Medical Drone Market Size (2024-2030)

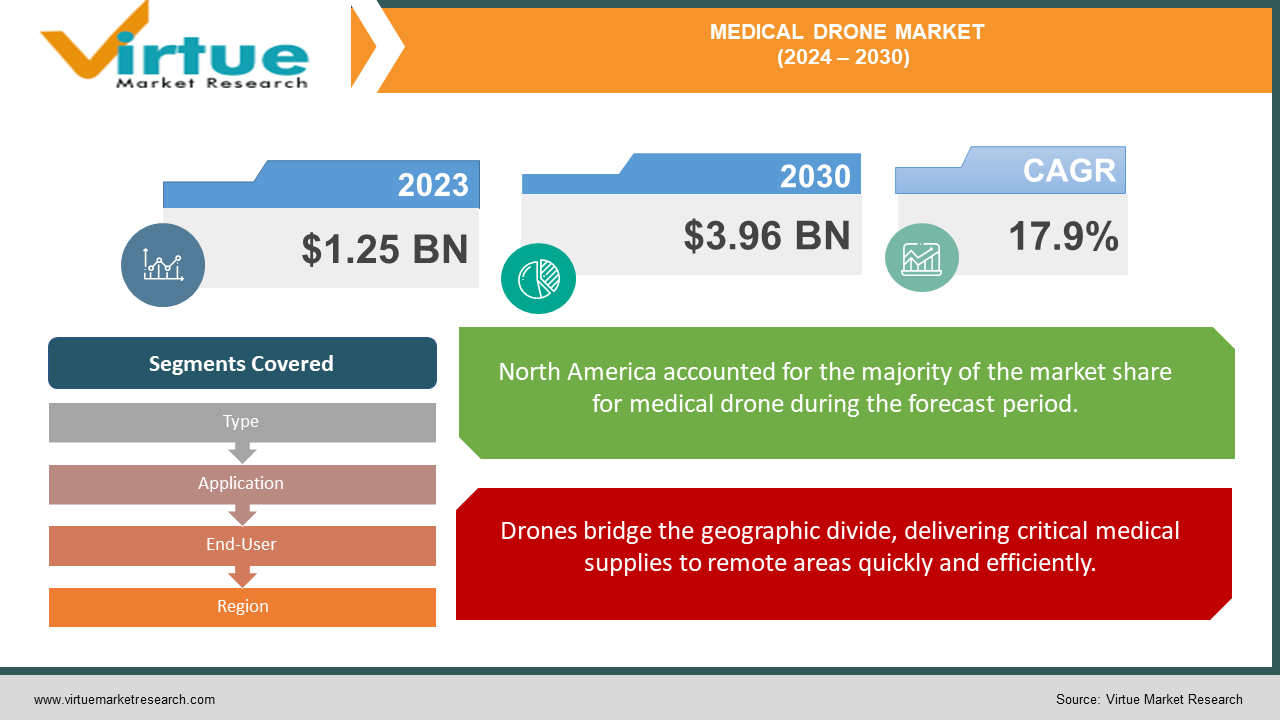

The Medical Drone Market was valued at USD 1.25 billion in 2023 and is projected to reach a market size of USD 3.96 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 17.9%.

The medical drone market is taking flight, fueled by its ability to deliver critical medical supplies quickly and efficiently, especially in remote areas. This technology is revolutionizing healthcare by bridging geographical gaps and offering contactless delivery options, a factor highlighted during the COVID-19 pandemic. Drones are being utilized for various applications, including transporting blood, vaccines, organs for transplant, and even emergency medical supplies. While still in its early stages, the medical drone market holds immense promise.

Key Market Insights:

The medical drone market is experiencing a surge in demand, with projections indicating a Compound Annual Growth Rate (CAGR) of 17.9% over the next decade. This translates to a potential doubling or even tripling in market size by 2033.

Additionally, advancements in drone technology across various industries are driving down overall drone costs, making them more accessible for medical applications (e.g., blood delivery).

The medical drone market is still in its early stages, but pilot programs around the world are demonstrating its effectiveness. For instance, Zipline is a company using drones to deliver blood and other medical supplies in remote areas of Rwanda.

