Medical Cannabis Market Size (2023 - 2030)

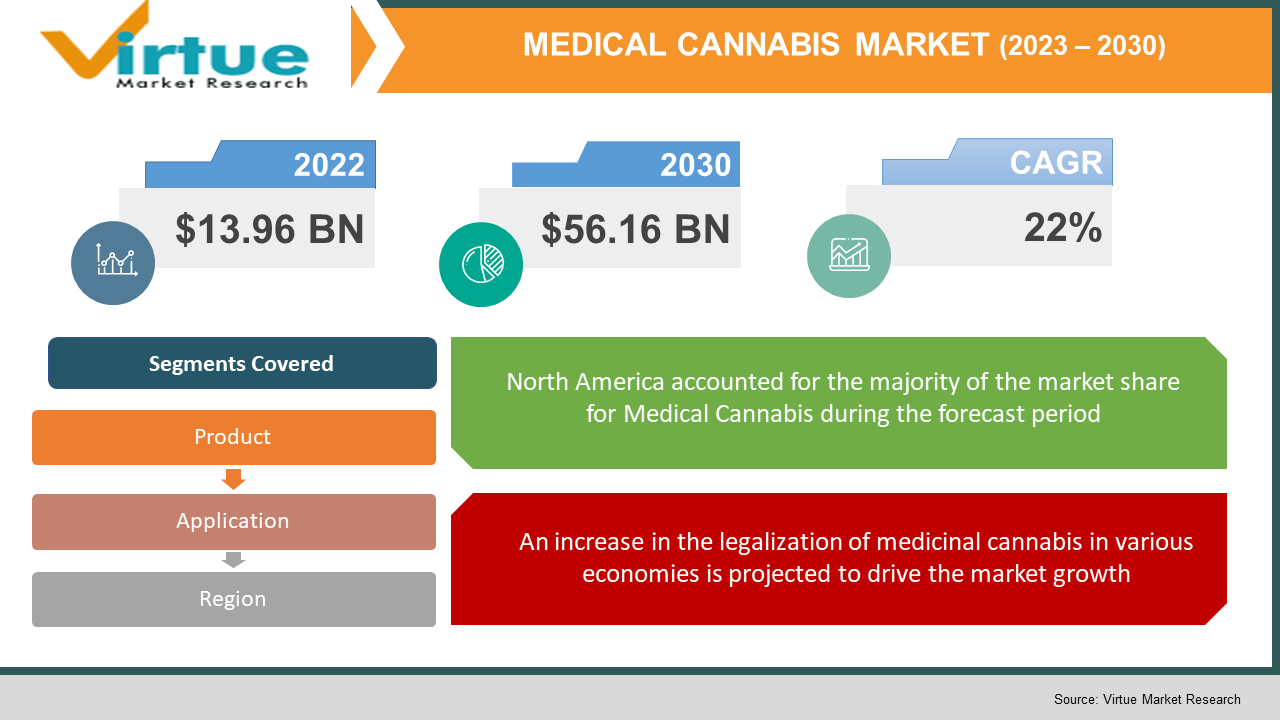

According to our research report, the global medical cannabis market size in 2023 is USD 13.96 billion. and estimated to reach USD 56.16 billion by 2030. The market is projected to grow with a CAGR of 22% per annum during the period of analysis (2024 - 2030).

Industry Overview

Medicinal cannabis, commonly known as medicinal marijuana, is used to cure sickness or alleviate its symptoms. The two cannabinoids, delta-9-tetrahydrocannabinol (THC) and Cannabidiol (CBD) are utilized in the treatment of various diseases and health disorders, as well as applications such as pain management, blood pressure, memory, focus, hunger, sensory stimulation, muscle difficulties, and seizures. Several nations throughout the world are legalizing the export of medicinal cannabis products, which is projected to accelerate the expansion of the medicinal cannabis industry. For example, in January 2018, the Australian government authorized cannabis producers to export medicinal cannabis and cannabis products to the worldwide market.

The market is expanding due to increased knowledge of numerous medicinal uses such as pain management, appetite augmentation, and ocular pressure reduction. Medical marijuana is divided into two types: Cannabis Sativa and Cannabis Indica, which are native to the Western Hemisphere and the Central and South Asian areas, respectively. One of the primary elements increasing the usage rate of cannabis in therapeutic applications is the growing number of nations authorizing the use of medicinal marijuana in various regions of the world.

