Global Meat Microbiological Testing Market Size (2023 - 2030)

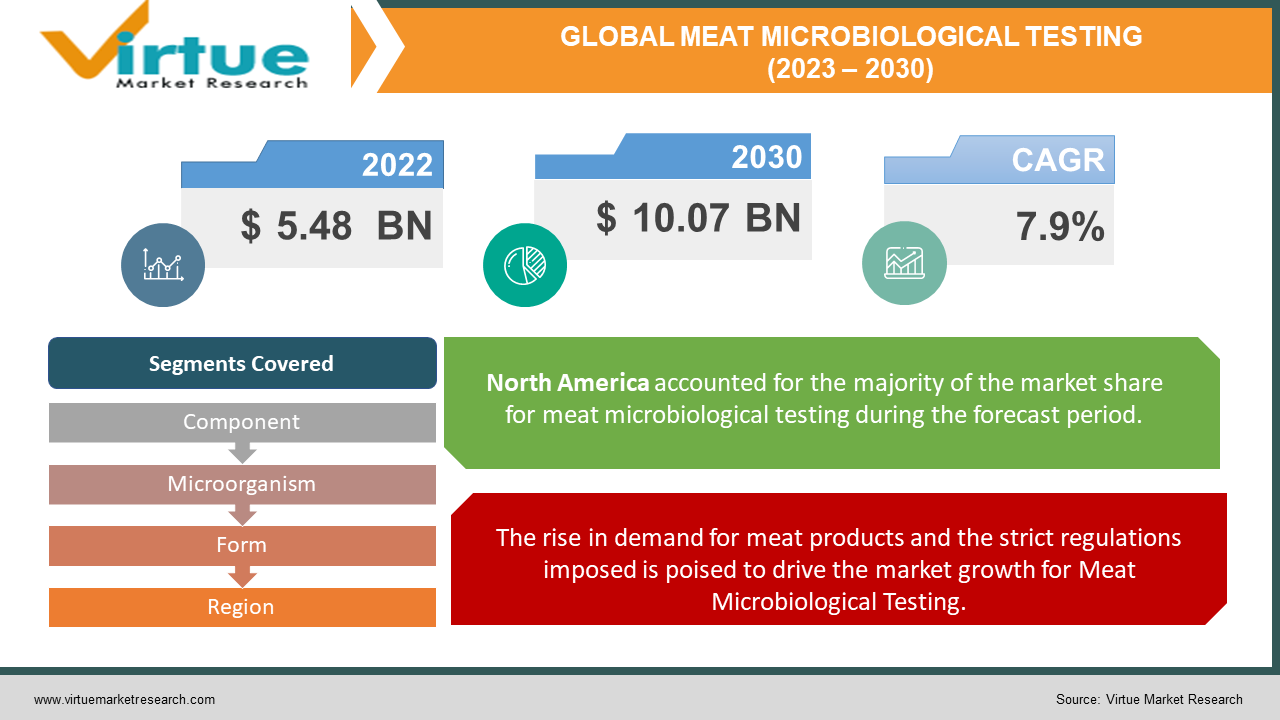

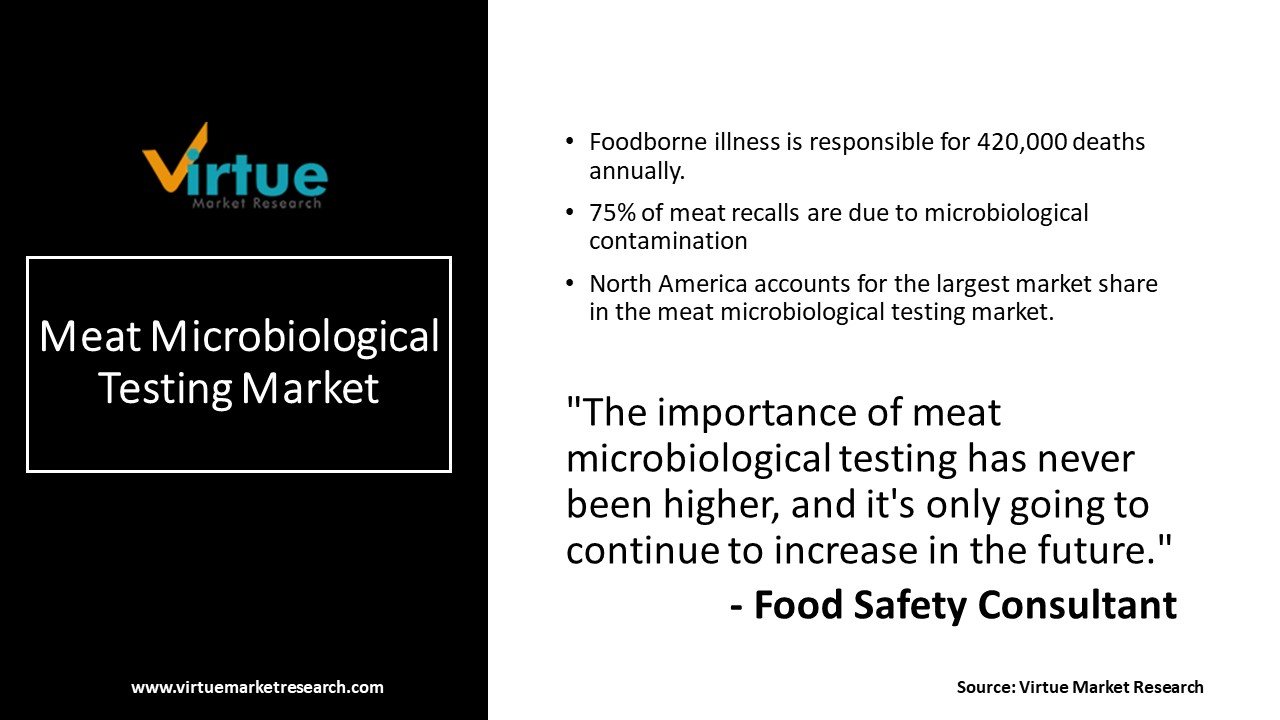

The Meat Microbiological Testing Market was evaluated at $5.48 billion in 2022, and it is projected to reach $10.07 billion by the end of 2030, with a fast CAGR of 7.9 % during the outlook period (2023 - 2030).

The primary drivers projected to propel the meat microbiological testing market are the rise in demand for meat products and the strict regulations imposed as well as technological advancements in the testing market aided by increasing investments.

Industry Overview:

Meat by itself and overall meat products have been a major source of nutrition for many communities all over the globe. Before the invention of relatively newer and developed products, the main source for people to stay alive and continue with their lifestyles used to be meat. But times have progressed significantly since then and the development of newer and more innovative food items has given the meat market significant competition. Because of this and the rising cases of gastrointestinal diseases the meat microbiological testing market has been a significant industry. Different meats have different storage temperatures and conditions requirements. If this is not maintained growth of different microorganisms in the meat is possible. It can also be spoilt and become completely unfit for consumption. Fatal diseases like salmonella are caused by rotten, spoiled, or aged-out meat. To prevent this the meat microbiological testing market is very significant. It tests the product for different organisms’ growth on the meat, tests for its longevity, and ensures that it is fit for consumption. It is significant to maintain the health of the consumers and follow standard guidelines put in place by different authorities like the FDA.

COVID-19 Impact on the Meat Microbiological Testing Market:

The COVID-19 Pandemic was a result of the rampant spread of the coronavirus. The virus led to fatal consequences where hundreds of thousands of people lost their lives and economies all across the globe were affected negatively. The manufacturing of several different products was shut down because of the ban on the transportation of goods across the borders. This led to several different kinds of supply chain issues. If raw materials could not be obtained then the desired products could not be made. Factories were shut down owing to the lack of workers present because of the lockdown and quarantine measures. This affected the meat microbiological testing market very significantly. Testing equipment and kits required products to function. Testing sites were the hubs for different viruses and bacteria and needed to be very carefully operated, if at all. The testing of the products became difficult which in turn led to a decrease in sales of the meat products. But the market has seen a steady recovery since and is estimated to flourish in the future.

