Medical Vacuum Systems Market Size (2025 – 2030)

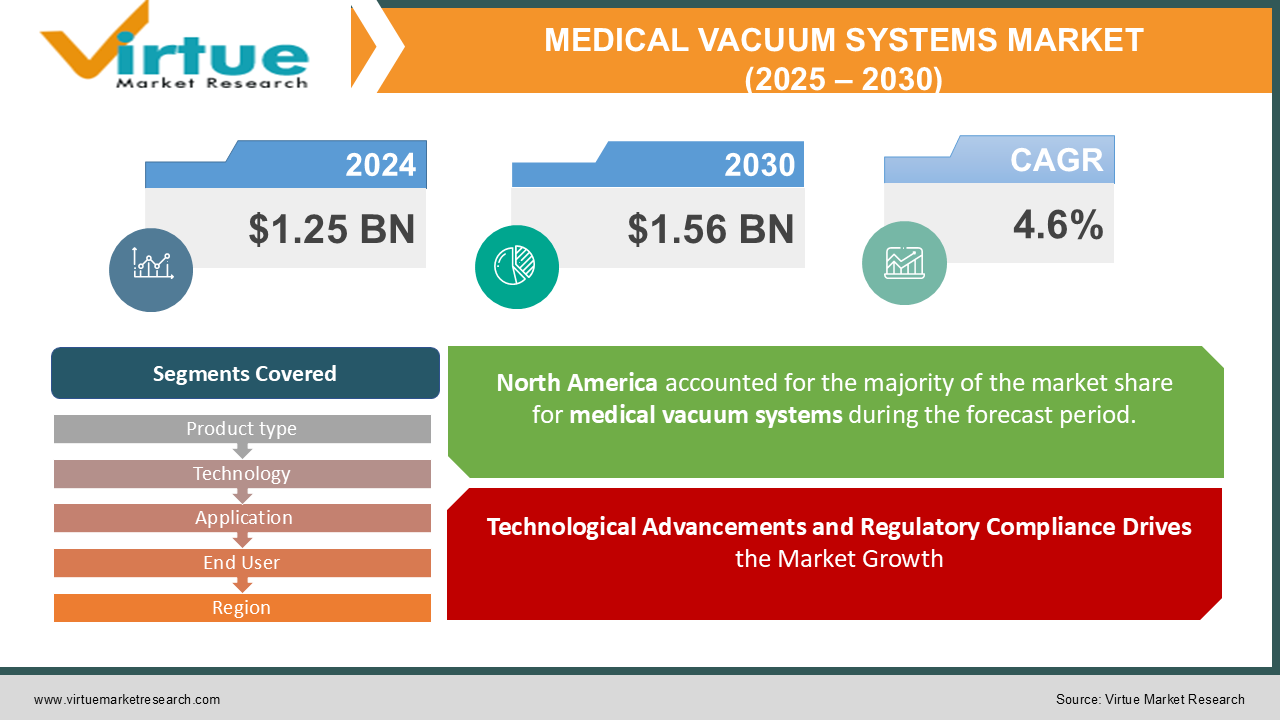

The Global Medical Vacuum Systems Market was valued at USD 1.25 billion and is projected to reach a market size of USD 1.56 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 4.6%.

Rising demand for efficient medical suction devices, surgical procedures, and infection control measures is boosting the growth of the medical vacuum systems market. These systems play a vital role in patient care because they maintain sterile conditions, remove unwanted fluids, and ensure proper airflow in medical facilities. The growth is expected to occur at a healthy CAGR over the next ten years due to technological advancements, stringent regulatory standards, and increasing healthcare spending worldwide.

Key Market Insights:

-

Standalone vacuum systems hold a significant market share, which is expected to be around USD 911.2 million by 2030 with a CAGR of 5.5%. Centralized vacuum systems are also expected to rise at a CAGR of 5.4% in the same period.

-

Advancements like dry claw and oil-sealed rotary vane technologies are enhancing the efficiency of systems, noise reduction, and easy maintenance, and thus are contributing to market acceptance.

-

Market growth is fuelled by therapeutic applications such as anaesthesiology, wound care, gynecology, and dental procedures due to the growing number of cases for relevant medical conditions and growing numbers of relevant target medical procedures.

-

The North American market will be dominating with an estimate of USD 434.6 million in 2023 for the U.S. The region of China will witness significant growth, with an estimated CAGR of 8.4% in 2030 at a USD 535.1 million value.

-

Key players like Atlas Copco AB, Gardner Denver Holdings, and Busch Holding GmbH are focusing on product launches, acquisitions, and strategic agreements to strengthen their market positions.