The increased understanding of the advantages of medicinal marijuana among healthcare sector experts, medical professionals, and patients has spurred regulatory authorities to consider and allow medical marijuana. Over 30 countries, including the United States, Canada, Argentina, the United Kingdom, Australia, Germany, and several European countries, have approved its medicinal use through various national efforts. It has also been licensed for medical use in several states around the United States. Medical marijuana has been the topic of intense research and debate for decades. Multiple drugs have been commercially licensed by the United States Food and Drug Administration owing to the demonstrated medical advantages of marijuana-based formulations in healthcare.

The expanding number of states adopting medical marijuana, as well as the increasing need for cannabis in medicinal and recreational applications, are some of the key drivers predicted to drive medical marijuana demand in the future years. Increasing research and development efforts are also predicted to increase medicine demand throughout the forecast period. Because of its medicinal characteristics, the Food and Drug Administration (FDA) in the United States has authorized certain cannabis drugs: Epidiolex, a medicine containing a refined version of cannabidiol produced from the cannabis plant, is used to treat seizures caused by two kinds of epilepsy: Lennox-Gastaut syndrome and Dravet syndrome.

Impact of Covid-19 on the Industry

COVID-19 had a moderately favorable influence on the industry, as it expanded the use of medicinal cannabis in various states across the United States, Europe, and Canada. Customers buying from the offline or retail market decreased as a result of the lockdown, but many prominent participants in the cannabis industry moved their attention to selling and promoting products on social media and e-commerce platforms. During the pandemic, the number of patients using medicinal marijuana increased significantly in Europe and the United States. With the legalization of adult-use cannabis in jurisdictions such as California, Washington, New York, and Colorado, the industry experienced a decline in growth.

The construction of Pharmacon's 178,000-square-foot cannabis grow center in North Macedonia has been halted owing to social distancing restrictions. Furthermore, following the government's proclamation of a state of emergency across the country, Cannabis Social Clubs—private, non-profit organizations in which cannabis is collaboratively cultivated and given to registered members—closed their doors in Barcelona. Cannabis firms that provide an e-commerce platform, on the other hand, are experiencing a rise in business. The Alberta Government, for example, declared cannabis retail shops, growers, manufacturers, distributors, and warehouses to be essential services on March 30, 2020. As a result, during the COVID-19 epidemic, cannabis companies and services continued to serve Albertans.

Market Drivers

An increase in the legalization of medicinal cannabis in various economies is projected to drive the market growth

Increased approvals for medical cannabis products, as well as increased research and development activities in the medicinal cannabis industry, are likely to drive market growth. For example, in March 2017, Germany's parliament enacted a bill enabling healthcare practitioners to prescribe medical cannabis products to people suffering from health concerns such as chronic pain, vomiting, and nausea. However, health risks associated with excessive cannabis usage, such as tachycardia and the risk of heart attack, particularly in persons with pre-existing heart disease or arrhythmias, are predicted to limit market expansion.

The legalization of medical cannabis is predicted to increase as solid proof of its safety and usefulness is achieved via significant studies. In 2013, the Czech Republic, for example, approved medical marijuana for patients suffering from chronic pain, epilepsy, chemotherapy-induced side effects, and other serious illness indications. Furthermore, people with marijuana prescriptions are permitted to obtain medicinal marijuana from pharmacies under the statute. However, marijuana growing is not permitted in the nation, so providers must import medicinal cannabis. These characteristics are projected to boost the usage of medical cannabis in the pharmaceutical and biotechnology industries.

Hemp-infused Edibles Product Innovation, Differentiation, and Availability to Drive Market Growth

Consumer product firms and shops selling C. Sativa are fast emerging to fulfill the requirements of the "mainstream" marijuana consumer. Customers are no longer confined to smoking flowers via joints, pipes, or bongs, but have access to an expanding range of goods like concentrates, infused products, and topicals. Concerns over COVID-19 prompted people to seek out newly created replacements such as edibles and other infused goods. Inhaling the substance causes THC to enter the lungs and bloodstream swiftly, allowing the user to experience the related mind-altering effects considerably faster than swallowing an edible product. Scientific advancements and product innovation have begun to tackle the disadvantages of edibles, such as the variable impact of marijuana after eating.

