Medical Breathable Tapes Market Size (2024 – 2030)

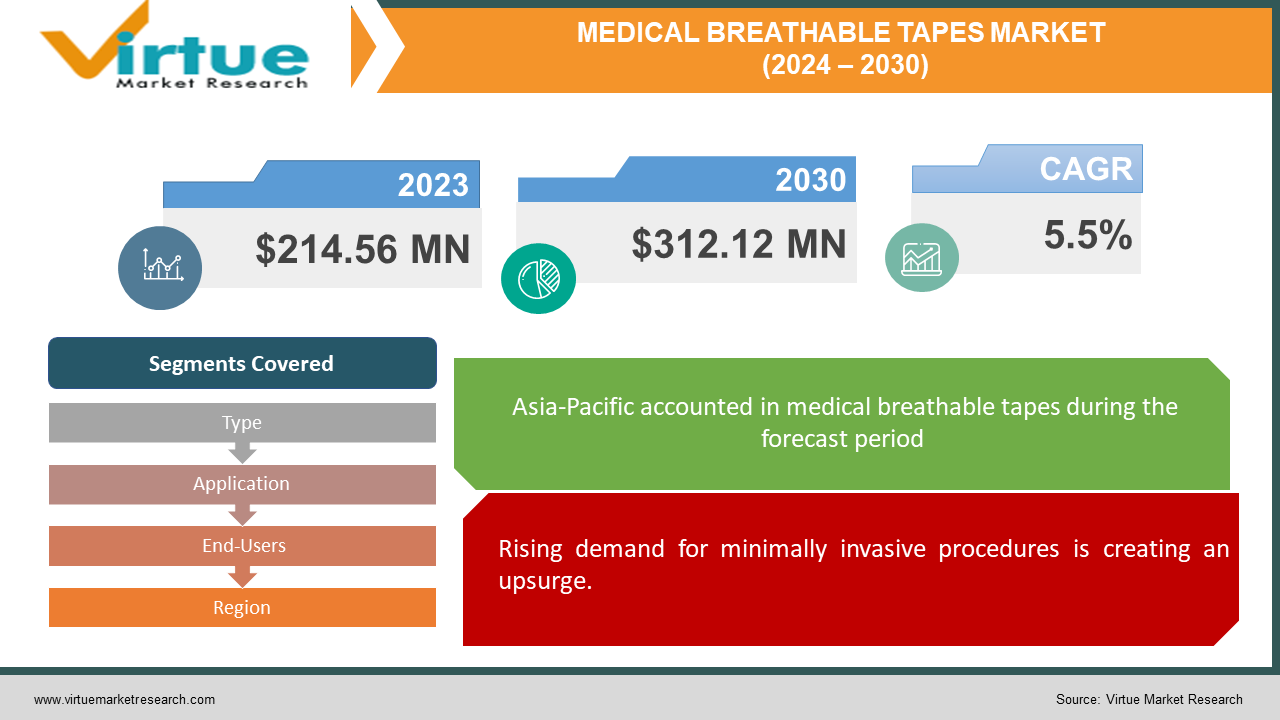

The global medical breathable tape market was valued at USD 214.56 million in 2023 and will grow at a CAGR of 5.5% from 2024 to 2030. The market is expected to reach USD 312.12 million by 2030.

Surgical tapes, sometimes referred to as medical breathable tapes, are easy to remove and comfortable since they are composed of materials that let air pass through to the skin. They have zinc oxide to help prevent infections, and they are frequently white. While 3M Micropore is a porous substance, cotton is used to make some breathable tapes. Despite being robust and long-lasting, microfoam surgical tape is kind to the skin. It is breathable, water-resistant, and has a seven-day wear time. Compared to other kinds of medical tape, microfoam surgical tape offers several benefits. It can be applied to delicate skin types and is less likely to irritate or break the skin.

Key Market Insights:

The market may not grow as planned due to obstacles like strict regulations, competition from less expensive options, and a lack of knowledge and training among healthcare professionals. Opportunities in the market include the growing number of older people with chronic wounds, the popularity of less invasive operations, and developments in adhesive technology, especially in the Asia-Pacific area. Because of factors like an aging population, rising healthcare costs, and increased awareness of medical breathable tapes, Asia-Pacific is the largest and fastest-growing market.

Global Medical Breathable Tape Market Drivers:

Rising demand for minimally invasive procedures is creating an upsurge.