Medical Vacuum Market Drivers:

Technological Advancements and Regulatory Compliance Drives the Market Growth:

Innovations in vacuum system technology, such as oil-free and portable systems, have enhanced efficiency and safety in healthcare settings. These advancements, coupled with stringent regulatory frameworks mandating the use of vacuum systems to maintain hygiene and safety standards, are propelling market growth.

Rising Surgical Procedures and Focus on Infection Control:

The global increase in surgical treatments necessitates reliable vacuum systems for applications like suction and wound drainage. Additionally, heightened awareness of infection control in healthcare facilities boosts the demand for efficient vacuum systems to maintain sterility, ensuring patient safety.

Expansion of Healthcare Infrastructure and Growth in Home-Based Healthcare:

The development of new healthcare facilities and the renovation of existing ones, especially in developing countries, lead to a higher uptake of advanced medical vacuum systems. Simultaneously, the growing preference for home-based healthcare services has escalated the demand for portable and compact vacuum systems suitable for non-clinical settings.

Medical Vacuum Market Restraints and Challenges:

The medical vacuum systems market faces multiple challenges that hinder its growth. High installation and maintenance costs tend to be considerable financial burdens when considering the restricted budgets of more minor healthcare operations. Moreover, the complexity involved in these complex systems requires considerable technical expertise when it comes to proper operation and integration, hindering institutions unable to provide such resources. Strict regulatory compliance requirements further add to the challenge, as manufacturers and healthcare providers must continually stay updated with evolving standards, necessitating ongoing investments in training and system upgrades. Moreover, environmental concerns are becoming increasingly prominent, with a growing emphasis on energy sustainability and green technologies. Medical vacuum systems are scrutinized for their energy consumption and waste generation, compelling the industry to seek more sustainable alternatives. All these aspects pointed toward the need for strategic planning and innovation to overcome obstacles in adopting and utilizing medical vacuum systems.

Medical Vacuum Market Opportunities:

The medical vacuum systems market is experiencing significant growth due to several key factors. Technological advancements, such as the development of oil-free and portable vacuum systems, have enhanced efficiency and safety in healthcare settings, making them attractive for improving patient care. The increasing emphasis on infection control within healthcare facilities has heightened the demand for sophisticated vacuum systems that ensure sterility during surgical procedures. Additionally, the global rise in surgical procedures necessitates reliable vacuum systems for the removal of fluids and gases, maintaining steady demand in hospitals and clinics. The shift towards home healthcare presents opportunities for portable and compact vacuum systems, catering to patients requiring medical suction outside traditional clinical environments. Investments in healthcare infrastructure in emerging markets offer avenues for vacuum system providers to establish a presence and meet the growing needs of these regions. Furthermore, strict healthcare regulations drive the adoption of certified medical vacuum systems, ensuring safety and efficacy in patient care. The demand for energy-efficient and environmentally friendly medical equipment encourages the development of advanced vacuum systems that reduce operational expenses and are eco-friendly. Lastly, digital monitoring and automatic controls integrated into vacuum systems improve performance tracking and maintenance, which appeals to advanced healthcare facilities.

MEDICAL VACUUM SYSTEMS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

4.6% |

|

Segments Covered |

By Product type, Technology, Application, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Atlas Copco AB, Busch Group, INTEGRA Biosciences AG, Gardner Denver Holdings Inc., Olympus Corporation, Drägerwerk AG & Co. KGaA, Medela AG, Laerdal Medical, Allied Healthcare Products Inc., Parker Hannifin Corporation, Air Techniques |

Medical Vacuum Market Segmentation: By Product Type

-

Standalone vacuum systems

-

Centralized vacuum systems

-

Portable and compact vacuum systems

-

Accessories

Medical vacuum systems are essential in healthcare settings, with various types designed to meet specific needs. Standalone units are self-contained systems commonly utilized in dental clinics and research laboratories for targeted applications. Centralized vacuum systems are integrated into healthcare facilities, providing a centralized vacuum source for multiple departments, thereby enhancing efficiency and control. Portable and compact vacuum systems are designed for mobility, making them ideal for emergencies and home healthcare settings, offering flexibility in patient care. Additionally, accessories such as filters, regulators, and connectors support and enhance the functionality of these vacuum systems.

