Medical Imaging Market Size (2024 – 2030)

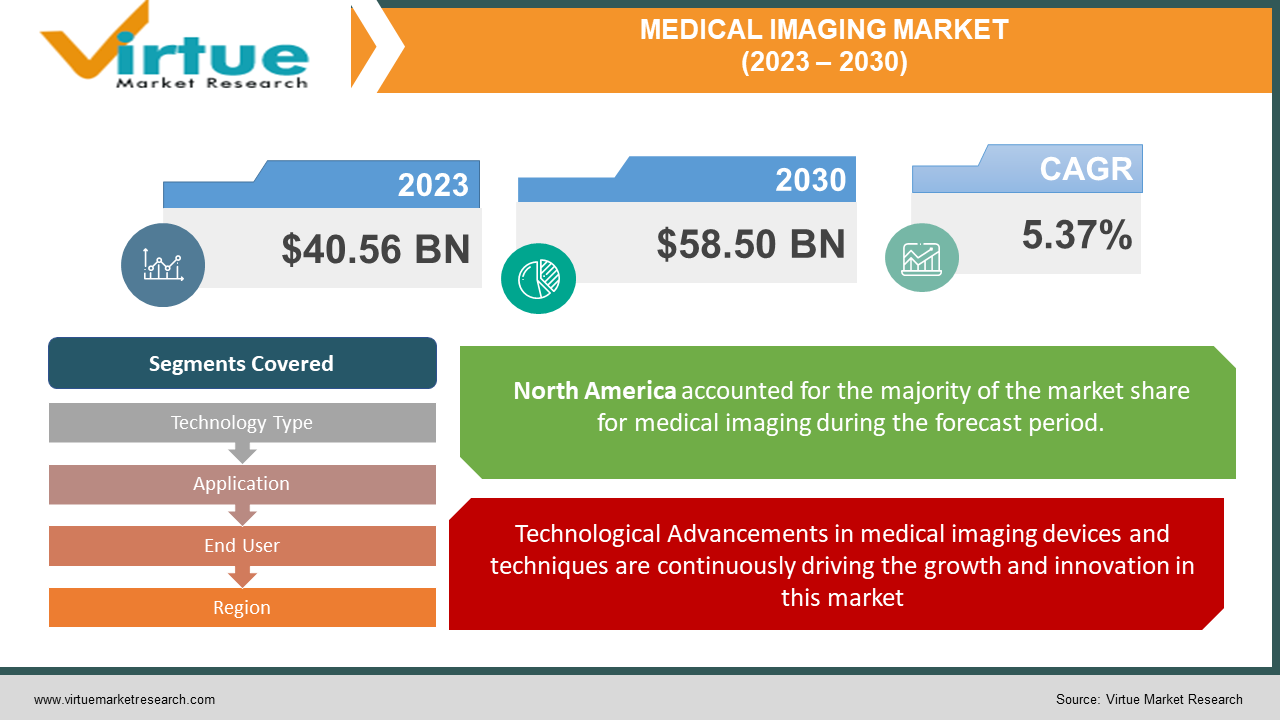

The Medical Imaging Market was valued at USD 40.56 Billion in 2023 and is projected to reach a market size of USD 58.50 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.37%.

The global medical imaging market is a dynamic sector driven by technological advancements, increasing chronic diseases, and a growing aging population. It encompasses various modalities such as MRI, CT, X-ray, ultrasound, and nuclear medicine. MRI and CT scans have witnessed significant growth due to their high-resolution imaging capabilities aiding in accurate diagnosis. The market has seen a surge in demand for portable and handheld devices, allowing for point-of-care imaging. AI integration within imaging technologies has enhanced diagnostic accuracy and workflow efficiency. North America holds a substantial market share owing to advanced healthcare infrastructure and high adoption rates of novel technologies. Emerging economies in Asia-Pacific are rapidly growing due to improving healthcare facilities and increased investments in the healthcare sector.

Key Market Insights:

An article published in European Radiology in November 2020 highlighted the significance of chest radiography in pinpointing COVID-19 patients prone to rapid deterioration, aiding clinical decision-making, and efficiently allocating hospital resources like beds and ventilators.

GLOBOCAN's 2020 data noted over 19 million new cancer cases worldwide, a figure anticipated to surge to 30 million by 2040. This projected rise in cancer cases is poised to substantially contribute to the medical imaging market's growth.

As per the British Heart Foundation's January 2022 report, prevalent heart conditions globally include coronary heart disease affecting around 200 million, peripheral arterial disease impacting 110 million, stroke affecting 100 million, and atrial fibrillation affecting approximately 60 million individuals.

