Meat Snacks Market Size (2024-2030)

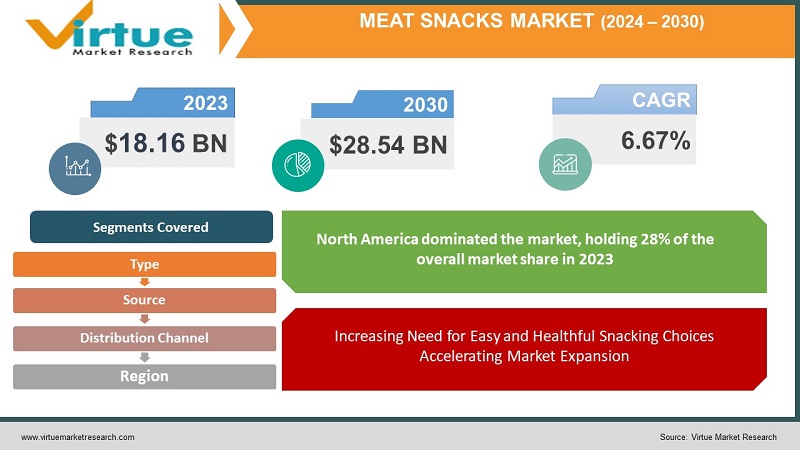

The Meat Snacks Market size is estimated at USD 18.16 billion in 2023, and is expected to reach USD 28.54 billion by 2030, growing at a CAGR of 6.67% during the forecast period (2024-2030).

The meat snacks market exhibits a high degree of fragmentation, with numerous participants contributing to its diversity. The surge in consumer demand for convenient, high-protein snacks has propelled the popularity of meat snacks. Manufacturers are making substantial investments in crafting unique products and flavors aligned with consumer preferences, thereby further stimulating the growth of the meat snacks market. The availability of these snacks in a range of sweet and savory flavors enhances their appeal among consumers. A noticeable trend has emerged where consumers, grappling with busy lifestyles, are substituting their regular diets with convenient, protein-rich, and flavorful snacks. Globally, meat snacks, such as beef steak strips in original and teriyaki forms containing eight grams of protein per serving, present significant market opportunities. Additionally, the proliferation of convenience stores contributes to the upward trajectory of the meat snacks market.

In the global market, a discernible shift in consumer preferences, particularly among Millennials, is evident. This demographic favors less-processed items with lower sodium content, natural ingredients, and trendy flavors. Consequently, certain manufacturers are strategically adapting their product offerings to align with these preferences. Some companies have announced the relaunch of their brands, aiming to expand their customer base by introducing a diverse range of flavored meat snacks in upgraded packaging. The growing inclination towards healthy snacks among Millennials plays a pivotal role in shaping the forecast for the meat snacks market.

Key Market Insights:

The expansion of the retail industry is underpinned by a rapid increase in the economy, a heightened consumption of innovative snacking products like meat snacks, urbanization trends, and a growing middle-class population, particularly in emerging economies. The influx of foreign direct investments (FDI) encourages the active involvement of foreign and private players, further propelling the growth of the retail industry. According to the India Brand Equity Foundation (IBEF), India's retail sector has generated substantial revenue and is poised to grow at a CAGR of 10%, reaching USD 1.6 trillion by 2026. Similarly, as per the Foreign Agriculture Services (FAOs), China witnessed a 10.7% growth in the total retail sale of consumer goods in 2015, amounting to USD 4.49 trillion. This enhancement in retail infrastructure enhances the visibility and accessibility of products, including food and convenience goods, contributing to overall sales. Consequently, these combined factors are instrumental in the expansion of retail networks in emerging economies, thereby fostering the growth of the meat snacks market.

Global Meat Snacks Market Drivers:

Increasing Need for Easy and Healthful Snacking Choices Accelerating Market Expansion

The search for quick snacking solutions persists among customers, and major meat snack suppliers are actively enhancing these options. The popularity of meat snacks is on the rise, especially among the nation's working population and the emerging younger generation, driven by their hectic lifestyles.

As reported by Convenience Store Products magazine, the sales of meat snacks in US convenience shops reached approximately USD 2.16 billion in 2021. Among traditional jerky brands, the Old Trapper secured the third position in terms of sales at convenience shops in the United States.

Market expansion is being driven by an increase in the demand for high-protein snacks.

