MEA Popcorn Market Size (2025-2030)

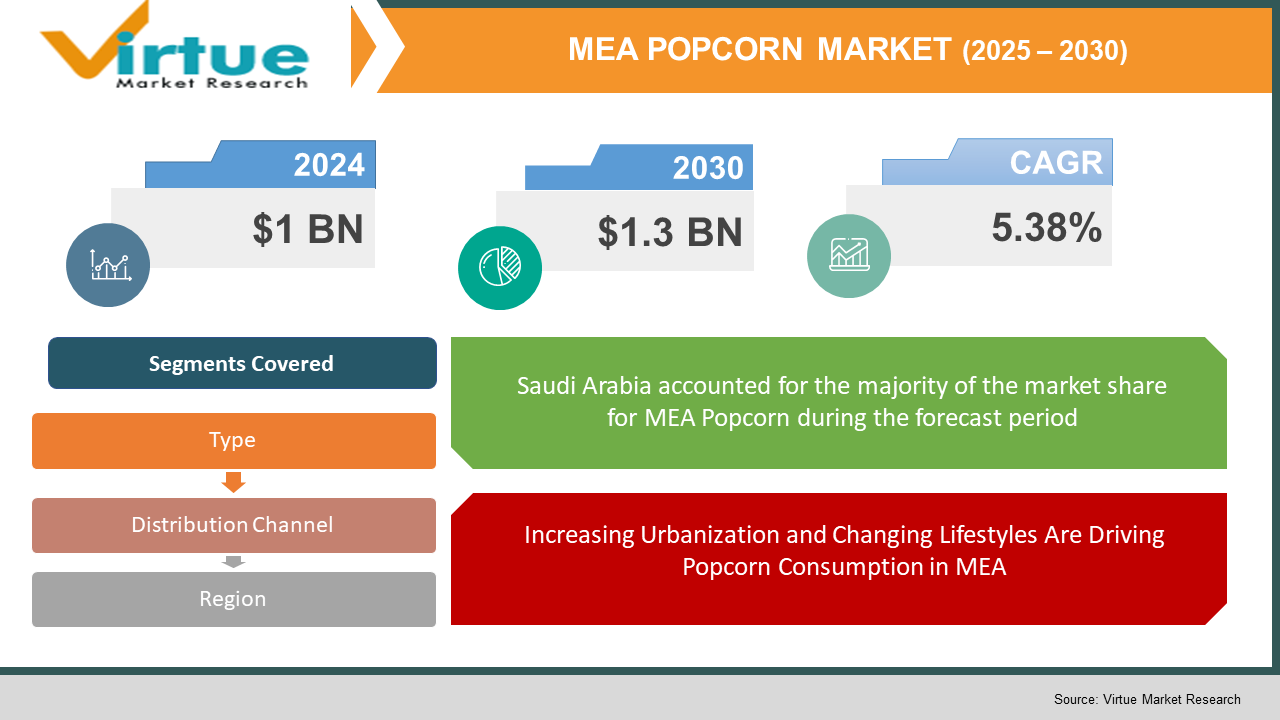

The MEA Popcorn Market was valued at USD 1 billion in 2024 and is projected to reach a market size of USD 1.3 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 5.38%.

The Middle East & Africa (MEA) popcorn market is witnessing steady growth, driven by shifting consumer preferences, urbanization, and the increasing demand for convenient and ready-to-eat snacks. As more people in the region adopt Western snacking habits, popcorn has emerged as a popular choice due to its versatility, affordability, and perceived health benefits compared to other processed snacks. The market is benefiting from the rising number of movie theaters, home entertainment culture, and growing disposable incomes, which have contributed to the increasing consumption of both traditional and flavored popcorn varieties. Furthermore, manufacturers are introducing innovative flavors and healthier options, such as organic and low-fat popcorn, to cater to evolving consumer demands. The expanding retail sector, including supermarkets, hypermarkets, and e-commerce platforms, has also made popcorn more accessible across urban and rural markets. With the rise in health-conscious consumers and the expansion of distribution channels, the MEA popcorn market is poised for sustained growth in the coming years.

Key Market Insights:

- The MEA popcorn market is experiencing notable growth, driven by a rising demand for convenient and healthy snacking options. Studies indicate that the consumption of ready-to-eat (RTE) popcorn in the region has surged by over 30% in the last five years, reflecting a shift in consumer preferences toward on-the-go snacks. Countries such as the UAE and Saudi Arabia are at the forefront of this growth, accounting for a significant share of the regional demand due to the proliferation of cinemas, entertainment hubs, and a growing inclination toward Western snacking habits.