In the span of a decade, the number of publications focusing on AI in radiology has surged from an annual range of 100–150 to a robust 700–800 per year.

Medical Imaging Market Drivers:

Technological Advancements in medical imaging devices and techniques are continuously driving the growth and innovation in this market.

Continuous innovation and technological advancements in medical imaging devices drive market growth. Improvements in imaging resolution, speed, and accuracy have revolutionized diagnostic capabilities. For instance, the integration of Artificial Intelligence (AI) and machine learning algorithms has enhanced image interpretation, allowing for more precise diagnoses and personalized treatments. The development of portable and handheld imaging devices has expanded accessibility, especially in remote or resource-constrained areas, further driving market expansion.

Increasing Chronic Diseases and an Aging Population is one of the biggest growth drivers in the medical imaging market.

The rise in chronic diseases, such as cardiovascular conditions, cancer, and neurological disorders, coupled with a globally aging population, has led to a higher demand for medical imaging. Imaging modalities play a crucial role in the early detection, diagnosis, and monitoring of these conditions. As the prevalence of chronic illnesses increases, there's a parallel increase in the need for advanced imaging technologies for accurate and timely diagnosis, treatment planning, and monitoring of disease progression, consequently propelling the market growth.

Medical Imaging Market Restraints and Challenges:

Cost and Accessibility associated with medical devices are a hindrance for businesses and healthcare facilities.

High costs associated with acquiring and maintaining advanced imaging equipment pose a challenge, particularly in developing regions and smaller healthcare facilities. The expense of purchasing, operating, and upgrading imaging technologies often leads to limited accessibility for patients in these areas. Additionally, reimbursement policies and insurance coverage may not fully support the costs, creating financial burdens for both healthcare providers and patients. This issue contributes to disparities in healthcare access, where individuals with limited resources may not receive timely or adequate imaging services.

Radiation Exposure and Safety Concerns associated with medical devices might pose challenges for the medical imaging market.

Certain imaging modalities, such as X-rays and CT scans, involve ionizing radiation, raising concerns about potential health risks associated with repeated exposure. While the doses are generally considered safe, there's an ongoing effort to minimize radiation exposure, especially in pediatric and vulnerable populations. Balancing the necessity of accurate imaging with the need to limit radiation exposure remains a challenge. Additionally, ensuring the safety and efficacy of newer imaging technologies, especially when implementing novel techniques or equipment, requires comprehensive studies and regulatory scrutiny to mitigate potential risks to patients and healthcare professionals.

Medical Imaging Market Opportunities:

The medical imaging market presents several promising opportunities driven by technological advancements and evolving healthcare needs. The integration of artificial intelligence (AI) and machine learning algorithms into imaging devices offers tremendous potential to enhance diagnostic accuracy, streamline workflows, and improve patient outcomes. Furthermore, the growing demand for point-of-care and portable imaging solutions is creating a niche for smaller, more accessible devices that can be utilized in remote or resource-limited settings. The expanding application of imaging technologies in emerging fields such as telemedicine, personalized medicine, and minimally invasive procedures opens doors for innovation, paving the way for improved patient care and more efficient healthcare delivery models. The increasing prevalence of chronic diseases and the aging population globally create a sustained demand for advanced imaging techniques, presenting a fertile ground for market growth and innovation in the medical imaging sector.

MEDICAL IMAGING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.37% |

|

Segments Covered |

By Technology Type, Application, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Siemens Healthineers, GE Healthcarem Philips Healthcare, Canon Medical Systems Corporation, Fujifilm Medical Systems, Hologic, Inc., Carestream Health, Shimadzu Corporation, Hitachi Healthcare, Toshiba Medical Systems Corporation (now Canon Medical Systems) |

Medical Imaging Market Segmentation: By Technology Type

-

Magnetic Resonance Imaging (MRI)

-

Computed Tomography (CT)

-

X-ray

-

Ultrasound

-

Nuclear Medicine

-

Others

Ultrasound holds a prominent position as the largest segment in the medical imaging market with a market share of 32% in 2023, due to its non-invasive nature, absence of ionizing radiation, versatility across various medical specialties, and relatively lower cost compared to other imaging modalities making it highly accessible and widely adopted. Ultrasound technology has evolved significantly, offering improved resolution and portability, allowing for real-time imaging and facilitating point-of-care diagnostics. Its applications span diverse medical fields, including obstetrics, gynecology, cardiology, and musculoskeletal imaging, contributing to its widespread usage in both developed and developing healthcare systems.