Candies, chocolates, and drinks are still among the most popular hemp-based consumables on the market. The onset of the euphoric "high" effect produced by such edibles takes one to two hours, although the impact lasts longer than that produced by breathing smoke or vapor. Nonetheless, product innovation and packaging-related changes are likely to play a critical part in raising edibles sales sentiments and expanding at the quickest rate over the projection period.

Market Restraints

Regulations governing the use of hemp in several countries are stifling market growth

Marijuana is theoretically designated and legal for medicinal use in parts of North America, Africa, Australia, Europe, and South America. However, it is still illegal in the majority of Middle Eastern and Asian nations. Consumption, possession, purchase, or sale of the substance is illegal in rising nations such as Japan, India, and Korea and is viewed as a criminal offense. As a result, the legal environment on goods in these places is projected to impede the market from reaching its full growth potential. Furthermore, negative effects connected with its usage as a drug, such as cognitive impairment, are predicted to limit expansion.

MEDICAL CANNABIS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

22% |

|

Segments Covered |

By Product, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Cara Therapeutics Inc., Cannabis Sativa, Inc., CannaGrow Holdings, Inc., United Cannabis Corporation, Growblox Sciences, Inc., GreenGro Technologies, Inc., GW Pharmaceuticals plc, International Consolidated Companies, Inc., Lexaria Corp |

Global Medical Cannabis Market – By Product

-

Flower

-

Oil & Tinctures

In 2021, the oil and tinctures category led the market, accounting for 51.8 percent of total sales. Over the projected period, the category is estimated to increase at the quickest rate. Marijuana oils are recommended because they combine cannabis extracts with innocuous carrier oils. The oils are easy to get by. Because tinctures are often alcohol-based, they have a longer shelf life. The bitterness of tinctures is sometimes disguised by additions such as sweeteners and flavoring compounds.

Global Medical Cannabis Market – By Application

-

Cancer

-

Chronic Pain

-

Depression and Anxiety

-

Arthritis

-

Diabetes

-

Glaucoma

-

Migraines

-

Epilepsy

-

Multiple Sclerosis

-

AIDS

-

Amyotrophic Lateral Sclerosis

-

Alzheimer’s Disease

-

Post-Traumatic Stress Disorder (PTSD)

-

Parkinson's Disease

-

Tourette

In 2021, the chronic pain sector led the market, accounting for approximately 26.0 percent of total revenue. According to different studies, medicinal cannabis is safe for treating individuals with chronic pain and neuropathic pain. One of the important signs demonstrating the expanding use of cannabis in pain treatment in the next years is the increasing number of clinical trials with marijuana to treat neuropathic and chronic pain. According to New York's "New Medicinal Marijuana Law," a patient who is certified by a healthcare practitioner to use medical marijuana and who has a patient identification card registered with the New York State Department of Health is allowed to use medical marijuana for pain treatment.

Medical marijuana has gained quick adoption for chronic pain management, and this trend is estimated to continue in the future years. Cannabinoids have surpassed opioids in the treatment of chronic pain due to their capacity to relieve pain more effectively than opioids. It is used to treat chronic pain, as well as nerve discomfort and multiple sclerosis. It is also used to treat tremors in Parkinson's disease, interstitial cystitis, endometriosis, fibromyalgia, and other chronic pain conditions. It is used to treat glaucoma, nausea, and weight loss, as well as people suffering from pain and wasting syndrome caused by HIV, Crohn's disease, and bowel syndrome.

Cancer, on the other hand, will be the fastest-growing application sector over the projection period, with a CAGR of 25.0 percent. The use of cannabis outside of a scientific environment is unlawful under federal law. However, the constantly increasing number of states, districts, and territories passing legislation to legalize the medicine is fuelling its demand in cancer therapy. Several clinical experiments have shown that marijuana can kill cancer cells. However, the medicine is not licensed by the US Food and Drug Administration for the treatment of cancer, which is a major impediment to the expansion of this application area. Furthermore, the rising prevalence of cancer and increased interest among researchers in the use of medicinal marijuana in cancer treatment are some of the causes to blame.

