Medical Composites Market Size (2024 – 2030)

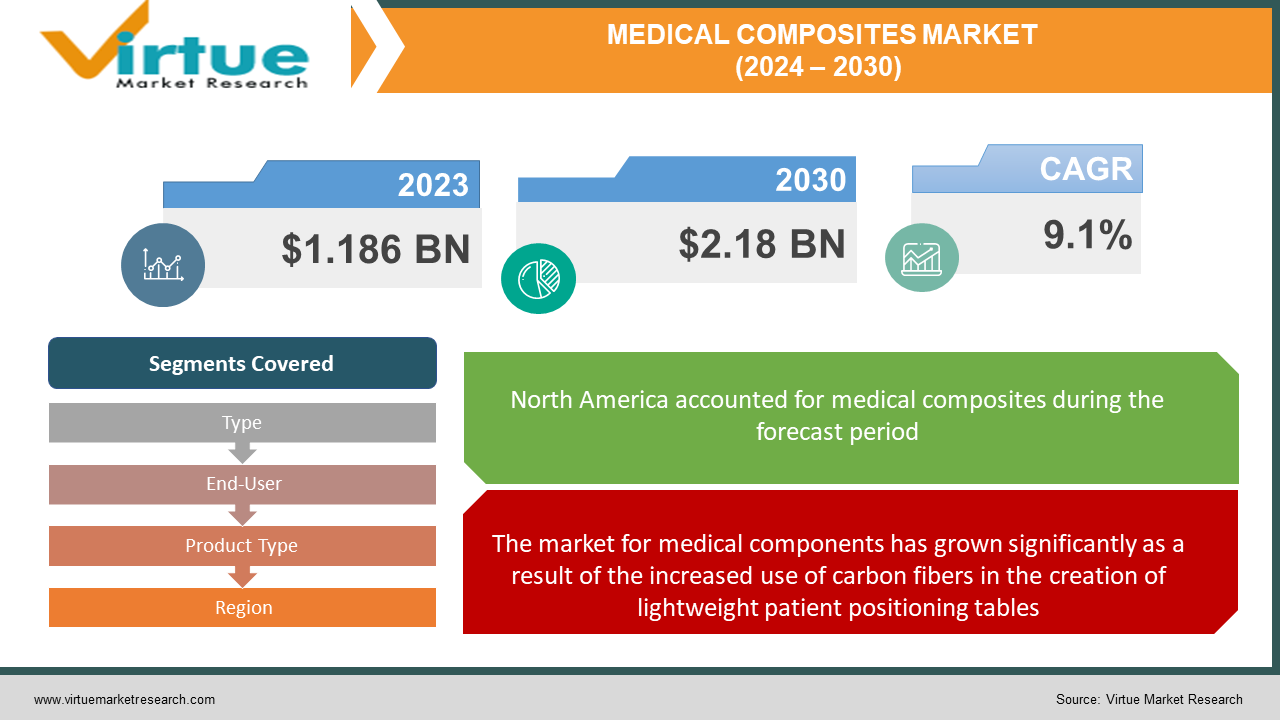

The global market for medical composites was valued at USD 1.186 billion and is projected to reach a market size of USD 2.18 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 9.1%.

A growing number of people are developing chronic illnesses, and technological developments in medicine are major drivers of the medical composites market's revenue growth. One of the main factors propelling the medical composites market's revenue growth is the expanding need for these materials in medical imaging. Carbon fiber composites are incredibly useful for a variety of medical applications because of their capacity to remain transparent to X-rays. Carbon fiber composites are very suitable for particle accelerators or computed tomography components since they absorb little X-rays. However, the great transmissivity of these materials affects the quality of the images produced. In several studies, carbon nanotube-polymer composites have been used to cultivate T-cells, which can target and eliminate malignant cells that spread cancer. This novel approach is currently experimental for use in adoptive immunotherapy. Adoptive immunotherapy involves taking a patient's cells, improving them in a lab setting using carbon nanotube polymer composites, and then reinjecting them back into the patient. This method enhances a patient's capacity to fight cancer, which creates a wealth of potential for market participants in medical composites.

