Meal Planning and Recipes Application Market Size (2024 – 2030)

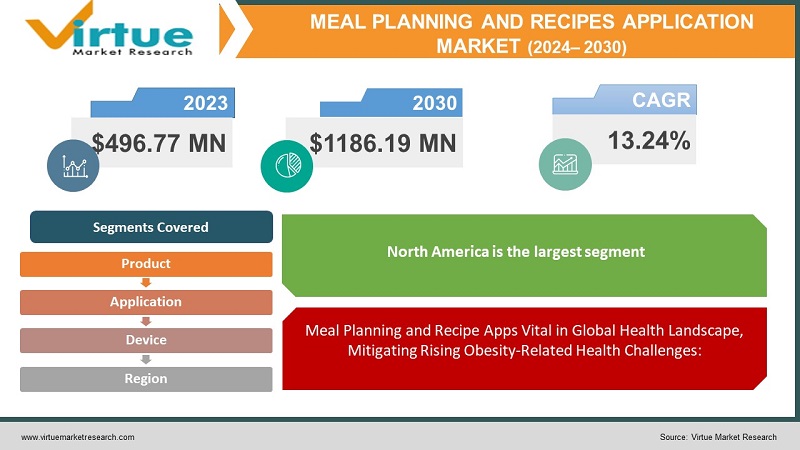

In 2023, the Global Meal Planning and Recipes Application Market was valued at $496.77 million, and is projected to reach a market size of $1186.19 million by 2030. Over the forecast period of 2024-2030, market is projected to grow at a CAGR of 13.24%.

The Meal Planning and Recipes Application Market has experienced steady growth in the past, propelled by an increased interest in cooking, a preference for healthier food options, and the rising awareness of recipe apps. Currently, the market continues to thrive, driven by consumers' focus on healthy eating and the convenience offered by these applications. Technological advancements have further enhanced user-friendly features and personalized functionalities. Looking ahead, the market is poised for sustained growth, with anticipated trends including increased adoption, innovative developments leveraging artificial intelligence, and an expanded range of recipes catering to diverse global cuisines. These applications are expected to play a major role in guiding individuals toward informed and health-conscious choices, helping a future where technology seamlessly integrates with gastronomy.

Key Market Insights:

Maintaining a vigilant concern is crucial, given recent findings indicating that 4.7 million individuals face premature death due to obesity. However, obesity is a preventable concern that can be effectively managed through rigorous meal planning and disciplined routines.

The growth of the worldwide meal planning and recipe apps market is propelled by the increasing adoption of a faster-paced lifestyle. These apps contribute to convenience, saving time in food preparation and encouraging users to explore new ingredients and cooking techniques.

Subscription-based recipe apps come equipped with advanced features like voice assistance, a streamlined backend CMS, and intelligent search and filters, facilitating the preparation of healthy meals.

Notably, over 23 million individuals in the United States, Canada, India, and Australia have actively sought food recipes and cooking apps.

Meal Planning and Recipes Application Market Drivers:

Meal Planning and Recipe Apps Vital in Global Health Landscape, Mitigating Rising Obesity-Related Health Challenges:

The escalating prevalence of preventable health issues, notably obesity, is driving the adoption of apps globally. With a huge number of people facing premature death due to obesity, there is a heightened need for solutions that address health concerns. Meal Planning and Recipe apps, with their emphasis on strict meal planning and disciplined approaches, emerge as effective tools for managing and preventing health issues.

Technological Innovations Propel Global Meal Planning and Recipe Apps Market, Revolutionizing User Engagement and Healthier Meal Preparation:

A major factor boosting the market is the integration of technological advancements aimed at enhancing user engagement. Vendors are leveraging innovations such as voice assistance, efficient backend content management systems (CMS), and intelligent search and filtering features. These advancements not only contribute to a more user-friendly experience but also empower consumers to prepare healthier meals efficiently. The incorporation of cutting-edge technology plays a crucial role in sustaining the market's upward trajectory.

Subscription Solutions Transform Global Meal Planning and Recipe Apps Market, Catering to Rapid Lifestyles and Health-Conscious Consumers:

To meet the demands of a rapidly paced lifestyle, vendors are introducing subscription options in meal planning and recipe apps. Users can subscribe and specify dietary preferences, enabling automatic changes to meal recipes on a daily basis. The subscription model enhances adherence to dietary resolutions, providing a seamless and efficient solution for individuals committed to healthier eating. The growing popularity of such plans is expected to drive the global meal planning and recipe app market during the forecast period.