A significant driver in the global meat snacks market is the increasing demand for high-protein snacks. Consumers, including fitness enthusiasts, athletes, and those conscious of their health, recognize the crucial role of protein in promoting muscle growth, recovery, and satiety. This awareness has prompted a shift in dietary preferences toward protein-rich foods, including meat snacks.

Particularly appealing due to their concentrated protein content, meat snacks such as jerky and sticks provide a convenient and portable source of protein suitable for busy lifestyles. Whether used as a post-workout refuel or a midday snack, these snacks offer a satisfying way to fulfill protein needs without the heaviness of a full meal. Furthermore, the demand for high-protein snacking transcends fitness circles. Many consumers acknowledge the satiating properties of protein and its effectiveness in curbing hunger between meals. As the quest for healthier snacking options continues, the protein-packed attributes of meat snacks position them as a preferred choice for individuals seeking a balance of taste, convenience, and nutritional benefits in their snacking habits.

Global Meat Snacks Market Constraints and Challenges:

Regulatory Difficulties act as a hindrance to market expansion.

Regulatory complexities present a significant challenge for the global meat snacks market. Varying standards and labeling mandates across different countries and regions create a complex landscape, requiring brands to ensure compliance while maintaining consistency in quality and messaging. Adhering to diverse regulations demands meticulous attention to detail regarding ingredients, nutritional information, allergen declarations, and more. This challenge is heightened for brands with international operations, necessitating a delicate balance between each market's regulations while offering a consistent product experience. Successfully navigating these complexities requires a deep understanding of global regulatory frameworks and a commitment to transparency, accuracy, and consumer safety.

Maintaining Flavor Consistency is a Challenge to its unprecedented Market Growth

Ensuring consistent flavor profiles poses a critical challenge in the global meat snacks market. Fluctuations in ingredient quality, sourcing, and processing methods can lead to taste variations, potentially disappointing consumers expecting reliable flavors. Brands must implement stringent quality control measures, standardize production processes, and closely monitor ingredient sourcing to ensure each batch meets taste expectations. Continuous sensory evaluations and flavor testing are essential to identify any deviations and take corrective actions. Additionally, investing in research and development to create robust and stable flavor formulations can help mitigate challenges arising from ingredient variability. Consistency in flavor not only enhances consumer trust and loyalty but also reflects the brand's commitment to delivering a satisfying snacking experience consistently.

Global Meat Snacks Market Opportunities:

Convenience in Snacking and Adaptation to On-the-Go Lifestyles

The fast-paced dynamics of contemporary living have spurred a heightened demand for convenient, on-the-go snacks, and meat snacks are strategically positioned to meet this evolving consumer trend. Individuals are actively seeking portable, protein-rich options that seamlessly integrate into their busy daily routines. The enduring shelf life and minimal refrigeration requirements of meat snacks make them an ideal choice for this demand. Concurrently, packaging formats are undergoing transformations, with resealable pouches, single-serve packs, and portion-controlled options gaining increasing popularity. Consequently, the meat snacks market is capitalizing on consumers' departure from traditional meal structures in favor of a more adaptable and snacking-centric dietary pattern.

Emergence of Plant-Based Alternatives

One of the most impactful trends in the food industry is the rapid proliferation of plant-based alternatives. Driven by concerns related to health, environmental impact, and animal welfare, consumers are progressively embracing plant-based diets or incorporating more plant-based choices into their culinary preferences. This shift extends to the meat snacks market, witnessing a notable surge in the demand for plant-based alternatives. Innovative products crafted from sources such as soy, mushrooms, jackfruit, and pea protein have emerged to cater to this growing trend. These alternatives not only serve the preferences of vegetarians and vegans but also resonate with flexitarian consumers seeking healthier and sustainable snacking options. Consequently, both traditional meat snack manufacturers and emerging players are diversifying their product portfolios to encompass plant-based offerings.

