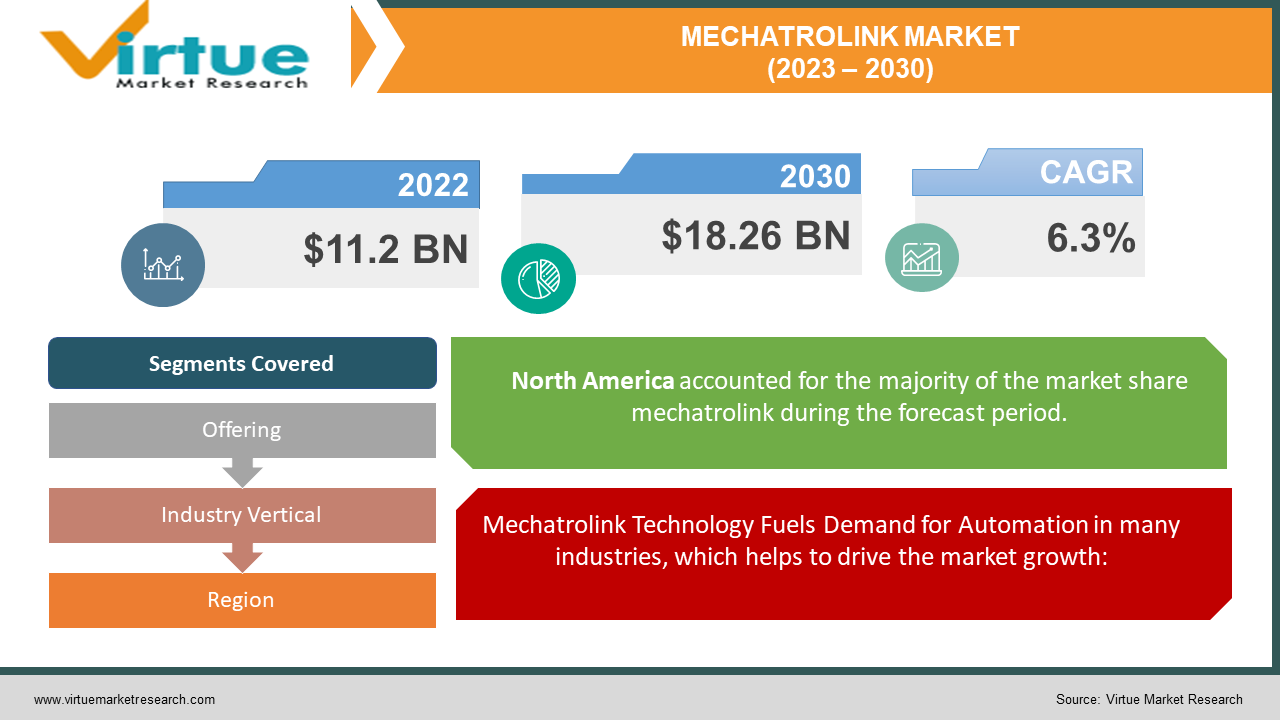

Global Mechatrolink Market Size (2023-2030)

The Mechatrolink market was estimated to be worth $11.2 billion in 2022, and it is anticipated to grow at a CAGR of 6.3% to attain $18.26 billion by the end of 2030. To transport data between programmable logic controllers (PLCs) and other control devices including servo motors, inverters, and sensors, a field bus system called Mechatrolink is commonly used in industrial automation.

The rise in demand for automation across a number of industries, including the automotive, semiconductor, and food and beverage sectors, is credited with driving the expansion of the mechatrolink industry. The expansion of this industry is also being fuelled by the growing emphasis on energy efficiency and cost optimization in industrial processes.With key players like Omron Corporation, Yaskawa Electric Company, and Panasonic Corporation focusing on innovation and strategic alliances to increase their market share, the mechatrolink market is extremely competitive.

Industry Overview:

The industry of mechatrolink is one that is expanding quickly due to the rising demand for motion control systems that are efficacious and sophisticated. Mechatrolink is an open field network system that links accountants, other devices, and motion control components including servo motors and actuators. With this technology, a variety of applications, including robots, machine tools, and factory automation, can become more accurate, swift, and efficient. With technological breakthroughs and the introduction of new products aimed at enhancing performance, reliability, and efficiency, the industry is always changing and developing. In addition, businesses are putting more of an emphasis on the need for sustainability in the sector. The growing use of automation and robotics in manufacturing industries, also the requirement for increased fecundity and cost-effectiveness, are driving demand for mechatrolink systems.

