Merchant Marketing Software Market Size (2024 – 2030)

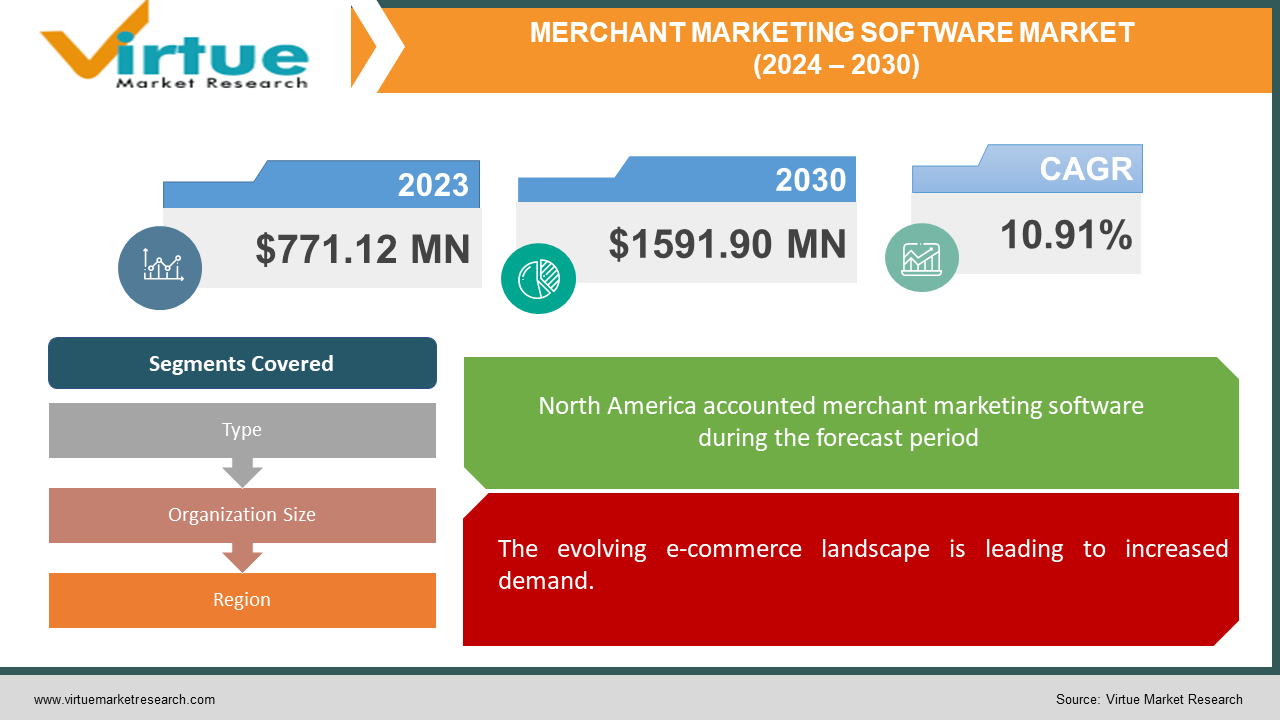

The global merchant marketing software market was valued at USD 771.12 million in 2023 and is projected to reach a market size of USD 1591.90 million by the end of 2030. Over the forecast period of 2024–2030, the market is expected to grow at a CAGR of 10.91%.

The market for merchant marketing software is made up of a wide range of software products that are intended to help retailers, merchants, and eCommerce companies manage and maximize their marketing initiatives. To meet the specific requirements of retailers, these software platforms usually provide a variety of features and capabilities, such as campaign automation, social media management, email marketing, consumer segmentation, and loyalty programs. In the past, companies have gradually digitized their marketing campaigns by using social media and simple email tools to connect with consumers, according to the merchant marketing software market. Presently, omnichannel campaigns that are highly personalized and encourage consumer engagement and loyalty can be created by merchants due to innovations in automation, artificial intelligence, and data analytics. In the future, the market's reach will only grow as advanced technologies such as machine learning and predictive analytics enable retailers to instantly provide hyper-targeted marketing experiences to customers, thereby changing the way that consumers interact with brands and conduct business.