MEAT SNACKS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.67% |

|

Segments Covered |

By Type, Source, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Conagra Brands, Inc, Golden Valley Natural, Jack Link's LLC, Hormel Foods Corporation, The Meatsnacks Group, Nestlé S.A, Monogram Food Solutions, LLC, Wilde Brands, Copperstone Foods, LLC, Marfood USA Inc. |

Global Meat Snacks Market Segmentation:

Global Meat Snacks Market Segmentation: By Type

- Jerky

- Meat Sticks

- Sausages Others

The segmentation of the Meat Snacks Market by type includes Jerky, Meat Sticks, Sausages, and Others. This classification is based on the variety of meat snacks available in the market. The Jerky segment has dominated the market, holding the largest share. This is attributed to the increased demand for jerky products infused with artificial flavors and the continuous product launches by key industry players. The heightened demand for black pepper jerky meat products in developed nations is a significant factor propelling the growth of the Meat Snacks Market. The Meat Sticks segment is anticipated to be the fastest-growing category, exhibiting a projected CAGR of 7.7% from 2024 to 2030. This growth is fueled by substantial investments by key players in crafting high-quality meat sticks with natural ingredients, coupled with the rise in disposable income among the younger population.

Global Meat Snacks Market Segmentation: By Source

- Beef

- Chicken

- Pork

- Others

The categorization of the meat snacks market by source encompasses Beef, Chicken, Pork, and Others. In 2023, the Beef segment secured the largest market share. However, the Chicken segment is forecasted to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. The preference for chicken-based meat products is driven by its lower saturated fat content compared to Beef, Pork, and Lamb. This aligns with the increasing consumer focus on fulfilling protein requirements while maintaining a lower calorie intake, thereby contributing to a healthier lifestyle. The inclination towards chicken-based meat products is expected to drive growth in the Chicken segment in the upcoming years.

Global Meat Snacks Market Segmentation: By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Online Retail

- Others

The segmentation of the Meat Snacks Market by distribution channel encompasses Supermarkets/Hypermarkets, Online Retail, Convenience Stores, and Others. In 2023, the Supermarkets/Hypermarkets segment held the largest share. This dominance is attributed to factors such as cost-effectiveness and the availability of a diverse range of meat and potato chips with various brands and innovative artificial flavors. The distinctive product shelves and attractive schemes in supermarkets contribute to driving the growth of the Meat Snacks Market. The Online Retail segment is anticipated to be the fastest-growing, exhibiting a projected CAGR of 7.9% from 2024 to 2030. This growth is driven by the increasing demand for digitalized shopping experiences and the rising preference for door-stop delivery.

Global Meat Snacks Market Segmentation: By Region

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

Geographically, the segmentation of the Meat Snacks Market includes North America, Europe, Asia-Pacific, South America, and the Middle East and Africa. North America dominated the market, holding 28% of the overall market share in 2023. This growth is attributed to the rising adoption of black pepper jerkies in developed nations and the increased product launches by key players focusing on natural ingredients. The surge in demand for ready-to-eat meat snacks is a key driver of market growth. The Asia-Pacific segment is expected to be the fastest-growing, with projected growth from 2024 to 2030. The expansion in this segment is fueled by the increased availability of a diverse range of meat and potato chips and substantial investments by key players in developing high-quality meat snack products.

Impact of COVID-19 on the Global Meat Snacks Market:

The global Meat Snacks Market has experienced the impact of the COVID-19 pandemic, resulting in a heightened demand for packaged foods, including meat snacks. However, this market expansion has faced challenges due to disruptions in supply chains and personnel shortages. Despite these obstacles, if normalcy is restored, the market is anticipated to rebound. The pandemic has affected various industries, including technology, media, and notably the food industry. The overall influence of the pandemic has disrupted production processes and altered market dynamics for meat snacks. The demand-supply outlook is further hindered by trade obstacles, contributing to a shift in the market share and outlook for meat snacks.

Recent Trends/Developments:

In October 2023, Country Archer Provisions, a meat snack brand, introduced two new products, Rosemary Turkey Mini Sticks, and Original Beef Jerky Snack Packs. These portioned protein snacks cater to health-conscious consumers with clean-label ingredients.

In September 2023, Volpi Foods, a United States-based company, expanded its presence in the meat snacks category by introducing a new line of Salami Stix. These high-quality, all-natural products are available in two flavors, Spicy and Original, in 2-oz packages.

In April 2023, Doki Foods, a New Delhi-based startup, launched chicken chips and buffalo jerky in various flavors like Korean Gochujang, Tokyo Teriyaki, and Telicherry pepper.

