Medical Ventilator Market Size (2025– 2030)

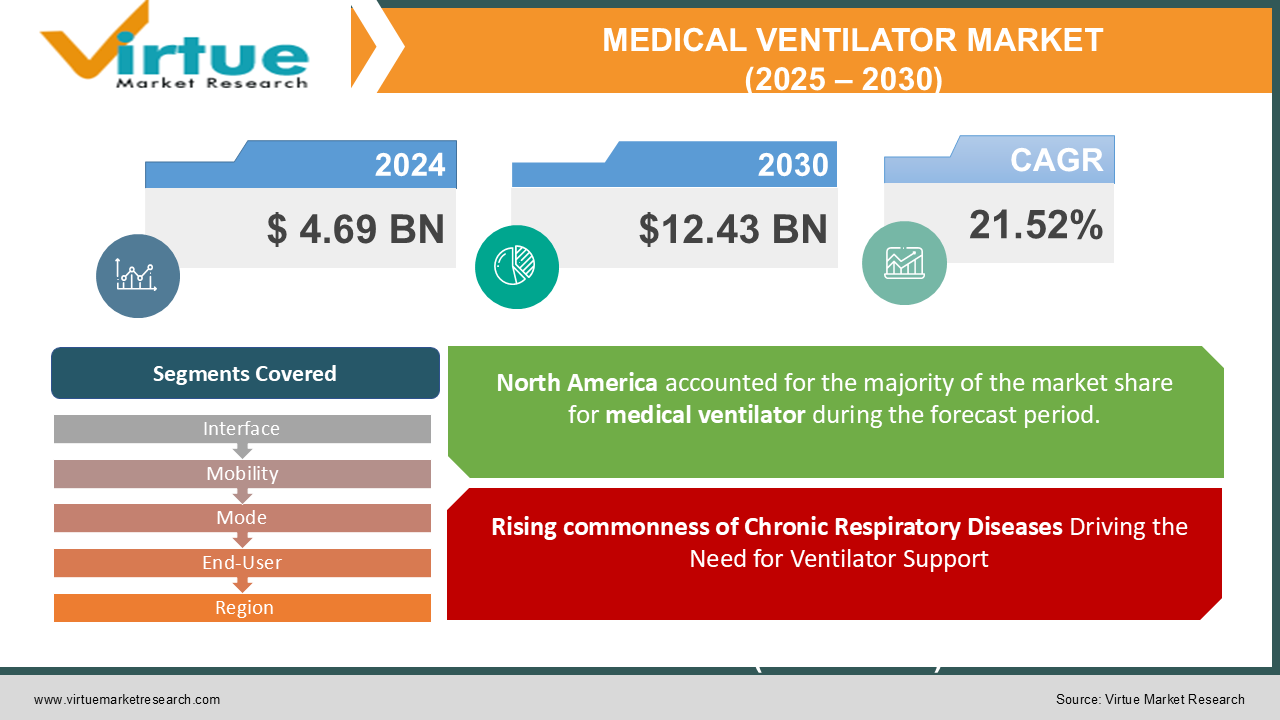

The Global Medical Ventilator Market was valued at USD 4.69 billion in 2024 and is projected to reach a market size of USD 12.43 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 21.52%.

A ventilator, often known as a breathing machine or respirator, is a mechanism that helps people breathe. Medical ventilators are critical life-support devices used in hospitals, emergency care, and home settings to assist patients with respiratory failure. These devices play important role in intensive care units (ICUs), surgical procedures, and chronic respiratory disease management, making them crucial in modern healthcare. The market has seen significant advancements, with the development of portable, non-invasive, and AI-driven ventilators enhancing patient outcomes.

The COVID-19 pandemic proved as a major catalyst for market growth, highlighting the urgent need for efficient respiratory support systems and increased government investments in healthcare infrastructure. Additionally, the rising generality of chronic obstructive pulmonary disease (COPD), asthma, and other respiratory conditions, coupled with an aging population, continues to rise demand for advanced ventilator solutions worldwide.