Meal Planning and Recipes Application Market Restraints and Challenges:

Meal Planning and Recipe Apps Navigate Global Palates and Cultural Sensitivities in the Challenge of Culinary Diversity:

Addressing the diverse dietary preferences and cultural nuances of a global audience stands a significant challenge for the apps. Adapting content to resonate with users from various regions while maintaining accuracy and authenticity in recipe recommendations necessitates an innovative approach to content creation. Creating cooking content that appeals to different tastes while respecting cultural differences is a delicate task for these apps. Striking this balance is crucial to keep users happy and stay relevant in today's global digital world.

Meal Planning and Recipes Application Market Opportunities:

A promising opportunity for the Meal Planning and Recipes Application Market involves strategic partnerships with grocery delivery services. By forming collaborations, these applications can seamlessly integrate grocery lists with trusted delivery platforms. This will streamline the entire cooking process and provide users with a convenient one-stop solution for meal planning, recipe discovery, and ingredient procurement. This synergistic approach capitalizes on the rising trend of online grocery shopping, creating a comprehensive ecosystem that enhances user convenience and fosters a more holistic experience within the Meal Planning and Recipes Application Market.

MEAL PLANNING AND RECIPES APPLICATION MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

13.24% |

|

Segments Covered |

By Product, Application, Device, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

AJNS New Media GmbH, BuzzFeed Inc., Conde Nast, Cookpad Inc., Discovery Inc., Dotdash Meredith, Forks over Knives LLC, Glo Bakery Corp., Green Kitchen Stories., Gronda GmbH |

Meal Planning and Recipes Application Market Segmentation: By Product

-

Free Users

-

Paid Users/Customers

The largest in this segment is free users and the fastest growing during the forecast period is also free users. Opting for free downloads is the favored selection among users due to its cost-free nature. The participation of free users significantly boosts the revenue for most companies, offering increased visibility that leads to a broader audience and heightened app popularity. According to App Annie's latest compilation of the highest-earning iPhone apps in the U.S., only 9 out of 100 apps operate strictly on a paid model, emphasizing that 91 out of the top 100 apps are accessible for free download.

Meal Planning and Recipes Application Market Segmentation: By Application

-

IOS

-

Android

The largest in this segment is Android and the fastest growing during the forecast period is also Android. Boasting a user base exceeding 2.5 billion across more than 190 countries, Android devices dominate mobile phone sales, securing over 70% of the market share according to various surveys. The Android operating system (OS) is built upon the Linux kernel, providing a versatile foundation. In contrast to Apple's iOS, Android operates on an open-source model, empowering developers to modify and customize the OS to suit the specifications of each device.

Meal Planning and Recipes Application Market Segmentation: By Device

-

Tablet

-

PC

-

Smartphone

The largest in this segment is Smartphones and the fastest growing during the forecast period is also Smartphones. The preference for smartphones can be attributed to their ubiquitous presence, offering users the convenience of accessing meal planning and recipe apps anytime and anywhere. The intuitive interfaces and portability of smartphones make them a go-to choice for users seeking quick and on-the-go access to meal-planning resources. While smartphones lead in popularity, tablets, and PCs cater to users who may prefer larger screens and more extensive interfaces for a more immersive cooking experience at home or in a dedicated workspace.

Meal Planning and Recipes Application Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The largest in this segment is North America with a 33% share and the fastest growing during the forecast period is Asia-Pacific. Food service establishments are intensifying their emphasis on culinary innovations, anticipating a rise in the adoption of meal planning and recipe apps in North America. In Asia-Pacific, a burgeoning market for meal planning and recipe apps is foreseen as the region experiences a culinary renaissance, embracing diverse tastes and preferences. A similar trend is observed with a growing inclination towards convenient and innovative cooking solutions in Europe. South America, known for its rich culinary heritage, is witnessing an uptake in meal planning and recipe app adoption, driven by a desire for both traditional and modern recipes. In the Middle East and Africa, the adoption of these apps is on the rise, reflecting an increasing demand for culinary diversity and efficiency in food preparation methods.

