Metal Plating and Finishing Market Size (2024-2030)

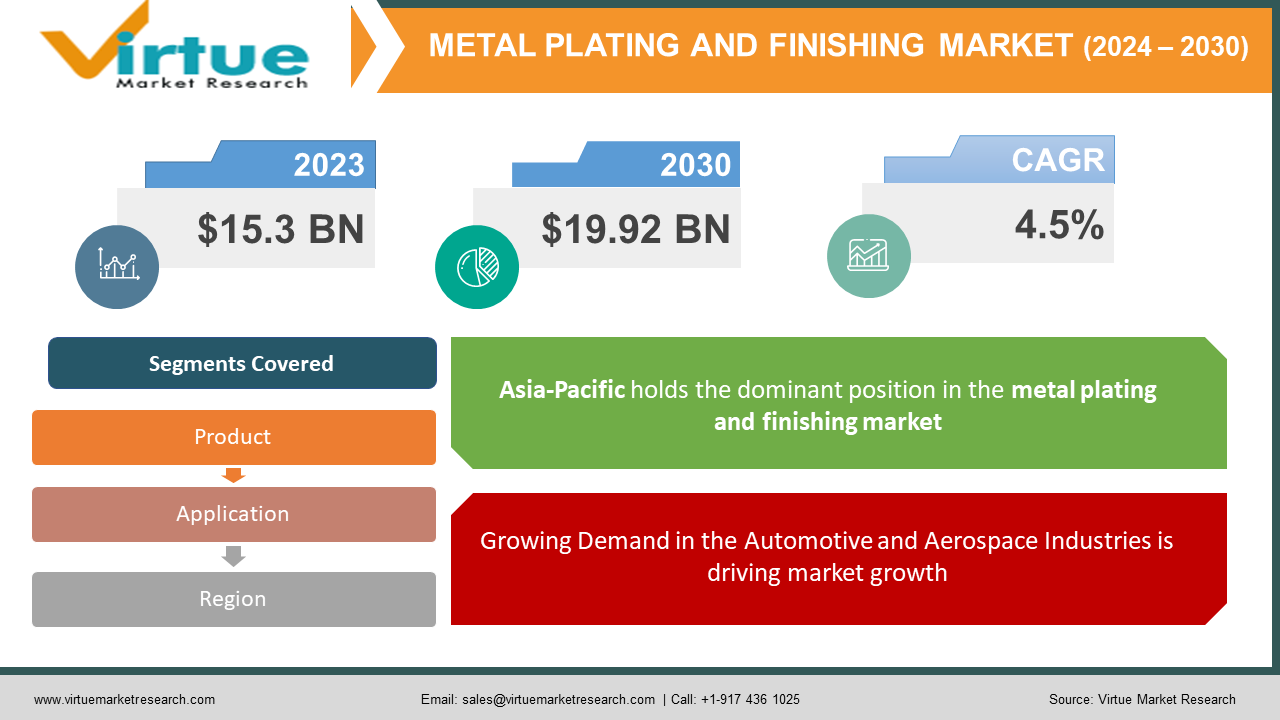

The Global Metal Plating and Finishing Market was valued at USD 15.3 billion in 2024 and is projected to grow at a CAGR of 4.5% from 2025 to 2030. The market is expected to reach approximately USD 19.92 billion by 2030.

Metal plating and finishing are essential processes that enhance the durability, appearance, and resistance of metal surfaces. These processes find extensive use across various sectors, including automotive, aerospace, electronics, and industrial machinery, to protect components from corrosion, improve wear resistance, and add aesthetic value. With increasing industrial production and technological advancements in surface finishing, the demand for metal plating and finishing services is expected to see substantial growth over the forecast period.

Key Market Insights

- The automotive industry accounts for the largest share of the metal plating and finishing market, representing over 30% of global demand in 2023, driven by the need for corrosion-resistant components in vehicles.

- The aerospace sector is expected to witness a significant CAGR of around 5.2% from 2025 to 2030 due to heightened demand for lightweight, corrosion-resistant materials for aircraft components.

- Asia-Pacific leads in market volume, driven by industrial growth and manufacturing activities in China, India, and Southeast Asia. This region held approximately 40% of the market share in 2023.

- Electroplating remains the dominant method within metal finishing, accounting for 50% of the market share in 2023, as it provides a cost-effective and versatile finishing solution across various metals.

- Environmentally friendly plating alternatives, such as electroless plating, are gaining popularity due to regulatory pressures for reduced waste and environmental impacts in Europe and North America.

- Stringent regulations, especially in Europe and North America, are encouraging the adoption of eco-friendly plating materials, contributing to an estimated 6% CAGR in the green plating segment.

Global Metal Plating and Finishing Market Drivers

Growing Demand in the Automotive and Aerospace Industries is driving market growth:

The automotive and aerospace industries represent two of the most significant sectors for metal plating and finishing applications. In the automotive sector, metal plating enhances corrosion resistance, appearance, and longevity of components such as engine parts, exhaust systems, and decorative trim. The aerospace industry similarly benefits from metal finishing, as it requires materials that can withstand extreme conditions and protect against corrosion, wear, and tear. The shift toward electric vehicles (EVs) is further driving demand for metal plating on batteries, connectors, and electronic components, while the aviation industry's focus on weight reduction and durability continues to push innovation in metal finishing processes. These demands are anticipated to drive significant growth in the metal plating and finishing market as manufacturers seek cost-effective, long-lasting solutions.