Key Market Insights:

-

The demand for medical ventilators has surged significantly due to the rising demand of chronic respiratory diseases, with over 200 million people affected by COPD worldwide. Moreover, asthma impacts more than 260 million people, highlighting the need for advanced respiratory support systems. The growing aging population, which is expected to surpass 1.5 billion by 2050, further increase market expansion, as elderly individuals are more affected by respiratory complications. The increasing number of ICU admissions globally, driven by rising healthcare awareness and better hospital infrastructure, has also contributed to sustained ventilator demand.

-

Technological advancements have revolutionized the market, with over 70% of ventilators now amalgamating AI-driven monitoring and automated oxygen adjustment features. Portable and homecare ventilators have gained popularity, with the home healthcare segment growing at a high pace due to a nearly 50% increase in demand for non-invasive ventilation. Furthermore, the expansion of healthcare facilities in emerging economies has led to a 30% rise in ventilator installations across hospitals and emergency care centers in recent years. The shift toward wireless connectivity and remote monitoring capabilities has also enhanced patient care, making ventilators more efficient and accessible in diverse medical settings.

Medical Ventilator Market Drivers:

Rising commonness of Chronic Respiratory Diseases Driving the Need for Ventilator Support

The increasing occurrence of chronic respiratory conditions such as COPD, asthma, and pneumonia has fueled the demand for medical ventilators. With over 200 million people suffering from COPD and millions more affected by respiratory infections, the need for efficient respiratory support devices continues to rise globally.

Aging Population and Growing ICU Admissions expanding Ventilator Utilization

As the global geriatric population is expected to surpass 1.5 billion by 2050, the prevalence of age-related respiratory problems is also rising. Older adults are more attracted to respiratory failure, pneumonia, and post-surgical breathing difficulties, leading to a steady increase in ICU admissions and ventilator dependency.

Technological Advancements in Ventilators Enhancing Organization and Patient Outcomes

The integration of AI-driven monitoring systems, wireless connectivity, and non-invasive ventilation technologies has enhanced the effectiveness of ventilators. Innovations such as adaptive ventilation modes, remote monitoring, and automated oxygen adjustments have improved patient care and increased ventilator adoption in both hospital and homecare settings.

Government and Private Investments in Healthcare Infrastructure Enlarging Market Growth

Rising healthcare expenditures, along with government initiatives to strengthen emergency preparedness, have led to increased funding for ventilator procurement. The post-pandemic healthcare landscape has seen higher investments in ICU facilities, respiratory care equipment, and homecare solutions, further boosting the global ventilator market.

Medical Ventilators Market Restraints and Challenges:

High Costs, Technical Complexities, and Limited Access to Ventilators in Appearing Economies

The medical ventilator market faces several challenges, including high costs of advanced ventilators, which compel them inaccessible to healthcare facilities in low-income regions. Additionally, technical complexities corelated with ventilator operation and maintenance require specialized training, leading to a shortage of skilled professionals. Frequent device malfunctions, risk of ventilator-associated infections, and power dependency further limit widespread adoption. In many developing countries, inadequate healthcare infrastructure and limited government funding restrict ventilator availability, affecting patient outcomes. Moreover, stringent regulatory approvals and supply chain disruptions continue to pose significant barriers to market growth.

Medical Ventilators Market Opportunities:

The growing adoption of homecare ventilators presents a significant opportunity, as demand for portable and non-invasive solutions continues to rise due to a growing preference for in-home treatment. AI-powered ventilators with real-time monitoring and automated oxygen control are revolutionizing critical care, improving patient outcomes, and reducing ICU burden. Additionally, emerging economies are witnessing rapid healthcare infrastructure expansion, generating new opportunities for ventilator manufacturers to tap into previously underserved markets. The trend for smart, energy-efficient, and cost-effective ventilator solutions, alongside increasing government and private-sector investments, further accelerates market growth potential.

MEDICAL VENTILATOR MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

21.52% |

|

Segments Covered |

By Interface, Mobility, Mode, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Medtronic, Philips Healthcare, ResMed, GE Healthcare, Drägerwerk AG & Co. KGaA, Smiths Medical, Hamilton Medical, Fisher & Paykel Healthcare, Vyaire Medical, Nihon Kohden Corporation, Getinge AB, Allied Healthcare Products, Air Liquide Medical Systems, Zoll Medical Corporation, Mindray Bio-Medical Electronics Co., Ltd. |

Medical Ventilators Market Segmentation: By Interface

-

Invasive Ventilation

-

Non-Invasive Ventilation

Invasive Ventilation is currently the ruling segment, as it is widely used in ICUs and critical care settings for patients with serious respiratory failure. These ventilators provide direct airway support through an endotracheal tube or tracheostomy, ensuring controlled oxygen delivery in life-threatening conditions.

