Metal Coatings Market Size (2024 – 2030)

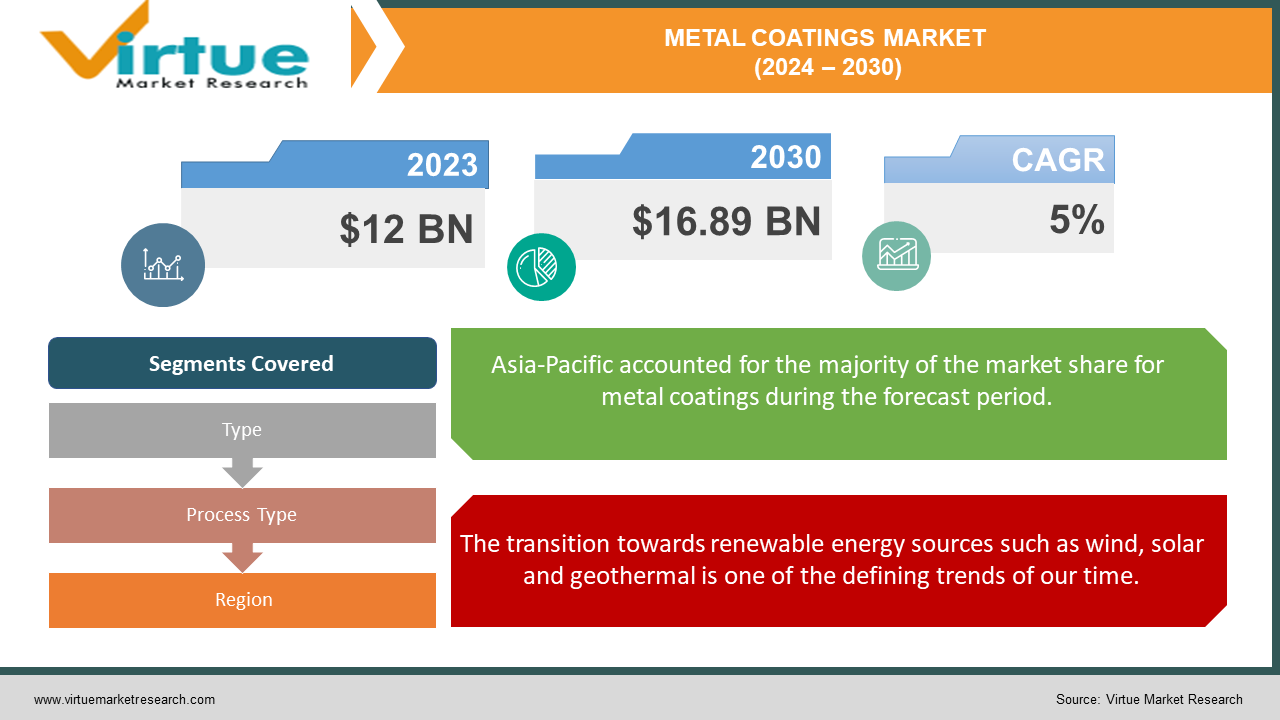

The Global Metal Coatings Market was valued at USD 12 Billion in 2023 and is projected to reach a market size of USD 16.89 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5%.

The metal coatings market plays a vital role in safeguarding and enhancing the properties of metals across diverse industries. These coatings act as a protective and functional layer, extending the lifespan of metals, improving their aesthetics, and enabling them to perform in harsh environments. The booming renewable energy sector with its focus on wind turbines, solar panels, and geothermal installations, presents significant opportunities for metal coatings used in these applications. The demand for visually appealing and functional metal products across various industries like automotive and consumer electronics is driving the use of advanced coatings that offer both aesthetics and performance benefits. The development of new industries and infrastructure in emerging economies is creating a growing demand for metal coatings used in the construction, manufacturing, and transportation sectors.

Key Market Insights:

Polyester coatings hold the largest market share, exceeding $5. 5 billion in 2023, due to their affordability and versatility.

Epoxy coatings are expected to witness the fastest growth rate at a CAGR exceeding 7.2 % due to their superior chemical resistance.

Coil coating dominates the market, accounting for over $6.8 billion in 2023 due to its efficiency in high-volume applications such as construction materials.

Hot-dip galvanising is projected to reach over $4 billion by 2032 due to its effectiveness in preventing corrosion on steel structures.

