Metal Stamping Market Size (2024 – 2030)

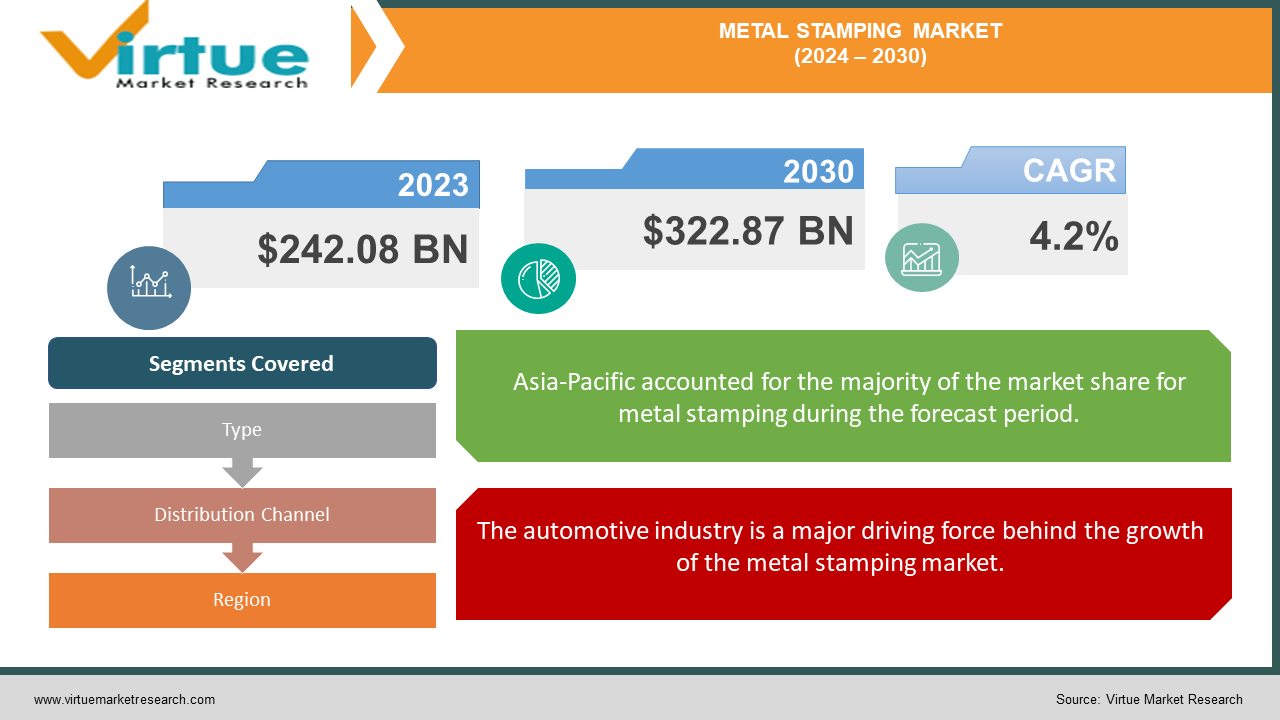

The Global Metal Stamping Market was valued at USD 242.08 Billion in 2023 and is projected to reach a market size of USD 322.87 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.2%.

The metal stamping market is an essential sector in modern manufacturing, playing a critical role in producing parts for various industries such as automotive, aerospace, electronics, and industrial machinery. Metal stamping is a process of using dies and presses to shape flat sheets of metal into desired forms, offering cost-effective, high-volume production of precision components. In 2023, the market continues to thrive due to advancements in stamping technologies and increased demand from end-use industries. The automotive sector remains the largest consumer of metal-stamped parts, driven by the production of vehicles, especially electric and hybrid cars, which require complex metal components. Furthermore, lightweight materials such as aluminum and high-strength steel are increasingly being stamped, offering enhanced durability and fuel efficiency. Technological advancements, like servo presses, are also pushing the metal stamping market forward by improving accuracy and speed while minimizing downtime. These innovations are helping manufacturers meet rising demand while maintaining quality standards. The use of metal stamping is evolving, with increased demand for complex geometries and intricate designs. In particular, the electronics industry is benefiting from precision stamping to produce components used in mobile devices, wearables, and other electronic gadgets. As industries pursue automation and digitalization, metal stamping is essential to maintaining precision and uniformity in mass-produced parts.

