Measuring and Dispensing Pumps Market Size (2023 – 2030)

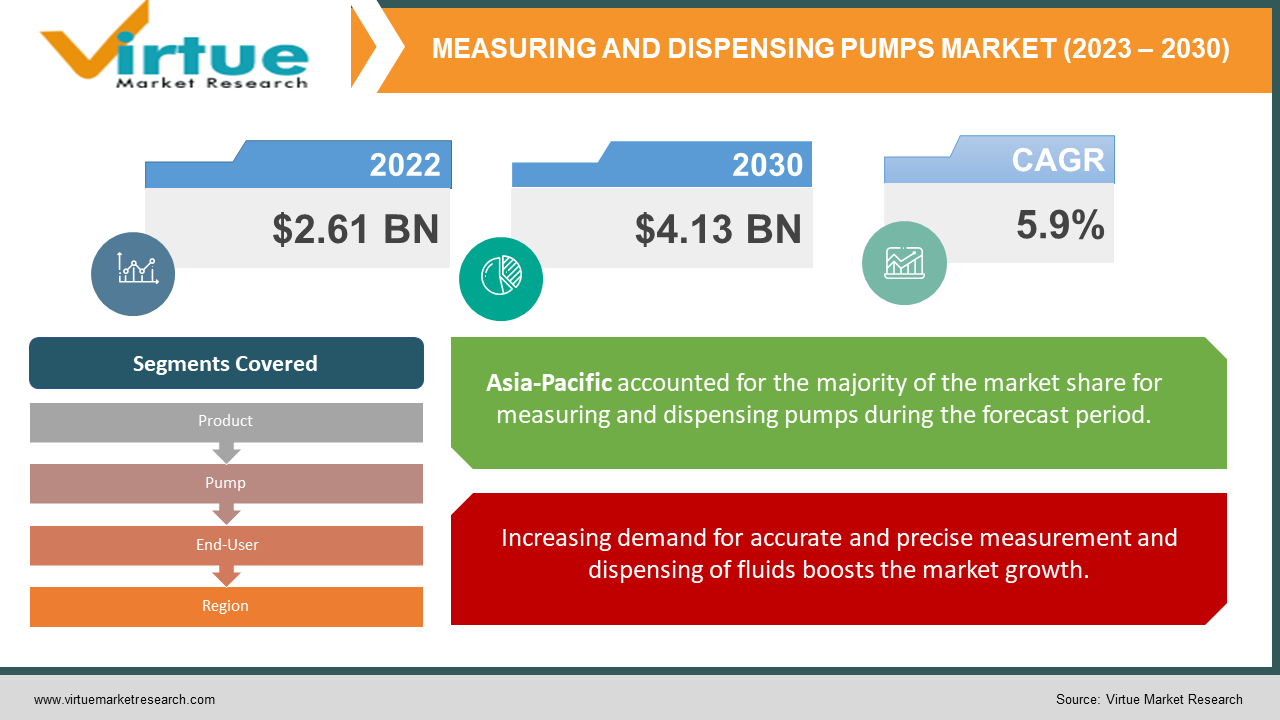

The Global Measuring and Dispensing Pumps Market was estimated to be worth USD 2.61 Billion in 2022 and is projected to reach a value of USD 4.13 Billion by 2030, growing at a CAGR of 5.9% during the forecast period 2023-2030.

Impact of COVID-19 on Measuring and Dispensing Pumps Market:

The COVID-19 outbreak has had an opposing effect on the measuring and dispensing pump business. Although disrupting worldwide supply chains, the pandemic has increased demand for pumps in industries including pharmaceuticals, healthcare, and food & beverage. The pandemic has highlighted the need for precise and accurate fluid dispensing in these industries, and measurement and dispensing pumps have been critical in aiding vaccine development and manufacture. Nonetheless, the industry has faced challenges such as diminished productivity and supply chain disruptions caused by lockdowns and travel restrictions, which have caused delays in project timelines and installations. Nevertheless, the market is expected to recover in the coming years as the global economy gradually recovers from the impact of the pandemic.

Market Overview:

A crucial industry that meets numerous industrial demands, the measuring and dispensing pump market is expanding quickly. These pumps are in great demand in sectors including oil and gas, pharmaceuticals, food and beverage, and chemical processing because they are made to measure and distribute fluids with the utmost accuracy and precision. Since they make it possible to handle fluids precisely throughout numerous industrial processes, their significance in these sectors cannot be emphasised. These pumps guarantee that the quality of the finished product is not harmed in any way due to their high degree of precision and consistency.