Expansion of Industrial Production and Manufacturing Activities is driving market growth:

Industrial production and manufacturing activities are on the rise globally, especially in Asia-Pacific and emerging economies. Industrial manufacturing demands metal finishing for various equipment, machinery, and tools to improve wear resistance, extend equipment life, and ensure safety. Key industries such as machinery, electronics, consumer goods, and infrastructure rely on robust metal finishing to meet durability and safety standards. Countries like China, India, and Brazil are witnessing rapid industrial growth, which, in turn, increases the demand for metal plating. The steady expansion of these industries globally has a multiplier effect on the market for metal plating and finishing, as each sector seeks reliable solutions to improve product quality and longevity.

Increased Focus on Sustainable and Eco-friendly Plating Solutions is driving market growth:

With increasing environmental regulations and consumer demand for sustainable manufacturing practices, the metal plating and finishing industry is shifting toward eco-friendly solutions. Traditional methods like chrome plating involve hazardous chemicals and generate toxic waste, leading to strict regulations, particularly in North America and Europe. In response, manufacturers are adopting electroless plating, water-based solutions, and recyclable plating materials that reduce waste and energy consumption. Additionally, technological advancements are enabling high-performance results with less environmental impact, aligning with corporate sustainability goals. This trend toward sustainable solutions is creating new growth opportunities in the metal plating and finishing market, particularly among companies that prioritize eco-friendly production.

Global Metal Plating and Finishing Market Challenges and Restraints

Stringent Environmental Regulations and Compliance Costs is restricting market growth:

The metal plating and finishing industry faces strict environmental regulations, particularly in developed regions like North America and Europe. Regulations concerning hazardous waste, toxic chemical emissions, and workplace safety standards necessitate compliance with complex laws, including the EPA's restrictions on chemicals such as cadmium and chromium. Compliance costs for small and mid-sized companies can be high, as they must implement waste treatment systems, meet air and water quality standards, and safely manage hazardous materials. The need for frequent audits, environmental permits, and record-keeping adds to the operational expenses, which can strain companies’ profitability. These regulatory pressures are expected to challenge the market, pushing smaller players out and potentially reducing competition.

High Initial Investment and Maintenance Costs is restricting market growth:

Metal plating and finishing processes require specialized equipment, trained personnel, and stringent safety measures, leading to high initial capital investment and maintenance costs. High-performance plating equipment and advanced surface treatment systems involve costly machinery and significant infrastructure, which can be a barrier for companies, especially in emerging economies. Additionally, the use of advanced materials and techniques, such as electroplating for aerospace-grade components, requires substantial investment in R&D and skilled labor. The ongoing maintenance of plating equipment and adherence to safety and quality standards further drive up costs, posing a challenge for smaller companies to remain competitive without significant capital.

Market Opportunities

The metal plating and finishing market presents vast opportunities, especially as industries prioritize durability, corrosion resistance, and aesthetic appeal in metal components. Innovations in plating technologies, such as plasma finishing and PVD (Physical Vapor Deposition), offer advanced solutions that cater to high-performance industries. Growing demand for electric vehicles (EVs) offers additional opportunities for metal plating, particularly for battery connectors and electronic circuitry. Additionally, the shift toward environmentally sustainable plating alternatives aligns with consumer demand and regulatory trends, creating new market openings. Emerging markets in Asia-Pacific and Latin America are seeing an increase in automotive and industrial manufacturing, providing further growth opportunities for plating services. With industrial automation and IoT integration in manufacturing, metal finishing is essential to ensure the quality and reliability of sensors, connectors, and machinery. Collectively, these trends represent a robust growth trajectory for the global metal plating and finishing industry, which can capitalize on both established demand and emerging needs for advanced and sustainable finishing solutions.

METAL PLATING AND FINISHING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.5% |

|

Segments Covered |

By Product, application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Atotech, DuPont, Pioneer Metal Finishing, Aalberts Surface Treatment, and Interplex Industries. |

Metal Plating and Finishing Market Segmentation

Metal Plating and Finishing Market Segmentation By Product:

- Electroplating

- Electroless Plating

- Anodizing

- Physical Vapor Deposition (PVD)

- Others (such as Powder Coating)

Electroplating is the leading segment, constituting over 50% of the market due to its versatility, cost-effectiveness, and applicability across various industries such as automotive, electronics, and aerospace.

Metal Plating and Finishing Market Segmentation By Application:

- Automotive

- Aerospace

- Electronics

- Industrial Machinery

- Others (including jewelry, medical devices)

The automotive segment leads the market, accounting for the largest share due to its high demand for corrosion-resistant, durable finishes on engine parts, trims, and various metal components.