Key Market Insights:

Automotive applications accounted for over 52% of total metal stamping market demand in 2023.

The electronics sector's contribution to metal stamping demand was valued at around $42 billion in 2023.

Consumer appliances accounted for approximately 15% of the total metal stamping revenue in 2023.

The aerospace industry consumed nearly 15 million tons of stamped metal components in 2023.

Deep drawing stamping accounted for 23% of the global metal stamping process in 2023.

The average price of metal stamping services was $1.23 per piece in 2023, depending on the complexity and materials used.

40% of metal stamping materials utilized in 2023 were steel, reflecting its dominance in the sector.

12% of total metal stamping production in 2023 was dedicated to manufacturing electrical connectors.

High-precision metal stamping demand surged by 18% in 2023 due to increasing complexity in end-user applications.

17% of all metal stamped parts produced in 2023 were used in power generation equipment.

Metal stamping contributed to the production of over 9 million tons of automotive chassis and structural components in 2023.

Metal Stamping Market Drivers:

The automotive industry is a major driving force behind the growth of the metal stamping market.

With the advent of electric vehicles (EVs) and hybrid technologies, car manufacturers need lightweight but robust components. Metal stamping is useful for making complicated pieces including battery enclosures, body panels, and structural components. Regulations requiring fuel economy and pollution reductions have increased demand for lightweight materials such as aluminum and high-strength steel. Stamped components contribute to these aims by decreasing total vehicle weight while retaining structural integrity.

The second major driver propelling the Metal Stamping Market forward is the ever-expanding array of commercial applications.

One of the key innovations is the widespread adoption of servo presses, which provide precise control over the stamping process. These presses are capable of adjusting force and speed throughout the stamping cycle, allowing manufacturers to produce complex geometries with higher precision. Servo presses also reduce downtime, improve energy efficiency, and enhance the lifespan of dies, contributing to lower operational costs. Other innovations include the integration of computer-aided design (CAD) and computer-aided manufacturing (CAM) technologies, which allow for better simulation and testing before production. This reduces trial-and-error in die creation, speeding up the manufacturing process.

Metal Stamping Market Restraints and Challenges:

The metal stamping market is not without obstacles. One of the major constraints is the significant initial expenditure necessary to purchase and operate stamping equipment and dies. Smaller firms, particularly in emerging nations, may find it too expensive to start up and maintain a stamping plant. Dies, in particular, may be costly to design and manufacture, costing anywhere from tens of thousands to hundreds of thousands of dollars depending on complexity. Another concern is the growing competition from alternative production technologies like 3D printing and plastic injection molding. These techniques provide benefits in terms of flexibility and material savings, especially for small-scale production runs. While metal stamping is highly cost-effective for large-scale manufacturing, its benefits diminish for small batches or highly customized parts, making it less competitive in certain scenarios. Lastly, environmental regulations are becoming stricter, especially in industries such as automotive and aerospace, which rely heavily on metal-stamped parts. Manufacturers must find ways to reduce waste, improve energy efficiency, and recycle materials to stay compliant with environmental laws. While advancements in recycling technologies have made progress, this remains a significant challenge for the industry as a whole.

Metal Stamping Market Opportunities:

The future of the metal stamping market offers a range of exciting opportunities. One key opportunity lies in the growing demand for electric vehicles (EVs). As automakers shift their focus toward EVs, the need for lightweight and high-strength components will increase. Stamped parts, particularly those made from advanced materials like aluminum and high-strength steel, will play a crucial role in improving the range and efficiency of electric vehicles. Companies that can innovate and meet the specific needs of the EV market stand to gain a competitive edge. Another opportunity exists in the electronics industry, where the miniaturization of devices is driving demand for precision metal stamping. The production of intricate components for smartphones, wearables, and other consumer electronics is growing rapidly. Stamping manufacturers that can offer precision stamping for tiny, complex parts will benefit from this trend. Automation and the adoption of Industry 4.0 technologies also present significant growth opportunities. As manufacturers continue to embrace automation, there is a growing need for highly efficient stamping machines equipped with advanced control systems. The integration of robotics, artificial intelligence, and machine learning into stamping processes offers the potential for increased productivity, reduced downtime, and improved quality.

