Meat Blending Equipment Market Size (2024 –2030)

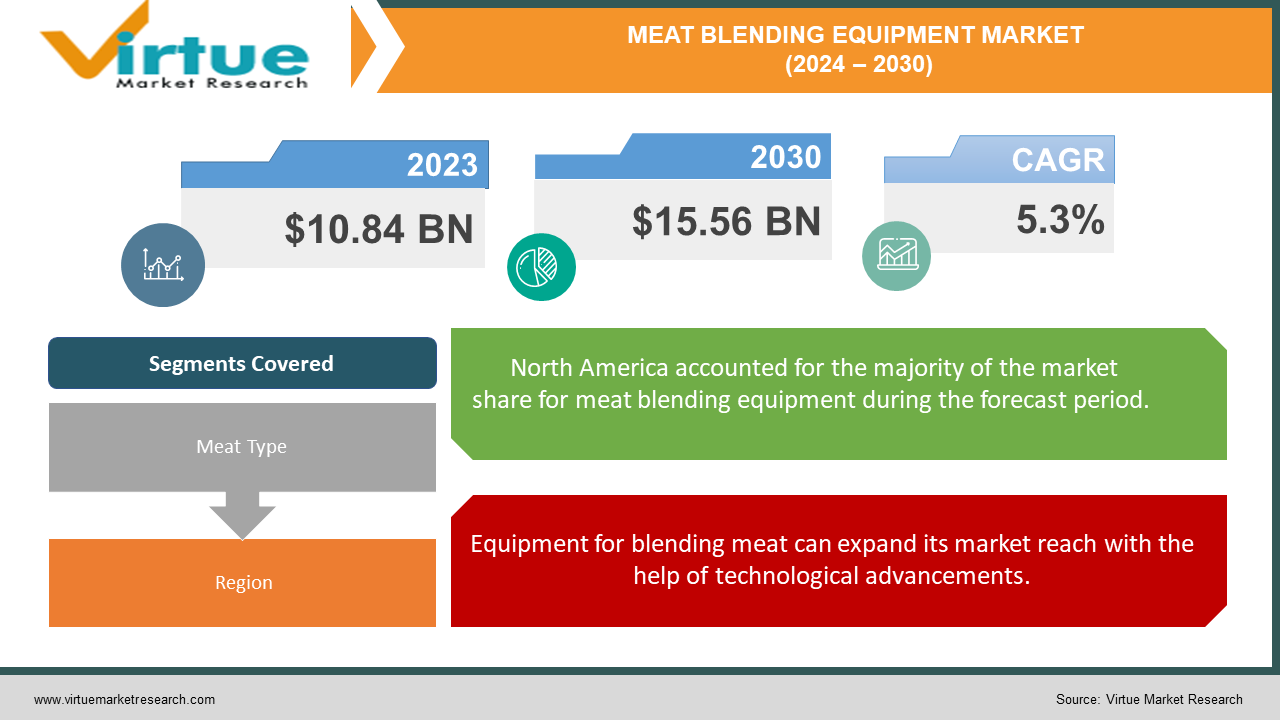

The Global Meat Blending Equipment Market was valued at USD 10.84 Billion and is projected to reach a market size of USD 15.56 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.3%.

Since businesses are increasing their investments in meat processing equipment and making technological advancements, it is anticipated that the meat industry will expand. Equipment that maintains meat fresh and healthy is in greater demand as regulations about the safe sale, trade, and transportation of meat become more stringent. New machines that can slice, blend, and grind all at once have been made possible by research and development, saving costs and maintaining cleanliness. The Dutch company Marel had to construct a new factory in Dongen since their previous one was unable to meet the demands of the contemporary world. Their goal in building this new facility was to increase productivity. Additionally, they acquired Cedar Creek Company, an Australian company, to produce more sophisticated meat processing products. Marel became a major player in the production of high-tech machinery when it acquired half of Curio, another company in Iceland. To expand and produce more equipment, a US company by the name of JBT purchased Proseal in the UK and Prime Equipment Group in the US.

Key Market Insights:

With bowl choppers accounting for about 40% of the market, they are the preferred option for meat-blending equipment. Their popularity stems from their versatility and ability to perform a wide range of meat processing tasks.

The market for processed meat products accounts for about 55% of the demand for meat blending equipment. This includes foods like patties and sausages, which mainly depend on blending tools to get the right consistency and taste.

Approximately thirty percent of the market for meat blending equipment is dominated by North America. This is a result of the area's well-established meat processing sector and stringent food safety laws.

The use of sophisticated meat-blending machinery, like high-speed emulsifiers and vacuum blenders, is expanding at a rate of about 8% per year. The need for improved productivity in meat processing operations and consistent product quality is what motivates this.