COVID-19 impact on the Mechatrolink market:

The COVID-19 pandemic has had a significant impact on the Mechatrolink industry, with both positive and negative effects. The pandemic has led to supply chain disruptions, reduced consumer spending, and a decrease in global trade and economic activity, additionally, the closure of factories and manufacturing facilities due to lockdowns and social distancing measures has caused a slowdown in production and a decrease in demand for Mechatrolink products. However, the pandemic has also accelerated the adoption of digital technologies and automation, leading to an increased demand for Mechatrolink products in industries such as healthcare, e-commerce, and logistics. The need for social distancing and remote work has also led to an increased demand for robots and automation in industries such as manufacturing and agriculture. Despite these challenges, the long-term outlook for the Mechatrolink industry remains positive, as the adoption of automation and digital technologies is projected to increase in the post pandemic era. The industry is also analysed to benefit from the increasing demand for industrial automation, especially in emerging economies.

Market Drivers:

Mechatrolink Technology Fuels Demand for Automation in many industries, which helps to drive the market growth:

The demand for automation in industries such as automotive, aerospace, and food and beverage is increasing as it can improve efficiency, reduce labor costs, and enhance production output. Mechatrolink technology, which is a high-speed, high performance motion control network, enables the synchronization of multiple axes of motion and control in real-time. This technology is well-suited for the control of high precision positioning, speed, and torque in industrial automation applications.

Adoption of AI and Smart Factory Trends help to drive the market growth:

The adoption of smart factories and AI is a major manipulator for the Mechatrolink market. As the trend towards digitization and automation in the manufacturing industry continues to grow, the need for advanced motion control technology such as Mechatrolink increases. Mechatrolink provides real-time synchronization of multiple axes of motion and control, making it an ideal technology for use in smart factories that rely on advanced sensors and automation systems. The use of Mechatrolink technology in combination with AI enables the creation of intelligent systems that can optimize production output, reduce costs, and improve overall efficiency. As the trend towards smart factories and AI continue to grow, the demand for Mechatrolink technology is projected to increase, driving growth in the market.

Market Restraints:

The Mechatrolink Market's growth is being stifled by the high initial cost of implementing and installing:

The high initial cost of implementing and installing Mechatrolink technology is a significant market restraint, the cost related with retrofitting or replacing existing systems can be a barrier for companies looking to adopt the technology, particularly for small and medium-sized enterprises. This can lead to slower adoption rates and limited market growth for Mechatrolink technology.

The Mechatrolink Market's growth is being stifled by the limited availability of skilled professionals:

A significant market restraint for Mechatrolink technology is the limited availability of skilled professionals who can design, install, and maintain the systems. This is a particular concern in regions where there is a shortage of skilled labor, as it can result in longer implementation times and higher costs. To address this challenge, companies may need to invest in additional training for their employees or hire outside contractors with the necessary expertise, which can further increase costs. This can be a significant barrier for smaller establishments or those with limited resources.

Market Segments:

MECHATROLINK MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

6.3% |

|

Segments Covered |

By Offering, Industry Vertical and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Yokogawa Electric Corporation , Omron Corporation , Schneider Electric SE, Panasonic Corporation, Siemens AG, ABB Ltd., Delta Electronics, Inc., SMC Corporation, National Instruments Corporation, Mitsubishi Electric Corporation |

This research report on the global Mechatrolink Market has been segmented based on offering, Industry Vertical, and Region.

Mechatrolink Market - By Offering

- Hardware

- Software

- Services

Segmentation based on offering refers to categorizing the Mechatrolink market based on the type of products and services offered. The offerings can include hardware, such as motion controllers and servo drives, software, such as programming tools and monitoring systems, and services, such as installation and maintenance. This segmentation allows companies to better understand the specific needs and preferences of their customers, and tailor their product offerings accordingly. Additionally, it helps customers choose the products and services that best fit their requirements and budget.The Asia-Pacific region is likely to dominate the Mechatrolink market due to the presence of several key players and the increasing adoption of automation in manufacturing processes.The automotive industry is predicted to remain the largest end-user segment for Mechatrolink technology, followed by the food and beverage and aerospace industries.