Non-Invasive Ventilation (NIV) is the rapidly growing segment due to its increasing adoption in homecare, emergency care, and chronic respiratory disease management. With advancements in portable and AI-powered NIV devices, this segment is witnessing a rise in demand, particularly among patients seeking comfortable, flexible, and lower-risk respiratory support outside of hospital settings.

Medical Ventilator Market Segmentation: By Mobility

-

Intensive Care Ventilation

-

Portable Ventilation

Intensive Care Ventilation remains the dominant segment, as ICU ventilators are important for critically ill patients requiring continuous respiratory support. These ventilators provide advanced life-support features, precise oxygen control, and multiple ventilation modes, making them indispensable in hospitals and emergency care units.

Portable Ventilation is the fastest-growing segment, driven by the rising demand for home healthcare, emergency transport, and flexible respiratory support. The development of lightweight, battery-powered, and AI-integrated portable ventilators has grown rapid adoption, particularly among patients with chronic respiratory diseases and post-COVID-19 recovery needs.

Medical Ventilator Market Segmentation: By Mode

-

Combined-Mode

-

Volume-Mode

-

Pressure-Mode

-

Other modes

Combined-Mode Ventilation is the dominant segment, as it unites both volume and pressure control, allowing for greater flexibility and precise patient-specific respiratory support. This mode is popular in critical care settings due to its ability to adjust to changing lung conditions and improve patient outcomes.

Pressure-Mode Ventilation is the fastest-growing segment, driven by its increasing use in non-invasive ventilation (NIV) and homecare settings. With advancements in AI-driven pressure control and flexible ventilation, this mode is gaining popularity for enhancing patient comfort, reducing lung injury risks, and improving oxygen delivery efficiency.

Medical Ventilator Market Segmentation: By End-User

-

Hospitals & Clinics

-

Home Care Settings

-

Ambulatory Care Centers

-

Emergency Medical Services

Hospitals & Clinics remain the controlling segment, as they account for the highest ventilator usage in ICU, critical care, and surgical units. Given the increasing generality of chronic respiratory diseases, post-surgical complications, and emergency cases, hospitals continue to be the primary end-users of ventilators.

Home Care Settings is the fastest-growing, driven by the high demand for portable and non-invasive ventilators. With advancements in remote monitoring, AI integration, and user-friendly ventilation solutions, more patients with chronic respiratory conditions, post-COVID complications, and neuromuscular disorders are opting for home-based care, reducing hospital dependency and improving patient convenience.

Medical Ventilator Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America is the dominant region, contributing approximately 40% of the global market share, because of advanced healthcare infrastructure, high adoption of critical care technologies, and strong government support for respiratory care. The presence of leading ventilator manufacturers and increasing cases of chronic respiratory diseases further sets its market leadership.

Asia-Pacific is the fastest-growing region, with a highly expanding healthcare sector and rising demand for affordable ventilators in emerging economies like China and India. Factors such as growing elderly populations, increasing pollution-related respiratory diseases, and government healthcare investments are accelerating market expansion in the region.

COVID-19 Impact Analysis on the Global Medical Ventilator Market:

The COVID-19 pandemic caused an unmatched surge in demand for medical ventilators, as hospitals worldwide faced shortages in treating critically ill patients. Governments and healthcare organizations rushed to procure ventilators, leading to emergency production expansions by key manufacturers. However, global supply chain disruptions, component shortages, and logistical constraints created challenges in fulfilling demand. The crisis also accelerated technological advancements, including AI-integrated and portable ventilators, shaping the future of the market. While demand has stabilized post-pandemic, the focus on pandemic preparedness and critical care infrastructure improvements continues to drive market growth.

Latest Trends/ Developments:

One of the most significant trends in the ventilator market is the rising integration of artificial intelligence (AI) and automation in ventilator systems. AI-driven ventilators now provide real-time monitoring, automated oxygen adjustments, and predictive analytics to enhance patient outcomes while reducing the workload on healthcare professionals.