- Flavored popcorn is rapidly gaining traction, with caramel and cheese flavors leading the market. Research suggests that flavored popcorn accounts for nearly 40% of total popcorn sales in the region, as brands introduce innovative variants to attract consumers. Additionally, health-conscious consumers are driving the demand for organic, gluten-free, and low-calorie popcorn, contributing to an estimated 25% annual growth in the healthier snack segment. This trend is being further accelerated by growing awareness about the benefits of air-popped and non-GMO popcorn.

- The retail landscape is also playing a crucial role in shaping the MEA popcorn market. Supermarkets and hypermarkets remain the primary distribution channels, with nearly 60% of total sales coming from these outlets. However, e-commerce platforms are witnessing exponential growth, with online popcorn sales increasing by approximately 50% in recent years. This surge is fueled by the convenience of home delivery, exclusive online discounts, and the growing adoption of digital payment methods.

MEA Popcorn Market Drivers:

Increasing Urbanization and Changing Lifestyles Are Driving Popcorn Consumption in MEA

As urbanization accelerates across the Middle East and Africa (MEA), more consumers are adopting fast-paced lifestyles that favor convenient, ready-to-eat snack options. Popcorn, being a light and easily accessible snack, is gaining significant popularity among working professionals and young consumers looking for healthier and quick snacking alternatives. The growing influence of Western food trends and the rise of organized retail channels have further contributed to rising popcorn consumption, especially in metropolitan areas.

Expanding Cinema and Entertainment Industry Fuels Popcorn Sales Across the Region

The rapid expansion of cinemas, entertainment hubs, and multiplexes in countries such as the UAE, Saudi Arabia, and South Africa has led to a surge in popcorn consumption. As moviegoers consider popcorn an essential part of their experience, the increasing number of theaters and film screenings has significantly driven demand. Additionally, partnerships between popcorn brands and cinema chains, along with premium flavored offerings, have helped increase sales and create new revenue opportunities within the market.

Health-Conscious Consumers Are Driving Demand for Better-for-You Popcorn Options

With a rising awareness of health and wellness, consumers in MEA are seeking popcorn products that align with their dietary preferences. Low-calorie, air-popped, and organic popcorn variants are gaining traction, particularly among fitness enthusiasts and health-conscious individuals. Brands are responding to this shift by introducing non-GMO, gluten-free, and reduced-sodium popcorn options to cater to this expanding consumer base. The demand for such healthier snacking alternatives is further supported by government initiatives promoting better dietary habits across the region.

E-Commerce and Online Retailing Are Transforming Popcorn Distribution in MEA

The rise of e-commerce and digital grocery platforms is making popcorn more accessible to consumers across MEA. With the convenience of home delivery and an expanding range of popcorn flavors available online, more consumers are opting to purchase their favorite snack through digital platforms. Leading popcorn brands and startups are capitalizing on this trend by leveraging digital marketing, subscription-based popcorn services, and exclusive online flavors to capture a larger market share.

MEA Popcorn Market Restraints and Challenges:

Limited Distribution Networks and High Import Dependence Restrict Market Growth

The MEA popcorn market faces challenges because of underdeveloped distribution networks in several regions, particularly in rural and less urbanized areas. Many countries in the region rely heavily on imported popcorn kernels, leading to higher costs due to fluctuating import tariffs, supply chain disruptions, and currency exchange fluctuations. Additionally, limited consumer awareness about premium and healthier popcorn alternatives, along with competition from traditional local snacks, poses a barrier to market expansion. The lack of advanced production facilities and inconsistent supply chains further hinder the smooth growth of the industry across the region.

MEA Popcorn Market Opportunities:

The MEA popcorn market presents significant opportunities fueled by the increasing consumer preference for healthier snack options. With a growing awareness of the benefits of whole-grain, fiber-rich, and low-calorie snacks, popcorn is gaining traction as a better alternative to fried and processed snacks. Additionally, the expansion of modern retail channels, including supermarkets, hypermarkets, and e-commerce platforms, is making popcorn more accessible to a wider audience. The rise of flavored and gourmet popcorn varieties, tailored to local taste preferences, further enhances market potential. Moreover, the increasing penetration of international popcorn brands and local production initiatives are expected to create new avenues for growth in the region.

