Global Meat, Poultry, and Seafood Packaging Market Size (2024-2030)

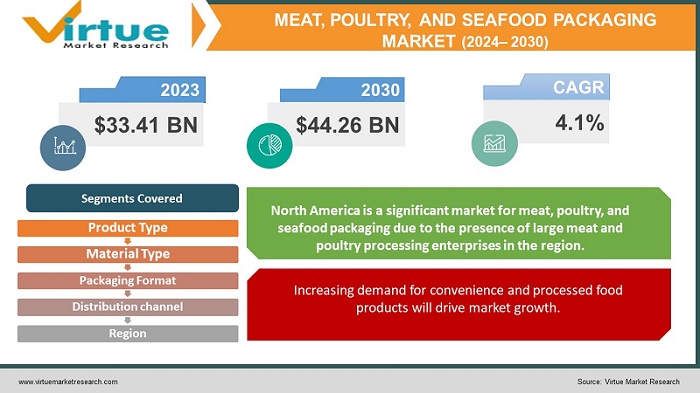

In 2023, the Global Meat, Poultry, and Seafood Packaging Market was valued at $33.41 billion, and is projected to reach a market size of $44.26 billion by 2030. Over the forecast period of 2024-2030, market is projected to grow at a CAGR of 4.1%.

Market Overview

The market for meat, poultry, and seafood packaging is the sector that offers supplies and services for the packaging of these goods. The industry is being driven by rising convenience and processed food demand as well as growing awareness of food preservation and safety. These packaging supplies and methods are meant to preserve food’s freshness and condition while also protecting them from infection and other external factors. Meat, poultry, and seafood products are packaged using a variety of materials, including plastic, paper, metal, and others.

The market's expansion may be attributed to rising demand for packaged meat, poultry, and fish items due to the convenience they provide. Consumers' busy lifestyles and the need for easy-to-prepare food products are two main reasons driving market expansion. Furthermore, as customers become more aware of the environmental effect of packaging, there is a rising trend for sustainable packaging.

Meat, Poultry, and Seafood Packaging Market Driver

Increasing demand for convenience and processed food products will drive market growth.

The busy lifestyles of consumers and the desire for food items that are easy to prepare are the two main factors fuelling the growth of the Meat, Poultry, and Seafood Packaging Market. There is a high demand for packaged meat, poultry, and fish items that offer convenience and simple storage due to the rising popularity of on-the-go and ready-to-eat foods. The industry is predicted to advance in the coming years due to the anticipated increase in demand for these products.

Growing awareness of food safety and preservation will drive market growth.

The growing public consciousness of food preservation and safety is a significant growth driver for the meat, poultry, and seafood packaging market. Consumers are getting more and more concerned about the safety and quality of the foods they eat as food contamination and food-borne illnesses are on the rise. Meat, poultry, and seafood products are packaged with materials and methods that are meant to preserve their quality and freshness while also shielding them from contamination and other external factors. As consumers' concerns about food safety and preservation increase, this is anticipated to spur market expansion.

Meat, Poultry, and Seafood Packaging Market Challenges

The complexity of the food safety and preservation techniques impedes the growth of the market.

Keeping meat, poultry, and seafood well-maintained and sterile during storage and transportation is one of the toughest packaging challenges. This urges the use of packaging materials and techniques that can effectively protect the goods from bacteria, moisture, and other outside factors that could cause deterioration or foodborne illness.

Sustainability factors restrain the global packaging market growth.

The necessity to provide environmentally friendly and sustainable packaging is another major issue for the meat, poultry, and seafood packaging industry. This involves using fewer single-use plastics, finding recyclable or biodegradable materials as replacements, and developing packaging that is more carbon- and energy-efficient.

Impact of COVID-19 on the Meat, Poultry, and Seafood Packaging Market.

The COVID-19 epidemic has had a significant impact on the meat, poultry, and seafood packing business. Global supply chain disruptions brought on by the outbreak have increased prices and caused a shortage of raw materials. It is now more difficult for businesses to obtain the resources required to produce and package their products as a result. However the epidemic has changed consumer behaviour, and more people are now opting to purchase meat, poultry, and seafood from supermarkets, grocery stores, as well as online. Packaging that can keep food fresh for long periods of time is, therefore, more in demand.

