Material Testing Market Size (2024 – 2030)

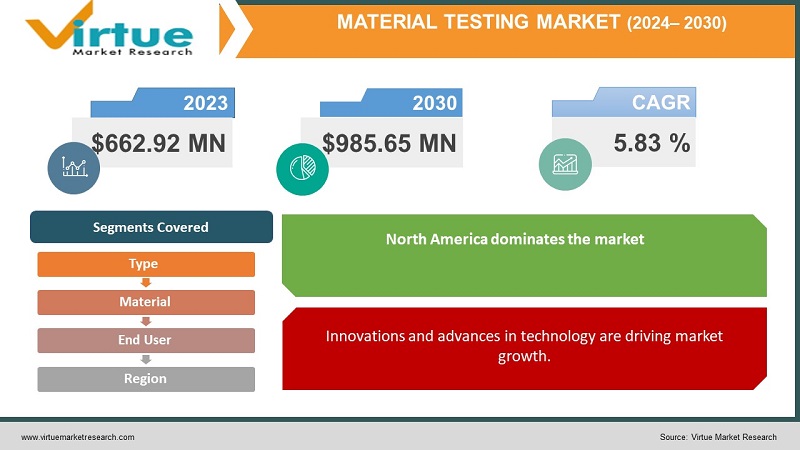

The Global Material Testing Market was valued at USD 662.92 million and is projected to reach a market size of USD 985.65 million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.83 %.

Testing materials is a process that involves evaluating and analyzing the mechanical and chemical properties of different substances. It provides insights, into the quality, durability, and performance of materials helping in the selection, development, and enhancement of materials for applications. This examination includes studying chemical composition, resistance to corrosion, reactivity, and other chemical characteristics. It plays a role in developing materials and improving existing ones leading to technological advancements across different industries. Moreover, it ensures that materials used in implants, prosthetics, and medical instruments are both compatible, with the body, and long-lasting.

The growth of industries worldwide is driving the demand, for material testing methods. Moreover, the increasing sales of vehicles (EVs) are creating a need for materials that have improved conductivity effective thermal management, and lightweight properties. Material testing plays a role in assessing the suitability of materials used in EV components like batteries and charging infrastructure. Additionally, as industries transform they are integrating twins and simulation models. Material testing data contributes to these models enabling testing and analysis reducing time to market and improving efficiency. Furthermore, the renewable energy sector heavily relies on efficient materials, for panels, wind turbines, and energy storage systems – further fueling market growth.

Key Market Insights:

According to a report, from the International Organization of Motor Vehicles Manufacturers, the global production of cars and commercial vehicles reached 91.53 million in 2018. This growth, in the industry is directly linked to advancements in the material testing market.

The defense, construction, automotive, and aerospace industries are being influenced by the expansion of economies rising populations, and changing lifestyles. As a result, the material testing market, in the APAC region is experiencing growth accounting for 25% of the market share in 2018.

The market growth is being driven by projects undertaken by institutions in collaboration, with industries and other institutions to develop new products. It is expected that the market will experience a 5% compound growth rate (CAGR) until 2025.

Material Testing Market Drivers:

Innovations and advances in technology are driving market growth.

The market is experiencing growth due, to the progress in technology. Incorporating state-of-the-art technologies like intelligence, machine learning, and automation has led to testing processes that are more efficient and accurate. Automated testing equipment can conduct a range of tests with results reducing human errors and increasing the reliability of outcomes. Additionally, the introduction of testing techniques, like destructive testing (NDT) methods has expanded material analysis capabilities. Destructive testing (NDT) methods such, as ultrasound, radiography, and thermal imaging provide a thorough assessment of materials without causing any harm.

Sustainability and ecological issues are driving the need for material testing to augment market growth.

There is a growing concern regarding the need, for sustainability, which has led industries to focus on developing materials that are both eco-friendly and have a minimal impact on the environment. To evaluate the sustainability of these materials material testing plays a role by examining factors like recyclability, energy efficiency, and carbon footprint. Additionally, there is an increasing preference among individuals, governments, and organizations for products that align with practices and are environmentally friendly. This preference has further fueled the demand for materials, with improved profiles. Material testing helps in identifying those materials that meet these criteria. By assessing the recyclability of packaging materials or the energy efficiency of construction materials, material testing contributes significantly to the development of sustainable products.

Personalization for a range of uses across industry verticals is leading to market expansion.

The industry’s expansion and the increasing demand, for solutions such as lightweight and durable materials to improve fuel efficiency while maintaining safety are driving market growth. Material testing plays a role in identifying the composition and characteristics needed to achieve desired outcomes. Additionally, industries are focusing on enhancing material performance to ensure reliability and durability. By conducting material testing manufacturers can evaluate how different formulations and processing methods affect customization and performance. This empowers them to make decisions about material compositions and processing techniques to strike the balance, between customization and performance.

Material Testing Market Restraints and Challenges:

As cloud computing, big data analysis, and the Internet of Things (IoT) continue to emerge as technologies many industries are embracing their deployment. To keep up with this evolving landscape material testing software needs to adapt and integrate seamlessly with enterprise-level software solutions. This includes real-time data sharing to enhance efficiency and decision-making processes. By ensuring that the results are shared to guarantee product quality and provide feedback, manufacturers' strategies can be improved, ultimately determining the success of products.

