Medical Oxygen Concentrators Market Size (2025-2030)

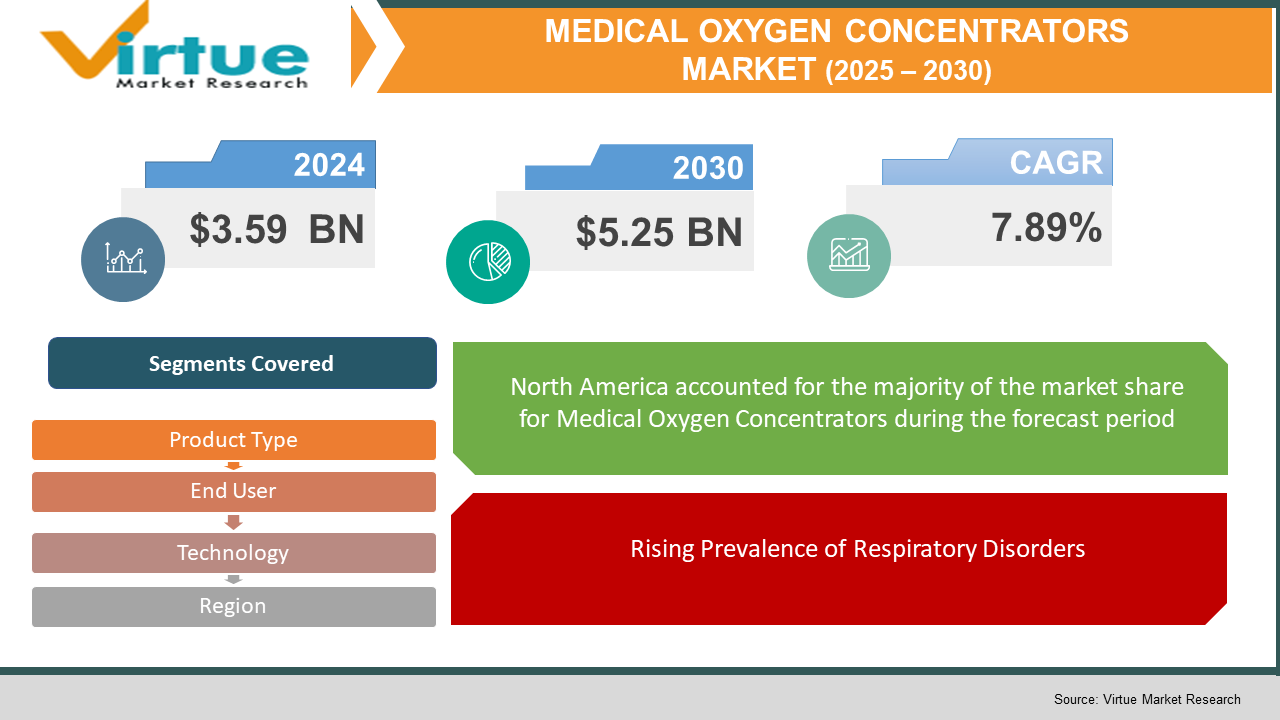

The Medical Oxygen Concentrators Market was valued at USD 3.59 billion and is projected to reach a market size of USD 5.25 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 7.89%.

The medical oxygen concentrators market focuses on devices that provide supplemental oxygen to individuals with respiratory conditions such as COPD, asthma, and other chronic pulmonary disorders. These devices work by filtering and concentrating oxygen from ambient air, delivering it directly to the patient through a nasal cannula or mask. Oxygen concentrators are widely used in both clinical settings and at home, offering an alternative to traditional oxygen cylinders. The market includes two primary types of devices: stationary units, typically used in homecare or hospital environments, and portable units, designed for mobility and ease of use.

The demand for oxygen concentrators has increased due to the growing global prevalence of respiratory diseases and a rise in the aging population. Technological advancements have made modern concentrators more compact, energy-efficient, and user-friendly. In healthcare systems, oxygen concentrators are seen as essential medical equipment, particularly in low-resource or remote settings where oxygen cylinders are less feasible. Regulatory support and healthcare infrastructure development further contribute to the adoption of these devices. The market also includes a mix of established medical device manufacturers and emerging players focusing on innovation and cost-effectiveness.

Key Market Insights:

Chronic respiratory diseases affect over 500 million people globally, with COPD alone accounting for about 3.2 million deaths annually (WHO). This rising burden significantly drives demand for oxygen concentrators as part of long-term therapy, especially in aging populations.

Homecare is the largest end-user segment, driven by the need for long-term oxygen therapy (LTOT) in chronic patients. Over 60% of oxygen concentrators sold globally are intended for home use, reducing hospital readmissions and lowering overall treatment costs.