Key Market Insights:

According to a report published in Forbes, 2021, the adoption of merchant marketing software among small and medium-sized enterprises (SMEs) has increased by 25% in the past two years, with over 60% of SMEs now utilizing such software to enhance their marketing efforts.

Businesses leveraging merchant marketing software report an average return on investment (ROI) of over 300%, with every dollar spent on these platforms resulting in a threefold increase in revenue generation (Source: Gartner).

Merchant Marketing Software Market Drivers:

The evolving e-commerce landscape is leading to increased demand.

The ever-growing e-commerce market compels merchants to find innovative ways to reach and engage customers. Merchant marketing software equips them with tools for omnichannel marketing, data-driven customer segmentation, and personalized marketing campaigns, all of which are crucial for success in the competitive e-commerce landscape.

Increasing customer acquisition costs is also a major growth driver.

Customer acquisition costs (CAC) are on the rise due to factors like saturation in traditional marketing channels and competition for online advertising space. Merchant marketing software helps merchants optimize their marketing efforts, improve campaign targeting, and personalize communication, leading to a better return on investment (ROI) and reduced CAC.

The need for data-driven marketing is driving growth in the market.

Today's consumers expect personalized experiences. Merchant marketing software empowers businesses with customer data analytics, allowing them to gain insights into customer behavior, preferences, and buying journeys. This data can then be leveraged for targeted marketing campaigns, leading to increased customer engagement and sales.

Market Restraints and Challenges:

Integration complexity is a major challenge.

Merchant marketing software needs to integrate seamlessly with various existing business systems like e-commerce platforms, CRM software, and loyalty programs. However, data silos and lack of standardization across platforms can make this integration complex and expensive.

Keeping up with evolving regulations is restricting market growth.

Data privacy regulations like GDPR and CCPA are constantly evolving. Merchant marketing software providers need to ensure their solutions comply with these regulations to avoid hefty fines and reputational damage. This can be a challenge, as keeping up with the changing legal landscape requires ongoing investment in compliance measures.

Competition and feature overload are increasing confusion among merchants.

The market for merchant marketing software is becoming increasingly saturated, with numerous vendors offering a wide range of features. This can make it difficult for merchants to choose the right solution for their specific needs and budget. Furthermore, feature overload within the software itself can lead to user confusion and hinder adoption by merchants.

Market Opportunities:

A focus on niche markets opens up new opportunities for the market.

While the overall merchant marketing software market is growing, there's an opportunity to cater to specific industry needs. Developing solutions tailored to the unique marketing challenges of verticals like restaurants, healthcare providers, or B2B businesses can attract new customer segments and create a competitive advantage.

AI-powered marketing automation is a major trend.

Leveraging Artificial Intelligence (AI) for marketing automation presents a significant opportunity. AI can automate tasks like campaign optimization, content creation, and personalized recommendations, allowing merchants to streamline their marketing efforts and improve campaign effectiveness. Developing merchant marketing software with integrated AI functionalities can attract businesses seeking to automate their marketing processes and gain a data-driven edge.

MERCHANT MARKETING SOFTWARE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

10.91% |

|

Segments Covered |

By Type, Organization Size, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Groupon, LocalFlavor, Travelzoo, LivingSocial Vagaro, Gilt, HalfOffDeals, Dealsave. |