The rise of minimally invasive surgeries (MIS) is a boon for patients, offering smaller incisions made with tools like laparoscopes. These translate to faster recovery times, reduced pain, and less scarring compared to traditional open surgeries. Medical breathable tapes play a critical role in this shift. Since MIS procedures rely on smaller entry points, traditional sutures might be impractical. Breathable tapes effectively secure dressings and catheters at these incision sites. Breathability is crucial as it promotes proper healing by preventing moisture buildup and infection while also allowing the skin to breathe and maintain its health. This not only improves patient comfort but also reduces the risk of complications, contributing to the overall success of minimally invasive surgeries.

The growing geriatric population with chronic wounds is boosting the market.

As the global population ages, the prevalence of chronic wounds like diabetic ulcers and pressure ulcers is on the rise. These wounds can be debilitating and slow to heal, often requiring long-term management. Medical breathable tapes offer a welcome solution for both patients and healthcare providers. Their breathable design allows for optimal moisture management, preventing the wound bed from becoming excessively dry or wet. This creates an ideal environment for healing while minimizing the risk of infection, a major concern with chronic wounds. Breathable tapes also provide gentle yet secure adhesion, which is crucial for dressings to stay in place without causing further skin irritation. This translates to increased patient comfort, allowing for greater mobility and participation in daily activities. Furthermore, the ease of application and removal of these tapes simplifies wound care routines for both patients and caregivers, improving overall management and potentially reducing healthcare costs associated with chronic wounds.

Technological advancements are fueling the progress.

The public's growing focus on skin health is driving a shift towards gentler medical tapes. Traditional tapes can be harsh, causing irritation and even allergic reactions. Breathable tapes address this concern by prioritizing skin health. Their unique construction allows for proper air circulation, prevents moisture buildup, and promotes a healthy skin environment. This is particularly important for extended wear times or sensitive skin. Breathable tapes also minimize the risk of maceration, a condition where prolonged contact with moisture softens the skin, making it more susceptible to tears and infection. By allowing the skin to breathe, breathable tapes prevent this weakening and promote a stronger barrier against external threats. This translates to a more comfortable experience for patients, reducing the need for frequent dressing changes and minimizing the risk of complications related to skin breakdown. Ultimately, the focus on skin-friendly materials in medical tapes reflects a growing understanding of how crucial healthy skin is for overall healing and patient well-being.

Global Medical Breathable Tapes Market Challenges and Restraints:

Stringent regulatory requirements are a hindrance.

Stringent government regulations, while essential for patient safety, can act as a hurdle. These regulations, implemented in both developed and developing countries, require thorough testing and documentation to ensure the tapes meet strict safety and efficacy standards. This process can be lengthy and expensive, demanding significant investment from manufacturers. While these regulations ensure patients receive high-quality products, they can also delay market entry for innovative breathable tapes with the potential to revolutionize wound care or surgical procedures. This delay can stifle competition and limit patient access to potentially life-changing advancements in medical technology. Finding the right balance between robust regulations and fostering innovation is crucial for the continued growth and development of the market.

Competition from cost-effective alternatives leads to losses.

Cost remains a significant challenge. Traditional medical tapes and wound dressings are often considerably cheaper, making them an attractive option for healthcare providers, particularly in budget-constrained environments. Hospitals, clinics, and long-term care facilities often face pressure to reduce costs, and the initial higher price tag of breathable tapes can be a deterrent. This price difference can be attributed to several factors. Breathable tapes often incorporate more advanced materials and technologies to achieve their breathability and skin-friendliness, leading to higher production costs. Additionally, the research and development required to create these innovative tapes adds to the overall expense. While breathable tapes may offer long-term benefits like reduced dressing changes and improved healing times, these advantages may not translate into immediate cost savings for healthcare providers. This can create a situation where the potential benefits of breathable tapes are overshadowed by the initial cost barrier.

Lack of awareness and training can create complexities.

Knowledge gaps and training needs pose a challenge to the wider adoption of medical breathable tapes. Some healthcare professionals may not be fully aware of the advantages these tapes offer over traditional options. Breathable tapes can promote faster healing, improve patient comfort, and minimize skin complications. However, if these benefits are not well understood, medical staff may default to familiar, traditional tapes. Furthermore, proper application techniques are crucial to maximizing the effectiveness of breathable tapes. Improper application can compromise breathability, reduce adhesion, and ultimately hinder the healing process. Incorporating educational programs and workshops into healthcare settings can address this knowledge gap and ensure staff are equipped to use breathable tapes effectively. By raising awareness of the benefits and promoting proper application techniques, medical professionals can make informed decisions about using breathable tapes, leading to improved patient outcomes.

