Medical Refrigerators Market Size (2025-2030)

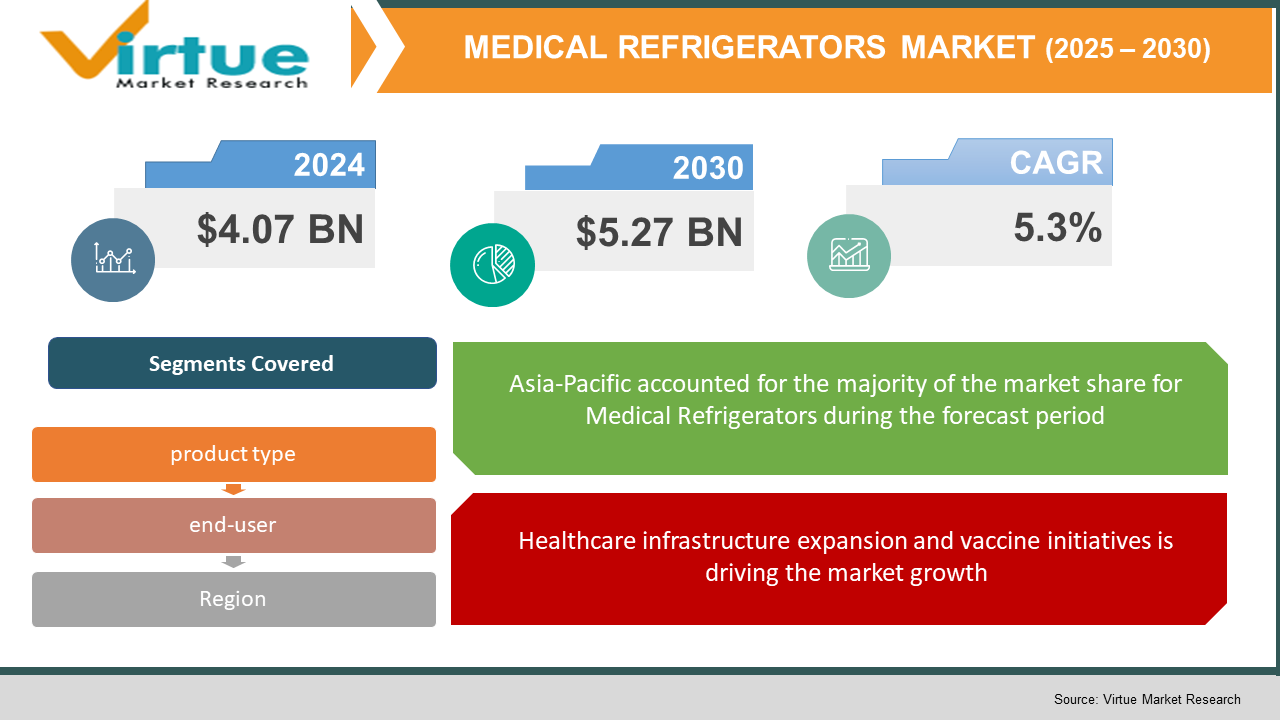

The Global Medical Refrigerators Market was valued at USD 4.07 billion in 2024 and is projected to reach USD 5.27 billion by 2030, growing at a CAGR of 5.3% during 2025–2030.

Specialized refrigeration units are designed to safely store vaccines, medicines, blood products, and laboratory reagents at precise temperatures. Key growth drivers include expanding healthcare infrastructure, vaccine distribution programs, biopharmaceutical research, and focus on energy-efficient cooling systems. Technological advancements and growing demand in emerging regions such as Asia-Pacific and Latin America further support market expansion.

Key market insights:

Alternative estimates place 2024 market value at USD 4.13 billion, growing to USD 6.74 billion by 2033 at 5.6% CAGR.

North America is the largest regional market, valued at approximately USD 2.87 billion in 2024.

Asia-Pacific is the fastest-growing region, driven by expanding healthcare access and rising biopharmaceutical activity.

Blood bank refrigerators and plasma freezers segment is expected to reach USD 2.6 billion by 2030 at 8.1% CAGR.

Laboratory refrigerators and freezers projected to grow at 6.3% CAGR over the 2024–2030 period.