Portable oxygen concentrators (POCs) account for an increasing share, estimated at around 30–35% of total market volume. Their growth is fueled by patient preference for mobility, improved battery life, and lighter designs that weigh as little as 5 pounds (2.3 kg).

North America represents the largest regional market, contributing over 40% of global revenue, driven by high healthcare spending, awareness, and Medicare coverage for oxygen therapy. The U.S. alone has more than 16 million people diagnosed with COPD.

Technological advances such as pulse dose flow, Bluetooth monitoring, and noise reduction have enhanced usability. Additionally, regulatory approvals like FDA Class II classification ensure safety and standardization, encouraging product development and market entry for new players.

Medical Oxygen Concentrators Market Drivers:

Rising Prevalence of Respiratory Disorders

Conditions like chronic obstructive pulmonary disease (COPD), asthma, pulmonary hypertension, and pneumonia are increasing globally due to factors such as aging populations, tobacco use, air pollution, and occupational exposures. COPD alone affects over 200 million people and remains a top cause of mortality, driving the demand for long-term oxygen therapy.

Growing Shift to Home‑Based Oxygen Therapy

Patients and healthcare systems are increasingly favoring portable and stationary concentrators for at‑home use. These devices offer greater independence, convenience, and cost savings compared to traditional oxygen cylinders, especially with supportive reimbursement policies in regions like the UK and France.

Advancements in Portable & High‑Efficiency Technologies

Innovations in devices—such as lightweight portable models with pulse flow, continuous flow options, molecular sieve and membrane technologies—enhance usability, mobility, and oxygen purity. New product launches with these advancements are significantly improving patient adoption and fueling market expansion.

Medical Oxygen Concentrators Market Restraints and Challenges:

High Cost of Devices and Maintenance

Medical oxygen concentrators, particularly advanced portable models, remain expensive for patients in low- and middle-income countries. The cost burden also includes regular maintenance, replacement filters, and power consumption, which limits affordability and widespread adoption in resource-constrained settings.

Limited Access to Electricity and Infrastructure

Many rural and underdeveloped regions lack consistent electricity supply, which is critical for concentrator operation. This infrastructure gap hinders device use in areas with high respiratory disease burden, especially during emergencies or humanitarian crises.

Regulatory and Reimbursement Challenges

Obtaining approvals from health authorities like the FDA or CE can be time-consuming and costly, especially for startups and smaller manufacturers. Additionally, varying insurance coverage and reimbursement policies across countries can restrict patient access and slow market penetration.

Medical Oxygen Concentrators Market Opportunities:

The medical oxygen concentrator market holds several promising opportunities for growth. Increasing healthcare investments in emerging economies offer a fertile ground for market expansion, particularly as governments prioritize respiratory care infrastructure. The aging global population and rising incidence of chronic respiratory illnesses continue to drive sustained demand. There is also a growing opportunity in telehealth integration, enabling remote monitoring and support for patients using oxygen concentrators at home.

Technological innovation—such as AI-driven flow adjustments and improved battery efficiency—presents potential for product differentiation and premium offerings. Humanitarian and disaster relief sectors increasingly require portable oxygen solutions, opening niche yet critical demand areas. Public-private partnerships and global health initiatives (e.g., WHO programs) can facilitate wider deployment in low-resource settings. Lastly, as awareness of respiratory health rises post-COVID-19, preventive and home-based oxygen solutions are gaining traction among both consumers and caregivers.

MEDICAL OXYGEN CONCENTRATORS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

7.89% |

|

Segments Covered |

By Product Type, end user, technology, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Philips Respironics, Inogen, Inc., CAIRE Inc. (a Chart Industries company), Invacare Corporation, Drive DeVilbiss Healthcare, Nidek Medical Products, Inc., Precision Medical, Inc., GCE Group, O2 Concepts, LLC, Belluscura plc etc. |

Medical Oxygen Concentrators Market Segmentation:

Medical Oxygen Concentrators Market Segmentation: by Product Type

- Portable Oxygen Concentrators

- Stationary Oxygen Concentrators

Portable oxygen concentrators account for about 60% of the market. Their compact, lightweight design and battery-powered operation make them ideal for active patients who need oxygen therapy on the go. These devices are increasingly favored for home use due to convenience, greater mobility, and advances in battery efficiency and smart features. Demand for portable units is rising, especially in aging populations and among patients with chronic conditions seeking independence and quality of life.

Stationary oxygen concentrators hold around 40% of the market. These larger units are typically used in home or clinical settings where continuous, high-volume oxygen delivery is needed. They are more affordable than portable units and are reliable for patients requiring 24/7 oxygen therapy. Despite their lack of mobility, they remain essential for severe respiratory cases and long-term care environments.