Global Medical Breathable Tape Market Opportunities:

The market presents exciting growth opportunities. The increasing popularity of minimally invasive surgeries creates a strong demand for tapes that effectively secure dressings and catheters while allowing the skin to breathe. This translates to faster patient recovery and reduced complications. Furthermore, the aging population with a growing prevalence of chronic wounds like diabetic ulcers represents a significant market opportunity. Breathable tapes offer a comfortable and effective solution for managing these wounds by promoting healing, preventing infection, and minimizing skin irritation. Additionally, the rising focus on skin health is driving demand for gentle medical tapes. Breathable tapes address this concern by allowing for proper air circulation and reducing the risk of maceration. This translates to a more comfortable experience for patients and minimizes the risk of complications related to skin breakdown. Looking ahead, opportunities lie in the Asia Pacific region, where a growing geriatric population, a rising number of surgical procedures, and expanding healthcare infrastructure are expected to fuel market expansion. Manufacturers can capitalize on this by developing tapes specifically designed for the needs of this region. Further advancements in adhesive technology hold promise for even more breathable, hypoallergenic, and high-performing tapes. However, navigating stringent regulatory requirements and overcoming the price barrier compared to traditional options will be crucial for market growth. By focusing on educating healthcare professionals about the benefits of breathable tapes and developing cost-effective solutions, manufacturers can unlock the full potential of this dynamic market.

MEDICAL BREATHABLE TAPES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.5% |

|

Segments Covered |

By Type, Application, End-Users, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

3M Company (US), Medtronic PLC (US), Medline Industries (US), Smith & Nephew Plc (UK), B. Braun Melsungen AG (Germany), Hartmann AG (Germany), Nitto Denko Corporation (Japan), Nichiban (Japan), Lohmann GmbH & Co. KG (Germany), Avery Dennison Corporation (US) |

Medical Breathable Tapes Market Segmentation: By Type

-

Non-Woven Tapes

-

PET Tapes

Non-woven tapes are the largest and fastest-growing type. They are known for their breathability and comfort and are popular choices for wound dressings and general applications. Their soft, cloth-like texture minimizes skin irritation while allowing proper air circulation to promote healing. In contrast, PET (Polyethylene) tapes prioritize moisture management. They boast good moisture vapor transmission, making them ideal for surgical fixation. PET tapes effectively secure dressings and catheters while allowing excess moisture to escape, reducing the risk of infection and promoting a healthy healing environment.

Medical Breathable Tapes Market Segmentation: By Application

-

Wound Care

-

Post-Operative Care

-

Others

Wound care is the largest and fastest-growing segment, encompassing a wide range of applications. These tapes play a vital role in securing dressings, managing chronic wounds like diabetic ulcers, and promoting optimal healing. Breathable properties are crucial here, as they allow for proper moisture balance, preventing excessive dryness or build-up that could hinder healing or increase infection risk. Beyond wound care, breathable tapes are also essential for post-operative care. They effectively secure bandages and catheters used after surgeries, providing comfort and stability for patients during recovery. This ensures the dressings remain in place while allowing the skin to breathe, minimizing discomfort, and promoting a smooth healing process.

Medical Breathable Tapes Market Segmentation: By End-Users

-

Hospital

-

Specialty Clinics

-

Ambulatory Surgical Centers

-

Others

Hospitals are the largest and fastest-growing end-users. Medical breathable tapes are in high demand because hospitals treat a high number of patients who need various medical treatments, surgeries, and wound care. A hospital can provide care for patients in a variety of medical specializations, such as general medicine, surgery, dermatology, and wound care. All of these professions require the use of medical tapes for different purposes. Hospitals are frequently equipped with the resources and infrastructure necessary to provide the best possible care for their patients. As such, they can invest in high-quality medical supplies and equipment, such as breathable tapes.

Medical Breathable Tapes Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

Asia-Pacific is the largest and fastest-growing market, with established players and strong healthcare infrastructure. Here, a large aging population, rising healthcare spending, and growing awareness of these tapes are fueling rapid market expansion, albeit with price sensitivity and regulations posing some hurdles. In the Asia-Pacific area, the frequency of injuries, chronic illnesses, and surgical operations is increasing, making the use of medical tapes for wound care, post-operative care, and other medical purposes necessary.