COVID-19 Impact Analysis on the Meal Planning and Recipes Application Market:

The advent of COVID-19 vaccines in the region played a pivotal role in mitigating the pandemic's impact, leading to a decline in cases and the gradual normalization of the situation. Consequently, commercial establishments, including cafes and restaurants, resumed operations, fostering an increased adoption of recipe apps and catalyzing the growth of the regional market in 2021. This positive trajectory is further bolstered by rising internet penetration and the sustained demand for mobile devices, which are anticipated to underpin the continued expansion of the regional recipe apps market throughout the forecast period.

Latest Trends/ Developments:

A recent evolution in the meal planning and recipe market is the heightened focus on sustainability and eco-conscious choices. Recipe apps are increasingly incorporating features that guide users in creating environmentally friendly and locally sourced meals. Moreover, there is a growing emphasis on reducing food waste, with apps providing creative recipes that repurpose leftovers and utilize commonly discarded ingredients. Additionally, the integration of artificial intelligence (AI) for personalized nutrition recommendations and adaptive meal planning is gaining traction, offering users tailored suggestions based on their dietary preferences, health goals, and lifestyle. These advancements reflect a broader trend towards not only healthier eating but also more sustainable and personalized culinary practices within the meal planning and recipe app landscape.

Key Players:

-

AJNS New Media GmbH

-

BuzzFeed Inc.

-

Conde Nast

-

Cookpad Inc.

-

Discovery Inc.

-

Dotdash Meredith

-

Forks over Knives LLC

-

Glo Bakery Corp.

-

Green Kitchen Stories

-

Gronda GmbH

- August 31, 2023: Samsung Electronics unveiled Samsung Food, a novel AI-driven food and recipe platform designed for personalized culinary experiences.

Chapter 1. Meal Planning and Recipes Application Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Meal Planning and Recipes Application Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Meal Planning and Recipes Application Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Meal Planning and Recipes Application Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Meal Planning and Recipes Application Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Meal Planning and Recipes Application Market – By Product

6.1 Introduction/Key Findings

6.2 Free Users

6.3 Paid Users/Customers

6.4 Y-O-Y Growth trend Analysis By Product

6.5 Absolute $ Opportunity Analysis By Product, 2024-2030

Chapter 7. Meal Planning and Recipes Application Market – By Application

7.1 Introduction/Key Findings

7.2 IOS

7.3 Android

7.4 Y-O-Y Growth trend Analysis By Application

7.5 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Meal Planning and Recipes Application Market – By Device

8.1 Introduction/Key Findings

8.2 Tablet

8.3 PC

8.4 Smartphone

8.5 Y-O-Y Growth trend Analysis By Device

8.6 Absolute $ Opportunity Analysis By Device, 2024-2030

Chapter 9. Meal Planning and Recipes Application Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product

9.1.3 By Application

9.1.4 By Device

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product

9.2.3 By Application

9.2.4 By Device

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product

9.3.3 By Application

9.3.4 By Device

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product

9.4.3 By Application

9.4.4 By Device

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product

9.5.3 By Application

9.5.4 By Device

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Meal Planning and Recipes Application Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 AJNS New Media GmbH

10.2 BuzzFeed Inc.

10.3 Conde Nast

10.4 Cookpad Inc.

10.5 Discovery Inc.

10.6 Dotdash Meredith

10.7 Forks over Knives LLC

10.8 Glo Bakery Corp.

10.9 Green Kitchen Stories

10.10 Gronda GmbH

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

In 2023, the Global Meal Planning and Recipes Application Market was valued at $496.77 million, and is projected to reach a market size of $1186.19 million by 2030. Over the forecast period of 2024-2030, market is projected to grow at a CAGR of 13.24%.

The market is driven by factors such as the increasing adoption of a faster lifestyle, a focus on healthy eating, and technological innovations enhancing user engagement. Subscription-based models, technological advancements, and the rising demand for personalized nutrition recommendations are key drivers.

Free users significantly boost company revenue by offering increased visibility, leading to a broader audience and heightened app popularity. According to App Annie's data, 91 out of the top 100 apps are accessible for free download.

Smartphones lead in popularity among device segments, with the largest market share and fastest growth. Regionally, North America holds the largest share (33%), and it is also the fastest-growing market.

The introduction of COVID-19 vaccines played a crucial role in mitigating the pandemic's impact, leading to a decline in cases and the gradual normalization of the situation. This resulted in the resumption of commercial establishments, fostering increased adoption of recipe apps. Rising internet penetration and sustained demand for mobile devices further supported market recovery in 2021.