The building and construction industry is the largest consumer, exceeding $7.2 billion in 2023, driven by the need for durable and weather-resistant metals.

The automotive industry is projected to reach over $4.5 billion by 2032 due to the growing demand for lightweight and corrosion-resistant car parts.

Global infrastructure spending is expected to surpass $5.7 trillion annually by 2030, propelling demand for corrosion-resistant coated metals in bridges, buildings and power grids.

The surging renewable energy sector, with a projected market value exceeding $1.8 trillion by 2030, will require a significant amount of metal coatings for wind turbines, solar panels, and geothermal installations.

Stringent environmental regulations are fostering a $22.3 billion global market for waterborne and E-coatings by 2027, offering eco-friendly alternatives to traditional solvent-based coatings.

The increasing demand for visually appealing and high-performance metal products in automotive, appliances, and consumer electronics is expected to drive a $3.8 billion market for advanced coatings by 2028.

Metal Coatings Market Drivers:

The global infrastructure landscape is undergoing a significant transformation. As populations grow and urbanization accelerates, the demand for robust and sustainable infrastructure is paramount.

Infrastructure projects are often exposed to harsh elements such as rain, wind, and extreme temperatures. Uncoated metals are susceptible to corrosion, leading to structural weakening, safety hazards, and expensive repairs. Metal coatings, particularly those with zinc or epoxy formulations act as a protective barrier, significantly extending the lifespan of metal components in bridges, buildings and power grids. Modern infrastructure projects are not solely about functionality. They also play a role in shaping the visual identity of our cities and landscapes. Metal coatings can be formulated to offer a variety of colours and finishes, allowing for aesthetically pleasing infrastructure that complements its surroundings. Additionally, certain coatings can enhance specific functionalities, such as improved heat reflection for buildings in hot climates or self-cleaning properties for structures exposed to dust and pollution.

The transition towards renewable energy sources such as wind, solar and geothermal is one of the defining trends of our time.

Wind turbines operating in harsh offshore environments are exposed to constant wind, salt spray, and extreme temperatures. Metal coatings, particularly those with zinc-rich formulations play a vital role in protecting wind turbine components from corrosion, ensuring their optimal performance and lifespan. While solar panels are generally durable, metal coatings can further enhance their efficiency and longevity. Anti-reflective coatings can improve light absorption, while hydrophobic coatings can repel dust and dirt maximising energy production. Geothermal energy utilizes the Earth's heat to generate power. Metal coatings are crucial for protecting pipelines and other metal components used in geothermal plants from the corrosive and high-temperature conditions encountered in geothermal operations.

Metal Coatings Market Restraints and Challenges:

Prices of key raw materials like zinc, nickel, and chromium can fluctuate based on global economic conditions, supply chain disruptions, and geo-political factors. These fluctuations can significantly impact production costs for metal coating manufacturers, squeezing profit margins and hindering their ability to invest in research and development. Sudden price hikes in raw materials can translate to increased costs for metal coatings. This can make it challenging for manufacturers of end products, like automobiles or construction materials, to maintain affordability for their customers. In a competitive market, Price sensitivity can lead to a decline in demand for coated metals. Developing and implementing new coating technologies and processes to comply with stricter VOC emission regulations can be expensive for manufacturers. The additional costs associated with compliant coatings can be a burden, particularly for smaller players in the market. While environmentally friendly coatings are a necessity, some may not offer the same level of performance or durability as traditional solvent-based alternatives. This can lead to challenges in meeting specific application requirements, especially in industries such as automotive or construction where performance is paramount.

Metal Coatings Market Opportunities:

The integration of nanotechnology in metal coatings holds immense potential. Nanoparticles can be incorporated into coatings to create unique properties such as superior scratch resistance, self-healing capabilities, and improved heat dissipation. Modern consumers are increasingly drawn to products that not only perform well but also boast a visually appealing design. Metal coatings can be formulated to offer a wider range of colours and finishes, while simultaneously imbuing the metal with functional properties. The burgeoning Internet of Things (IoT) landscape opens doors for the development of smart coatings. These coatings can be embedded with sensors that monitor factors such as temperature, pressure or corrosion, enabling real-time data collection and predictive maintenance. This can be particularly valuable in industries such as aerospace or oil and gas where early detection of potential issues is crucial.

