Medical Aesthetic Devices Market Size (2023 – 2030)

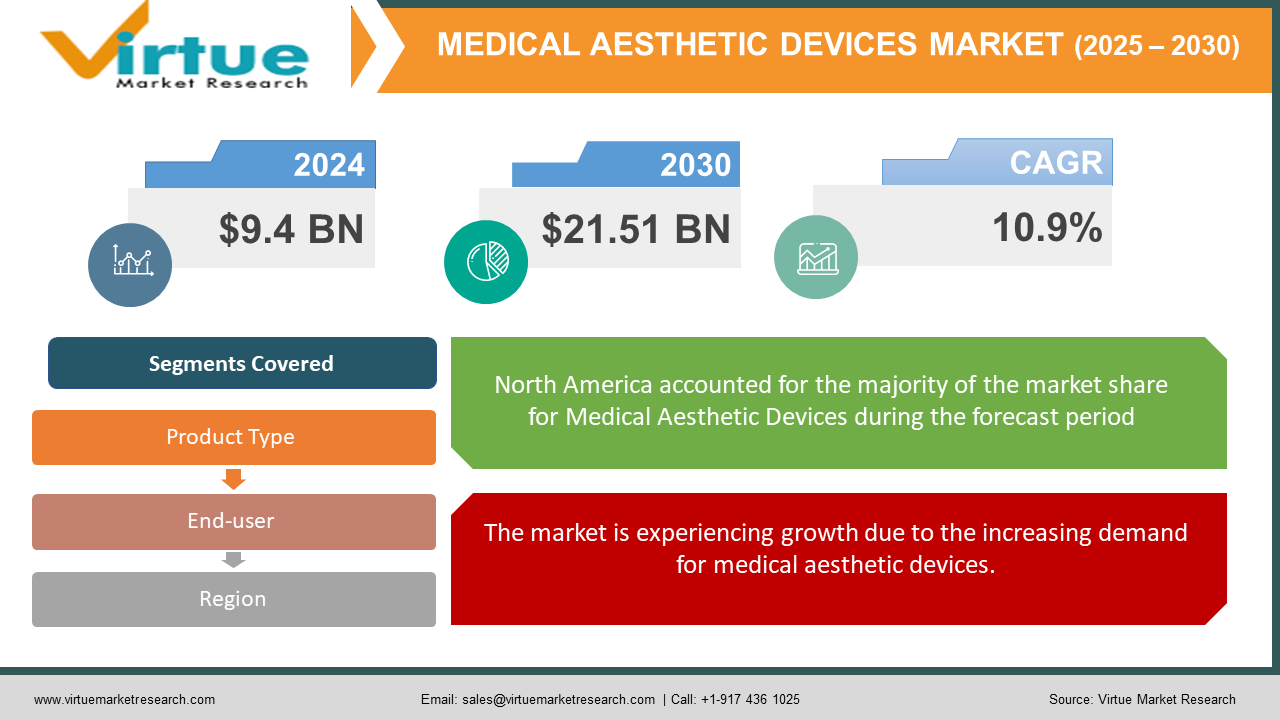

The worldwide medical aesthetics market is estimated to grow at a CAGR of 10.9% from USD 9.4 billion in 2022 to USD 21.51 billion in 2030. The availability of technologically improved and user-friendly products, as well as increased public knowledge of cosmetic treatments, are significant drivers driving the market's expansion.

MARKET OVERVIEW

Due to the global lockdown imposed at the start of the COVID-19 epidemic, cosmetic and aesthetic device manufacturers had to shut down production and supply units. According to a poll done in March 2020 with 1,360 cosmetic practitioners in the United Kingdom to assess the impact of the pandemic on cosmetic operations, 99.78 percent of practitioners reported that their profession had been impacted by the current epidemic. Consumers are also shopping for cosmetic home treatments available online. As more consumers seek aesthetic counsel from the comfort of their own homes, cosmetic firms can take advantage of this opportunity to revamp their online offerings, offer e-consultation services, and invest in the relevant technology, such as chatbots and augmented/virtual reality.

Increased obesity, increased awareness of cosmetic operations, rising acceptance of minimally invasive devices, and technological progress in devices are some of the reasons driving the market growth.

People's concerns about their appearance are constantly increasing in both developed and developing countries. As a result, the number of cosmetic procedures performed each year is increasing. Although the rate of increase in developing countries is not very significant, the reality remains that individuals are becoming more concerned about their looks, particularly as their standard of living rises.

Cosmetic surgery has been a common practice in Asia, with countries like South Korea, China, and India being Asia's largest cosmetic surgery markets. The industry is also driven by the increased popularity of minimally invasive and non-invasive aesthetic procedures. With the introduction of the internet, information became more widely available, and individuals became more aware of aesthetic operations. All of these variables combined raised public awareness of medical aesthetic procedures, resulting in increased sales of medical aesthetic devices and a massive increase in the market size for medical aesthetic devices.