METAL STAMPING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.2% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Gestamp Automoción, S.A. (Spain) , Arconic Corporation (United States) , American Axle & Manufacturing Holdings, Inc. (United States) , CIE Automotive S.A. (Spain) , Interplex Holdings Pte. Ltd. (Singapore) , Aapico Hitech Public Company Limited (Thailand) , Acro Metal Stamping (United States) , Manor Tool & Manufacturing Company (United States) , D&H Industries, Inc. (United States) , Kenmode, Inc. (United States) , Klesk Metal Stamping Co. (United States) , Clow Stamping Company (United States) , Goshen Stamping Company (United States) , Tempco Manufacturing Company, Inc. (United States) |

Metal Stamping Market Segmentation: By Types

-

Blanking

-

Embossing

-

Bending

-

Coining

-

Flanging

-

Deep Drawing

-

Others (including piercing, notching, and lancing)

Blanking remains the most dominant type of metal stamping due to its fundamental role in producing flat, two-dimensional parts and as a preparatory step for other stamping processes. Its wide applicability across various industries, from electronics to construction, ensures its continued dominance. The process's simplicity, speed, and cost-effectiveness for high-volume production contribute to its widespread use.

Deep drawing is experiencing rapid growth due to its versatility in producing complex, three-dimensional shapes from flat metal sheets. This process is particularly valuable in industries like automotive and aerospace, where there's an increasing demand for lightweight, high-strength components with intricate geometries. The ability of deep drawing to create parts with minimal material waste and high dimensional accuracy makes it attractive for manufacturers looking to optimize their production processes.

Metal Stamping Market Segmentation: By Distribution Channel

-

Direct Sales

-

Distributors

-

Online Retail

-

Specialty Stores

-

OEM

OEMs remain the dominant distribution channel for metal-stamped parts. The high volume and long-term nature of OEM contracts, particularly in industries like automotive and appliances, ensure a steady demand for stamped components. The close collaboration between OEMs and stamping companies in product design and development further cements this channel's dominance.

The metal stamping market's fastest-growing channel is internet shopping. This spike is being driven by the rising digitalization of B2B trade, which makes it simpler to find, compare, and purchase stamped components. Online platforms give smaller firms and specialized projects access to a diverse choice of suppliers, encouraging competition and innovation in the sector.

Metal Stamping Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

The Asia Pacific region dominates the worldwide metal stamping industry, accounting for 40% of the total. This supremacy is supported by numerous critical reasons that have propelled the area to the forefront of the sector. China, being the world's industrial powerhouse, drives the region's metal stamping industry. The country's enormous industrial base, which includes automotive, electronics, and consumer products, drives an insatiable need for stamped components.

While the Middle East and Africa area has the lowest market share (5%), it is emerging as the fastest-growing market for metal stamping. This fast expansion is being fueled by a number of factors that are changing the region's industrial environment. The continuous diversification of the Middle Eastern economy is a key driver of growth. Countries such as Saudi Arabia and the United Arab Emirates are actively seeking ways to minimize their reliance on oil earnings. This has resulted in increasing expenditures in industrial areas such as automotive, aerospace, and consumer products, all of which rely heavily on metal stamping components.

COVID-19 Impact Analysis on the Metal Stamping Market:

The COVID-19 pandemic sent shockwaves through global industries, and the metal stamping market was no exception. This unprecedented crisis reshaped market dynamics, exposing vulnerabilities while also catalyzing innovation and adaptation within the sector. In the initial stages of the pandemic, the metal stamping industry faced severe disruptions. Lockdowns and social distancing measures led to temporary closures of manufacturing facilities, causing a sharp decline in production. The automotive sector, a major consumer of stamped parts, experienced a significant slowdown, with vehicle production halting in many regions. This ripple effect cascaded through the supply chain, leaving many stamping companies grappling with reduced orders and idle capacity. Supply chain disruptions emerged as a critical challenge. The global nature of metal stamping supply networks meant that localized outbreaks could have far-reaching consequences. Companies struggled with shortages of raw materials, delayed shipments, and increased logistics costs. This crisis highlighted the vulnerabilities of just-in-time inventory systems and sparked a revaluation of supply chain strategies, with many firms looking to diversify suppliers and increase local sourcing. However, the pandemic also spurred rapid innovation within the industry. Many stamping companies pivoted to produce components for medical equipment and personal protective gear, showcasing the sector's agility. This shift not only provided a lifeline for some businesses but also opened up new market opportunities in the healthcare sector