Global Medical Refrigerators Market Drivers

Healthcare infrastructure expansion and vaccine initiatives is driving the market growth

Rapid expansion in healthcare infrastructure worldwide—especially in emerging economies—has significantly increased demand for medical refrigeration. New hospitals, clinics, diagnostic labs, and blood banks are being established to serve growing populations and address public health needs. Vaccine distribution initiatives, especially in response to infectious disease outbreaks, require reliable cold chain solutions. As noted, global vaccination programs and biopharmaceutical R&D are major demand drivers. Additionally, research labs and academic institutions are a growing end use, as they require precise temperature control for biological samples such as tissues and reagents. Expansion in healthcare services places pressure on logistics systems to maintain stringent storage standards, creating long-term need for advanced refrigeration units with uniform cooling, alarm systems, and data logging. Government health budgets and global aid programs contribute to equipment procurement budgets. Combined, these factors ensure consistent market growth and attract investments from equipment manufacturers targeting new installations and capacity upgrades.

Regulatory and compliance requirements is driving the market growth

Strict regulatory frameworks targeting temperature-sensitive medical supplies are shaping the medical refrigerators market. Authorities such as the WHO, FDA, and EMA mandate compliance with specific storage conditions for vaccines, blood, pharmaceuticals, and biotech products. Healthcare facilities must demonstrate adherence to defined temperature ranges, backup systems, and alarm mechanisms. This drives investment in certified refrigeration equipment with remote monitoring capabilities and audit trails . Additionally, environmental regulations require the phase-out of ozone-depleting refrigerants and encourage use of energy-efficient, low-GWP systems, pushing manufacturers toward sustainable cooling technologies . To comply, vendors are developing units that use natural refrigerants, improved insulation, and vacuum panels. Facilities are also migrating from basic units to intelligent systems integrating IoT and AI for predictive maintenance and regulatory compliance.

Technological innovation and product differentiation is driving the market growth

Technological advancements are a critical growth catalyst in the market. Manufacturers are innovating with features like ultra-low temperature ranges, precise microprocessor controls, and remote connectivity. Companies such as Thermo Fisher Scientific launched new TSV refrigerator ranges with advanced temperature accuracy and natural refrigerants. New coolers based on SureChill technology maintain 4°C for over ten days without power, ideal for off-grid vaccine storage. AI- and IoT-enabled models provide automated alerts, data logging, and predictive maintenance capabilities. Sustainable design features, such as solar power integration and eco-friendly materials, support environmental certifications. These innovations allow premium product differentiation and create opportunities for manufacturers to offer integrated solutions that improve operational efficiency and reduce total cost of ownership, while meeting evolving regulatory and performance requirements.

Global Medical Refrigerators Market Challenges and Restraints

High capital expenditure and operational cost pressures is restricting the market growth

Medical-grade refrigeration units are associated with high upfront costs due to advanced insulation, precision control systems, and compliance features. Ultra-low temperature freezers and plasma/blood bank units are among the most expensive, often exceeding tens of thousands of dollars per unit. Ongoing operational costs—including energy consumption, maintenance, calibration services, and repairs—also contribute to total cost of ownership. Energy efficiency improvements help reduce utility expenses, but standards for reliability, redundancy, and environmental compliance still drive higher initial investment. In emerging economies, limited budgets and lower healthcare spending constrain procurement, leading to the use of reconditioned or basic units, which may not meet stringent performance requirements . High costs can slow adoption of premium solutions, making it challenging for suppliers to penetrate low-margin market segments without localized production or financing support.

Supply chain issues and component scarcity is restricting the market growth

Medical refrigerators rely on specialized components—such as vacuum insulation, electronic temperature controllers, sensors, and certified compressors—that require complex global supply chains. Disruptions caused by raw material shortages, geopolitical tensions, or trade restrictions can delay manufacturing and delivery. The COVID-19 pandemic highlighted vulnerabilities, with lockdowns impacting production of critical parts and slowing global logistics. Even as demand grew for medical refrigeration during vaccine rollouts, some manufacturers struggled to scale output due to component scarcity and capacity constraints . These supply chain constraints can extend lead times, escalate costs, and erode customer confidence in timely delivery. Mitigating these barriers requires inventory buffers, alternate sourcing strategies, and local assembly, but these measures add operational complexity and costs amid tightening regulatory and environmental standards.