Market Drivers:

The rise in demand for meat products and the strict regulations imposed is poised to drive the market growth for Meat Microbiological Testing:

Meat products and their different varieties have been in increasing demand recently. Meat consumers have increased consumption due to several proclaimed benefits of eating meat. Beyond that, organizations that regulate the food and consumption market have imposed strict testing regulations. The initially strong established regulations have become even stauncher owing to the health concerns raised by people and the need to meet the basic standards. Organisations like the FDA, which is the United States Food and Drug Administration, have established strict standards for meat products that can be viably sold in the market and reinforced the technologies for the same. This has helped boost the market.

Technological advancements in the testing market aided by increasing investments help to drive market growth:

As the demand for the market increases so does the advancement. New technological processes have taken shape and replaced the old machinery and products. This has made the final product much more sanitary, contamination-free, and as healthy as possible. These advancements are a result of installations of new heavy machinery and innovative technologies which is not possible without investments. The market has proven to be very lucrative for a lot of investors which has attracted a larger customer base. Therefore the growing technologies and the rise in investments help the market grow.

Market Restraints:

The Meat Microbiological Testing Market's growth is being stifled by the adoption of meat substitutes in regular diets as well as expenses involved with testing technologies:

More and more people have been adopting vegan and vegetarian lifestyles. These include the complete abandonment of meat and animal products like milk, cheese, honey, cream, and more. This lifestyle has come into practice more often leading to the overall environmental benefits caused by it as well as the element of abandonment of animal cruelty. Thus, the vegan lifestyle and the growing popularity of meat substitutes are restraining the market. Beyond that, the installation of the devices and kits is very expensive. Laboratory testing environments need to be controlled and chemicals of different kinds are used. Therefore the overall expense of the initial establishment and maintenance of testing technologies is restraining the market.

GLOBAL MEAT MICROBIOLOGICAL TESTING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

7.9 % |

|

Segments Covered |

By Component, Microorganism, Form and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

bioMérieux SA, Danaher Corporation, Becton, Dickinson and Company, F. Hoffmann-La Roche Ltd, Bruker Corporation, Hologic, Inc., Bio-Rad Laboratories, Inc., Thermo Fisher Scientific Inc., Merck KGaA |

This research report on the global Meat Microbiological Testing Market has been segmented based on components, microorganisms, forms, and region.

Meat Microbiological Testing Market- By Component

-

Reagents and kits

-

Equipment

-

Microbial Identification Systems

-

PCR Systems

-

Mass Spectrometers

-

High-performance Liquid Chromatography (HPLC) Systems

-

Stainer

-

Cell/Colony Counters

-

Incubators

-

Autoclave

-

Microscopes

-

-

Service

The market by component is divided into reagents and kits, equipment, and services. The equipment section holds the largest market share due to its significance in the testing process. The equipment like Spectrometers, colony counters, PCR systems, Liquid chromatography systems, and more perform the actual task of testing the products and ensuring that they are fit for consumption and approved by the standards.

Meat Microbiological Testing Market- By Microorganism

-

Bacteria

-

Fungi

-

Others

In the meat microbiological testing market, the bacteria segment held the largest market share and has been the most prevalent. They grow very easily even in normal environments and in a very short period of time. They are very harmful and extremely widespread which makes the task of containment and bacteria prevention just as difficult.

Meat Microbiological Testing Market- By Form

-

Fresh Meat

-

Frozen Meat

-

Processed Meat

-

Cured Meat

-

Smoked Meat

-

Canned Meat

-

Cooked Meat

-

Poultry

Poultry held the largest market share for the meat microbiological testing market and is expected to continue the growth during the forecast period of 2023-2030. Poultry includes meat from animals like chickens, ducks, turkeys, and more. These are very popular meat sources and chicken is amongst the most common meat used across the world. Because of this they require significant testing and are thus most prevalent.