Computed Tomography (CT) stands out as the fastest-growing technology type in the medical imaging market expected to grow at a CAGR of 21.7%, due to several key factors. Technological advancements have led to the development of high-resolution CT scanners capable of producing detailed images with reduced scan times, improving patient comfort and diagnostic accuracy. The expanding applications of CT imaging across various medical specialties, especially in oncology, neurology, and cardiology, have driven its adoption. The versatility of CT scans for both routine diagnostic procedures and complex imaging needs, coupled with the increasing prevalence of chronic diseases necessitating precise and rapid diagnoses, has fueled the rapid growth of CT technology in the medical imaging market.

Medical Imaging Market Segmentation: By Application

-

Oncology

-

Cardiology

-

Neurology

-

Orthopedics

-

Gastroenterology

-

Gynecology

-

Others

The largest segment in the medical imaging market by application is oncology having a market share of 43% in 2023. This dominance is primarily due to the widespread use of imaging technologies, including MRI, CT, PET, and ultrasound, in the diagnosis, staging, treatment planning, and monitoring of various cancers. Oncology demands precise imaging for early detection, accurate tumor characterization, and assessment of treatment response, driving a significant volume of imaging procedures. The continuous advancements in imaging modalities, such as functional imaging and molecular imaging, have further strengthened their role in oncology, enabling detailed insights into tumor biology and aiding in personalized treatment strategies. The fastest-growing segment in the medical imaging market by application is also oncology. The rising incidence of cancer globally has heightened the demand for precise and advanced imaging techniques for early detection, accurate staging, treatment planning, and monitoring of cancer progression. The continuous development of imaging modalities and the integration of artificial intelligence for oncological imaging are further accelerating the growth of imaging applications in oncology by offering enhanced accuracy, efficiency, and improved patient care.

Medical Imaging Market Segmentation: By End User

-

Hospitals

-

Diagnostic Imaging Centers

-

Ambulatory Surgical Centers

-

Research and Academic Institutes

Hospitals represent the largest segment in the medical imaging market by end user holding a revenue share of 48% in 2023, due to their role as primary healthcare providers and the extensive range of medical imaging services they offer. Hospitals typically serve a diverse patient population, necessitating a wide array of imaging modalities to cater to various diagnostic needs. Hospitals often handle complex cases that require advanced imaging technologies, such as MRI and CT scans, for precise diagnoses and treatment planning. The integration of imaging services within hospitals streamlines patient care pathways, making imaging more accessible and convenient for both inpatients and outpatients. The fastest growing segment in the medical imaging market by end users is the Ambulatory Surgical Centers. This growth is primarily fueled by evolving healthcare models favoring outpatient procedures, increased patient preference for minimally invasive treatments, and advancements in imaging technologies enabling portable and cost-effective solutions suitable for ASC settings. ASCs leverage imaging technologies for efficient and precise diagnoses, enabling immediate interventions and reduced hospital stays. The shift towards value-based care and the emphasis on cost-effective healthcare delivery further drive the demand for imaging services within ASCs, positioning this segment as the fastest growing in the medical imaging market.

Medical Imaging Market Segmentation: Regional Analysis

-

North America

-

Asia- Pacific

-

Europe

-

South America

-

Middle East and Africa

North America stands out as the largest region in the medical imaging market having a share of 40%. It boasts advanced healthcare infrastructure, high adoption rates of cutting-edge imaging technologies, and robust research and development activities. Substantial healthcare expenditure and favorable reimbursement policies contribute to widespread access to sophisticated imaging modalities among both healthcare providers and patients. The region's focus on early disease detection, coupled with a high prevalence of chronic diseases, drives the consistent demand for various imaging techniques, positioning North America as the largest market for medical imaging. The Asia-Pacific region stands out as the fastest-growing market in medical imaging market with a CAGR of 18.9%. Rapid urbanization, increasing healthcare expenditure, and the growing prevalence of chronic diseases in countries like China and India are fostering substantial demand for advanced medical imaging technologies. Supportive government initiatives aimed at improving healthcare infrastructure, rising investments in healthcare modernization, and the adoption of innovative imaging solutions are propelling market growth.

COVID-19 Impact Analysis on the Medical Imaging Market:

The COVID-19 pandemic had a multifaceted impact on the medical imaging market, initially causing disruptions due to reduced elective procedures, postponed screenings, and a focus on emergency cases. However, the crisis accelerated the adoption of telemedicine and remote imaging solutions, driving a shift towards decentralized care models. There was a surge in demand for imaging technologies such as CT scans and X-rays to aid in COVID-19 diagnosis and monitoring, leading to a temporary spike in sales. While the pandemic highlighted the importance of diagnostic imaging in healthcare, supply chain disruptions and financial constraints for healthcare facilities posed challenges. The increased emphasis on infection control measures within imaging facilities and the growing recognition of imaging's pivotal role in managing health crises are expected to influence future market trends, fostering innovation and digital transformation within the medical imaging sector.

