Medical Equipment Management Software Market Size (2023 - 2030)

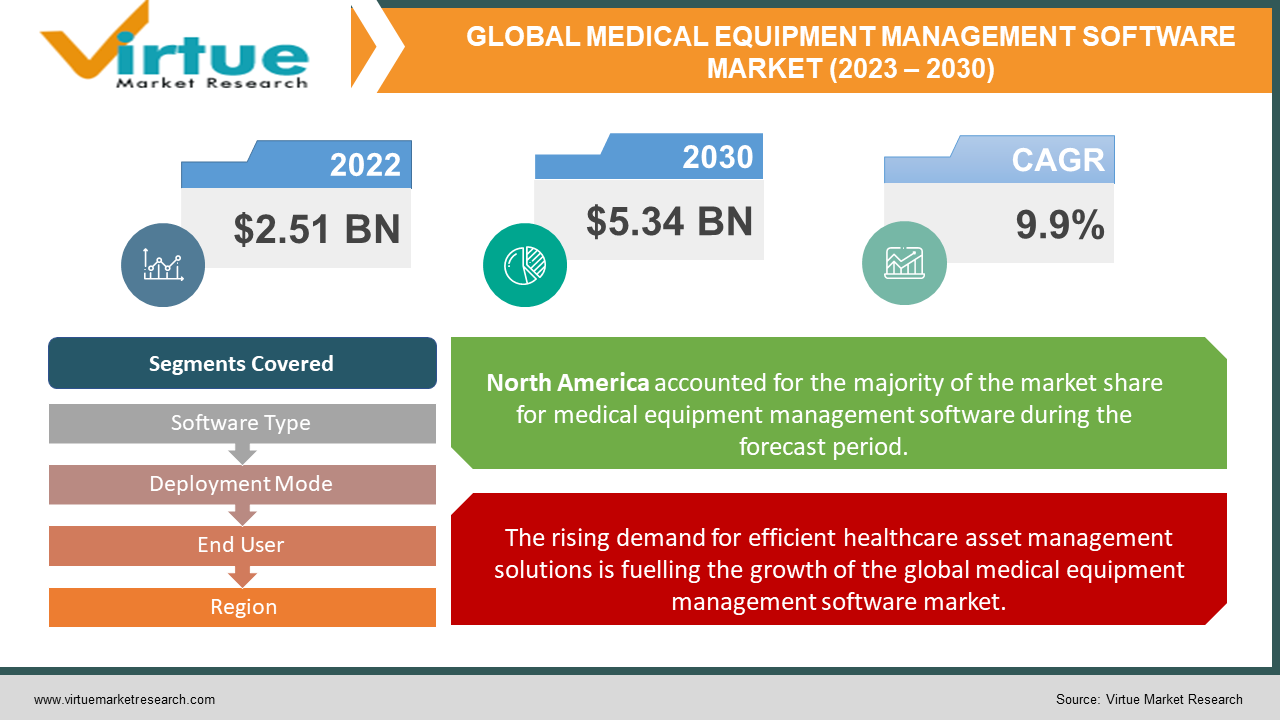

Global Medical Equipment Management Software Market was estimated to be worth USD 2.51 Billion in 2022 and is projected to reach a value of USD 5.34 Billion by 2030, growing at a CAGR of 9.9% during the forecast period 2023-2030.