Global Medical Cannabis Market – By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

The Middle East and Africa

North America led the market, accounting for 76.1 percent of total sales in 2021. Most Asian and Latin American economies have not yet legalized the use of cannabis for medicinal purposes. As a result, the market's regional breadth is confined to North America, Europe, and the Rest of the World. One of the primary elements leading to its growing demand is the quick speed of cannabis legalization and the rapid growth in the approval and commercialization of medicinal marijuana in the United States and Canada. The area is predicted to increase at an exponential pace throughout the projection period, owing to a huge population preferring medical cannabis as a therapeutic choice.

The growing number of patients suffering from chronic illnesses such as Crohn's and Alzheimer's has also spurred the expansion of medical marijuana sales in North America. Furthermore, several important companies are taking steps to secure the availability and supply of medicinal marijuana in the area, which is propelling the North American medical marijuana market. In the United States, cannabis has been legalized for recreational use in four states, and five states, notably California, Maine, Arizona, Massachusetts, and Nevada, have voted to legalize it for recreational purposes as well. Furthermore, the increasing number of major companies investing in the US and Canadian markets is likely to boost the market throughout the projection period.

Global Medical Cannabis Market – By Companies

-

Cara Therapeutics Inc.

-

Cannabis Sativa, Inc.

-

CannaGrow Holdings, Inc.

-

United Cannabis Corporation

-

Growblox Sciences, Inc.

-

GreenGro Technologies, Inc.

-

GW Pharmaceuticals plc

-

International Consolidated Companies, Inc.

-

Lexaria Corp

NOTABLE HAPPENINGS IN THE GLOBAL MEDICAL CANNABIS MARKET IN THE RECENT PAST:

-

Merger & Acquisition: - In 2021, Canopy Growth Corporation and The Supreme Cannabis Company, Inc. announced that they have reached a binding agreement for the former to acquire the latter. This purchase will help the firm not only extend its product offering but also strengthen its market position.

-

Regulatory Approval: - In 2021, Mexican senators backed a measure legalizing recreational cannabis, a watershed moment in the country's drug battle that might lead to it becoming the world's largest market. With permission, adults would be able to use marijuana and cultivate a limited number of plants at home. It also provides manufacturers permission to produce and sell the crop.

-

Business Partnership: - In 2020, Vifor Pharma and Cara Therapeutics have signed a US license agreement for Korsuva to treat dialysis patients with pruritus.

Chapter 1.GLOBAL MEDICAL CANNABIS MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2.GLOBAL MEDICAL CANNABIS MARKET – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3.GLOBAL MEDICAL CANNABIS MARKET – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4.GLOBAL MEDICAL CANNABIS MARKET - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. GLOBAL MEDICAL CANNABIS MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6.GLOBAL MEDICAL CANNABIS MARKET – By Product

6.1. Flower

6.2. Oil & Tinctures

Chapter 7.GLOBAL MEDICAL CANNABIS MARKET – By Application

7.1. Cancer

7.2. Chronic Pain

7.3. Depression and Anxiety

7.4. Arthritis

7.5. Diabetes

7.6. Glaucoma

7.7. Migraines

7.8. Epilepsy

7.8. Multiple Sclerosis

7.9. AIDS

7.11. Amyotrophic Lateral Sclerosis

7.12. Alzheimer’s Disease

7.13. Post-Traumatic Stress Disorder (PTSD)

7.14. Parkinson's Disease

7.15. Tourette

Chapter 8.GLOBAL MEDICAL CANNABIS MARKET – By Region

8.1. North America

8.2. Europe

8.3. The Asia Pacific

8.4. Latin America

8.5. The Middle East

8.6. Africa

Chapter 9. GLOBAL MEDICAL CANNABIS MARKET – Key players

9.1. Cara Therapeutics Inc.

9.2. Cannabis Sativa, Inc.

9.3. CannaGrow Holdings, Inc.

9.4. United Cannabis Corporation

9.5. Growblox Sciences, Inc.

9.6. GreenGro Technologies, Inc.

9.7. GW Pharmaceuticals plc

9.8. International Consolidated Companies, Inc.

9.9. Lexaria Corp

Download Sample

Choose License Type

2500

4250

5250

6900