Key Market Insights:

The World Health Organization (WHO) estimates that 35–40 million people in developing nations are amputees. One of the problems facing emerging nations is the scarcity of skilled workers in the prosthetics industry, and acquiring a prosthetic limb from outside is costly. For this reason, amputees in developing nations depend on regional prosthesis manufacturers. Unfortunately, due to inexperience, prosthetics in developing nations are only constructed from wood mixed with resin or a material resembling fibers. The framework. This range of materials presents problems for amputees because of their weight. Research has revealed that emerging nations are using more advanced composite materials (ACM) in various industries because of their strength-to-weight ratio. For use in prosthetic sockets, its ratio and biocompatibility make it perfect.

Global Medical Composites Market Drivers:

The market for medical components has grown significantly as a result of the increased use of carbon fibers in the creation of lightweight patient positioning tables.

Carbon fiber sandwich composite panels for patient positioning tables are a major development for companies in the medical composites sector. For example, Broncos Medical Inc., a producer of medical equipment, is using composite patient positioning tables made by ACP Composites, a family-run composites fabricator. Manufacturers in the medical composites industry are developing strategic collaborations to improve the performance of composite materials. More and more focus is being placed on the creation of composite patient positioning tables that are strong, light, and transparent to X-ray radiation. There is a need for patient positioning tables that can be readily machined to accommodate a certain type of insert for the installation of clamps and medical devices.

The market for mechanical components has expanded because of FRPs' flexibility in manufacturing artificial limbs.

FRPs are becoming more and more popular due to their advantages in high power, lightweight, and biocompatibility. Artificial limbs with fatigue resistance are made with fiber-reinforced polymers (FRPs). Companies in the medical composites sector strongly favor the flexibility of manufacturing using FRPs. This explains why, by the end of 2030, it is expected that the medical composites market will have grown to a value of over USD 500 million. Carbon fiber's chemical inertness is assisting producers in creating steady revenue streams as the material becomes increasingly popular in surgical applications. In surgical applications, carbon fiber is taking the place of metallic and polymeric materials. Carbon fiber has recently advanced to the point that it is used in load-bearing joints in prosthetic limb devices. To encourage the biological resurfacing of damaged areas, companies in the medical composites market are expanding their production capacities for carbon composites that are implanted into cartilage.

The market expansion for medical components has been impacted by the use of CFRP in spreaders and surgical procedure components.

Since CFRP seldom absorbs any X-rays, it is well known for its X-ray clarity and stiffness. Carbon fiber composites are becoming more widely produced by companies in the medical composites industry because they are a good fit for particle accelerators and CT system components. There are no consequences caused by CFRP's great transmissivity advantage that could impede imaging. In medical imaging applications, elevated-temperature sterilization of CFRP is preferred. Medical imaging applications use a lot of CFRP because it is physiologically innocuous, biocompatible, and resistant to corrosion. Businesses in the medical composites industry are taking advantage of additional prospects by positioning implants using radiolucent, orthopedic, and low-deformation insertion guides constructed of CFRP. The high-strength properties of CFRP make them appropriate for use as components for the external anchorage of bone structures and as spreaders during surgical procedures.

Global Medical Composites Market Restraints and Challenges:

The intricate procedures needed to produce medical composites are anticipated to increase production expenses, which would obstruct the market's expansion on a worldwide scale. The tight rules and regulations of the Food and Drug Administration would hinder the expansion of the medical composite market throughout the estimated timeframe.

Global Medical Composites Market Opportunities:

Through process solutions in medical technology, development and production initiatives are being initiated to lower the manufacturing costs of carbon fiber-reinforced items. Numerous entities are extensively researching and producing diverse medical composites to enhance production procedures and achieve greater product stability. These developments are anticipated to generate substantial prospects for the expansion of the medical composites industry. Throughout the aforementioned forecast period, there will be numerous chances for the medical composites market to grow due to the development of novel materials, such as fathomers, and the demand for biodegradable medical composites for medical implants.