MEAT, POULTRY, AND SEA FOOD PACKAGING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.1% |

|

Segments Covered |

By Product Type, Material Type, Packaging Format, Distribution channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Amcor Limited (Australia), Berry Global Group Inc. (USA), Bemis Company, Inc. (USA), Sealed Air Corporation (USA), International Paper Company (USA), Tetra Pak International S.A. (Switzerland), Mondi Group (Austria), Ball Corporation (USA), Reynolds Group Holdings (New Zealand), Crown Holdings, Inc. (USA) |

Meat, Poultry, Seafood Packaging Market Segmentation -By Product Type

- Fresh meat, poultry, and seafood

- Frozen meat, poultry, and fish

The most perishable foodstuffs are fresh meat, poultry, and seafood, which calls for packaging that can preserve freshness while preventing deterioration. These products are typically packaged in vacuum-sealed bags, modified environment packaging, or trays with a film or top. To avoid freezer burn and maintain product quality during storage and delivery, frozen meat, poultry, and fish are kept packed. Therefore, processed meat, poultry, and fish products' shelf lives are extended through packaging. These items are frequently packaged in vacuum-sealed bags, modified atmosphere packaging, cans, jars, or bottles. This packaging must establish a barrier against air, light, and moisture in order to maintain and sustain the product's quality.

Meat, Poultry, Seafood Packaging Market Segmentation- By Material Type

- Plastic

- Sustainable Material

- Metal

Plastic packaging is a common choice for packing meat, poultry, and seafood due to its affordability, durability, and flexibility.Fresh, frozen, and processed meat, poultry, and seafood are frequently packaged in polyethylene, polypropylene, and PVC, three typical types of plastic. The sector is also increasingly using paper and paperboard, bioplastics, and bio-based materials. These eco-friendly materials may be recycled or composted, which lessens the impact of the packaging on the environment. The most popular method for keeping processed meat, poultry, and seafood are in metal containers. Metal cans and jars are ideal for storing products for a long time because they are airtight and create a barrier against light, moisture, and oxygen.

Meat, Poultry, Seafood Packaging Market Segmentation -By Packaging Format

- Flexible Packaging

- Rigid packaging

- Modified Atmosphere Packaging

Flexible packaging is frequently used to package meat, poultry, and seafood because of its affordability, low weight, and ease of handling. Fresh, frozen, and processed meat, poultry, and fish products are frequently packaged in plastic bags, pouches, and films. They may be shaped into a variety of sizes and forms and combined with other materials like foams and trays. For the most part, processed meat, poultry, and fish products are packaged in rigid packaging. Metal cans, jars, and bottles are suitable for storing the product for a longer amount of time since they are airtight and offer a barrier to light, moisture, and oxygen. Additionally, they are quite strong and protect the product throughout storage and transportation.Modified atmosphere packaging (MAP) is a packaging technology that includes manipulating the environment within the box in order to lengthen the product's shelf life. MAP is mostly used for fresh meat, poultry, and seafood. This method involves the use of specific films and trays that are meant to manage the environment within the packaging and keep the contents fresh for a long time.

Meat, Poultry, Seafood Packaging Market Segmentation-By Distribution channel

- Supermarket/ Hypermarket

- Convenience Store

- Online

- Food Service

Traditional distribution outlets for meat, poultry, and seafood packaging items are supermarkets and hypermarkets. These channels provide a diverse choice of items and brands, as well as the ability for clients to physically view the things before purchasing. These channels are suitable for bulk purchases and are handy for consumers to acquire big amounts of things. Convenience stores are becoming an increasingly important distribution channel for packaging items for the meat, poultry, and seafood industry. These stores often have a limited product variety, but they are at handy locations and are open for longer hours. They are great for customers who want to make quick and uncomplicated transactions.

Online shopping is a growing distribution method for packaging items for meat, poultry, and seafood. Customers may shop for things online from the comfort of their own homes and have them delivered right to their doorstep. This distribution channel is growing in popularity among customers since it offers convenience as well as a greater selection opportunity of items and brands. Another key distribution route for meat, poultry, and seafood packaging items is the food service and hotel business. Restaurants, hotels, and catering services are all part of this channel. They buy vast amounts of meat, poultry, and seafood and pack them to their specifications.

