Steel Group Corporation Limited

- Aluminum Corporation of China Limited (Chalco)

- Vale S.A.

- Jiangxi Copper Co., Ltd.

- Anglo American plc

- CMOC Group Limited (formerly China Molybdenum Co., Ltd.)

- Tata Steel Group

Chapter 1. Metals Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources`

1.5. Secondary Sources

Chapter 2. Metals Market– Executive Summary

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Metals Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Metals Market- Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Metals Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Metals Market – By Metal Type

6.1 Introduction/Key Findings

6.2 Precious Metals

6.3 Base Metals

6.4 Minor Metals

6.5 Y-O-Y Growth trend Analysis By Metal Type

6.6 Absolute $ Opportunity Analysis By Metal Type Metal Type , 2025-2030

Chapter 7. Metals Market – By Packaging Application

7.1 Introduction/Key Findings

7.2 Cans

7.3 Caps & Closures

7.4 Barrels & Drums

7.5 Materials Used (Aluminum, Steel)

7.6 Y-O-Y Growth trend Analysis By Packaging Application

7.7 Absolute $ Opportunity Analysis By Packaging Application , 2025-2030

Chapter 8. Metals Market – By Product Type

8.1 Introduction/Key Findings

8.2 Raw and Processed Metals

8.3 Fabricated Metal Products

8.4 Y-O-Y Growth trend Analysis Product Type

8.5 Absolute $ Opportunity Analysis Product Type , 2025-2030

Chapter 9. Metals Market – By End-Use Industry

9.1 Introduction/Key Findings

9.2 Construction

9.3 Manufacturing

9.4 Automotive

9.5 Aerospace

9.6 Energy

9.7 Medical

9.8 Consumer Goods

9.9 Y-O-Y Growth trend Analysis End-Use Industry

9.10 Absolute $ Opportunity Analysis End-Use Industry , 2025-2030

Chapter 10. Metals Market – By Processing Method

10.1 Introduction/Key Findings

10.2 Forging

10.3 Machining

10.4 Casting

10.5 Stamping

10.6 Rolling

10.7 Extrusion

10.8 Y-O-Y Growth trend Analysis Processing Method

10.9 Absolute $ Opportunity Analysis Processing Method , 2025-2030

Chapter 11. Metals Market – By Recycling Type

11.1 Introduction/Key Findings

11.2 Ferrous Metals

11.3 Non-Ferrous Metals

11.4 Scrap Types (Old Scrap, New Scrap)

11.5 Y-O-Y Growth trend Analysis Recycling Type

11.6 Absolute $ Opportunity Analysis Recycling Type , 2025-2030

Chapter 12. Metals Market , By Geography – Market Size, Forecast, Trends & Insights

12.1. North America

12.1.1. By Country

12.1.1.1. U.S.A.

12.1.1.2. Canada

12.1.1.3. Mexico

12.1.2. By Metal Type

12.1.3. By Packaging Application

12.1.4. By Recycling Type

12.1.5. Product Type

12.1.6. End-Use Industry

12.1.7. Processing Method

12.1.8. Countries & Segments - Market Attractiveness Analysis

12.2. Europe

12.2.1. By Country

12.2.1.1. U.K.

12.2.1.2. Germany

12.2.1.3. France

12.2.1.4. Italy

12.2.1.5. Spain

12.2.1.6. Rest of Europe

12.2.2. By Metal Type

12.2.3. By Recycling Type

12.2.4. By End-Use Industry

12.2.5. Product Type

12.2.6. Packaging Application

12.2.7. Processing Method

12.2.8. Countries & Segments - Market Attractiveness Analysis

12.3. Asia Pacific

12.3.1. By Country

12.3.2.1. China

12.3.2.2. Japan

12.3.2.3. South Korea

12.3.2.4. India

12.3.2.5. Australia & New Zealand

12.3.2.6. Rest of Asia-Pacific

12.3.2. By Metal Type

12.3.3. By Recycling Type

12.3.4. By Packaging Application

12.3.5. Processing Method

12.3.6. Product Type

12.3.7. End-Use Industry

12.3.8. Countries & Segments - Market Attractiveness Analysis

12.4. South America

12.4.3. By Country

12.4.3.3. Brazil

12.4.3.2. Argentina

12.4.3.3. Colombia

12.4.3.4. Chile

12.4.3.5. Rest of South America

12.4.2. By Metal Type

12.4.3. By Recycling Type

12.4.4. By Packaging Application

12.4.5. Product Type

12.4.6. Processing Method

12.4.7. End-Use Industry

12.4.8. Countries & Segments - Market Attractiveness Analysis

12.5. Middle East & Africa

12.5.4. By Country

12.5.4.4. United Arab Emirates (UAE)

12.5.4.2. Saudi Arabia

12.5.4.3. Qatar

12.5.4.4. Israel

12.5.4.5. South Africa

12.5.4.6. Nigeria

12.5.4.7. Kenya

12.5.4.12. Egypt

12.5.4.12. Rest of MEA

12.5.2. By Metal Type

12.5.3. By Packaging Application

12.5.4. By Recycling Type

12.6.5. End-Use Industry

12.5.6. Processing Method

12.5.7. Product Type

12.5.8. Countries & Segments - Market Attractiveness Analysis

Chapter 13. Metals Market – Company Profiles – (Overview, Metal Type Portfolio, Financials, Strategies & Developments)

13.1 Glencore Plc

13.2 BHP Group Ltd.

13.3 Rio Tinto Group

13.4 China Baowu Steel Group Corporation Limited

13.5 Aluminum Corporation of China Limited (Chalco)

13.6 Vale S.A.

13.7 Jiangxi Copper Co., Ltd.

13.8 Anglo American plc

13.9 CMOC Group Limited (formerly China Molybdenum Co., Ltd.)

13.10 Tata Steel Group

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Demand is soaring in construction, automotive, renewable energy, and electronics, fueled by urbanization and infrastructure projects around the globe

Major users are construction, automotive, aerospace, energy, industrial manufacturing, and consumer electronics, all needing base and specialty metals.

Automation, AI, and new metallurgy methods boost efficiency, improve sustainability, and advance alloy development and recycling

The Asia-Pacific region is leading due to industrialization, with North America and Europe following thanks to infrastructure and mining investments

Trends to watch include green metallurgy, recycling metals, smart mining, lightweight materials, and a greater focus on ESG standards.