MEDICAL COMPOSITES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

9.1% |

|

Segments Covered |

By Type, End-User, Product Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Mizuho Medical Co., Ltd., Fillauer LLC, Össur, Steris Corporation, Stille AB, Stryker Corporation, HillRom, Skytron LLC, Composite Horizons, Ottobock SE & Co. KGaA |

Global Medical Composites Market Segmentation: By Type

-

Carbon Fiber Composites

-

Ceramic Fiber Composites

Carbon fiber composites are the largest and fastest-growing segment. Carbon fiber composites are used as implant materials for cartilage and bone that aid in the biological healing of injured tissues. This substance encourages the formation of new cells in the spaces between individual fibers, which results in proper healing. Additionally, because of their poor tissue adherence and biological inert qualities, these materials are thought to be safer when used as implant materials. For instance, compared to metals, carbon-fiber-reinforced PEEK implants offer better fatigue strength and a lower elasticity modulus that is comparable to that of bone. It is anticipated that oil-based carbon will eventually be replaced by bio-based carbon fiber development. Stora Enso and Cordina have decided to work together on the creation of precursors for carbon fiber that are derived from biomass. As a result of their physiochemical properties, ceramic fiber composites find extensive applications as biomaterials. This product type is a good fit for bone replacement because of its superior hardness and improved abrasion resistance. Ceramics also referred to as bioceramics, are macro- and nanoparticles used mostly in dentistry, medicine, and bone applications. In orthopedic applications, where biocompatibility and mechanical properties of the materials are important considerations for clinical utilization, bioceramics have been widely used. Research is being done on nanostructured ceramics for use in dentistry, orthopedics, and other medical fields.

Global Medical Composites Market Segmentation: By End-User

-

Hospitals

-

Clinics

Hospitals are the largest and fastest-growing in this market. The use of carbon fiber is common in the medical field. It makes it easier for a variety of patients to recover from injuries and resume their normal lifestyles, which enhances their quality of life. Among its many benefits is carbon fiber's radiolucency, which is essential for medical imaging. This suggests that the radiation might pass through a bed of carbon fiber and produce images with greater clarity. This is the reason hospitals frequently use carbon fibers. Moreover, the field of prosthetics has changed because of carbon fiber. Prosthetic designers love this material because of its durability and minimal weight. Many prosthetic companies already manufacture sockets and limbs made of carbon fiber. Prosthetics are made using 3D-printed carbon fiber components. Especially for athletes with disabilities, this is advantageous. Some athletes claim that carbon fiber prostheses allow them a more dynamic response.

Global Medical Composites Market Segmentation: By Product Type

-

Surgical Instruments

-

Diagnostic Imaging

-

Body Implants

-

Tissue Engineering

-

Others

Diagnostic imaging is the largest and fastest-growing segment. Diagnostic imaging facilitates clinicians' understanding of human body problems and improves their decision-making. Except for contrast material, medical imaging procedures are completely painless, non-invasive, and don't require any special preparation. In certain cases, like breast cancer, medical imaging can save lives. A medical examiner can evaluate internal body structures like tendons, muscles, joints, arteries, and internal organs due to ultrasound imaging tools. Pregnant women undergo these ultrasonography exams, or sonograms, as prenatal diagnostics. The dental segment's revenue share was moderate. Dentists are beginning to favor composite fillings more and more because they are mercury-free, closely resemble natural teeth in color, and are incredibly durable. Composite fillings offer a higher lifespan, decay protection, and tooth strength restoration. Dental composites bind chemically to the structure of teeth. This restores the tooth's natural physical integrity and strengthens its structure. A composite restoration requires the removal of a less healthy tooth structure since composites are adhered to the tooth.

