Meat Ingredients Market Size (2025 – 2030)

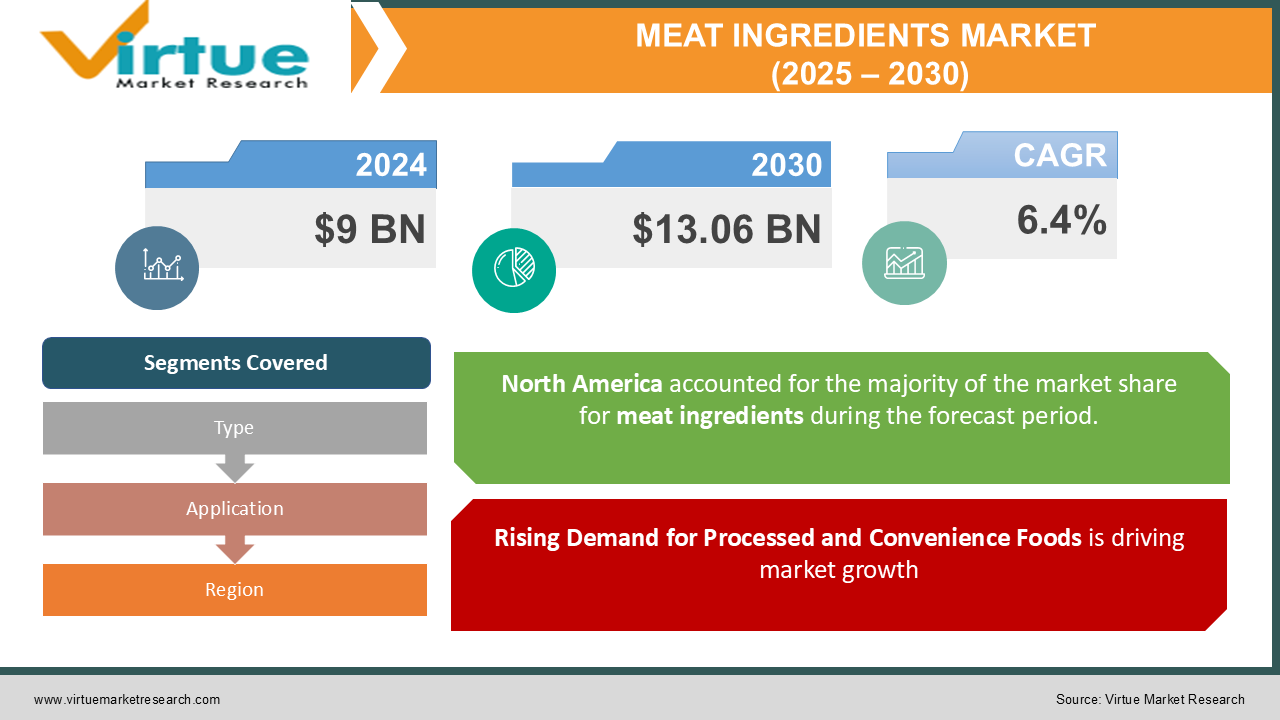

The Global Meat Ingredients Market was valued at USD 9 billion in 2024 and is expected to grow at a CAGR of 6.4% from 2025 to 2030, reaching USD 13.06 billion by 2030.

The Meat Ingredients Market focuses on functional additives, seasonings, preservatives, binders, and other ingredients used in processed and fresh meat products to enhance flavor, texture, shelf life, and nutritional value. The increasing demand for processed meat, coupled with innovations in food technology, is propelling market growth. Rising consumer preferences for protein-rich diets and convenience foods further drive the adoption of advanced meat ingredients globally.

Key Market Insights

Flavoring agents are among the fastest-growing categories, witnessing a CAGR of 7.2%, as consumers prioritize taste enhancement in meat products.

Natural meat preservatives, such as vinegar and rosemary extract, are gaining traction, accounting for 25% of the preservatives segment as clean-label trends shape purchasing decisions.

The Asia-Pacific region is emerging as the fastest-growing market, with countries like China and India leading due to increased meat consumption and urbanization.

E-commerce channels contribute significantly to the sales of pre-packaged meat products, making up 15% of global sales in 2024, as consumers increasingly prefer online grocery shopping.

Global Meat Ingredients Market Drivers

Rising Demand for Processed and Convenience Foods is driving market growth:

The fast-paced lifestyle of modern consumers has led to an increased demand for ready-to-eat and processed meat products. Meat ingredients, such as binders, flavor enhancers, and preservatives, play a crucial role in meeting this demand by ensuring consistent quality, taste, and shelf life. Convenience-oriented consumers, particularly in urban regions, prioritize products that are easy to prepare and store. This trend has fueled the growth of processed meat products like sausages, patties, and cold cuts, which heavily rely on advanced meat ingredient formulations for appeal and functionality.