Global Meat Blending Equipment Market Drivers:

Equipment for blending meat can expand its market reach with the help of technological advancements.

We frequently use the muscles and fat of animals, such as beef, pork, chicken, and shellfish, to make food. However, slicing through fat can be difficult, so businesses use powerful machinery to accomplish this. More powerful machines have recently been produced for this task by a few major rivals. A good way to keep meat tasty and fresh is to use a meat grinder. It improves the food's flavor and softness. An increasing number of people are beginning to use machines similar to this one to make sausages in places like China.

The market for meat processing equipment is growing as people consume more meat and more animal protein, which is rapidly shifting consumer preferences.

The global population is predicted to increase to approximately 37 kilograms of meat annually by 2030, as more and more people eat meat. As a result, there is a growing market for meat processing machinery. The public wants more processed meat products like burgers and sausages as well as safer food. This rise is also being fueled by the popularity of packaged foods and our hectic lifestyles. However, the market is being held back in part by the high cost of these machines. Still, the industry is expanding because of new devices that can perform the task autonomously.

Meat Blending Equipment Market Challenges and Restraints:

As more people become aware of the advantages of plant-based diets for their health, the environment, and ethics, they are deciding to eat less meat. They're trying plant-based foods like soy, peas, or wheat that are designed to resemble and taste like meat in place of meat. These are referred to as plant-based meat alternatives, and they are available as nuggets, burgers, and sausages. Traditional meat producers may face challenges as a result of this shift toward plant-based diets, as they may lose business to businesses producing these plant-based substitutes. The market for meat-mixing equipment is facing challenges due to the increasing demand for meat substitutes that are natural, organic, and plant-based.

Meat Blending Equipment Market Opportunities:

There are plenty of growth prospects in the market for meat-blending equipment. The increasing demand for processed meat products has led to a need for efficient machines that can blend different types of meat. Businesses can increase the speed and accuracy of their equipment by investing in new technology. Additionally, there's an opportunity to enter new markets, particularly in regions where people's dietary habits are changing, like Asia and Latin America. Leaner meats are becoming more popular as people become more health conscious, and blenders can help create healthier options. Businesses can exchange ideas and create new products with other companies and organizations to stay ahead of the competition in this market. All things considered, the meat blending equipment market is rife with chances for businesses that can innovate to satisfy consumer demands and adjust to shifting trends.

MEAT BLENDING EQUIPMENT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.3% |

|

Segments Covered |

By Meat Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

GEA Group, JBT Corporation, Marel, Illinois Tool Works, The Middleby Corporation, Bettcher Industries, Equipamientos Carnicos, Biro Manufacturing Company, Brahe, RZPO |

Global Meat Blending Equipment Market Segmentation: By Meat Type

-

Beef

-

Mutton

-

Pork

Pork accounted for the largest portion of meat sales in 2022 (47.1%). Pork is still popular because it doesn't carry diseases like mad cow disease, which can lower the protein content of the meat, even though some religions forbid eating it. Mutton is a popular sheep product in the Middle East, Africa, and Asia Pacific regions. People adore it for its flavor and convenience of availability. However, the disease known as scrapie, which lowers the quality of the meat produced by sheep and goats, has recently resulted in a decrease in demand.

Global Meat Blending Equipment Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

With more than 30% of global sales in 2023, North America ranked as the largest market worldwide. Because food processing is done in a highly automated manner, blending meat requires a large number of machines. Meat is an essential component of the diet because it is high in protein. Because more people are becoming aware of the health benefits of meat, such as its ability to boost immunity and provide protein, the market in Europe is expanding. The market is expanding thanks in part to new machines that integrate multiple tasks into one. With 7% annual growth, the Asia Pacific region is expanding at the fastest rate due to a rapidly growing population with a diverse population. Fast-food restaurants from Western nations are also opening up shop there, necessitating the purchase of additional machinery to quickly process meat. Rich people are consuming more tough meats like horses and camel in the Middle East and Africa. Lean meats, such as guinea pig and rabbit, are highly sought after in Central and South America due to their lower fat content. This implies that these meats must be blended using machinery.

COVID-19 Impact on the global Meat Blending Equipment Market:

The market for meat blending equipment has been greatly impacted by the COVID-19 pandemic in several ways. First, delays in the production and delivery of equipment have impacted market growth due to disruptions in supply chains and manufacturing operations. Lockdowns and safety precautions forced many manufacturing facilities to temporarily close or operate at reduced capacity, which hurt output and sales. International trade has also been hampered by travel restrictions and border closures, which have an impact on the import and export of raw materials and equipment. Market expansion has been further impacted by some companies delaying investments in new equipment due to uncertainty and economic challenges. However, the pandemic has also brought attention to how crucial technology and automation are to maintaining food safety and production efficiency, which has increased demand for intelligent and automated blending equipment solutions. Overall, COVID-19 has posed difficulties for the market for meat blending equipment, but it has also highlighted the necessity of creativity and adaptability to global disruptions.