Another key development is the rise of compact and battery-powered ventilators, designed for ambulatory care, emergency transport, and disaster response scenarios. Manufacturers are focused on energy-efficient, user-friendly, and telehealth-compatible ventilators to support remote patient monitoring. Furthermore, governments and healthcare institutions are investing in ventilator stockpiles and emergency preparedness programs to prevent future shortages, ensuring better crisis management in potential pandemics or public health emergencies. Additionally, there is a growing shift toward non-invasive ventilation (NIV) solutions, particularly for homecare settings, as patients seek more comfortable, portable, and cost-effective respiratory support outside of hospital environments.

Key Players:

-

Medtronic

-

Philips Healthcare

-

ResMed

-

GE Healthcare

-

Drägerwerk AG & Co. KGaA

-

Smiths Medical

-

Hamilton Medical

-

Fisher & Paykel Healthcare

-

Vyaire Medical

-

Nihon Kohden Corporation

-

Getinge AB

-

Allied Healthcare Products

-

Air Liquide Medical Systems

-

Zoll Medical Corporation

-

Mindray Bio-Medical Electronics Co., Ltd.

Chapter 1. Medical Ventilator Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Medical Ventilator Market– Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Medical Ventilator Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Medical Ventilator Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Medical Ventilator Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Medical Ventilator Market – By Interface

6.1 Introduction/Key Findings

6.2 Invasive Ventilation

6.3 Non-Invasive Ventilation

6.4 Y-O-Y Growth trend Analysis By Interface

6.5 Absolute $ Opportunity Analysis By Interface, 2025-2030

Chapter 7. Medical Ventilator Market – By Mobility

7.1 Introduction/Key Findings

7.2 Intensive Care Ventilation

7.3 Portable Ventilation

7.4 Y-O-Y Growth trend Analysis By Mobility

7.5 Absolute $ Opportunity Analysis By Mobility, 2025-2030

Chapter 8. Medical Ventilator Market – By Mode

8.1 Introduction/Key Findings

8.2 Combined-Mode

8.3 Volume-Mode

8.4 Pressure-Mode

8.5 Other modes

8.6 Y-O-Y Growth trend Analysis By Mode

8.7 Absolute $ Opportunity Analysis By Mode, 2025-2030

Chapter 9. Medical Ventilator Market – By End-User

9.1 Introduction/Key Findings

9.2 Hospitals & Clinics

9.3 Home Care Settings

9.4 Ambulatory Care Centers

9.5 Emergency Medical Services

9.6 Y-O-Y Growth trend Analysis By End-User

9.7 Absolute $ Opportunity Analysis By End-User, 2025-2030

Chapter 10. Medical Ventilator Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Interface

10.1.2.1 By Mobility

10.1.3 By By Mode

10.1.4 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Interface

10.2.3 By Mobility

10.2.4 By By Mode

10.2.5 By By End-User

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Interface

10.3.3 By Mobility

10.3.4 By By Mode

10.3.5 By By End-User

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Interface

10.4.3 By Mobility

10.4.4 By By Mode

10.4.5 By By End-User

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Interface

10.5.3 By Mobility

10.5.4 By By Mode

10.5.5 By By End-User

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Medical Ventilator Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Medtronic

11.2 Philips Healthcare

11.3 ResMed

11.4 GE Healthcare

11.5 Drägerwerk AG & Co. KGaA

11.6 Smiths Medical

11.7 Hamilton Medical

11.8 Fisher & Paykel Healthcare

11.9 Vyaire Medical

11.10 Nihon Kohden Corporation

11.11 Getinge AB

11.12 Allied Healthcare Products

11.13 Air Liquide Medical Systems

11.14 Zoll Medical Corporation

11.15 Mindray Bio-Medical Electronics Co., Ltd

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Medical Ventilator Market was valued at USD 4.69 billion in 2024 and is projected to reach a market size of USD 12.43 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 21.52%.

Advancements in respiratory care technology, rising chronic respiratory diseases, and increasing demand for emergency preparedness.

Based on Interface, the Global Medical Ventilator Market is segmented into Invasive and Non-Invasive Ventilation.

North America is the most dominant region for the Global Medical Ventilator Market.

Medtronic, Philips Healthcare, ResMed, GE Healthcare are the leading players for the Global Medical Ventilators Market.