Merchant Marketing Software Market Segmentation: By Type

-

Cloud-Based

-

Web Based

The merchant marketing software market caters to businesses with varying preferences regarding deployment mode. Cloud solutions are currently the largest and fastest-growing type, accounting for 63% of the market share in 2023. This dominance is driven by the numerous advantages the cloud offers, including scalability, cost-efficiency, and simplified management. Cloud-based solutions provide instant access to applications and data from anywhere, making them ideal for geographically dispersed teams and operations like branch offices, remote workforces, and global enterprises. Additionally, cloud providers handle infrastructure maintenance and upgrades, freeing up internal IT resources for core business activities. However, on-premises solutions are not without merit and are expected to witness significant growth at a CAGR of 12.8% during the forecast period. Certain industries, like manufacturing and finance, might prioritize on-premises deployments due to concerns around data security and regulatory compliance. Additionally, organizations with substantial existing infrastructure investments might opt for a hybrid approach, combining on-premises solutions with cloud services for a customized solution that meets their specific needs. This trend highlights the evolving nature of the market, where flexibility and a mix-and-match approach are becoming increasingly important for merchant marketing software.

Merchant Marketing Software Market Segmentation: By Organization Size

-

Large Enterprises

-

SMEs

Large-scale enterprises are the largest growing organization size. The focus of large-scale businesses in the merchant marketing software market is frequently on putting complete solutions in place that are suited to the requirements of big retailers and international firms. These businesses usually need software that is scalable and strong enough to handle large product catalogs, analyze large volumes of consumer data, and run intricate marketing campaigns across a variety of media. Large-scale businesses spend heavily on artificial intelligence-driven analytics, sophisticated marketing automation technologies, and enterprise system integration to increase productivity and optimize return on investment. Moreover, they place a high value on smooth cooperation with other software platforms and outside suppliers to build a networked ecosystem that improves consumer interaction and offers customized marketing experiences on a large scale.

SMEs are the fastest-growing category. In the merchant marketing software market, small and medium-sized enterprises (SMEs) prioritize using flexible, affordable solutions that cater to their unique requirements. SMEs need user-friendly software that streamlines marketing chores, automates repetitive procedures, and offers actionable information to optimize campaigns because they have limited funds and resources. These companies value affordability, scalability, and flexibility above all else. They like software-as-a-service (SaaS) solutions that are hosted in the cloud and provide pay-as-you-go pricing options and simple scaling. SMEs also appreciate software vendors who give them thorough training materials, prompt customer service, and features that can be adjusted to meet changing marketing needs. SMEs may successfully compete with larger competitors, improve brand recognition, and promote sustainable growth in their industries by using the power of cutting-edge marketing tools.

Merchant Marketing Software Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

The global merchant marketing software market is a geographically diverse landscape, with each region presenting unique growth opportunities. North America currently dominates the market, according to Inkwood Research, due to a high internet penetration rate, the presence of major technology players like Google and Hubspot, and a large smartphone user base. This translates to a strong demand for feature-rich marketing software solutions amongst established enterprises in the region. However, the Asia-Pacific (APAC) region is anticipated to witness the fastest growth in the coming years. This is fueled by factors like the burgeoning e-commerce sector, government initiatives promoting digital transformation, and a rapidly growing middle class with rising disposable income. This trend creates a demand for cloud-based and mobile-friendly marketing software solutions that cater to the specific needs of SMEs in the APAC region. Regions like Europe, South America, and the Middle East and Africa (MEA) also hold significant potential, with growing internet penetration and increasing mobile phone usage driving the adoption of merchant marketing software. Software providers that can offer localized solutions and address regional regulatory requirements are poised to capitalize on the growth potential in these emerging markets.

COVID-19 Impact Analysis on the Global Merchant Marketing Software Market:

The COVID-19 pandemic had a complex impact on the merchant marketing software market. In the initial stages, with lockdowns and economic disruptions, some businesses froze or reduced marketing budgets. This led to a temporary slowdown in market growth. However, the pandemic also accelerated the shift towards e-commerce and digital marketing channels. Businesses, forced to adapt to a more online-centric environment, recognized the value of merchant marketing software. This realization fueled a surge in demand for solutions that could facilitate online customer engagement, targeted marketing automation, and data-driven campaign optimization. Cloud-based software offerings emerged as a preferred choice due to their remote accessibility and scalability, allowing businesses to manage their marketing efforts effectively even with limited physical resources. As businesses navigate the post-pandemic landscape, the focus on efficient digital marketing strategies is expected to continue driving the growth of the merchant marketing software market.