METAL COATINGS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5% |

|

Segments Covered |

By Type, Process Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

AkzoNobel N.V., Axalta Coating Systems Ltd., BASF SE, PPG Industries Inc., The Sherwin-Williams Company, Nippon Paint Holdings Co., Ltd., Kansai Paint Co., Ltd., Hempel A/S, Jotun Group, Henkel AG & Co. KGaA |

Metal Coatings Market Segmentation: By Type

-

Polyester Coatings

-

Epoxy Coatings

-

Polyurethane Coatings

-

Fluoropolymer Coatings

-

Other Resins

Polyester (35-40%) Polyester coatings reign supreme in the metal coatings market, capturing a significant market share. Polyester resins are generally the most affordable option, making them an attractive choice for budget-conscious manufacturers. The versatility of polyester coatings translates to a broad application base. They are commonly used in construction materials (roofing sheets, cladding), appliances, furniture, and even automotive parts for non-critical components. Polyester's dominance in the metal coatings market can be attributed to its affordability, versatility, and ease of application. These factors make it a go-to choice for a wide range of applications, particularly in cost-sensitive sectors like construction and basic appliance manufacturing. Additionally, advancements in polyester technology have led to the development of more durable and weather-resistant formulations, further solidifying its position.

The market for polyurethane coatings is expanding significantly due to its all-around performance qualities. This rise is being driven by the growing need across a range of industries for robust and visually beautiful metal components. Because of their remarkable flexibility, polyurethane coatings are perfect for applications where resistance to movement or vibration is required. They also have better resistance to abrasion, which is important for surfaces that are worn down. These coatings boast excellent weatherability, withstanding harsh sunlight, rain, and extreme temperatures. This makes them well-suited for outdoor applications like architectural panels, building materials, and automotive components.

Metal Coatings Market Segmentation: By Process Type

-

Coil Coating

-

Hot-Dip Galvanizing

-

Electroplating

-

Powder Coating

-

Other Processes

Coil Coating (Estimated Market Share: 45-50%) Reigning supreme in the metal coatings market is coil coating, a high-volume, continuous process ideal for applications requiring consistent quality and efficiency. Uncoiled metal sheets are passed through a series of stations where cleaning, pre-treatment, coating application, and curing occur. Coil coating is a rapid and cost-effective process, making it ideal for large-scale production of pre-finished metal sheets. The continuous nature of the process ensures uniform coating thickness and finish across the entire metal sheet. Coil coating can accommodate a wide range of coating materials and thicknesses, catering to various applications.

While coil coating and hot-dip galvanizing remain dominant forces, the fastest-growing segment in the metal coatings market is powder coating. This environmentally friendly process offers several advantages that are increasingly attractive to manufacturers and consumers alike. Powder coatings eliminate the use of solvents, minimizing VOC emissions and contributing to a more sustainable production process. This aligns well with growing environmental concerns and regulations. Powder coatings offer excellent adhesion, abrasion resistance, and weatherability, making them suitable for a wide range of applications. Powder coatings can be formulated in a vast array of colours and finishes, providing both aesthetic appeal and functional properties. The high transfer efficiency of powder coating minimizes material waste compared to traditional solvent-based methods.

Metal Coatings Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

The Middle East & Africa

With a market share of roughly 30–35%, the Asia-Pacific region leads the global Metal Coatings industry. The region's fast industrialization, the rising need for infrastructure development, and the expansion of numerous manufacturing sectors, especially in China and India, are all responsible for this domination. The Asia-Pacific market's expansion has also been aided by the existence of significant metal coating providers and the availability of cost-effective manufacturing capabilities.

On the other hand, the Asia-Pacific region is also considered the fastest-growing market for metal coatings. The region's economic development, coupled with the increasing adoption of advanced manufacturing technologies and the focus on sustainable practices, has created a favourable environment for the growth of the Metal Coatings market. Additionally, the rising demand for consumer goods and the expansion of industries such as automotive and electronics have fueled the need for metal coatings with enhanced properties and aesthetics.