MARKET DRIVERS

The growing popularity of minimally invasive and non-invasive aesthetic procedures is driving market growth.

The preference for minimally invasive and non-invasive aesthetic operations over traditional surgical procedures has risen dramatically in the last decade. Minimally invasive/nonsurgical techniques have several advantages over typical surgical procedures, including less pain, scars, and recovery time. These techniques are also less expensive than regular surgeries. According to the International Society of Aesthetic Plastic Surgery (ISAPS), the number of plastic and cosmetic treatments increased by 5.4 percent between 2020 and 2021.

The market is experiencing growth due to the increasing demand for medical aesthetic devices.

Emerging markets like China, Brazil, Mexico, and India provide considerable prospects for participants in the medical aesthetics industry. Medical aesthetic device demand is rising in these countries as a result of rising medical tourism, a growing adult population (aged 20 and up), rising disposable incomes, and more knowledge of aesthetic specialties. The presence of a significant number of surgeons in these developing countries is also helping the medical aesthetics market to flourish.

MARKET RESTRAINTS

Medical aesthetic therapies have clinical risks and consequences hampering the market growth

Medical cosmetic procedures have grown in popularity during the last two decades. Because of the increase in the number of doctors and surgeons delivering safe and effective medical aesthetic treatments, as well as the introduction of technologically improved goods for the same, the market for aesthetic treatments has seen tremendous expansion. Medical aesthetic procedures, on the other hand, have several potential negative effects. Aesthetic treatment patients may experience several risks and consequences after or during the surgery.

Social and ethical concerns about cosmetic procedures are limiting industry expansion.

Negative opinions of aesthetic operations, as well as religious and ethical concerns about specific aesthetic treatments, such as modifications, augmentations, erasures, and fillings, contribute to social stigmas linked with cosmetic treatments (surgical and nonsurgical). Even though many people undertake cosmetic procedures, few of them like to talk about it. Invasive anti-aging procedures, such as BOTOX or cosmetic surgery, are viewed by some as vain, self-centered, or mentally ill. Even though there is a growing emphasis on looking younger among the elderly, cosmetic age concealing may have detrimental social implications. The social stigma linked to cosmetic treatments harms the social acceptability of these procedures, limiting market expansion.

MEDICAL AESTHETIC DEVICES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

10.9% |

|

Segments Covered |

By Product Type, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Abbvie Inc. (Allergan PLC), Alma Lasers Ltd (Sisram Med), Bausch Health Companies Inc. (Solta Medical Inc.), Cutera Inc., El. En. (Asclepion Laser Technologies), Lumenis Inc., Sciton Inc., and Syneron Medical |

This research report, based on Medical Aesthetic Devices Market is segmented and sub-segmented by product type, end-user, and region.

Medical Aesthetic Devices Market by product type

- Botox

- Dermal Filler

- Liposuction

- Cellulite Reduction

- Fat Reduction

- Skin Tightening

- Breast Implant

- Tattoo Removal

- Thread Lift

Product types within the Medical Aesthetic Devices market contain a rich assortment of options. Among them, Hair/Tattoo removal holds the largest market segment. The increasing need for hair removal solutions highlights the industry's dedication to offering convenient and efficient aesthetic choices for people who desire lasting hair reduction. The surge in demand for hair removal solutions aligns with the industry's response to evolving beauty standards and the desire for smooth, hair-free skin. This trend reflects the increasing preference for non-invasive and convenient aesthetic procedures. Botox is the fastest-growing market in this segment owing to the general shift in beauty standards among people and their desire to look younger.

Medical Aesthetic Devices Market by end-user

- Clinic

- Medical Spa

- Hospital

- Beauty Centre

Clinics have emerged as the dominant segment in the end-user category with the highest share in the market revenue share. This is attributed to the wide range of aesthetic treatments and services, making them a central hub for individuals seeking cosmetic enhancements.

Medical Spas stand out as the fastest-growing segment within the End User category. Medical Spas offers a blend of medical and spa services, creating an environment that combines relaxation with aesthetic improvements. The growth of Medical Spas reflects the increasing demand for holistic experiences that prioritize both beauty enhancement and well-being.

Medical Aesthetic Devices by region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

North America emerges as the largest contributor towards the regional segment within the global market. This dominance in the market is owed to technological advancement and is a testament to its robust healthcare sector and the cultural significance placed on aesthetics.

The Asia-Pacific region is poised to experience the fastest growth within the Medical Aesthetic Devices market. This growth trajectory is driven by factors such as increasing disposable income, growing awareness of aesthetic procedures, and the rise of medical tourism in the region. The Asia-Pacific's potential for rapid expansion aligns with the global trend of seeking advanced aesthetic solution

Medical Aesthetic Devices by the company

The medical aesthetic devices industry is competitive and has a large number of companies.

- Abbvie Inc. (Allergan PLC)

- Alma Lasers Ltd (Sisram Med)

- Bausch Health Companies Inc. (Solta Medical Inc.)

- Cutera Inc.