MEA POPCORN MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

5.38% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

American Popcorn Company, ConAgra Brands, Inc., The Hershey Company, and PepsiCo, Inc. |

MEA Popcorn Market Segmentation:

MEA Popcorn Market Segmentation: By Type:

- Microwave

- Ready-to-Eat

The Ready-to-Eat (RTE) Popcorn segment holds the dominant position in the MEA popcorn market, driven by growing consumer demand for convenience, busy urban lifestyles, and the increasing trend of on-the-go snacking. The expansion of cinema culture, growing preference for premium and gourmet flavors, and the availability of healthier options such as organic, low-calorie, and air-popped varieties have significantly contributed to the widespread adoption of RTE popcorn. Additionally, leading brands are continuously innovating by introducing unique flavors, better packaging, and improved shelf life, making this segment a favorite among consumers across various age groups.

The Microwave Popcorn segment is witnessing the fastest growth in the MEA region, as consumers seek easy-to-make, fresh, and customizable snacking options at home. With the rising influence of Western eating habits, greater awareness of portion-controlled snacking, and improved access to modern kitchen appliances, microwave popcorn has become a preferred choice for individuals and families alike. The introduction of diverse seasoning options, healthier ingredient formulations, and eco-friendly packaging has further fueled the rapid expansion of this segment. Additionally, the affordability and availability of microwave popcorn in supermarkets and online platforms have boosted its popularity, making it an essential part of home entertainment and casual snacking trends.

MEA Popcorn Market Segmentation: By Distribution Channel:

- B2B

- B2C

- Supermarkets

- Convenience Store

- Online

- Others

The B2C (Business-to-Consumer) segment dominates the MEA popcorn market as consumers increasingly purchase popcorn for personal consumption, fueled by the rising demand for convenient, ready-to-eat snacks. The growing trend of home movie nights, increased disposable income, and the influence of Western snacking habits have fueled this segment's growth. Supermarkets and convenience stores serve as the primary retail points for popcorn purchases, with attractive promotions, bulk-buying options, and a wide range of flavors and packaging sizes catering to different consumer preferences.

The Online distribution channel is the fastest-growing segment in the MEA popcorn market, as e-commerce platforms gain popularity due to their convenience, discounts, and doorstep delivery. With growing internet penetration, digital transformation, and a shift toward online grocery shopping, consumers are opting for online platforms to explore a broader variety of popcorn products, including premium, organic, and international brands. Subscription-based snack boxes and direct-to-consumer (D2C) models are also gaining traction, providing personalized offerings and specialty flavors to popcorn lovers across the region.

MEA Popcorn Market Segmentation: Regional Analysis:

- United Arab Emirates

- Saudi Arabia

- Qatar

- Israel

- South Africa

- Nigeria

- Kenya

- Egypt

- Rest of MEA

Saudi Arabia stands out as the dominant region in the MEA popcorn market, benefiting from a well-established retail sector, a high number of cinema-goers, and increasing disposable income among consumers. Popcorn has become an integral part of the snacking culture, especially in entertainment venues such as movie theaters, shopping malls, and amusement parks. The need for premium and gourmet popcorn is rising, driven by evolving consumer preferences and a growing inclination toward flavored and healthier snacking options. Additionally, strong investments in the food and beverage industry, along with an expanding network of supermarkets and convenience stores, are further solidifying Saudi Arabia's position as the leading market in the region.

On the other hand, South Africa is experiencing the fastest growth in the MEA popcorn market, driven by changing consumer lifestyles, increasing urbanization, and a rising demand for convenient, ready-to-eat snacks. The snacking culture is evolving rapidly, with a significant shift toward healthier and innovative food products, including organic and gluten-free popcorn variants. The expansion of e-commerce platforms has further accelerated the accessibility of popcorn products, making them available to a broader consumer base. Additionally, the growing influence of Western food trends and increasing penetration of international brands in the region are contributing to the market's rapid expansion. The rising preference for unique and exotic flavors, along with a heightened awareness of nutritious snacking alternatives, is expected to keep South Africa at the forefront of market growth in the coming years.

COVID-19 Impact Analysis on the MEA Popcorn Market:

The COVID-19 pandemic had a significant impact on the MEA popcorn market, particularly due to the closure of cinemas, entertainment venues, and public gathering spaces, which are major sales channels for popcorn. With strict lockdowns and movement restrictions in place, demand for theater-style popcorn declined sharply, leading to reduced sales for suppliers and distributors reliant on bulk purchases from the hospitality and entertainment sectors. Additionally, disruptions in the supply chain, labor shortages, and logistical challenges further slowed down production and distribution, causing temporary setbacks in the market.