Latest Trends/ Developments:

One of the most significant developments is the increased use of smart manufacturing technology. Metal stamping firms are embracing Industry 4.0 ideas by incorporating IoT sensors, big data analytics, and artificial intelligence into their operations. These technologies allow for real-time monitoring of stamping operations, predictive maintenance of equipment, and data-driven optimization of production parameters. The end effect is increased productivity, less downtime, and better quality control. Additive manufacturing is gaining traction in the stamping business, not as a replacement, but as a supplementary technique. 3D printing is being utilized to produce complicated stamping dies with conformal cooling channels, which has the potential to dramatically increase stamping efficiency and quality. Some companies are also exploring hybrid manufacturing approaches that combine stamping with additive techniques to produce parts with features that would be impossible or cost-prohibitive with stamping alone. The trend towards lightweight in industries like automotive and aerospace is driving innovation in materials and stamping techniques. Advanced high-strength steels, aluminum alloys, and even some composite materials are becoming more common in stamping operations.

Key Players:

-

Gestamp Automoción, S.A. (Spain)

-

Arconic Corporation (United States)

-

American Axle & Manufacturing Holdings, Inc. (United States)

-

CIE Automotive S.A. (Spain)

-

Interplex Holdings Pte. Ltd. (Singapore)

-

Aapico Hitech Public Company Limited (Thailand)

-

Acro Metal Stamping (United States)

-

Manor Tool & Manufacturing Company (United States)

-

D&H Industries, Inc. (United States)

-

Kenmode, Inc. (United States)

-

Klesk Metal Stamping Co. (United States)

-

Clow Stamping Company (United States)

-

Goshen Stamping Company (United States)

-

Tempco Manufacturing Company, Inc. (United States)

Chapter 1. Metal Stamping Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Metal Stamping Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Metal Stamping Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Metal Stamping Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Metal Stamping Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Metal Stamping Market – By Types

6.1 Introduction/Key Findings

6.2 Blanking

6.3 Embossing

6.4 Bending

6.5 Coining

6.6 Flanging

6.7 Deep Drawing

6.8 Others (including piercing, notching, and lancing)

6.9 Y-O-Y Growth trend Analysis By Types

6.10 Absolute $ Opportunity Analysis By Types, 2024-2030

Chapter 7. Metal Stamping Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Direct Sales

7.3 Distributors

7.4 Online Retail

7.5 Specialty Stores

7.6 OEM

7.7 Y-O-Y Growth trend Analysis By Distribution Channel

7.8 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Metal Stamping Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Types

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Types

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Types

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Types

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Types

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Metal Stamping Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Gestamp Automoción, S.A. (Spain)

9.2 Arconic Corporation (United States)

9.3 American Axle & Manufacturing Holdings, Inc. (United States)

9.4 CIE Automotive S.A. (Spain)

9.5 Interplex Holdings Pte. Ltd. (Singapore)

9.6 Aapico Hitech Public Company Limited (Thailand)

9.7 Acro Metal Stamping (United States)

9.8 Manor Tool & Manufacturing Company (United States)

9.9 D&H Industries, Inc. (United States)

9.10 Kenmode, Inc. (United States)

9.11 Klesk Metal Stamping Co. (United States)

9.12 Clow Stamping Company (United States)

9.13 Goshen Stamping Company (United States)

9.14 Tempco Manufacturing Company, Inc. (United States)

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The global automotive industry is expanding, leading to increased demand for metal-stamped components.

The prices of metals used in stamping, such as steel and aluminum, can fluctuate significantly, affecting production costs.

Manor Tool & Manufacturing Company (United States), D&H Industries, Inc. (United States), Kenmode, Inc. (United States), Klesk Metal Stamping Co. (United States), Clow Stamping Company (United States), Goshen Stamping Company (United States).

Asia Pacific is the most dominant region in the market, accounting for approximately 40% of the total market share.

Middle East and Africa is the fastest-growing region in the market.