- El. En. (Asclepion Laser Technologies)

- Lumenis Inc.

- Sciton Inc.

- Syneron Medical Ltd

all have significant market share. To secure their position in the global market, the leading players engage in strategic partnerships such as acquisitions, collaborations, and research and development initiatives.

NOTABLE HAPPENINGS IN THE MEDICAL AESTHETIC DEVICES MARKET IN THE RECENT PAST

- PRODUCT LAUNCH

- In March 2021, The Clear + Brilliant Touch laser, which is the company's next-generation Clear + Brilliant laser, will be launched in the United States by Bausch Health Companies Inc. and its Solta Medical business, one of the global leaders in the medical aesthetics market.

- In July 2021, Lynton Lasers Ltd introduced the Medical CE certified system Focus Dual, which combines Radio-frequency (RF) Micro-needling and High-intensity focused ultrasound (HIFU), two of the most cutting-edge clinical technologies, to perform non-surgical facelifts, double chin reduction, eyebrow lifts, wrinkle reduction, and other procedures.

- EXPANSION

- In January 2022, Illume Cosmetic Surgery and MedSpa inaugurated their new Glendale practice site. It was previously known as the Cosmetic Surgery Clinic. The 10,000s square-foot facility is located at 6002 N. Port Washington Road. Two surgical rooms, clinical suites, and a full-service med-spa would be included. Milwaukee plastic surgeons Mark Blake, Thomas Korkos, and Christopher Hussussian founded Illume Cosmetic Surgery and MedSpa. The medspa is supervised by five board-certified plastic surgeons to assure safe and advanced care, according to the release, which includes injectable, laser, and non-invasive cosmetic surgery procedures.

COVID-19 Impact on Medical Aesthetic Devices Market

The COVID-19 epidemic has had a major impact on the medical aesthetics industry. The beauty and luxury industry is dealing with issues in its manufacturing and supply chain, such as getting items to end-users on time and dealing with irregular demand for products and services. The market is experiencing short-term negative growth as a result of the lockdown, which can be attributed to factors like a drop in product demand from major end-users, limited operations in most industries, temporary closure of major end-user facilities (including beauty centers and spas), disrupted supply chain, and challenges in providing essential/post-sales services. According to a study published in the Journal of Cutaneous and Aesthetic Surgery (September 2020), certain lasers, such as ablative fractional lasers and high-peak-power ultrashort-pulsed lasers like nano- and picosecond lasers, are linked to airborne pollutants. Furthermore, technologies like excimer lamps and skin-tightening devices include probes that come into intimate contact with the skin, posing a high risk of SARS-CoV2 viral transmission. COVID-19 has had a significant impact on the global market for medical aesthetic products. The situation is, however, steadily improving.

Chapter 1. MEDICAL AESTHETIC DEVICES MARKET– Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. MEDICAL AESTHETIC DEVICES MARKET– Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 – 2030

2.3.2. Impact on Supply – Demand

Chapter 3. MEDICAL AESTHETIC DEVICES MARKET– Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. MEDICAL AESTHETIC DEVICES MARKET- Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. MEDICAL AESTHETIC DEVICES MARKET- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. MEDICAL AESTHETIC DEVICES MARKET– By Product

6.1. Facial Aesthetic Products

6.1.1. Botulinum toxin

6.1.2. Derma Fillers

6.1.3. Microdermabrasion products

6.1.4. Chemical peels

6.2. Cosmetic Implants

6.2.1. Breast implants

6.2.2. Gluteal implants

6.2.3. Facial implants

6.3. Skin Aesthetic Devices

6.3.1. Nonsurgical skin tightening devices

6.3.2. Laser skin resurfacing devices

6.3.3. Microneedling products

6.3.4. Light therapy devices

6.4. Body Contouring Devices

6.4.1. Nonsurgical fat reduction devices

6.4.2. Cellulite reduction devices

6.5. Physician-Dispensed Cosmeceuticals & Skin Lighteners

6.6. Hair Removal Devices

6.6.1. LASER hair removal devices

6.6.2. IPL hair removal devices

6.7. Tattoo Removal Devices

6.8. Thread Lift Products

6.9. Physician-Dispensed Eyelash Products

6.10. Nail Treatment laser Devices

Chapter 7. MEDICAL AESTHETIC DEVICES MARKET– By End User

7.1. Clinics, Hospitals, And Medical Spas

7.2. Beauty Centers

7.3. Home Care Settings

Chapter 8. MEDICAL AESTHETIC DEVICES MARKET– By Region

8.1. North America

8.2. Europe

8.3. The Asia Pacific

8.4. Latin America

8.5. Middle-East and Africa

Chapter 9. MEDICAL AESTHETIC DEVICES MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Developments)

9.1. Company 1

9.2. Company 2

9.3. Company 3

9.4. Company 4

9.5. Company 5

9.6. Company 6

9.7. Company 7

9.8. Company 8

9.9. Company 9

9.10. Company 10

Download Sample

Choose License Type

2500

4250

5250

6900