Metal Plating and Finishing Market Regional Segmentation

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

Asia-Pacific holds the dominant position in the metal plating and finishing market, driven by rapid industrialization, economic growth, and increased manufacturing activities in countries like China, India, Japan, and South Korea. This region is witnessing a high demand for metal finishing solutions in automotive, electronics, and industrial applications due to large-scale production and export activities. Government support for infrastructure development, combined with rising disposable income, contributes to the expansion of industries that depend on metal finishing, thus solidifying Asia-Pacific’s leading position in the global market.

COVID-19 Impact Analysis on the Metal Plating and Finishing Market

The COVID-19 pandemic affected the metal plating and finishing market due to disruptions in manufacturing, supply chains, and demand fluctuations across key industries like automotive and aerospace. Lockdowns and travel restrictions caused a temporary halt in industrial production and delays in projects, reducing demand for metal finishing services. However, as industries adjusted to the "new normal" and manufacturing activities resumed, the demand for high-quality metal plating rebounded, especially in sectors such as medical devices and electronics. Increased focus on hygiene and sanitation also created demand for antimicrobial and protective coatings, which are integral to metal finishing processes. The pandemic accelerated the trend toward automation in plating facilities, with manufacturers investing in automated and IoT-enabled solutions to minimize dependency on manual labor. Overall, while COVID-19 posed challenges initially, it also stimulated technological advancements and operational efficiencies that are expected to benefit the metal plating and finishing industry in the long term.

Latest Trends/Developments

The metal plating and finishing market is witnessing notable trends such as the shift towards sustainable and eco-friendly plating methods due to environmental regulations. Alternatives to traditional chrome plating, such as trivalent chromium and electroless nickel, are being adopted to reduce toxic waste and environmental impact. The demand for advanced finishes in electronics, aerospace, and medical sectors has spurred innovations in nanocoating and plasma finishing, providing superior surface performance at a microscopic level. Automation in metal finishing facilities, including robotic arms and IoT-enabled quality checks, is enhancing process efficiency, reducing labor dependency, and improving safety standards. Additionally, lightweight and high-performance metal coatings, particularly for electric vehicles and aerospace components, represent a growing segment. These developments are shaping the future of the metal plating and finishing market, highlighting an increasing focus on sustainable and high-performance solutions.

Key Players

- Atotech

- DuPont

- Pioneer Metal Finishing

- Aalberts Surface Treatment

- Interplex Industries

- Anoplate Corporation

- C. Uyemura & Co.

- Peninsula Metal Finishing

- Lincoln Industries

- Allied Finishing Inc.

Chapter 1. GLOBAL METAL PLATING AND FINISHING MARKET– SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL METAL PLATING AND FINISHING MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. GLOBAL METAL PLATING AND FINISHING MARKET– COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL METAL PLATING AND FINISHING MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.4.5. Threat of Substitutes

Chapter 5. GLOBAL METAL PLATING AND FINISHING MARKET- LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL METAL PLATING AND FINISHING MARKET– BY Product

6.1. Introduction/Key Findings

6.2. Electroplating

6.3. Electroless Plating

6.4. Anodizing

6.5. Physical Vapor Deposition (PVD)

6.6. Others (such as Powder Coating)

6.7. Y-O-Y Growth trend Analysis By Product

6.8. Absolute $ Opportunity Analysis By Product , 2024-2030

Chapter 7. GLOBAL METAL PLATING AND FINISHING MARKET– BY APPLICATION

7.1. Introduction/Key Findings

7.2. Automotive

7.3. Aerospace

7.4. Electronics

7.5. Industrial Machinery

7.6. Others (including jewelry, medical devices)

7.7. Y-O-Y Growth trend Analysis By APPLICATION

7.8. Absolute $ Opportunity Analysis By APPLICATION , 2024-2030

Chapter 8. GLOBAL METAL PLATING AND FINISHING MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By Product

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Application

8.2.3. By Product

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Application

8.3.3. By Product

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Application

8.4.3. By Product

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Application

8.5.3. By Product

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. GLOBAL METAL PLATING AND FINISHING MARKET – Company Profiles – (Overview, Product Product s Portfolio, Financials, Strategies & Development

9.1. Atotech

9.2. DuPont

9.3. Pioneer Metal Finishing

9.4. Aalberts Surface Treatment

9.5. Interplex Industries

9.6. Anoplate Corporation

9.7. C. Uyemura & Co.

9.8. Peninsula Metal Finishing

9.9. Lincoln Industries

9.10. Allied Finishing Inc

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Metal Plating and Finishing Market was valued at USD 15.3 billion in 2024 and is projected to grow at a CAGR of 4.5% from 2025 to 2030. The market is expected to reach approximately USD 19.92 billion by 2030.

Key drivers include rising demand in automotive and aerospace industries, expansion of industrial production, and a shift towards sustainable plating solutions.

The market segments include electroplating, electroless plating, anodizing, PVD, and powder coating by product, and automotive, aerospace, electronics, and industrial machinery by application.

Asia-Pacific is the dominant region due to rapid industrialization and increased manufacturing activities, especially in countries like China and India.

Leading players include Atotech, DuPont, Pioneer Metal Finishing, Aalberts Surface Treatment, and Interplex Industries.