COVID-19 Impact Analysis on the Global Medical Breathable Tapes Market

The COVID-19 pandemic produced a mixed impact on the Global Medical Breathable Tapes Market. Initially, there was a surge in demand due to a rise in hospitalizations and a focus on securing critical care equipment like ventilators. Breathable tapes played a vital role in fixing these devices comfortably for extended periods. However, this demand hike was countered by disruptions in the supply chain and manufacturing slowdowns. Elective surgeries, a significant application segment for breathable tapes, were postponed to free up hospital resources for COVID-19 patients. This led to a temporary decline in demand. Looking ahead, the long-term impact is expected to be positive. The focus on hygiene and infection control is likely to boost the use of breathable tapes in various medical settings. Additionally, the potential rise in chronic wounds due to delayed surgeries or complications from COVID-19 itself could create a sustained demand for breathable wound dressings. Overall, while the pandemic caused some short-term disruptions, it is unlikely to hinder the long-term growth trajectory of the medical breathable tape market.

Latest trends/Developments

The market is abuzz with exciting developments. Manufacturers are focusing on innovation to cater to specific needs. Advanced adhesives with even greater breathability and hypoallergenic properties are being developed, promoting patient comfort and minimizing skin irritation. Product diversification is another key trend, with tapes designed for specialized applications like diabetic foot care or negative pressure wound therapy gaining traction. Telehealth advancements are also influencing the market. Breathable tapes designed for self-application at home are being developed to support the growing trend of home-based healthcare. Looking beyond product development, research is ongoing to explore the use of breathable tapes in drug delivery systems, potentially revolutionizing wound management. Furthermore, sustainability is gaining importance. Manufacturers are exploring the use of biodegradable or recyclable materials in breathable tapes, minimizing environmental impact without compromising performance. These trends highlight the dynamic nature of the market, constantly evolving to meet the needs of patients, healthcare providers, and a changing healthcare landscape.

Key Players:

-

3M Company (US)

-

Medtronic PLC (US)

-

Medline Industries (US)

-

Smith & Nephew Plc (UK)

-

B. Braun Melsungen AG (Germany)

-

Hartmann AG (Germany)

-

Nitto Denko Corporation (Japan)

-

Nichiban (Japan)

-

Lohmann GmbH & Co. KG (Germany)

-

Avery Dennison Corporation (US)

Chapter 1. Medical Breathable Tapes Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Medical Breathable Tapes Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Medical Breathable Tapes Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Medical Breathable Tapes Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Medical Breathable Tapes Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Medical Breathable Tapes Market – By Type

6.1 Introduction/Key Findings

6.2 Non-Woven Tapes

6.3 PET Tapes

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Medical Breathable Tapes Market – By End-Use Industry

7.1 Introduction/Key Findings

7.2 Hospital

7.3 Specialty Clinics

7.4 Ambulatory Surgical Centers

7.5 Others

7.6 Y-O-Y Growth trend Analysis By End-Use Industry

7.7 Absolute $ Opportunity Analysis By End-Use Industry, 2024-2030

Chapter 8. Medical Breathable Tapes Market – By Application

8.1 Introduction/Key Findings

8.2 Wound Care

8.3 Post-Operative Care

8.4 Others

8.5 Y-O-Y Growth trend Analysis By Application

8.6 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 9. Medical Breathable Tapes Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type

9.1.3 By End-Use Industry

9.1.4 By Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type

9.2.3 By End-Use Industry

9.2.4 By Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type

9.3.3 By End-Use Industry

9.3.4 By Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type

9.4.3 By End-Use Industry

9.4.4 By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type

9.5.3 By End-Use Industry

9.5.4 By Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Medical Breathable Tapes Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 3M Company (US)

10.2 Medtronic PLC (US)

10.3 Medline Industries (US)

10.4 Smith & Nephew Plc (UK)

10.5 B. Braun Melsungen AG (Germany)

10.6 Hartmann AG (Germany)

10.7 Nitto Denko Corporation (Japan)

10.8 Nichiban (Japan)

10.9 Lohmann GmbH & Co. KG (Germany)

10.10 Avery Dennison Corporation (US)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global medical breathable tape market was valued at USD 214.56 million in 2023 and will grow at a CAGR of 5.5% from 2024 to 2030. The market is expected to reach USD 312.12 million by 2030.

Rising demand for minimally invasive procedures, a growing geriatric population with chronic wounds, and increasing awareness of skin health are the reasons that are driving the market.

Based on application, the market is divided into wound care, post-operative care, and others.

Asia-Pacific is the most dominant region for the global medical breathable tape market.

3M Company, Medtronic PLC, Medline Industries, Smith & Nephew Plc, and B. Braun Melsungen AG are the major players in the global medical breathable tape market.