Key Players:

- Conagra Brands, Inc

- Golden Valley Natural

- Jack Link's LLC

- Hormel Foods Corporation

- The Meatsnacks Group

- Nestlé S.A

- Monogram Food Solutions, LLC

- Wilde Brands

- Copperstone Foods, LLC

- Marfood USA Inc.

Chapter 1. GLOBAL MEAT SNACKS MARKET– SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL MEAT SNACKS MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. GLOBAL MEAT SNACKS MARKET– COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL MEAT SNACKS MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. GLOBAL MEAT SNACKS MARKET- LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL MEAT SNACKS MARKET– BY TYPE

6.1. Introduction/Key Findings

6.2. Jerky

6.3. Meat Sticks

6.4. Sausages Others

6.5. Y-O-Y Growth trend Analysis By Type

6.6. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. GLOBAL MEAT SNACKS MARKET– BY SOURCE

7.1. Introduction/Key Findings

7.2. Beef

7.3. Chicken

7.4. Pork

7.5. Others

7.6. Y-O-Y Growth trend Analysis By SOURCE

7.7. Absolute $ Opportunity Analysis By SOURCE , 2024-2030

Chapter 8. GLOBAL MEAT SNACKS MARKET– BY DISTRIBUTION CHANNEL

8.1. Introduction/Key Findings

8.2 Supermarkets & Hypermarkets

8.3. Convenience Stores

8.4. Online Retail

8.5. Others

8.6. Y-O-Y Growth trend Analysis Distribution Channel

8.7. Absolute $ Opportunity Analysis Distribution Channel , 2024-2030

Chapter 9. GLOBAL MEAT SNACKS MARKET, BY GEOGRAPHY – MARKET SIZE, FORECAST, TRENDS & INSIGHTS

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By SOURCE

9.1.3. By Type

9.1.4. By Distribution Channel

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By SOURCE

9.2.3. By Type

9.2.4. By Distribution Channel

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.2. By Country

9.3.2.2. China

9.3.2.2. Japan

9.3.2.3. South Korea

9.3.2.4. India

9.3.2.5. Australia & New Zealand

9.3.2.6. Rest of Asia-Pacific

9.3.2. By SOURCE

9.3.3. By Type

9.3.4. By Distribution Channel

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.3. By Country

9.4.3.3. Brazil

9.4.3.2. Argentina

9.4.3.3. Colombia

9.4.3.4. Chile

9.4.3.5. Rest of South America

9.4.2. By SOURCE

9.4.3. By Type

9.4.4. By Distribution Channel

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.4. By Country

9.5.4.4. United Arab Emirates (UAE)

9.5.4.2. Saudi Arabia

9.5.4.3. Qatar

9.5.4.4. Israel

9.5.4.5. South Africa

9.5.4.6. Nigeria

9.5.4.7. Kenya

9.5.4.8. Egypt

9.5.4.9. Rest of MEA

9.5.2. By SOURCE

9.5.3. By Type

9.5.4. By Distribution Channel

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. GLOBAL MEAT SNACKS MARKET– COMPANY PROFILES – (OVERVIEW, PRODUCT PORTFOLIO, FINANCIALS, STRATEGIES & DEVELOPMENTS)

10.1 Conagra Brands, Inc

10.2. Golden Valley Natural

10.3. Jack Link's LLC

10.4. Hormel Foods Corporation

10.5. The Meatsnacks Group

10.6. Nestlé S.A

10.7. Monogram Food Solutions, LLC

10.8. Wilde Brands

10.9. Copperstone Foods, LLC

10.10. Marfood USA Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The Meat Snacks Market size is estimated at USD 18.16 billion in 2023

The worldwide Global Meat Snacks Market growth is estimated to be 6.67% from 2024 to 2030.

The Global Meat Snacks Market is Segmentation by Type (Jerky, Meat Sticks, Sausages, and Others), by Source (Beef, Chicken, Pork, and Others), by Distribution Channel (Supermarkets & Hypermarkets, Convenience Stores, Online Retail, and Others).

The demand for portable, high-protein snacks is driving growth in the global meat snack market. Trends to watch out for are plant-based substitutes, high-end artisan products, and sustainable sourcing, all of which provide rich prospects for product development and market expansion.

The worldwide meat snacks market was first affected by the COVID-19 pandemic because of issues with the supply chain and changing consumer tastes. Still, the market has recovered and become more resilient because to creative product adaptations and rising demand for protein-rich, shelf-stable snacks.