Market opportunities

The medical refrigerators market presents multiple growth avenues across product innovation, geographic expansion, and service ecosystems. Emerging technologies—such as IoT, AI, and data analytics—enable intelligent monitoring and predictive maintenance, appealing to large hospital systems and research organizations. Remote temperature logging and automated alerts improve compliance and reduce spoilage risks. Solar-powered and battery-free cooling systems, like SureChill, offer transformative solutions for rural and off-grid healthcare settings in Africa, India, and Southeast Asia. Public health programs targeting immunization and blood management are expanding in such regions, creating demand for robust cold chain infrastructure. Governments and NGOs often fund healthcare equipment deployments, providing procurement opportunities for multi-tiered product lines. Additionally, demand for ultra-low temperature and cryogenic storage is rising with increased biotech research and vaccine development, especially following the COVID-19 pandemic. Manufacturers can capitalize on this through specialized product lines. Retrofit and upgrade services—replacing aging units with energy-efficient models—present recurring revenue potential in developed markets like North America and Europe. Extended service contracts, calibration offerings, and remote diagnostics help lock in long-term customer relationships. Furthermore, partnerships with healthcare equipment distributors, solar solution integrators, and mobile health services can open new avenues. Finally, product modularization and localized manufacturing in emerging markets reduce cost and delivery times while supporting compliance with local specifications. The convergence of technology advancements, infrastructure development, and global health initiatives positions the medical refrigerators market for sustained and multi-dimensional growth by 2030.

MEDICAL REFRIGERATORS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

5.3% |

|

Segments Covered |

By Product Type, end user, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Thermo Fisher Scientific, Blue Star, Haier Biomedical, Aucma, and Standex International. |

Medical Refrigerators Market segmentation

Medical Refrigerators Market segmentation By product type:

- Blood bank refrigerators and plasma freezers

- Laboratory refrigerators and freezers

- Pharmacy refrigerators and freezers

- Chromatography refrigerators and freezers

- Enzyme refrigerators and freezers

- Ultra-low-temperature freezers

- Cryogenic storage systems

The blood bank refrigerators and plasma freezers segment is the most dominant. These units are essential for healthcare infrastructure, with projected value of USD 2.6 billion by 2030 and an 8.1% CAGR. They are critical for preserving temperature-sensitive blood and plasma products in hospitals and blood centers. The growth in blood donation and transfusion programs, along with stringent quality standards, drive continuous demand. Additionally, investment in emergency preparedness, pandemic response, and vaccine distribution programs further bolster segment growth worldwide.

Medical Refrigerators Market segmentation By end-user:

- Blood banks

- Pharmaceutical companies

- Hospitals and pharmacies

- Research institutes

- Medical laboratories

- Diagnostic centers

Hospitals and pharmacies combine to form the most dominant end-user segment. These facilities require reliable refrigeration for vaccines, pharmaceuticals, reagents, and patient care units. The hospital segment alone represents over half of industry demand. Growth is driven by rising healthcare investment, expansion of hospital networks, and integration of outpatient clinics. The push for point-of-care diagnostic solutions and on-site pharmaceutical storage also supports segment dominance. Overall, regulatory requirements and patient safety imperatives ensure continuous replacement and upgrade cycles in these settings.

Medical Refrigerators Market Regional segmentation

• North America

• Asia‑Pacific

• Europe

• South America

• Middle East and Africa

Asia-Pacific is the dominant region for medical refrigerators globally. Expanding healthcare infrastructure in China, India, Southeast Asia, and Australasia is fueling demand for new facilities and equipment. Markets in India and China are rapidly upgrading labs, blood banks, and diagnostic centers to WHO, FDA, and ISO standards. Public health campaigns, immunization drives, and private hospital growth are key contributors. In rural and off-grid areas, solar-powered units are becoming prevalent. Additionally, Asia-Pacific is home to several leading manufacturers (e.g., Haier Biomedical, Aucma), enhancing supply side capacity. Both growth rate and market size in APAC surpass those in North America and Europe. While North America remains important for high-end systems and retrofits, Asia-Pacific’s volume-centric demand and strategic importance secure its status as the region with the highest market share and growth trajectory through the forecast period.

COVID-19 Impact Analysis on the Medical Refrigerators Market

The COVID-19 pandemic had mixed effects on the medical refrigerators market. Early pandemic lockdowns disrupted global supply chains, limiting component availability and delaying scheduled deliveries. Manufacturing plants temporarily halted operations, leading to near-term shortages. Healthcare facilities shifted priorities and redirected budgets, delaying some non-critical purchases in 2020. However, from mid-2020 onward, vaccine development and distribution programs drove a surge in demand for medical-grade refrigeration worldwide. National immunization initiatives, particularly in emerging markets, required rapid deployment of cold chain equipment. Governments and international agencies allocated funding to procure specialized units capable of maintaining ultra-low temperatures. This increased investment offset earlier disruptions, resulting in a net market expansion. Simultaneously, manufacturers responded by offering virtual sales channels, remote maintenance solutions, and integrated monitoring platforms. Innovations such as solar-powered refrigerators gained momentum for outreach clinics. Post-2021, demand remained elevated with ongoing booster campaigns and growth in blood and biopharma sectors. COVID-19 effectively reshaped market dynamics: short-term barriers were outweighed by long-term structural shifts toward reliable and compliant cold chain deployment, leaving the industry at an elevated growth baseline after the pandemic.