Mechatrolink Market-By Industry Vertical

- Automotive

- Aerospace

- Food and beverage

- Healthcare

- Others

The automotive sector is a significant contributor to the market, owing to the high demand for automation in the manufacturing process. The aerospace and defense sector is also adopting Mechatrolink technology for improved control and precision in their applications. The automotive sector is the largest user of Mechatrolink technology due to the high demand for automation and the need for high precision and speed in production processes. The aerospace and semiconductor industries are also significant users of Mechatrolink technology. The food and beverage and healthcare sectors are emerging areas where Mechatrolink technology is being used for improved precision and efficiency in production processes.

Mechatrolink Market-By Region

- North America

- Europe

- Asia-Pacific

- Rest of the World

The Asia-Pacific region is currently dominating the Mechatrolink market. This is due to the high adoption rate of high technology and industrial control systems in countries like China, Japan, and South Korea. The presence of major companies in the region, coupled with government to promote industrial automation and modernization, is also contributing to the growth of the Mechatrolink market in the Asia-Pacific region. However, the market is also growing in North America and Europe, as companies in these regions are increasingly adopting precocious automation and control technologies.

Major Key Players in the Market:

- Yokogawa Electric Corporation

- Omron Corporation

- Schneider Electric SE

- Panasonic Corporation

- Siemens AG

- ABB Ltd.

- Delta Electronics, Inc.

- SMC Corporation

- National Instruments Corporation

- Mitsubishi Electric Corporation

Market Insights and Developments:

- In August 2021- Mitsubishi Electric announced the launch of a new Mechatrolink-based motion control system, which is designed to improve the performance of industrial robots and other motion control equipment. The new system is projected to raise the efficiency & productivity of manufacturing processes in various industries.

- In April 2020 - Yaskawa Electric Corporation announced the release of its latest Mechatrolink-4 motion control network technology, which offers high-speed communication and advanced synchronization capabilities. The new technology is projected to enhance the precision and efficiency of manufacturing processes in automotive, semiconductor, and other industries.

- In January 2020 - Omron Corporation announced the acquisition of Sentech Co., Ltd., a leading provider of industrial cameras and vision systems. The acquisition is projected to strengthen Omron's position in the Mechatrolink market by integrating Sentech's technology and expertise into Omron's automation systems.

Chapter 1. Mechatrolink Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Mechatrolink Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 – 2030

2.3.2. Impact on Supply – Demand

Chapter 3. Mechatrolink Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. Mechatrolink Market - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Mechatrolink Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Mechatrolink Market – By Offering

6.1. Hardware

6.2 .Software

6.3. Services

Chapter 7. Mechatrolink Market – By Industry Vertical

7.1. Automotive

7.2. Aerospace

7.3. Food and beverage

7.4. Healthcare

7.5. Others

Chapter 8. Mechatrolink Market – By Region

8.1. North America

8.2. Europe

8.3.The Asia Pacific

8.4. Rest of the World

Chapter 9. Mechatrolink Market – Company Profiles – (Overview, Product Portfolio, Financials, Developments)

9.1. Yokogawa Electric Corporation

9.2. Omron Corporation

9.3. Schneider Electric SE

9.4. Panasonic Corporation

9.5. Siemens AG

9.6. ABB Ltd.

9.7. Delta Electronics, Inc.

9.8. SMC Corporation

9.9. National Instruments Corporation

9.10. Mitsubishi Electric Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Mechatrolink technology is a high-speed, high-performance motion control network used in industrial automation applications. It enables the synchronization of multiple axes of motion and control in real-time, making it well-suited for the control of high-precision positioning, speed, and torque

Mechatrolink technology is used in a variety of industries, including automotive, aerospace, food and beverage, semiconductor manufacturing, and pharmaceuticals.

The major drivers for the Mechatrolink market include the increasing demand for automation in industries such as automotive, aerospace, and food and beverage; the need for higher productivity and efficiency in manufacturing processes; and the growing trend towards smart factories and the use of artificial intelligence (AI).

The major restraints for the Mechatrolink market include the high initial cost of implementation and installation, and the limited availability of skilled professionals who can design, install, and maintain the Mechatrolink systems

Some of the major players in the Mechatrolink market include Yaskawa Electric Corporation, Omron Corporation, National Instruments Corporation, Schneider Electric SE, and Mitsubishi Electric Corporation, among others