Meat, Poultry, Seafood Packaging Market Segmentation-By Region

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World

North America is a significant market for meat, poultry, and seafood packaging due to the presence of large meat and poultry processing enterprises in the region. The meat, poultry, and seafood packaging industries' major markets in North America are the United States and Canada. The industry is characterised by a significant need for creative and sustainable packaging solutions, which is being driven by altering consumer tastes and legislation. Due to the presence of a large meat processing sector in countries such as Germany, France, and the United Kingdom, Europe is yet another key market for meat, poultry, and seafood packaging. Consumer preferences and stringent regulations are driving increasing demand for sustainable packaging solutions in the area.Due to the region's expanding middle class and population, the packaging market for meat, poultry, and seafood is expanding significantly throughout Asia Pacific. China, Japan, and India are three significant regional markets for meat, poultry, and seafood packaging. The region has a significant demand for cost-effective packaging solutions since it must cater to a sizable and budget-conscious populace.

Key players

- Amcor Limited (Australia)

- Berry Global Group Inc. (USA)

- Bemis Company, Inc. (USA)

- Sealed Air Corporation (USA)

- International Paper Company (USA)

- Tetra Pak International S.A. (Switzerland)

- Mondi Group (Austria)

- Ball Corporation (USA)

- Reynolds Group Holdings (New Zealand)

- Crown Holdings, Inc. (USA)

Chapter 1. Meat, Poultry, and Seafood Packaging Market– Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Meat, Poultry, and Seafood Packaging Market– Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2024 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. Meat, Poultry, and Seafood Packaging Market– Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. Meat, Poultry, and Seafood Packaging Market- Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5.Meat, Poultry, and Seafood Packaging Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Meat, Poultry, and Seafood Packaging Market– By Product Type

6.1. Fresh meat, poultry, and seafood

6.2.Frozen meat, poultry, and fish

Chapter 7. Meat, Poultry, and Seafood Packaging Market– By Material Type

7.1. Plastic

7.2. Sustainable Material

7.3. Metal

Chapter 8. Meat, Poultry, and Seafood Packaging Market– By Packaging Format

8.1. Flexible Packaging

8.2. Rigid packaging

8.3. Modified Atmosphere Packaging

Chapter 9. Meat, Poultry, and Seafood Packaging Market– By Distribution channel

9.1. Supermarket/ Hypermarket

9.2. Convenience Store

9.3. Online

9.4. Food Service

Chapter 10. Meat, Poultry, and Seafood Packaging Market– By Region

10.1. North America

10.2. Europe

10.3.The Asia Pacific

10.4.South America

10.5. Rest of the world

Chapter 11. Meat, Poultry, and Seafood Packaging Market– Company Profiles – (Overview, Product Portfolio, Financials, Developments)

11.1. Amcor Limited (Australia)

11.2. Berry Global Group Inc. (USA)

11.3. Bemis Company, Inc. (USA)

11.4. Sealed Air Corporation (USA)

11.5. International Paper Company (USA)

11.6. Tetra Pak International S.A. (Switzerland)

11.7. Mondi Group (Austria)

11.8. Ball Corporation (USA)

11.9. Reynolds Group Holdings (New Zealand)

11.10. Crown Holdings, Inc. (USA)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

In 2023, the Global Meat, Poultry, and Seafood Packaging Market was valued at $33.41 billion, and is projected to reach a market size of $44.26 billion by 2030. Over the forecast period of 2024-2030, market is projected to grow at a CAGR of 4.1%.

The following are some of the major difficulties confronting the meat, poultry, and seafood packaging market:

- Meeting the growing need for environmentally friendly packaging solutions.

- Meeting stringent food safety and product labelling regulations.

- Managing the high raw material and energy costs.

Adapting to shifting customer tastes and trends

The following are the most commonly used materials in meat, poultry, and seafood packaging: Polyethylene, polypropylene, PVC, paper and paperboard, bioplastics, bio-based materials, and aluminium.

The advent of e-commerce is having a huge influence on the packaging industry for meat, poultry, and seafood. As more people are purchasing groceries online, the demand for e-commerce packaging solutions is growing thereby expanding the market size for meat, poultry, and seafood packaging

The primary distribution routes for meat, poultry, and seafood packing products are hypermarkets and supermarkets, convenience stores, food and hotel industries, and online retail stores.