Measuring and Dispensing Pumps Market Drivers:

Increasing demand for accurate and precise measurement and dispensing of fluids boosts the market growth:

The need for measuring and dispensing pumps has increased along with the demand for improved precision and accuracy across a variety of sectors. To guarantee product quality and consistency, accurate fluid measurement and dispensing are crucial in sectors including medicines, food and beverage production, and chemical processing. Measuring and dispensing pumps provide a high level of accuracy and repeatability, which helps to reduce waste, save time, and improve efficiency.

The growing need for automated systems to reduce human errors drive the growth of the market:

Pumps for measuring and dispensing are a crucial part of automated systems, which are becoming more and more in demand across a range of sectors. Automatic systems are intended to lessen the possibility of human mistakes and increase process effectiveness, enhancing product quality and decreasing waste. Automatic systems that make use of measurement and dispensing pumps may greatly increase the efficacy and precision of the fluid dispensing process, consequently lowering waste, raising productivity, and enhancing product quality. As a result, there is a rising need for measuring and dispensing pumps in a number of sectors to assist in the creation and use of automated systems.

Measuring and Dispensing Pumps Market Challenges:

High initial investment costs impede the growth of the market:

The market for measuring and dispensing pumps has several major obstacles, including the high initial investment cost of these pumps. For small and medium-sized businesses (SMEs) with tight budgets, buying and installing these pumps may be quite expensive. Certain firms, especially those that operate in sectors with slim profit margins, may be discouraged from investing in measuring and dispensing pumps due to the high initial investment costs. Further raising the overall cost of ownership is the potential for substantial costs associated with the maintenance and repair of these pumps.

The complexity of pump selection and customization drive the market growth:

Selecting the right measuring and dispensing pump can be a complex process, particularly for businesses that are not familiar with the technical specifications and requirements of these pumps. Factors such as fluid viscosity, flow rate, pressure, and temperature can all impact the performance of the pump, and selecting the wrong pump can result in inaccurate or inconsistent fluid dispensing.

MEASURING AND DISPENSING PUMPS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

5.9% |

|

Segments Covered |

By Product, Pump, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Watson-Marlow Fluid Technology Group, Idex Corporation, Dover Corporation, Flowserve Corporation, Graco Inc., Sulzer Ltd., ProMinent GmbH, LEWA GmbH, Cole-Parmer Instrument Company LLC, Neptune Chemical Pump Co., Inc. |

Measuring and Dispensing Pumps Market Segmentation - By Product

-

0-3 CC

-

4-8 CC

-

9-30 CC

-

>30 CC

The 0-3 CC pumps segment dominated the market and accounted for about 40.0% share of the revenue in 2022 due to it being increasingly used in kitchen cleaners, multi-purpose cleaners, glass cleaners, and others. The 4-8 CC dispensing pumps are greatly used in the packaging of food, personal care, cosmetic, and pharma-grade products. These pumps offer a higher dosage as compared to the pumps ranging from 0 CC to 3 CC, which makes them highly suitable for use in household products as well.

Measuring and Dispensing Pumps Market Segmentation - By Pump

-

Diaphragm Pumps

-

Piston Pumps

-

Peristaltic Pumps

-

Syringe Pumps

Because of their capacity to handle very viscous fluids while avoiding contamination, peristaltic pumps have grown in favour in recent years. These pumps are commonly utilised in the pharmaceutical and biotechnology sectors, where cleanliness and precision are critical. Piston pumps have experienced significant demand in the food and beverage sector due to their ability to handle a broad variety of fluids, from low to high viscosity. These pumps are commonly used to dispense sauces, syrups, and other culinary preparations, as well as in the manufacture of beer and other alcoholic drinks. Diaphragm pumps are commonly employed in sectors requiring accuracy and precision, such as medicines, chemicals, and food processing. Syringe pumps are commonly used in medical applications such as drug infusion and Anaesthesia delivery.

Measuring and Dispensing Pumps Market Segmentation – By End-User

-

Pharmaceutical Industry

-

Food and Beverage Industry

-

Cosmetics and Personal Care Industry

-

Bio-Technology

-

Others

For measuring and dispensing pumps, the pharmaceutical sector represents a significant business. Measuring and dispensing pumps are becoming more and more in demand in this sector of the economy due to the requirement for precise and accurate dispensing of liquids and chemicals during medication research, manufacture, and packaging. A sizable market for measuring and dispensing pumps is found in the food and beverage sector. Fluids like syrups, sauces, and flavourings can be dispensed using these pumps. For a variety of applications, including mixing, dispensing, and metering, the chemical industry demands precision and accuracy in fluid handling. For these applications, measuring and dispensing pumps are necessary. Other sectors including automotive, oil and gas, and water treatment also employ measuring and dispensing pumps.