Medical Vacuum Market Segmentation: By Technology

-

Oil-sealed rotary vane technology

-

Dry rotary vane technology

-

Dry claw pump technology

-

Oil-sealed liquid ring technology

-

Water-sealed liquid ring technology

Medical vacuum systems employ various technologies, each tailored to specific healthcare applications. Oil-sealed rotary vane pumps are renowned for their operational stability and efficiency, making them suitable for a wide range of medical uses. Dry rotary vane pumps offer oil-free operation, reducing maintenance needs and minimizing contamination risks, which is ideal for sensitive environments. Dry claw pumps are highly efficient with low energy consumption, making them very suitable for continuous operation in medical settings. Oil-sealed liquid ring pumps are robust and well-suited for wet and corrosive environments often encountered in laboratories. Similarly, water-sealed liquid ring pumps function like their oil-sealed counterparts but utilize water, offering an alternative for certain medical applications.

Medical Vacuum Market Segmentation: By Application

-

Pharma-biotech manufacturing

-

Therapeutic applications

-

Anesthesiology applications

-

Gynecology applications

-

Wound care applications

-

Dental applications

-

Diagnostic applications

-

Research applications

Medical vacuum systems play an essential role in different healthcare applications for efficient patient care across many specialties. In pharma-biotech manufacturing, vacuum systems provide the necessary sterile environments required to produce items without contamination. In therapeutic applications and more importantly in negative pressure wound therapy, vacuum control aids in efficient wound drainage, accelerating the healing process. In anesthesiology, vacuum systems ensure open airways and ventilate the patient appropriately during medical procedures. In gynecology, they provide necessary suction during childbirth and surgical interventions. For wound care, vacuum systems efficiently remove exudates from both chronic and acute wounds, aiding in faster recovery. In dental practices, they are employed to keep the surgical field clear by removing debris during procedures. Additionally, in diagnostic and research laboratories, vacuum systems support various procedures by providing the required suction and controlled environments for experiments. Overall, the flexibility and reliability of medical vacuum systems make them indispensable across these diverse medical fields.

Medical Vacuum Market Segmentation: By End User

-

Hospitals

-

Surgical Centers

-

Ambulatory Care Centers

-

Pharmaceutical and biotechnology manufacturers

-

Diagnostic laboratories

-

Research laboratories and academic institutes

Hospitals, surgical centers, and ambulatory care centers are the primary users of medical vacuum systems, given the high volume of procedures requiring suction, such as surgeries and wound drainage. Pharmaceutical and biotechnology manufacturers also rely on these systems to maintain sterile environments during production processes. Diagnostic laboratories utilize vacuum systems for various tests and analyses, while research laboratories and academic institutes employ them in scientific studies and educational activities. Notably, the demand for medical vacuum systems is rapidly increasing in diagnostic laboratories and research institutions, driven by the expansion of diagnostic procedures and scientific research.

Medical Vacuum Market Segmentation: by Regional Analysis

The medical vacuum systems market is experiencing significant growth across various regions. North America is expected to maintain a substantial market share, driven by its advanced healthcare infrastructure and high adoption rates of new technologies. Europe's growth is anticipated to be propelled by increasing healthcare investments and stringent regulatory standards. Notably, the Asia-Pacific region is projected to experience the highest growth rate, attributed to expanding healthcare facilities and rising medical tourism. In contrast, Latin America and the Middle East & Africa are expected to grow moderately, with improvements in healthcare infrastructure and a greater focus on healthcare services.

COVID-19 Impact Analysis on the Global Medical Vacuum Systems Market:

The COVID-19 pandemic has significantly impacted the medical vacuum systems market. The surge in COVID-19 cases necessitated the rapid expansion of intensive care units, leading to an increased demand for medical vacuum equipment essential for patient care. To meet this heightened need, regulatory bodies expedited approvals for medical suction devices, enabling manufacturers to scale up production and address supply shortages. However, the pandemic also exposed vulnerabilities in the global supply chain, resulting in acute shortages of essential medical devices and personal protective equipment, which affected the availability of components necessary for medical vacuum systems. Additionally, lockdowns and restrictions led to manufacturing delays, hindering the timely delivery of these critical systems to healthcare facilities.

Latest Trends/ Developments:

The medical vacuum systems market is experiencing significant growth due to several key factors. Technological advancements, such as the integration of Internet of Things (IoT) capabilities, have enabled real-time monitoring and predictive maintenance, enhancing operational efficiency. Additionally, the development of energy-efficient and sustainable vacuum systems aligns with global efforts to reduce operational costs and environmental impact. The rising number of surgical procedures necessitates efficient vacuum systems for applications like suction and post-operative drainage, while the increasing demand for vacuum-assisted closure (VAC) therapy in complex wound care further boosts the market. Moreover, investments in healthcare infrastructure, particularly in developing countries, are leading to the implementation of advanced vacuum systems. Heightened awareness of infection prevention in healthcare settings is also propelling the demand for efficient vacuum systems to maintain sterility. Furthermore, the growing market for portable and compact vacuum systems caters to ambulatory care and home healthcare settings, offering flexibility and ease of use. Manufacturers are responding by providing customized solutions tailored to specific clinical requirements, thereby enhancing patient care.