Medical Oxygen Concentrators Market Segmentation: by End User

- Homecare Settings

- Hospitals & Clinics

Homecare settings represent about 65% of the market, driven by the growing trend toward at-home management of chronic respiratory diseases. Patients increasingly prefer oxygen therapy at home due to its convenience, lower cost compared to hospital stays, and the availability of user-friendly portable concentrators. The aging population and rising prevalence of long-term respiratory conditions like COPD further support this shift. Healthcare systems and insurers are also promoting home-based care to reduce hospital burden and costs.

Hospitals and clinics account for around 35% of the market, primarily for acute care and post-operative respiratory support. These settings require high-capacity, continuous-flow concentrators for critical patients and those undergoing surgery or emergency care. Although this segment is smaller than homecare, it remains vital due to the need for reliable, high-performance equipment in controlled medical environments. Demand here is influenced by factors such as healthcare infrastructure, hospital capacity, and public health emergencies.

Medical Oxygen Concentrators Market Segmentation: by Technology

- Continuous Flow

- Pulse Dose Flow

Continuous flow technology holds about 55% of the market, as it provides a steady and consistent stream of oxygen regardless of the patient's breathing pattern. It is commonly used in stationary oxygen concentrators and is preferred for patients with higher or uninterrupted oxygen needs, especially during sleep or severe respiratory conditions. Though less energy-efficient, its reliability makes it essential in hospital settings and for patients requiring round-the-clock therapy. However, the bulkier design and higher power consumption limit its portability.

Pulse dose flow technology accounts for roughly 45% of the market and is primarily found in portable oxygen concentrators. This system delivers oxygen in bursts synchronized with the user’s inhalation, making it more efficient in conserving oxygen and battery life. It's ideal for active patients with milder oxygen needs, offering greater mobility and longer usage between charges. The growing demand for lightweight, travel-friendly oxygen solutions is steadily increasing the adoption of pulse dose systems.

Medical Oxygen Concentrators Market Segmentation: Regional Analysis

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

North America holds the largest share at around 35%, driven by high disease prevalence, advanced healthcare systems, and strong demand for home-based oxygen therapy. The U.S. leads with robust insurance coverage and widespread adoption of portable oxygen concentrators. High awareness and ongoing technological innovation further support market dominance. Post-COVID respiratory care and an aging population continue to fuel long-term demand.

Asia-Pacific accounts for approximately 25% of the market and is the fastest-growing region. Rapid urbanization, rising air pollution, and increasing respiratory disease diagnosis—especially in China, India, and Southeast Asia—are major drivers. Government healthcare initiatives and growing demand for affordable devices in rural areas contribute to expansion. While access remains uneven, the market outlook is highly positive.

Europe represents about 20% of the market, with steady growth supported by aging demographics and strong healthcare funding. Countries like Germany, France, and the UK drive usage through reimbursement schemes and emphasis on homecare. High regulatory standards ensure product quality and safety. Post-pandemic emphasis on respiratory preparedness also supports sustained demand.

South America holds an estimated 10% market share, with Brazil and Argentina leading in device adoption. The market is growing, albeit from a smaller base, as public awareness and healthcare access improve. Urban centers see increasing demand for portable units, while rural areas rely more on basic stationary models. Economic constraints and limited reimbursement remain key challenges.

Middle East and Africa collectively account for around 10% of the market. Growth is supported by improving healthcare infrastructure in the Gulf region and donor-supported programs in parts of Africa. Access to oxygen therapy is still limited in many low-income areas, but global health initiatives are beginning to bridge the gap. The region shows long-term potential, especially in urban hospitals and emerging homecare markets.

COVID-19 Impact Analysis on the Global Medical Oxygen Concentrators Market:

The COVID-19 pandemic had a profound impact on the medical oxygen concentrator market, causing a sharp and immediate surge in global demand. Hospitals and homecare providers faced severe shortages of oxygen supplies, especially during waves of severe respiratory infections. This led to emergency procurement programs by governments and NGOs, boosting sales of both stationary and portable concentrators. Manufacturers ramped up production, and new players entered the market to meet the urgent need.

The crisis also accelerated innovation, with rapid development of compact, high-flow, and battery-efficient models. Public awareness of respiratory health increased significantly, leading to greater long-term demand for home oxygen therapy. However, the post-COVID period saw a temporary market correction, as stockpiles and surplus inventory slowed new purchases. Despite this, the pandemic permanently raised the profile of oxygen therapy in healthcare planning and highlighted the importance of scalable oxygen delivery systems.

Latest Trends/Developments:

The medical oxygen concentrator market is experiencing rapid innovation driven by both patient needs and technological advancements. New devices now feature extended battery life and lightweight designs, significantly enhancing portability and ease of use. Smart connectivity and remote monitoring capabilities are becoming standard, allowing healthcare providers to track patient usage and oxygen levels in real time. Advanced AI-driven systems are being integrated to automatically adjust oxygen flow based on activity and breathing patterns, improving therapy efficiency and comfort.