COVID-19 Impact Analysis on the Metal Coatings Market:

Lockdowns in key manufacturing hubs like China, a major producer of raw materials for coatings, limited production and export capabilities. This scarcity led to price hikes and uncertainty for manufacturers of metal coatings. Restrictions on international travel and shipping caused delays and disruptions in the movement of raw materials and finished coatings. This not only impacted production timelines but also increased logistics costs. The pandemic forced manufacturers to re-evaluate their reliance on single-source suppliers. This led to a trend towards diversifying supplier networks to mitigate future disruptions and ensure a more stable supply of raw materials. Lockdowns and economic uncertainty led to the postponement or cancellation of construction projects. This resulted in a decreased demand for metal coatings used in roofing, cladding, and building materials. The heightened awareness of hygiene during the pandemic fueled the demand for antimicrobial coatings. These coatings can be applied to metals used in public spaces, healthcare facilities, and food processing plants, offering enhanced protection against the spread of germs.

Latest Trends/ Developments:

Nanoparticles can significantly improve the hardness and scratch resistance of metal coatings, extending the lifespan of coated products. This is particularly valuable for applications in harsh environments or high-wear situations. Coatings embedded with self-healing nanoparticles can repair minor scratches or damage autonomously, reducing maintenance requirements and improving product longevity. This technology is particularly promising for applications in self-healing infrastructure or automotive components. Nanoparticles can create a more effective barrier against corrosion, extending the lifespan of metals in harsh environments like marine applications or offshore structures. The use of bio-derived materials like vegetable oils or biopolymers offers a sustainable alternative to traditional solvent-based coatings. These bio-based coatings boast a lower environmental footprint while potentially offering comparable performance characteristics. Powder coatings are a dry coating technology that eliminates the use of solvents altogether. This translates to lower VOC emissions and a more sustainable coating process. Additionally, powder coatings often boast superior performance characteristics, including improved durability and scratch resistance.

Key Players:

-

AkzoNobel N.V.

-

Axalta Coating Systems Ltd.

-

BASF SE

-

PPG Industries Inc.

-

The Sherwin-Williams Company

-

Nippon Paint Holdings Co., Ltd.

-

Kansai Paint Co., Ltd.

-

Hempel A/S

-

Jotun Group

-

Henkel AG & Co. KGaA

Chapter 1. Metal Coatings Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Metal Coatings Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Metal Coatings Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Metal Coatings Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Metal Coatings Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Metal Coatings Market – By Type

6.1 Introduction/Key Findings

6.2 Polyester Coatings

6.3 Epoxy Coatings

6.4 Polyurethane Coatings

6.5 Fluoropolymer Coatings

6.6 Other Resins

6.7 Y-O-Y Growth trend Analysis By Type

6.8 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Metal Coatings Market – By Process Type

7.1 Introduction/Key Findings

7.2 Coil Coating

7.3 Hot-Dip Galvanizing

7.4 Electroplating

7.5 Powder Coating

7.6 Other Processes

7.7 Y-O-Y Growth trend Analysis By Process Type

7.8 Absolute $ Opportunity Analysis By Process Type, 2024-2030

Chapter 8. Metal Coatings Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Process Type

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Process Type

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Process Type

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Process Type

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Process Type

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Metal Coatings Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 AkzoNobel N.V.

9.2 Axalta Coating Systems Ltd.

9.3 BASF SE

9.4 PPG Industries Inc.

9.5 The Sherwin-Williams Company

9.6 Nippon Paint Holdings Co., Ltd.

9.7 Kansai Paint Co., Ltd.

9.8 Hempel A/S

9.9 Jotun Group

9.10 Henkel AG & Co. KGaA

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The construction industry remains the largest consumer of metal coatings. Growing urbanization, infrastructure development projects, and increasing demand for durable building materials all contribute to the need for coated metals in roofing, cladding, and structural components.

The metal coatings industry relies on various raw materials like resins, solvents, and pigments. Price fluctuations in these materials due to factors like global economic conditions, supply chain disruptions, or resource scarcity can significantly impact production costs and profitability for manufacturers.

AkzoNobel N.V, Axalta Coating Systems Ltd., BASF SE, PPG Industries Inc., The Sherwin-Williams Company, Nippon Paint Holdings Co., Ltd., Kansai Paint Co., Ltd., Hempel A/S, Jotun Group, Henkel AG & Co. KGaA.

Asia-Pacific has emerged as the most dominant player in the MEA smart irrigation market, commanding an impressive 35% share.

Asia-Pacific emerges as the fastest-growing region in this sector. Its burgeoning population, rising disposable incomes, and rapid urbanization have fueled the demand.