However, there are challenges that need to be addressed before wider adoption can occur. Legal and regulatory frameworks need further development to facilitate the use of medical drones, while safety concerns regarding potential collisions and privacy issues around data collection require careful consideration.

Looking ahead, continued advancements in drone technology, such as improved reliability, ease of use, and payload capacity, are expected to propel further market growth.

Additionally, government support through favorable regulations for medical drone use and the increasing demand for cost-effective and efficient healthcare services will likely play a significant role in shaping the future of this exciting market.

Medical Drone Market Drivers:

Drones bridge the geographic divide, delivering critical medical supplies to remote areas quickly and efficiently.

For geographically isolated regions, traditional methods of delivering medical supplies can be slow and unreliable. Drones offer a game-changing solution. Their ability to navigate challenging terrain and deliver critical medical supplies quickly and efficiently is revolutionizing healthcare access in remote areas. This ensures that even those in underserved communities can receive timely medical attention, potentially saving lives and improving overall health outcomes.

Advancements in drone technology make this cutting-edge solution more affordable for healthcare organizations.

Advancements in drone technology across various industries have led to a significant cost reduction in drone manufacturing and operation. This translates to a more accessible option for healthcare organizations. Previously, the high cost of drone technology might have been a barrier to entry. Now, with more affordable options available, healthcare providers can leverage this innovative technology to improve efficiency and expand their reach.

The pandemic's impact on contactless delivery fuels the lasting adoption of medical drones.

The COVID-19 pandemic served as a powerful catalyst, showcasing the transformative potential of medical drones. During this time of heightened health concerns, contactless delivery of medical supplies and samples became paramount. Drones emerged as a vital tool, minimizing risk for healthcare workers on the front lines by reducing the need for physical contact during deliveries. This successful application during the pandemic has created a lasting momentum for the wider adoption of medical drone technology.

Medical drones go beyond simple delivery, offering a wider range of healthcare functionalities.

The potential of medical drones extends far beyond just delivering medical supplies. This versatile technology is finding application in a growing number of areas, further expanding its reach within the healthcare landscape. Examples include emergency medical care (delivering defibrillators in critical situations), streamlining blood sample collection in remote locations, and even facilitating the rapid transport of organs for transplants. This ability to address diverse healthcare needs is a significant driver for market growth.

Medical Drone Market Restraints and Challenges:

The medical drone market, while brimming with potential, faces hurdles that require attention. A key challenge lies in ensuring the smooth integration of drones into airspace. Without robust regulations and air traffic management strategies, the risk of collisions with manned aircraft or people becomes significant. Furthermore, the data collection capabilities of drones raise privacy concerns. Building trust hinges on clear regulations and strong data security protocols that safeguard patient information.

Another obstacle is the evolving regulatory landscape. The legal frameworks for medical drone use are still under development in many regions. Standardized regulations across different countries are essential to facilitate wider adoption and ensure the safe operation of medical drones. Additionally, limitations in current drone technology pose challenges. Battery life, payload capacity, and operating range all need improvement to fully unlock the potential of drones in healthcare. Advancements in battery technology and drone capabilities are crucial for broader and more impactful medical applications.

Finally, gaining public acceptance is critical. Concerns around noise pollution, potential misuse of the technology, and safety risks need to be addressed. Effective communication and public education campaigns can play a vital role in building trust and ensuring the smooth integration of medical drones into the healthcare landscape

Medical Drone Market Opportunities:

The medical drone market buzzes with opportunities that extend far beyond simply expediting deliveries. This innovative technology has the potential to transform various facets of healthcare delivery. One exciting opportunity lies in strengthening disaster relief efforts. In the aftermath of natural disasters, traditional infrastructure is often compromised, hindering access to remote areas. Drones, with their maneuverability and ability to navigate challenging landscapes, can be lifesavers. They can deliver critical medical supplies and aid directly to affected areas, ensuring vital resources reach those in need even when traditional means of transportation are unavailable. Furthermore, medical drones can revolutionize logistics and inventory management within the healthcare system. Imagine streamlining the delivery of regular medications to patients in remote regions, or efficiently transporting medical supplies between healthcare facilities. This optimized approach can significantly reduce stockouts and ensure uninterrupted access to essential medications for patients. By optimizing logistics and inventory management, medical drones can not only improve patient care but also lead to substantial cost savings within the healthcare system, freeing up valuable resources for other critical areas.