Global Medical Composites Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America is the largest growing market. Due to the region's high demand for components used in prostatic surgery, composite implants, and diagnostic imaging, North America holds a significant market share worldwide. Due to the region's substantial use of composite materials in bio-medical applications, the market in North America is expected to grow rapidly. Furthermore, this area has many prominent companies that have a global presence. Prominent ones include Stryker Corporation, Johnson & Johnson, Zimmer Biomet Holdings, Inc., and Medtronic plc. Asia-Pacific is the fastest-growing market. This is because of the economic progress that is being achieved. This has resulted in better investments and funds for projects. Besides, the healthcare sector has seen significant development, due to which the application of medical composites has expanded. Startups have been coming up with innovative solutions to improve existing technologies.

COVID-19 Impact Analysis on the Global Medical Composites Market:

The entire world has been negatively impacted by this coronavirus, notably the underdeveloped world. Businesses have closed their production and operational facilities throughout the outbreak. Restrictions were placed on dental services, and hospitals were limited to treating emergency cases. As a result, the use of medical composites decreased in a variety of applications, including surgical instruments, imaging, composite body implants, and more. This also applied to the medical composites industry as a result of global supply chain disruption, reduced demand, production halts, and job losses. But the market has begun to recover, resulting in generally positive prospects in the years to follow.

Latest Trends/ Developments:

Recently, Vermont Composites Inc. announced ambitions to expand its medical imaging business with the award of a contract to produce complex composite assemblies for the DRX product line from Carestream Health. These advancements highlight the medical composite industry's ongoing evolution and progress as businesses work to satisfy the rising demand for premium and cutting-edge products.

Key players:

-

Mizuho Medical Co., Ltd.

-

Fillauer LLC

-

Össur

-

Steris Corporation

-

Stille AB

-

Stryker Corporation

-

HillRom

-

Skytron LLC

-

Composite Horizons

-

Ottobock SE & Co. KGaA

Chapter 1. Medical Composites Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Medical Composites Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Medical Composites Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Medical Composites Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Medical Composites Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Medical Composites Market – By Type

6.1 Introduction/Key Findings

6.2 Carbon Fiber Composites

6.3 Ceramic Fiber Composites

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Medical Composites Market – By End-User

7.1 Introduction/Key Findings

7.2 Hospitals

7.3 Clinics

7.4 Y-O-Y Growth trend Analysis By End-User

7.5 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 8. Medical Composites Market – By Product Type

8.1 Introduction/Key Findings

8.2 Surgical Instruments

8.3 Diagnostic Imaging

8.4 Body Implants

8.5 Tissue Engineering

8.6 Others

8.7 Y-O-Y Growth trend Analysis By Product Type

8.8 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 9. Medical Composites Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type

9.1.3 By End-User

9.1.4 By Product Type

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type

9.2.3 By End-User

9.2.4 By Product Type

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type

9.3.3 By End-User

9.3.4 By Product Type

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type

9.4.3 By End-User

9.4.4 By Product Type

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type

9.5.3 By End-User

9.5.4 By Product Type

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Medical Composites Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Mizuho Medical Co., Ltd.

10.2 Fillauer LLC

10.3 Össur

10.4 Steris Corporation

10.5 Stille AB

10.6 Stryker Corporation

10.7 HillRom

10.8 Skytron LLC

10.9 Composite Horizons

10.10 Ottobock SE & Co. KGaA

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The medical composites market is anticipated to grow at a compound annual growth rate (CAGR) of 9.1% from 2024 to 2030.

The top players in the medical composites market are Ottobock SE & Co. KGaA, Stryker Corporation, Getinge Group, Mizuho Medical Co. Ltd., HillRom, Stille AB, Steris Corporation, Skytron LLC, Össur, Fillauer LLC, and Composite Horizons.

Throughout the projected period (2024–2030), Asia-Pacific is predicted to grow at the greatest CAGR.

North America holds the biggest market share in the medical composites market.

Medical composites are used the most in hospitals.