Latest Trends/ Developments:

One prominent trend in the medical imaging market is the increasing integration of artificial intelligence (AI) and machine learning technologies. These innovations are revolutionizing diagnostic capabilities by augmenting the interpretation of imaging data, improving accuracy, and expediting the analysis process. AI-powered algorithms can swiftly analyze vast amounts of medical images, aiding radiologists in detecting abnormalities, predicting diseases, and personalizing treatment plans. This trend is reshaping workflows, optimizing resource utilization, and enhancing overall diagnostic accuracy.

As for a significant development, the advancement of 3D printing in medical imaging is gaining traction. 3D printing technology allows the creation of precise, patient-specific anatomical models based on imaging data from CT scans, MRIs, or ultrasounds. These models serve various purposes, including pre-surgical planning, medical education, and patient engagement. Surgeons can use 3D-printed models to visualize complex anatomical structures, practice surgeries, and plan intricate procedures with greater precision. This development has the potential to significantly impact surgical outcomes, reduce operating times, and improve patient care by enabling tailored approaches to individual patient needs.

Key Players:

-

Siemens Healthineers

-

GE Healthcare

-

Philips Healthcare

-

Canon Medical Systems Corporation

-

Fujifilm Medical Systems

-

Hologic, Inc.

-

Carestream Health

-

Shimadzu Corporation

-

Hitachi Healthcare

-

Toshiba Medical Systems Corporation (now Canon Medical Systems)

Chapter 1. Medical Imaging Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Medical Imaging Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Medical Imaging Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Medical Imaging Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Medical Imaging Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Medical Imaging Market – By Technology Type

6.1 Introduction/Key Findings

6.2 Magnetic Resonance Imaging (MRI)

6.3 Computed Tomography (CT)

6.4 X-ray

6.5 Ultrasound

6.6 Nuclear Medicine

6.7 Others

6.8 Y-O-Y Growth trend Analysis By Technology Type

6.9 Absolute $ Opportunity Analysis By Technology Type, 2024-2030

Chapter 7. Medical Imaging Market – By Application

7.1 Introduction/Key Findings

7.2 Oncology

7.3 Cardiology

7.4 Neurology

7.5 Orthopedics

7.6 Gastroenterology

7.7 Gynecology

7.8 Others

7.9 Y-O-Y Growth trend Analysis By Application

7.10 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Medical Imaging Market – By End User

8.1 Introduction/Key Findings

8.2 Hospitals

8.3 Diagnostic Imaging Centers

8.4 Ambulatory Surgical Centers

8.5 Research and Academic Institutes

8.6 Y-O-Y Growth trend Analysis By End User

8.7 Absolute $ Opportunity Analysis By End User, 2024-2030

Chapter 9. Medical Imaging Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Technology Type

9.1.3 By Application

9.1.4 By By End User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Technology Type

9.2.3 By Application

9.2.4 By End User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Technology Type

9.3.3 By Application

9.3.4 By End User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Technology Type

9.4.3 By Application

9.4.4 By End User

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Technology Type

9.5.3 By Application

9.5.4 By End User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Medical Imaging Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Siemens Healthineers

10.2 GE Healthcare

10.3 Philips Healthcare

10.4 Canon Medical Systems Corporation

10.5 Fujifilm Medical Systems

10.6 Hologic, Inc.

10.7 Carestream Health

10.8 Shimadzu Corporation

10.9 Hitachi Healthcare

10.10 Toshiba Medical Systems Corporation (now Canon Medical Systems)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Medical Imaging Market was valued at USD 40.56 Billion in 2023 and is projected to reach a market size of USD 58.50 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.37%.

Technological Advancements in medical imaging devices and techniques along with Increasing Chronic Diseases and Aging Population are drivers of the Medical Imaging market.

Based on end users, the Medical Imaging Market is segmented into Hospitals, Diagnostic Imaging Centers, Ambulatory Surgical Centers, and Research and Academic Institutes.

North America is the most dominant region for the Medical Imaging Market.

Siemens Healthineers, GE Healthcare, Philips Healthcare, Canon Medical Systems Corporation, and Fujifilm Medical Systems are a few of the key players operating in the Medical Imaging Market.