MEDICAL DRONE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

17.9% |

|

Segments Covered |

By Type, Application, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Zipline International Inc., DHL, Volocopter GmbH, Volansi, Embention, Bell Flight – Textron, Vayu Inc., Flirtey Holdings Inc., Flytrex Aviation Ltd., Manna Drone Delivery Inc., Matternet, Skyports |

Medical Drone Market Segmentation: By Type

-

Fixed-Wing Drones

-

Rotary-Wing Drones

-

Hybrid Drones

The dominant segment in the medical drone market by type is currently rotary-wing drones. Their maneuverability makes them well-suited for navigating urban environments and handling shorter-range deliveries within hospitals or between nearby facilities. However, the fastest-growing segment is expected to be fixed-wing drones. Advancements in range capabilities are making them ideal for medical supply delivery in remote areas, where long distances are a challenge for other drone types.

Medical Drone Market Segmentation: By Application

-

Emergency Medical Response

-

Vaccine Delivery

-

Blood Delivery

-

Organ Transport

-

Medical Sample Collection

Among application sectors, Blood Delivery is currently the most dominant segment within the medical drone market. This is due to the critical nature of timely blood deliveries for transfusions and lab testing. However, Emergency Medical Response is expected to be the fastest-growing segment. The increasing need for rapid response times in emergencies, particularly for delivering AEDs to cardiac arrest victims, is driving significant growth in this area.

Medical Drone Market Segmentation: By End-User

-

Hospitals & Healthcare Centres

-

Research Institutes

-

Government Institutes

-

Commercial Service Providers

Hospitals & Healthcare Centres are likely the most dominant segment in the medical drone market due to the established infrastructure and need for internal deliveries. However, Commercial Service Providers are expected to be the fastest-growing segment as drone technology becomes more accessible and regulations evolve. This opens the possibility of on-demand medical drone deliveries for various healthcare providers.

Medical Drone Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

North America: Currently leads the global medical drone market due to several factors. Strong government support for drone technology research and development, coupled with a well-established healthcare infrastructure, fosters innovation and adoption. Additionally, a growing demand for efficient and accessible healthcare services fuels market expansion. Regulatory frameworks are also evolving to accommodate the use of medical drones.

Europe: Europe presents a promising market for medical drones. Advanced healthcare systems, coupled with a growing acceptance of drone technology, create a favorable environment for market growth. However, stringent regulations regarding airspace management can pose challenges. Despite this, several European countries are actively exploring the potential of medical drones in pilot programs.

Asia-Pacific: The Asia-Pacific region is expected to witness significant growth in the medical drone market due to several factors. A large and growing population, coupled with a rising demand for improved healthcare access in remote areas, presents a compelling opportunity for medical drone deployment. Additionally, government initiatives in some countries to promote drone technology development are further propelling market growth.

COVID-19 Impact Analysis on the Medical Drone Market:

The COVID-19 pandemic acted as a powerful accelerant for the medical drone market, pushing it forward in unforeseen ways. A critical factor driving this growth was the heightened need for contactless delivery to curb the spread of the virus. Medical drones emerged as a valuable tool, allowing for the safe delivery of medical supplies and samples, significantly reducing the risk of exposure for healthcare workers on the front lines. This successful application during a global health crisis served as a powerful testament to the potential of medical drones to improve safety and efficiency within healthcare delivery systems.

Furthermore, the pandemic spurred a surge in government support for drone technology research and development, with a particular focus on medical applications. This financial boost not only accelerated advancements in drone technology but also paved the way for pilot programs exploring the use of drones in various healthcare settings. The successful application of medical drones during the pandemic also significantly boosted public awareness and acceptance of this technology. People witnessed firsthand the potential of drones to deliver essential medical supplies, fostering a more positive perception of this technology within the public sphere. Looking ahead, the potential integration of medical drones with the growing trend of telehealth services presents another exciting opportunity. This seamless integration could allow for the delivery of medications or samples directly to patients following telehealth consultations, further propelling the medical drone market forward and transforming the way healthcare is delivered.