Medical equipment management software (MEMS) is a powerful tool that helps healthcare facilities manage their assets more efficiently. In the healthcare industry, it is crucial that all medical equipment is properly maintained to ensure patient safety, especially high-risk devices like defibrillators and ventilators. MEMS helps manage preventive maintenance, reducing the risk of equipment failure and providing important analytics. Compliance with various regulations like Unique Device Identification (UDI), European Database on Medical Devices (EUDAMED), European Medical Device Regulation (MDR), and Global Medical Device Nomenclature (GMDN) is important depending on location. Healthcare organizations often require reports on device availability, downtime, planned and unplanned maintenance, and work order turnaround times to make informed decisions and investments. This information also helps clinical engineering balance their workload. MEMS plays a critical role in ensuring that medical equipment is always available, properly maintained, and ready for use. Effective management of medical equipment offers numerous benefits for healthcare organizations beyond ensuring compliance with regulations and internal requirements. It enables clinical engineers and maintenance teams to streamline the management of medical equipment, from basic oxygen concentrators to advanced CT scanners. With a comprehensive asset registry, authorized users can easily access information about medical equipment, assign requests and work orders, and schedule planned preventative maintenance. The help desk functionality allows clinical and administrative staff to log and track maintenance requests on medical devices with ease, while some providers offer an integrated mobile app for on- and off-site accessibility. Additionally, some medical equipment management software providers offer real-time analytical insights that enable users to create and share customized reports. The information can also be emailed directly to the relevant individuals or departments. The software can be integrated with a wide range of third-party solutions, reducing costs, and ensuring data security. For example, Siemens Teamplay Fleet and Medusa integrated their platforms to support healthcare regions in Denmark, Sweden, and Norway. Ultimately, effective management of medical equipment can help healthcare organizations optimize their resources, improve patient safety, and enhance overall operational efficiency.

Global Medical Equipment Management Software Market Drivers:

The rising demand for efficient healthcare asset management solutions is fuelling the growth of the global medical equipment management software market.

In the healthcare industry, accuracy and timeliness are of the utmost importance. Delays in operations can have serious repercussions for patients. To maintain day-to-day operations without interruption, healthcare facilities must keep accurate, up-to-date records of their inventory. For example, if a surgeon is unable to obtain the necessary surgical instruments for a scheduled surgery, delays and threats to patient safety can occur. Medical equipment management software can help hospital staff to manage bookings and reservations effectively, allowing them to access the right equipment without fail. The software keeps track of all items, along with their current status, in a centralized location that can be accessed by the entire team. As soon as an item is checked out or sent for maintenance, the software automatically updates its status, so everyone knows its availability. This centralized information makes it easy to plan and check the availability of any medical equipment on the availability calendar. Therefore, this factor drives the demand for medical equipment management software.

The growing need for healthcare analytics for effective decision-making is another factor contributing to the growth of the global medical equipment management software market.

Most hospitals now keep electronic patient records to maintain online data integrity. They aim to provide better patient care and meet higher safety standards with IT infrastructure. A tracking software ensures secure storage of medical equipment records in a cloud-based database. The software protects data with online backups to prevent unauthorized access or malware. Medical equipment management software can be used to forecast future trends and patterns with the help of usage history. Healthcare analytics help identify inventory management problems and generate reports on the costs of preventative maintenance. Data-driven decisions can be made to maintain and improve equipment quality standards. Therefore, this factor also drives the demand for medical equipment management software.

Global Medical Equipment Management Software Market Challenges:

The global medical equipment management software market is encountering challenges, primarily in terms of the complexity of learning new software and limited awareness regarding the potential benefits of the software. Medical equipment management software is equipped with various functions and tools to streamline the management of medical equipment. Hence, it is essential to undergo training to understand how to use the software efficiently. Software providers usually offer training for free or at a nominal cost. However, learning new software can be complicated and requires time for staff to be proficient at operating it. Training can take weeks to months to complete, and there will still be a learning curve for some staff members after completion. Moreover, many healthcare institutions are still unaware of the potential benefits that medical equipment management software offers, which may result in a slower adoption rate of this software. Thus, these challenges inhibit the growth of the global medical equipment management software market.

Global Medical Equipment Management Software Market Opportunities:

Advancements in software technology present a lucrative opportunity in the global medical equipment management software market. Given the rising demand for medical equipment management software owing to their advantages, including enhanced inventory management, increased efficiency, data-driven decision-making, and improved patient outcomes, businesses specializing in medical equipment management software can stand to gain significantly from this opportunity by integrating advanced technologies like artificial intelligence (AI), machine learning (ML), etc., with the existing medical equipment management software system, which will provide the end-users with enhanced automation and help improve their overall work efficiency and productivity. This development will help companies to increase their customer base and boost their overall revenue.