Key Players:

-

Atlas Copco AB

-

Busch Group

-

INTEGRA Biosciences AG

-

Gardner Denver Holdings Inc.

-

Olympus Corporation

-

Drägerwerk AG & Co. KGaA

-

Medela AG

-

Laerdal Medical

-

Allied Healthcare Products Inc.

-

Parker Hannifin Corporation

-

Air Techniques

Chapter 1. Medical Vacuum Systems Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Medical Vacuum Systems Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Medical Vacuum Systems Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Medical Vacuum Systems Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Medical Vacuum Systems Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Medical Vacuum Systems Market – BY PRODUCT TYPE

6.1 Introduction/Key Findings

6.2 Standalone vacuum systems

6.3 Centralized vacuum systems

6.4 Portable and compact vacuum systems

6.5 Accessories

6.6 Y-O-Y Growth trend Analysis BY PRODUCT TYPE

6.7 Absolute $ Opportunity Analysis BY PRODUCT TYPE, 2025-2030

Chapter 7. Medical Vacuum Systems Market – BY TECHNOLOGY

7.1 Introduction/Key Findings

7.2 Oil-sealed rotary vane technology

7.3 Dry rotary vane technology

7.4 Dry claw pump technology

7.5 Oil-sealed liquid ring technology

7.6 Water-sealed liquid ring technology

7.7 Y-O-Y Growth trend Analysis BY TECHNOLOGY

7.8 Absolute $ Opportunity Analysis BY TECHNOLOGY, 2025-2030

Chapter 8. Medical Vacuum Systems Market – BY END USER

8.1 Introduction/Key Findings

8.2 Hospitals

8.3 Surgical Centers

8.4 Ambulatory Care Centers

8.5 Pharmaceutical and biotechnology manufacturers

8.6 Diagnostic laboratories

8.7 Research laboratories and academic institutes

8.8 Y-O-Y Growth trend Analysis BY END USER

8.9 Absolute $ Opportunity Analysis BY END USER, 2025-2030

Chapter 9. Medical Vacuum Systems Market – By Application

9.1 Introduction/Key Findings

9.2 Pharma-biotech manufacturing

9.3 Therapeutic applications

9.4 Anesthesiology applications

9.5 Gynecology applications

9.6 Wound care applications

9.7 Dental applications

9.8 Diagnostic applications

9.9 Research applications

9.10 Y-O-Y Growth trend Analysis By Application

9.11 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 10. Medical Vacuum Systems Market , By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Technology

10.1.2.1 By Light Type

10.1.3 By Power System

10.1.4 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Technology

10.2.3 By Light Type

10.2.4 By Power System

10.2.5 By By Application

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Technology

10.3.3 By Light Type

10.3.4 By Power System

10.3.5 By By Application

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Technology

10.4.3 By Light Type

10.4.4 By Power System

10.4.5 By By Application

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Technology

10.5.3 By Light Type

10.5.4 By Power System

10.5.5 By By Application

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Medical Vacuum Systems Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Atlas Copco AB

11.2 Busch Group

11.3 INTEGRA Biosciences AG

11.4 Gardner Denver Holdings Inc.

11.5 Olympus Corporation

11.6 Drägerwerk AG & Co. KGaA

11.7 Medela AG

11.8 Laerdal Medical

11.9 Allied Healthcare Products Inc.

11.10 Parker Hannifin Corporation

11.11 Air Techniques

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Medical Vacuum Market was valued at USD 1.25 billion and is projected to reach a market size of USD 1.56 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 4.6%.

Key drivers that will drive growth in the medical vacuum systems market include technological developments in vacuum systems, strict regulations requiring their deployment, a greater number of surgeries, and increasing diagnostic imaging procedures.

North America currently has the largest market share, mainly because of its more advanced healthcare system and high uptake of medical vacuum systems.

Prominent companies in this market include Atlas Copco AB, Busch Group, Gardner Denver Holdings Inc., Medela AG, Allied Healthcare Products Inc., and Parker Hannifin Corporation.

Medical vacuum systems are used in various applications, including Therapeutic applications (e.g., wound care, anesthesiology, gynecology, dental procedures), Pharmaceutical and biotechnology manufacturing, Diagnostic procedures, and Research applications.