Measuring and Dispensing Pumps Market Segmentation- By Region

-

North America

-

Europe

-

Asia-Pacific

-

Rest of the World

The Asia-Pacific region is predicted to have the market's highest development due to the existence of large industrial sectors. It is projected that rising demand for these pumps will fuel market growth in the pharmaceutical, food and beverage, and water treatment industries. The measuring and dispensing pump market in the North American area is predicted to exhibit significant growth due to the increased demand for these pumps in the chemical and petrochemical sectors. Due to the presence of several important chemical production facilities in the region, it is projected that the need for high-performance pumps for fluid handling in these industries would only increase. The European region measuring and dispensing pump market is predicted to rise steadily due to increased demand for these pumps in the food and beverage, pharmaceutical, and chemical sectors. The strict fluid handling laws and requirements in these industries are projected to boost market expansion in this area. Because of the growing need for water treatment facilities and the rising demand for oil and gas, the Middle East and Africa areas are likely to have modest growth in the measuring and dispensing pumps market. The application of these pumps in the oil and gas industry is anticipated to drive market expansion in this area.

Measuring and Dispensing Pumps Market Segmentation - Key Players

Here are the top key players in the measuring and dispensing pumps market:

- Watson-Marlow Fluid Technology Group

- Idex Corporation

- Dover Corporation

- Flowserve Corporation

- Graco Inc.

- Sulzer Ltd.

- ProMinent GmbH

- LEWA GmbH

- Cole-Parmer Instrument Company LLC

- Neptune Chemical Pump Co., Inc.

Chapter 1. Measuring and Dispensing Pumps Market – Scope & Methodology

1.1 Market Segmentation

1.2 Assumptions

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Measuring and Dispensing Pumps Market – Executive Summary

2.1 Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.3 COVID-19 Impact Analysis

2.3.1 Impact during 2023 – 2030

2.3.2 Impact on Supply – Demand

Chapter 3. Measuring and Dispensing Pumps Market – Competition Scenario

3.1 Market Share Analysis

3.2 Product Benchmarking

3.3 Competitive Strategy & Development Scenario

3.4 Competitive Pricing Analysis

3.5 Supplier - Distributor Analysis

Chapter 4. Measuring and Dispensing Pumps Market - Entry Scenario

4.1 Case Studies – Start-up/Thriving Companies

4.2 Regulatory Scenario - By Region

4.3 Customer Analysis

4.4 Porter's Five Force Model

4.4.1 Bargaining Power of Suppliers

4.4.2 Bargaining Powers of Customers

4.4.3 Threat of New Entrants

4.4.4 .Rivalry among Existing Players

4.4.5 Threat of Substitutes

Chapter 5. Measuring and Dispensing Pumps Market - Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Measuring and Dispensing Pumps Market - By Product

6.1 0-3 CC

6.2 4-8 CC

6.3 9-30 CC

6.4 >30 CC

Chapter 7. Measuring and Dispensing Pumps Market - By Pump

7.1 Diaphragm Pumps

7.2 Piston Pumps

7.3 Peristaltic Pumps

7.4 Syringe Pumps

Chapter 8. Measuring and Dispensing Pumps Market – By End-User

8.1 Pharmaceutical Industry

8.2 Food and Beverage Industry

8.3 Cosmetics and Personal Care Industry

8.4 Bio-Technology

8.5 Others

Chapter 9. Measuring and Dispensing Pumps Market - By Region

9.1 North America

9.2 Europe

9.3 Asia-Pacific

9.4 Rest of the World

Chapter 10. Measuring and Dispensing Pumps Market - Key Players

10.1 Watson-Marlow Fluid Technology Group

10.2 Idex Corporation

10.3 Dover Corporation

10.4 Flowserve Corporation

10.5 Graco Inc.

10.6 Sulzer Ltd.

10.7 ProMinent GmbH

10.8 LEWA GmbH

10.9 Cole-Parmer Instrument Company LLC

10.10 Neptune Chemical Pump Co., Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Measuring and Dispensing Pumps Market was estimated to be worth USD 2.61 Billion in 2022 and is projected to reach a value of USD 4.13 Billion by 2030, growing at a CAGR of 5.9% during the forecast period 2023-2030.

Pumps for Measuring and Dispensing are tools used in a variety of industrial applications to precisely measure and dispense fluids. They include food and beverage, pharmaceutical, water treatment, chemical, oil and gas, and many more sectors.

The rising requirement for these pumps in the food and beverage, pharmaceutical, and water treatment sectors, as well as the necessity for precise fluid handling in a variety of industrial processes, are the main factors driving the market for measuring and dispensing pumps.

The Measuring and Dispensing Pumps Market is confronted with difficulties such as the high cost of these pumps, the requirement for routine calibration and maintenance, the complexity of the technology used in these pumps, and the strict regulations and standards for fluid handling in various industries.

Some of the key players in the Measuring and Dispensing Pumps Market include Watson-Marlow Fluid Technology Group, Idex Corporation, Dover Corporation, Flowserve Corporation, and Graco Inc.