COVID-19 Impact on the Global Medical Equipment Management Software Market:

The outbreak of the COVID-19 pandemic substantially impacted the global medical equipment management software market. The pandemic caused disruptions in supply chains and distribution of goods and services, which highly affected the deployment of medical equipment management solutions. This factor negatively impacted the growth of the global medical equipment management software market. However, the pandemic accelerated the demand for efficient and reliable medical equipment management solutions to assist healthcare institutions in effectively managing crucial medical equipment used in treating patients with COVID-19. This factor positively impacted the market's growth. Therefore, the global medical equipment management software market experienced both challenges and opportunities during the difficult time of the COVID-19 pandemic.

Global Medical Equipment Management Software Market Recent Developments:

-

In January 2023, Accord BioPharma, a US-based pharmaceuticals company specializing in the production and distribution of generic, biosimilar, and added-value medicines, unveiled the launch of AccordConnects, a new mobile application, and web-based inventory management tool. This new software is designed to help healthcare practices keep track of their inventory of Accord BioPharma therapies.

-

In September 2021, Hybrent Inc., a US-based inventory management software company, unveiled a merger with Procurement Partners, a US-based company offering procure-to-pay solutions for senior living communities and post-acute care. The merging of the two companies creates one of the largest healthcare procure-to-pay organizations.

-

In September 2020, U.S. Medical Equipment Consultants, Inc., and VMware, a US-based cloud computing and virtualization company, unveiled a collaboration to develop, test and launch a new solution that helps healthcare organizations efficiently manage vital medical equipment used in the treatment of COVID-19 patients.

MEDICAL EQUIPMENT MANAGEMENT SOFTWARE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

9.9% |

|

Segments Covered |

By Software Type, Deployment Mode, End User and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Hybrent, Inc. (United States), SoftPro Medical Solutions (Sweden), CrelioHealth Inc. (India), EZOfficeInventory (United States), Ordr, Inc. (United States), Asset Panda (United States), InnoMaint (India), eLabNext (Netherlands), BIT Consulting GmbH (Germany), Fortunesoft IT Innovations (India) |

Global Medical Equipment Management Software Market Segmentation: By Software Type

-

Integrated Software

-

Standalone Software

In 2022, the integrated software segment held the highest market share. The growth can be attributed to the advantages that integrated software offers in comparison to standalone software. Integrated medical equipment management software promises healthcare institutions a streamlined, more accurate way to manage their equipment, all in one platform. This is a highly valued advantage, contributing to improved efficiency, fewer mistakes, and ultimately better outcomes for patients. Seamless integration into other healthcare systems like electronic health records (EHRs) and clinical decision support systems (CDSSs) increases coordination of care, while stringent regulatory compliance aids institutions in meeting safety and quality standards. Although requiring a larger initial investment than standalone software, integrated equipment management software proves to be cost-effective in the long run due to the avoidance of duplicated effort and compatibility with other systems.

Global Medical Equipment Management Software Market Segmentation: By Deployment Mode

-

Cloud-Based

-

Web-Based

In 2022, the cloud-based segment held the highest market share. The growth can be attributed to the rising adoption of cloud-based solutions by healthcare facilities owing to their function of storing data on remote servers rather than maintaining it on physical devices, such as hard drives, USB drives, etc. Additionally, cloud-based platforms provide easy data accessibility, large storage availability, data-sharing capabilities, scalability, and the utmost data security. It is less expensive than on-site data centers and far more secure than storing data on personal computers. Cloud-based solutions can simplify the process of enhancing inventory management for organizations by automatically recording all data on the cloud. This enables end-users to access and calculate inventory easily.