Hybrid models that combine pulse-dose and continuous-flow modes are gaining popularity, especially for nighttime use and broader clinical flexibility. There’s also growing emphasis on eco-friendly, energy-efficient concentrators, including electrolysis-based models that reduce power consumption. Regulatory bodies are enforcing stricter safety standards, such as thermal fuses and firebreaks, to minimize risks during home use. Meanwhile, major manufacturers are expanding through partnerships and opening new R\&D and production facilities—especially in Asia—to meet rising global demand and navigate shifting trade dynamics.

Key Players:

- Philips Respironics

- Inogen, Inc.

- CAIRE Inc. (a Chart Industries company)

- Invacare Corporation

- Drive DeVilbiss Healthcare

- Nidek Medical Products, Inc.

- Precision Medical, Inc.

- GCE Group

- O2 Concepts, LLC

- Belluscura plc

Chapter 1. Medical Oxygen Concentrators Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Source

1.5. Secondary Source

Chapter 2. Medical Oxygen Concentrators Market – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Medical Oxygen Concentrators Market – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Packaging TYPE Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Medical Oxygen Concentrators Market - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. Medical Oxygen Concentrators Market - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Medical Oxygen Concentrators Market – By Product Type

6.1 Introduction/Key Findings

6.2 Portable Oxygen Concentrators

6.3 Stationary Oxygen Concentrators

6.4 Y-O-Y Growth trend Analysis By Product Type

6.5 Absolute $ Opportunity Analysis By Product Type , 2025-2030

Chapter 7. Medical Oxygen Concentrators Market – By End User

7.1 Introduction/Key Findings

7.2 Homecare Settings

7.3 Hospitals & Clinics

7.4 Y-O-Y Growth trend Analysis By End User

7.5 Absolute $ Opportunity Analysis By End User , 2025-2030

Chapter 8. Medical Oxygen Concentrators Market – By Technology

8.1 Introduction/Key Findings

8.2 Continuous Flow

8.3 Pulse Dose Flow

8.4 Y-O-Y Growth trend Analysis Technology

8.5 Absolute $ Opportunity Analysis Technology , 2025-2030

Chapter 9. Medical Oxygen Concentrators Market Market, BY GEOGRAPHY – MARKET SIZE, FORECAST, TRENDS & INSIGHTS

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By Product Type

9.1.3. By Technology

9.1.4. By End User

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By Product Type

9.2.3. By Technology

9.2.4. By End User

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.1. By Country

9.3.1.1. China

9.3.1.2. Japan

9.3.1.3. South Korea

9.3.1.4. India

9.3.1.5. Australia & New Zealand

9.3.1.6. Rest of Asia-Pacific

9.3.2. By Product Type

9.3.3. By Technology

9.3.4. By End User

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.1. By Country

9.4.1.1. Brazil

9.4.1.2. Argentina

9.4.1.3. Colombia

9.4.1.4. Chile

9.4.1.5. Rest of South America

9.4.2. By Technology

9.4.3. By End User

9.4.4. By Product Type

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.1. By Country

9.5.1.1. United Arab Emirates (UAE)

9.5.1.2. Saudi Arabia

9.5.1.3. Qatar

9.5.1.4. Israel

9.5.1.5. South Africa

9.5.1.6. Nigeria

9.5.1.7. Kenya

9.5.1.8. Egypt

9.5.1.9. Rest of MEA

9.5.2. By Technology

9.5.3. By Product Type

9.5.4. By End User

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Medical Oxygen Concentrators Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Philips Respironics

10.2 Inogen, Inc.

10.3 CAIRE Inc. (a Chart Industries company)

10.4 Invacare Corporation

10.5 Drive DeVilbiss Healthcare

10.6 Nidek Medical Products, Inc.

10.7 Precision Medical, Inc.

10.8 GCE Group

10.9 O2 Concepts, LLC

10.10 Belluscura plc

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Medical Oxygen Concentrators Market was valued at USD 3.59 billion and is projected to reach a market size of USD 5.25 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 7.89%.

Rising Prevalence of Respiratory Disorders, Growing Shift to Home‑Based Oxygen Therapy, Advancements in Portable & High‑Efficiency Technologies are some of the key market drivers in the Medical Oxygen Concentrators Market.

Portable Oxygen Concentrators, Stationary Oxygen Concentrators are the segments by Product Type in the Medical Oxygen Concentrators Market.

North America is the most dominant region for the Global Medical Oxygen Concentrators Market

Philips Respironics, Inogen, Inc., CAIRE Inc. (a Chart Industries company), Invacare Corporation, Drive DeVilbiss Healthcare, Nidek Medical Products, Inc., Precision Medical, Inc., GCE Group, O2 Concepts, LLC, Belluscura plc etc.