Increasing Awareness of Protein-Rich Diets is driving market growth:

As consumers become more health-conscious, there is a growing emphasis on high-protein diets, where meat products remain a primary source. Meat ingredients that enhance the nutritional profile of products, such as protein fortifiers and functional additives, are increasingly sought after. Additionally, rising disposable incomes in emerging economies have made meat-based diets more accessible to the masses, further bolstering the demand for meat ingredients that enhance quality and nutrition. This global shift towards protein consumption is particularly evident in markets like Asia-Pacific and Latin America.

Technological Innovations in Food Processing is driving market growth:

Advancements in food technology have enabled manufacturers to develop novel meat ingredients that improve taste, texture, and shelf life without compromising on safety or nutritional value. Innovations such as microencapsulation of flavors and the use of natural antimicrobials have revolutionized the meat industry. Furthermore, digitalization in manufacturing processes ensures consistency and efficiency in meat ingredient production, helping brands maintain high standards and meet consumer expectations. As companies increasingly adopt cutting-edge technologies, the meat ingredients market is set to witness sustained growth.

Global Meat Ingredients Market Challenges and Restraints

Stringent Regulatory Frameworks is restricting market growth:

The meat industry is subject to rigorous food safety regulations, which often impact the development and application of meat ingredients. Ingredients such as preservatives and colorants are closely monitored by regulatory authorities like the FDA, EFSA, and others to ensure consumer safety. Meeting these compliance requirements involves significant investment in research and development, which can be a barrier for small and medium-sized enterprises. Moreover, variations in regulations across regions create complexities for manufacturers aiming to expand their global footprint, hindering market growth.

Rising Consumer Demand for Clean-Label Products is restricting market growth:

As consumers become increasingly wary of synthetic additives and chemicals in food products, there is a growing demand for clean-label meat products. While this trend promotes the use of natural and organic meat ingredients, it poses challenges for manufacturers reliant on traditional additives for cost-effectiveness and functionality. Producing clean-label ingredients involves higher production costs, limited scalability, and shorter shelf lives, creating challenges for manufacturers to balance affordability and consumer preference. The clean-label movement also forces companies to reformulate their products, requiring significant investment in R&D and marketing.

Market Opportunities

The global meat ingredients market is poised for significant growth as consumer preferences evolve. One key factor driving this growth is the increasing demand for plant-based and hybrid meat products. This shift has created opportunities for ingredient manufacturers to innovate, particularly with the development of texturizers and binders that improve the sensory appeal of hybrid meats. These ingredients help enhance the texture and mouthfeel of plant-based alternatives, making them more appealing to a broader consumer base. Emerging markets, especially in Asia-Pacific and Africa, present untapped potential for the meat ingredients market. Rising meat consumption and urbanization in these regions are fueling demand for meat products, opening doors for ingredient manufacturers to expand their reach. Companies targeting these regions can benefit from increasing disposable income and changing dietary patterns, offering opportunities to introduce new meat-based innovations. Additionally, natural and organic meat ingredients are becoming central to product development. As clean-label and sustainability trends continue to rise, consumers are demanding products with fewer additives and more transparency in sourcing and production. Manufacturers are responding by focusing on high-quality, natural ingredients that align with these growing consumer preferences. Technological advancements are also reshaping the industry. Companies investing in blockchain for ingredient traceability and encapsulation for flavor preservation are able to address consumer concerns about product quality and safety. These technologies enable greater transparency and help brands build trust with consumers. Furthermore, the e-commerce boom offers brands an opportunity to reach a tech-savvy consumer base directly. Through digital platforms, companies can enhance product visibility and accessibility, creating more personalized experiences and fostering stronger connections with their audience.

MEAT INGREDIENTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

6.4% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Kerry Group, DuPont Nutrition & Biosciences, DSM, Givaudan, Corbion, Cargill, Ingredion Tate & Lyle,BASF SE,Archer Daniels Midland Company (ADM) |

Meat Ingredients Market Segmentation - By Application

-

Flavoring Agents

-

Preservatives

-

Binders

-

Fillers

-

Colorants

-

Texturizers

In the ingredient type category, flavoring agents hold the largest market share due to their critical role in enhancing taste and consumer satisfaction. This segment is expected to witness significant growth, driven by innovations in natural and exotic flavors that cater to diverse palates.

Meat Ingredients Market Segmentation - By Type

-

Fresh Meat

-

Processed Meat

-

Ready-to-Eat Meat

-

Canned Meat

-

Others

In terms of application, processed meat dominates the market, with over 70% share, attributed to the widespread consumption of sausages, cold cuts, and convenience meat products. Processed meat products leverage a variety of ingredients to ensure consistent quality and extended shelf life.