Latest Trends/Developments:

Companies in this industry are motivated to increase their market share by using a range of strategies, including acquisitions, joint ventures, and investments. Businesses are spending a lot of money to develop techniques to retain competitive pricing. Further growth has resulted from this. Headless commerce integration: Traditionally, merchant marketing software functioned within a closed ecosystem. However, a growing trend is the integration of headless commerce platforms. This allows merchants to leverage the flexibility and scalability of headless architecture while using marketing software for tasks like campaign management and customer segmentation. This trend is driven by the need for greater agility and customization in e-commerce marketing strategies.

Omnichannel marketing orchestration: Customers today expect a seamless brand experience across all touchpoints, whether online, in-store, or on social media. Merchant marketing software is evolving to facilitate omnichannel marketing orchestration. This allows merchants to design and execute campaigns that deliver a unified brand message and personalized experiences across various channels.

Rise of conversational marketing: Consumers are increasingly turning to chatbots and messaging apps for customer service and product inquiries. Merchant marketing software incorporates features like chatbot marketing and in-app messaging functionalities. This allows businesses to engage with customers in real-time, personalize product recommendations, and automate lead nurturing processes.

Key Players:

-

Groupon

-

LocalFlavor

-

Travelzoo

-

LivingSocial

-

Vagaro

-

Gilt

-

HalfOffDeals

-

Dealsave.

In November 2023, in a move to strengthen its marketing automation capabilities, Adobe announced the acquisition of Emarsys, a leading omnichannel customer engagement platform. This acquisition is expected to benefit merchants by providing them with a more comprehensive suite of marketing tools for data-driven customer segmentation, personalized campaigns, and real-time customer journey orchestration.

Chapter 1. MERCHANT MARKETING SOFTWARE MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. MERCHANT MARKETING SOFTWARE MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. MERCHANT MARKETING SOFTWARE MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. MERCHANT MARKETING SOFTWARE MARKET - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. MERCHANT MARKETING SOFTWARE MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. MERCHANT MARKETING SOFTWARE MARKET – By Type

6.1 Introduction/Key Findings

6.2 Cloud-Based

6.3 Web Based

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. MERCHANT MARKETING SOFTWARE MARKET – By Organization Size

7.1 Introduction/Key Findings

7.2 Large Enterprises

7.3 SMEs

7.4 Y-O-Y Growth trend Analysis By Organization Size

7.5 Absolute $ Opportunity Analysis By Organization Size, 2024-2030

Chapter 8. MERCHANT MARKETING SOFTWARE MARKET , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Organization Size

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Organization Size

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Organization Size

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Organization Size

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Organization Size

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. MERCHANT MARKETING SOFTWARE MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Groupon

9.2 LocalFlavor

9.3 Travelzoo

9.4 LivingSocial

9.5 Vagaro

9.6 Gilt

9.7 HalfOffDeals

9.8 Dealsave.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global merchant marketing software market was valued at USD 771.12 million in 2023 and is projected to reach a market size of USD 1591.90 million by the end of 2030. Over the forecast period of 2024–2030, the market is expected to grow at a CAGR of 10.91%.

Key drivers include the evolving e-commerce landscape, increasing customer acquisition costs, and the need for data-driven marketing.

Large enterprises and SMEs are the segmentations based on organization size in the global merchant marketing software market.

North America dominates the market with a significant share of over 40%.

Groupon, LocalFlavor, Travelzoo, LivingSocial, Vagaro, Gilt, HalfOffDeals, and Dealsave are some of the leading players in the global merchant marketing software market.