However, the pandemic also created new opportunities for ready-to-eat (RTE) popcorn and microwaveable popcorn, as home consumption surged during lockdowns. With consumers spending more time at home, demand for packaged snacks, including popcorn, saw a substantial rise, particularly through e-commerce and online grocery platforms. Health-conscious consumers also drove interest in organic, low-calorie, and gluten-free popcorn variants, pushing manufacturers to introduce innovative flavors and healthier alternatives. As restrictions eased and cinemas reopened, the market gradually rebounded, supported by hybrid consumer habits—where both in-home and out-of-home popcorn consumption continue to thrive.

Latest Trends/ Developments:

The MEA popcorn market is witnessing a shift toward premium and gourmet flavors, with consumers seeking unique taste experiences beyond traditional butter and salted popcorn. Flavors such as cheese, caramel, spicy chili, and exotic Middle Eastern-inspired blends like za'atar and saffron are gaining popularity. This shift is largely driven by younger consumers who are more experimental with their snack choices. Additionally, health-conscious trends have led to the rise of organic, gluten-free, and non-GMO popcorn, as well as popcorn made with healthier oils like olive and coconut oil. Brands are increasingly promoting air-popped variants with reduced sodium and artificial additives to cater to the growing demand for guilt-free snacking options.

E-commerce and direct-to-consumer (DTC) channels are also playing a important role in market expansion, with more popcorn brands leveraging online platforms to reach customers directly. Subscription-based models and customizable popcorn gift boxes are becoming a trend, allowing brands to engage with consumers in a more personalized manner. Moreover, the integration of smart packaging technologies, such as QR codes for nutritional information and interactive brand experiences, is enhancing consumer engagement. As digital retail and on-the-go consumption continue to grow, the MEA popcorn market is set to see increased investment in innovative product launches, sustainable packaging solutions, and targeted marketing strategies to attract a wider audience.

Key Players:

- American Popcorn Company

- ConAgra Brands, Inc.

- The Hershey Company

- PepsiCo, Inc.

- Weaver Popcorn Company, Inc.

- Opopop

- Popcornopolis

- Lancewood Holdings

- Cobs Popcorn

- Amazon Foods

- Al Rifai Roastery

- Yum Yum Popcorn

- Gourmet Popcorn Company

- Magic Corn

- Kernels Popcorn

Chapter 1. MEA POPCORN MARKET – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. MEA POPCORN MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. MEA POPCORN MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. MEA POPCORN MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. MEA POPCORN MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. MEA POPCORN MARKET – By Type

6.1 Introduction/Key Findings

6.2 Microwave

6.3 Ready-to-Eat

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type , 2025-2030

Chapter 7. MEA POPCORN MARKET – By Distribution Channel

7.1 Introduction/Key Findings

7.2 B2B

7.3 B2C

7.4 Supermarkets

7.5 Convenience Store

7.6 Online

7.7 Others

7.8 Y-O-Y Growth trend Analysis By Distribution Channel

7.9 Absolute $ Opportunity Analysis By Distribution Channel , 2025-2030

Chapter 8. MEA POPCORN MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Type

8.5.3. By Distribution Channel

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. MEA POPCORN MARKET – Company Profiles – (Overview, Packaging Type, Portfolio, Financials, Strategies & Developments)

9.1 American Popcorn Company

9.2 ConAgra Brands, Inc.

9.3 The Hershey Company

9.4 PepsiCo, Inc.

9.5 Weaver Popcorn Company, Inc.

9.6 Opopop

9.7 Popcornopolis

9.8 Lancewood Holdings

9.9 Cobs Popcorn

9.10 Amazon Foods

9.11 Al Rifai Roastery

9.12 Yum Yum Popcorn

9.13 Gourmet Popcorn Company

9.14 Magic Corn

9.15 Kernels Popcorn

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The MEA Popcorn Market was valued at USD 1 billion in 2024 and is projected to reach a market size of USD 1.3 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 5.38%.

Rising urbanization, increasing disposable income, and growing demand for ready-to-eat snacks

Based on Type, the MEA Popcorn Market is segmented into Microwave and Ready-to-Eat.

Saudi Arabia is the most dominant region for the MEA Popcorn Market.

American Popcorn Company, ConAgra Brands, Inc., The Hershey Company, and PepsiCo, Inc. are the leading players in the MEA Popcorn Market.