Meat Microbiological Testing Market- By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

The market in North America is the largest amongst its competitors owing to several different factors. Some of these include the increase in overall meat consumption, product recalls due to insufficient testing, strict testing procedures and laws, and more.

The Asia-Pacific market is estimated to grow at a significant rate. This is attributed to increased meat consumption among the younger generations in several countries and the rise in awareness regarding gastrointestinal problems and diseases caused by unfit meat products.

Major Key Players in the Market

-

bioMérieux SA

-

Danaher Corporation

-

Becton

-

Dickinson and Company

-

F. Hoffmann-La Roche Ltd

-

Bruker Corporation

-

Hologic, Inc.

-

Bio-Rad Laboratories, Inc.

-

Thermo Fisher Scientific Inc.

-

Merck KGaA

Market Insights and Developments

-

In November 2022, the Food Safety and Inspection Services (FSIS) announced its updated testing procedures. It announced that the routine testing for E. Coli in meat products will be expanded to 6 new adulterants that cause the disease.

-

In June 2022, Olymel LLC, a leading meat producer announced the launch of their new in-house microbiology laboratory in Quebec, Canada.

Chapter 1. Meat Microbiological Testing Market– Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Meat Microbiological Testing Market– Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. Meat Microbiological Testing Market– Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. Meat Microbiological Testing Market- Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Meat Microbiological Testing Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Meat Microbiological Testing Market- By Component

6.1 Reagents and kits

6.2 Equipment

6.2.1 Microbial Identification Systems

6.2.2 PCR Systems

6.2.3 Mass Spectrometers

6.2.4 High-performance Liquid Chromatography (HPLC) Systems

6.2.5 Stainer

6.2.6 Cell/Colony Counters

6.2.7 Incubators

6.2.8 Autoclave

6.2.9 Microscopes

6.3 Service

Chapter 7. Meat Microbiological Testing Market- By Microorganism

7.1 Bacteria

7.2 Fungi

7.3 Others

Chapter 8. Meat Microbiological Testing Market– By Form

8.1 Fresh Meat

8.2 Frozen Meat

8.3 Processed Meat

8.4 Cured Meat

8.5 Smoked Meat

8.6 Canned Meat

8.7 Cooked Meat

8.8 Poultry

Chapter 9. Meat Microbiological Testing Market- By Region

9.1 North America

9.2 Europe

9.3 Asia-Pacific

9.4 Rest of the World

Chapter 10. Meat Microbiological Testing Market- Key Players

10.1 bioMérieux SA

10.2 Danaher Corporation

10.3 Becton

10.4 Dickinson and Company

10.5 F. Hoffmann-La Roche Ltd

10.6 Bruker Corporation

10.7 Hologic, Inc.

10.8 Bio-Rad Laboratories, Inc.

10.9 Thermo Fisher Scientific Inc.

10.10 Merck KGaA

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Meat Microbiological Testing Market was evaluated at $5.48 billion in 2022, and it is projected to reach $10.07 billion by the end of 2030, with a fast CAGR of 7.9 % during the outlook period (2023 - 2030).

The rise in demand for meat products and the strict regulations imposed is poised to drive market growth for Meat Microbiological Testing.

The Meat Microbiological Testing Market's growth is being challenged by the adoption of meat substitutes in regular diets as well as the expenses involved with testing technologies.

bioMérieux SA, Danaher Corporation, Becton, Dickinson and Company, F. Hoffmann-La Roche Ltd, Bruker Corporation, Hologic, Inc., Bio-Rad Laboratories, Inc., Thermo Fisher Scientific Inc., Merck KGaA, are some of the major players in the Meat Microbiological Testing market.

The Meat Microbiological Testing Market by form is segmented into Fresh Meat, Frozen Meat, Processed Meat, Cured Meat, Smoked Meat, Canned Meat, Cooked Meat, and Poultry.