Latest Trends/ Developments:

The medical drone market is a hive of innovation, constantly pushing boundaries and exploring new possibilities. One key trend is the growing focus on establishing clear and standardized regulations for medical drone use. Collaborative efforts between governments, regulators, and industry players are crucial for ensuring safe operation and wider adoption across different regions. Furthermore, advancements in drone technology itself are expanding the potential applications. Improved battery life, payload capacity, and operating range are making drones more efficient for a wider range of medical applications, particularly in remote or challenging environments. This goes beyond traditional delivery, with drones being explored for tasks like remote patient monitoring or disaster zone search and rescue. Looking ahead, the potential integration with telehealth services is particularly exciting. Medical drones could seamlessly bridge the gap by delivering medications or samples to patients following telehealth consultations, potentially improving patient care and access to essential services. The future of medical drones also embraces sustainability. There's a growing emphasis on developing eco-friendly drone solutions, with explorations of alternative power sources and methods to minimize noise pollution. Finally, public-private partnerships are playing a key role in fostering innovation. Collaboration between governments, drone manufacturers, and healthcare providers is accelerating the development of medical drone technology through pilot programs and feasibility studies.

Key Players:

-

Zipline International Inc.

-

DHL

-

Volocopter GmbH

-

Volansi

-

Embention

-

Bell Flight – Textron

-

Vayu Inc.

-

Flirtey Holdings Inc.

-

Flytrex Aviation Ltd.

-

Manna Drone Delivery Inc.

-

Matternet

-

Skyports

Chapter 1. Medical Drone Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Medical Drone Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Medical Drone Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Medical Drone Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Medical Drone Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Medical Drone Market – By Type

6.1 Introduction/Key Findings

6.2 Fixed-Wing Drones

6.3 Rotary-Wing Drones

6.4 Hybrid Drones

6.5 Y-O-Y Growth trend Analysis By Type

6.6 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Medical Drone Market – By Application

7.1 Introduction/Key Findings

7.2 Emergency Medical Response

7.3 Vaccine Delivery

7.4 Blood Delivery

7.5 Organ Transport

7.6 Medical Sample Collection

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Medical Drone Market – By End-User

8.1 Introduction/Key Findings

8.2 Hospitals & Healthcare Centres

8.3 Research Institutes

8.4 Government Institutes

8.5 Commercial Service Providers

8.6 Y-O-Y Growth trend Analysis By End-User

8.7 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 9. Medical Drone Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type

9.1.3 By Application

9.1.4 By End-User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type

9.2.3 By Application

9.2.4 By End-User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type

9.3.3 By Application

9.3.4 By End-User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type

9.4.3 By Application

9.4.4 By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type

9.5.3 By Application

9.5.4 By End-User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Medical Drone Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Zipline International Inc.

10.2 DHL

10.3 Volocopter GmbH

10.4 Volansi

10.5 Embention

10.6 Bell Flight – Textron

10.7 Vayu Inc.

10.8 Flirtey Holdings Inc.

10.9 Flytrex Aviation Ltd.

10.10 Manna Drone Delivery Inc.

10.11 Matternet

10.12 Skyports

10.13 Saint Lucia

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Medical Drone Market was valued at USD 1.25 billion in 2023 and is projected to reach a market size of USD 3.96 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 17.9%.

Remote Access and Cost Advantages are the main Medical Drone Market drivers.

Hospitals & Healthcare Centers, Research Institutes, Government Institutes, Commercial Service Providers.

North America holds the dominant position in the medical drone market due to strong government support, established healthcare infrastructure, and high demand for efficient healthcare services.

Zipline International Inc., DHL, Volocopter GmbH, Volansi, Embention, Bell Flight – Textron, Vayu Inc., Flirtey Holdings Inc., Flytrex Aviation Ltd., Manna Drone Delivery Inc., Matternet, Skyports.