Meat Ingredients Market Segmentation - By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America leads the global meat ingredients market, holding a 35% share in 2024, primarily due to the region's advanced food processing industry and high consumption of processed and convenience meat products. The U.S. and Canada are major contributors, with robust demand for flavor-enhanced and functional meat ingredients. The clean-label trend is particularly strong in this region, encouraging manufacturers to innovate with natural and organic options. Furthermore, the presence of established players and technological advancements in meat processing further strengthen North America’s dominance.

COVID-19 Impact Analysis on the Meat Ingredients Market

The COVID-19 pandemic had a mixed impact on the global meat ingredients market. On one hand, the disruption of supply chains and restrictions on meat production posed challenges for ingredient availability and pricing. On the other hand, the pandemic increased consumer focus on food safety and shelf stability, leading to a higher demand for preservatives and functional ingredients in packaged meat products. While the foodservice segment struggled due to lockdowns and restrictions, retail sales of processed meat surged as consumers stocked up on long-lasting, convenient food options. This shift in consumer behavior highlighted the need for products that offered convenience and longer shelf lives. Manufacturers adapted to these changes by prioritizing e-commerce channels and investing in innovative ingredient formulations to meet the evolving preferences of consumers As the market stabilizes in the post-pandemic period, the demand for natural, clean-label meat ingredients is expected to grow. Health-conscious consumers are increasingly seeking products that are free from additives and artificial ingredients, focusing on transparency and quality in their food choices. This trend toward natural ingredients is likely to shape the future of the meat ingredients market, with an emphasis on clean-label products that align with consumer health and sustainability priorities.

Latest Trends/Developments

The meat ingredients market is undergoing significant transformation driven by evolving consumer demands and technological advancements. One of the major trends is the growing shift towards clean-label formulations, with manufacturers focusing on natural preservatives, organic binders, and plant-based flavoring agents. Consumers are increasingly seeking transparency in ingredient sourcing, prompting brands to offer simpler, more natural products. Technological advancements, such as encapsulation, are also playing a pivotal role in the market. This technology helps preserve the flavors and nutrients of meat ingredients, ensuring that the products maintain their quality over time. Additionally, hybrid meat products, which blend animal and plant-based ingredients, are gaining popularity, particularly among flexitarian consumers looking for healthier, more sustainable alternatives. Sustainability is becoming an essential factor in consumer decision-making, influencing both packaging and ingredient sourcing. Brands are adopting eco-friendly packaging solutions and sourcing ingredients from sustainable practices to align with growing environmental concerns. These efforts are helping companies cater to the rising demand for products that are both healthier and more environmentally responsible. Furthermore, the rise of direct-to-consumer (DTC) brands and online platforms is reshaping the way meat ingredients are marketed and sold. These digital channels enhance product accessibility and convenience, allowing consumers to purchase products directly from brands, often with greater customization options. The shift towards online sales also provides brands with opportunities to engage more effectively with consumers, offering a more personalized shopping experience.

Key Players

-

Kerry Group

-

DuPont Nutrition & Biosciences

-

DSM

-

Givaudan

-

Corbion

-

Cargill

-

Ingredion

-

Tate & Lyle

-

BASF SE

-

Archer Daniels Midland Company (ADM)

Chapter 1. Meat Ingredients Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Meat Ingredients Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Meat Ingredients Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Meat Ingredients Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Meat Ingredients Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Meat Ingredients Market – By Type

6.1 Introduction/Key Findings

6.2 Fresh Meat

6.3 Processed Meat

6.4 Ready-to-Eat Meat

6.5 Canned Meat

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Type

6.8 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Meat Ingredients Market – By Application

7.1 Introduction/Key Findings

7.2 Flavoring Agents

7.3 Preservatives

7.4 Binders

7.5 Fillers

7.6 Colorants

7.7 Texturizers

7.8 Y-O-Y Growth trend Analysis By Application

7.9 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Meat Ingredients Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Meat Ingredients Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Kerry Group

9.2 DuPont Nutrition & Biosciences

9.3 DSM

9.4 Givaudan

9.5 Corbion

9.6 Cargill

9.7 Ingredion

9.8 Tate & Lyle

9.9 BASF SE

9.10 Archer Daniels Midland Company (ADM)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Meat Ingredients Market was valued at USD 9 billion in 2024 and is expected to grow at a CAGR of 6.4% from 2025 to 2030, reaching USD 13.06 billion by 2030.

Key drivers include rising demand for processed foods, increasing consumer focus on protein-rich diets, and advancements in food processing technologies.

The market is segmented by ingredient type (flavoring agents, preservatives, binders, fillers, colorants, and texturizers) and application (fresh meat, processed meat, ready-to-eat meat, and canned meat).

North America is the dominant region, holding a 35% market share, driven by advanced food processing infrastructure and strong consumer demand for convenience meat products.

Leading players include Kerry Group, DuPont Nutrition & Biosciences, DSM, Givaudan, Corbion, Cargill, Ingredion, Tate & Lyle, BASF SE, and Archer Daniels Midland Company (ADM).