Latest trends/Developments

Recent trends in the medical refrigerators market reflect technological progression, sustainability focus, and digital integration. IoT-enabled units now offer remote monitoring, AI-based alerts, and audit trail systems that enhance regulatory compliance and prevent spoilage. Manufacturers, such as Thermo Fisher and Haier Biomedical, are launching energy-efficient product lines using natural refrigerants and vacuum insulation to cut utility costs and meet environmental regulations. Off-grid and rural healthcare has seen significant uptake of solar-based refrigeration systems employing SureChill technology, capable of maintaining consistent temperatures without electricity for over ten days . Regulatory agencies are advocating for green refrigerants, reducing GWP, and phasing out ozone-depleting chemicals—creating opportunities for eco-friendly offerings. Ultra-low-temperature and cryogenic equipment demand is growing with increasing vaccine production and biotech research activity. Modular and compact designs are being introduced for space-constrained clinics and laboratories. Besides hardware, service innovations like remote diagnostics, predictive maintenance, and calibration-as-a-service enhance lifecycle management. Strategic partnerships among OEMs, distributors, healthcare providers, and NGOs support deployment in resource-limited settings. The cumulative effect is a market that is not only growing in volume, but also improving in capability, efficiency, and global reach.

Key Players:

- Thermo Fisher Scientific Inc.

- Blue Star Limited

- Haier Biomedical

- Aucma

- Standex International Corporation

- Godrej & Boyce Manufacturing Co Ltd.

- Helmer Scientific Inc.

- Vestfrost Solutions

- Follett LLC

- Labcold

Chapter 1. Medical Refrigerators Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary source

1.5. Secondary source

Chapter 2. MEDICAL REFRIGERATORS MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. MEDICAL REFRIGERATORS MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. MEDICAL REFRIGERATORS MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. MEDICAL REFRIGERATORS MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. MEDICAL REFRIGERATORS MARKET – By Product type

6.1 Introduction/Key Findings

6.2 Blood bank refrigerators and plasma freezers

6.3 Laboratory refrigerators and freezers

6.4 Pharmacy refrigerators and freezers

6.5 Chromatography refrigerators and freezers

6.6 Enzyme refrigerators and freezers

6.7 Ultra-low-temperature freezers

6.8 Cryogenic storage systems

6.9 Y-O-Y Growth trend Analysis By Product type

6.10 Absolute $ Opportunity Analysis By Product type , 2025-2030

Chapter 7. MEDICAL REFRIGERATORS MARKET – By End-user

7.1 Introduction/Key Findings

7.2 K Blood banks

7.3 Pharmaceutical companies

7.4 Hospitals and pharmacies

7.5 Research institutes

7.6 Medical laboratories

7.7 Diagnostic centers

7.8 Y-O-Y Growth trend Analysis By End-user

7.9 Absolute $ Opportunity Analysis By End-user , 2025-2030

Chapter 8. MEDICAL REFRIGERATORS MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By End-user

8.1.3. By Product type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Product type

8.2.3. By End-user

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Product type

8.3.3. By End-user

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Product type

8.4.3. By End-user

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Product type

8.5.3. By End-user

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. MEDICAL REFRIGERATORS MARKET – Company Profiles – (Overview, Product type , Portfolio, Financials, Strategies & Developments)

9.1 Thermo Fisher Scientific Inc.

9.2 Blue Star Limited

9.3 Haier Biomedical

9.4 Aucma

9.5 Standex International Corporation

9.6 Godrej & Boyce Manufacturing Co Ltd.

9.7 Helmer Scientific Inc.

9.8 Vestfrost Solutions

9.9 Follett LLC

9.10 Labcold

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

It was valued at USD 4.07 billion in 2024 and expected to reach USD 5.27 billion by 2030.

Key drivers include expanding healthcare infrastructure, vaccine distribution programs, and technological innovations such as IoT-enabled and energy-efficient systems.

Segments by product: blood bank freezers, lab refrigerators, pharmacy units, ultra-low freezers, cryogenic systems. By end-user: hospitals, blood banks, labs, pharmacies, research centers, and diagnostic clinics

Asia-Pacific is the most dominant region due to high volume demand and healthcare expansion in China, India, and Southeast Asia.

Leading companies include Thermo Fisher Scientific, Blue Star, Haier Biomedical, Aucma, and Standex International.