Latest Trend/Development:

The meat blending equipment market is being shaped by several significant trends and advancements. First and foremost, there's a big emphasis on sustainability, with businesses trying to use innovative techniques and renewable energy to cut waste and environmental impact. The popularity of plant-based meat substitutes is another significant trend that is propelling the creation of blending apparatus to produce lifelike plant-based sausages and burgers. With IoT sensors and data analytics making equipment more sophisticated and effective, smart technology integration is also growing. Personalization and customization are becoming more and more crucial, and blending equipment can be tailored to accommodate a wide range of customer preferences. The growth of value-added products, such as meal solutions and pre-seasoned meats, is also encouraging the purchase of machinery that can generate a variety of value-added products. In general, businesses that adopt these innovations and trends will be well-positioned to thrive in the cutthroat meat processing industry.

Key Players:

-

GEA Group

-

JBT Corporation

-

Marel

-

Illinois Tool Works

-

The Middleby Corporation

-

Bettcher Industries

-

Equipamientos Carnicos

-

Biro Manufacturing Company

-

Brahe

-

RZPO

Chapter 1. MEAT BLENDING EQUIPMENT MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. MEAT BLENDING EQUIPMENT MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. MEAT BLENDING EQUIPMENT MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. MEAT BLENDING EQUIPMENT MARKET Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. MEAT BLENDING EQUIPMENT MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. MEAT BLENDING EQUIPMENT MARKET – By Meat Type

6.1 Introduction/Key Findings

6.2 Beef

6.3 Mutton

6.4 Pork

6.5 Y-O-Y Growth trend Analysis By Meat Type

6.6 Absolute $ Opportunity Analysis By Meat Type, 2024-2030

Chapter 7. MEAT BLENDING EQUIPMENT MARKET , By Geography – Market Size, Forecast, Trends & Insights

7.1 North America

7.1.1 By Country

7.1.1.1 U.S.A.

7.1.1.2 Canada

7.1.1.3 Mexico

7.1.2 By Meat Type

7.1.3 Countries & Segments - Market Attractiveness Analysis

7.2 Europe

7.2.1 By Country

7.2.1.1 U.K

7.2.1.2 Germany

7.2.1.3 France

7.2.1.4 Italy

7.2.1.5 Spain

7.2.1.6 Rest of Europe

7.2.2 By Meat Type

7.2.3 Countries & Segments - Market Attractiveness Analysis

7.3 Asia Pacific

7.3.1 By Country

7.3.1.1 China

7.3.1.2 Japan

7.3.1.3 South Korea

7.3.1.4 India

7.3.1.5 Australia & New Zealand

7.3.1.6 Rest of Asia-Pacific

7.3.2 By Meat Type

7.3.3 Countries & Segments - Market Attractiveness Analysis

7.4 South America

7.4.1 By Country

7.4.1.1 Brazil

7.4.1.2 Argentina

7.4.1.3 Colombia

7.4.1.4 Chile

7.4.1.5 Rest of South America

7.4.2 By Meat Type

7.4.3 Countries & Segments - Market Attractiveness Analysis

7.5 Middle East & Africa

7.5.1 By Country

7.5.1.1 United Arab Emirates (UAE)

7.5.1.2 Saudi Arabia

7.5.1.3 Qatar

7.5.1.4 Israel

7.5.1.5 South Africa

7.5.1.6 Nigeria

7.5.1.7 Kenya

7.5.1.8 Egypt

7.5.1.9 Rest of MEA

7.5.2 By Meat Type

7.5.3 Countries & Segments - Market Attractiveness Analysis

Chapter 8. MEAT BLENDING EQUIPMENT MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

8.1 GEA Group

8.2 JBT Corporation

8.3 Marel

8.4 Illinois Tool Works

8.5 The Middleby Corporation

8.6 Bettcher Industries

8.7 Equipamientos Carnicos

8.8 Biro Manufacturing Company

8.9 Brahe

8.10 RZPO

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Global Meat Blending Equipment Market was estimated to be worth USD 10.84 billion in 2024 and is projected to reach a value of USD 15.56 billion by 2030, growing at a CAGR of 5.3% during the forecast period 2024-2030.

Progressive innovation in technology can support the market expansion of meat-blending equipment. As consumers turn more and more to animal protein and meat consumption rises, the market for meat processing equipment is expanding, quickly changing customer preferences.

The growing customer desire for natural, organic, and plant-based meat substitutes, may lower the demand for processed meat products and have an impact on the meat processors' profitability.

Beef-based meat type is the fastest growing in the Global Meat Blending Equipment Market.

Asia-Pacific region is the fastest growing in the Global Meat Blending Equipment Market.