Global Medical Equipment Management Software Market Segmentation: By End User

-

Ambulatory Surgical Centers

-

Clinics

-

Hospitals

-

Others

In 2022, the hospital segment held the highest market share. The growth can be attributed to the hospitals usually having more medical equipment than other healthcare institutions, making inventory management more complex. Medical equipment management software simplifies this task by helping hospitals track their medical equipment, ensuring it's properly maintained and reducing the risk of errors. Since hospitals strive to provide top-notch patient care, the software can assist them in achieving this objective by ensuring that the equipment is functioning correctly and is well-maintained. By doing so, the software can help to enhance patient outcomes and reduce the likelihood of unfavorable events.

Global Medical Equipment Management Software Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

The region of North America held the largest share of the global medical equipment management software market in the year 2022. The early and wide adoption of advanced technologies, including medical equipment management solutions, and the presence of well-established healthcare infrastructure in nations, such as the United States and Canada, are some of the factors propelling the region's growth. Additionally, North America is home to several significant market players, including Hybrent, Inc., EZOfficeInventory, Ordr, Inc., Asset Panda, and Archon Systems Inc. Due to the rising demand for efficient healthcare asset management solutions, the increasing focus on patient safety, and the strong presence of major market players, including CrelioHealth Inc., InnoMaint, and Fortunesoft IT Innovations, the region of Asia-Pacific is anticipated to expand at the fastest rate over the forecast period.

Global Medical Equipment Management Software Market Key Players:

-

Hybrent, Inc. (United States)

-

SoftPro Medical Solutions (Sweden)

-

CrelioHealth Inc. (India)

-

EZOfficeInventory (United States)

-

Ordr, Inc. (United States)

-

Asset Panda (United States)

-

InnoMaint (India)

-

eLabNext (Netherlands)

-

BIT Consulting GmbH (Germany)

-

Fortunesoft IT Innovations (India)

Chapter 1. Medical Equipment Management Software Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Medical Equipment Management Software Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. Medical Equipment Management Software Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. Medical Equipment Management Software Market - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Medical Equipment Management Software Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Medical Equipment Management Software Market - By Software Type

6.1 Integrated Software

6.2 Standalone Software

Chapter 7. Medical Equipment Management Software Market - By Deployment Mode

7.1 Cloud-Based

7.2 Web-Based

Chapter 8. Medical Equipment Management Software Market - By End User

8.1 Ambulatory Surgical Centers

8.2 Clinics

8.3 Hospitals

8.4 Others

Chapter 8. Medical Equipment Management Software Market - By Region

9.1 North America

9.2 Europe

9.3 Asia-Pacific

9.4 Rest of the World

Chapter 9. Medical Equipment Management Software Market - Key Players

10.1 Hybrent, Inc. (United States)

10.2 SoftPro Medical Solutions (Sweden)

10.3 CrelioHealth Inc. (India)

10.4 EZOfficeInventory (United States)

10.5 Ordr, Inc. (United States)

10.6 Asset Panda (United States)

10.7 InnoMaint (India)

10.8 eLabNext (Netherlands)

10.9 BIT Consulting GmbH (Germany)

10.10 Fortunesoft IT Innovations (India)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Global Medical Equipment Management Software Market was estimated to be worth USD 2.51 Billion in 2022 and is projected to reach a value of USD 5.34 Billion by 2030, growing at a fast CAGR of 9.9% during the outlook period 2023-2030.

The Global Medical Equipment Management Software Market Drivers are The Rising Demand for Efficient Healthcare Asset Management Solutions and the Growing Need for Healthcare Analytics for Effective Decision-Making

Based on the Software Type, the Global Medical Equipment Management Software Market is segmented into Integrated Software and Standalone Software

The United States is the most dominating country in the region of North America for the Global Medical Equipment Management Software Market.

Hybrent, Inc., SoftPro Medical Solutions, and CrelioHealth Inc. are the leading players in the Global Medical Equipment Management Software Market.