Material Testing Market Opportunities:

The rapid growth of industries, in emerging markets is driving up the need for material testing equipment and services. This is primarily because these markets are experiencing the development of industries, a rising class, and fast urbanization. To illustrate India's automotive industry expansion is spurring an increased demand for material testing equipment and services to ensure the quality of components. Similarly, China's thriving construction sector is also generating a demand for material testing equipment and services to guarantee the quality of construction materials. Additionally Brazil's expanding oil and gas industry necessitates material testing equipment and services to ensure the safety and reliability of pipelines and other infrastructure. The growing demand for equipment and services in emerging markets presents opportunities, for companies operating in this sector.

MATERIAL TESTING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.83% |

|

Segments Covered |

By Type, Material, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Ametek Inc., Applied Test Systems LLC, Illinois Tool Works Inc., Labquip, Mistras Group Inc., Mitutoyo Corporation, MTS Systems Corporation, Shimadzu Corporation, Tinius Olsen Ltd., Wirsam Scientific |

Material Testing Market Segmentation: By Type

-

Universal Testing Machines

-

Servohydraulic Testing Machines

-

Hardness Testing Machines

-

Impact Testing Machines

-

Non-Destructive Testing Machines

In 2022, based on the type, the Universal Testing Machines segment accounted for the largest revenue share by almost 30% and has led the market. UTMs are machines that can test a wide array of materials, such, as metals, plastics, ceramics, and composites. These machines offer a multitude of testing options, including testing, compression testing, bending testing, and shear testing.

Non-Destructive testing (NDT) machines are experiencing rapid growth, in the material testing market. These machines are designed to test materials without causing any damage making them highly sought after in industries like aerospace, automotive, and oil and gas. NDT machines play a role in detecting defects such as cracks, voids, and corrosion, in materials.

Material Testing Market Segmentation: By Material

-

Metals and Alloys

-

Plastics

-

Rubber and Elastomers

-

Ceramics and Composites

-

Others

In 2022, based on the material, the Metals and Alloys segment accounted for the largest revenue share by almost 40% and has led the market. The reason, behind the use of metals and alloys in industries, such as automotive, aerospace, construction, and manufacturing is their wide range of applications.

Among all the materials tested in the market ceramics and composites are experiencing the fastest growth. This is primarily due to the increasing demand for ceramics and composites in industries like aerospace, automotive, and electronics. Ceramics and composites provide advantages over materials, like metals and plastics. These advantages include strength, lighter weight, and improved heat resistance.

Material Testing Market Segmentation: By End User

-

Automotive

-

Construction

-

Education

-

Aerospace and Defence

-

Oil and Gas

-

Energy and Power

-

Others

In 2022, based on the end-use industry, the Automotive segment accounted for the largest revenue share by almost 30% and has led the market. The automotive sector heavily depends on conducting material tests to guarantee the excellence and safety of its products. Material testing is applied to an array of automobile parts, such, as engines, chassis, and interiors.

The aerospace and defense sector is experiencing the fastest growth as an end-use industry segment, in the material testing market. This industry is consistently advancing with materials and technologies making material testing crucial for ensuring their safety and performance. Material testing plays a role in examining components within aerospace and defense such, as aircraft structures, rocket engines, and military vehicles.

Material Testing Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In 2022, the North American region dominated the global medical tourism market with a revenue of 35%. The reason, for this is that North America has material testing companies and there is a strong demand for their services from various industries in the region. On the other hand, the material testing market in the Asia Pacific is experiencing growth at the fastest rate because of the region's fast-paced industrialization and economic development. Moreover, there is an increasing need for materials and products in Asia Pacific, which has led to the emergence of large and expanding material testing companies, in that area.

COVID-19 Impact Analysis on the Global Material Testing Market:

The global economy has been greatly impacted by the COVID-19 pandemic causing disruptions, to the operations of companies worldwide. As a result, even the material testing market on a scale has suffered. The market's growth has been hindered by challenges in supply chain management and transportation of goods and services. The implementation of lockdowns and curfews enforced by governments around the world disrupted testing units leading to losses and wastage of material testing machines. Additionally, consumer demand and behavior changed during this time as people refrained from purchasing essential products due to the uncertain and unexpected circumstances brought about by the pandemic. These factors had an impact on slowing down the growth of the market. However, there have been improvements in the pandemic scenario resulting in a recovery, for the material testing market, which is now predicted to experience high growth rates.

Latest Trends/ Developments:

The market is experiencing an outlook due, to industrialization and substantial growth in the construction sector. To ensure the quality of products mechanical properties of materials are tested. For example, construction materials like adhesive sealants, concrete, mortar, ceramics, slates, stones, and pipes undergo testing to verify if they possess the desired properties. Additionally, the market is benefiting from the manufacturing of composites across industries. Technological advancements such as testing equipment with stage capabilities and picture video capture features are also contributing to market growth. Furthermore, the sector's increasing adoption of these products, for testing material integrity surface morphology evaluation and adhesive capacities is driving market expansion alongside extensive research and development activities.

Key Players:

-

Ametek Inc.

-

Applied Test Systems LLC

-

Illinois Tool Works Inc.

-

Labquip

-

Mistras Group Inc.

-

Mitutoyo Corporation

-

MTS Systems Corporation

-

Shimadzu Corporation

-

Tinius Olsen Ltd.

-

Wirsam Scientific

-

In December of 2022 Ametek India, a company, under Ametek Inc. revealed the opening of a cutting-edge facility located in Bengaluru. This facility aims to offer improved assistance to customers both, in India and globally.

-

In July of 2023, Shimadzu Corporation unveiled the Xslicer SMX 6010 microfocus X-ray inspection system. This advanced system facilitates CT imaging for 3D observation specifically designed to assist in failure analysis, within the electronics industries.

Chapter 1. Material Testing Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Material Testing Market – Executive Summary

2.1 Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Material Testing Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Material Testing Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Material Testing Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Material Testing Market – By Type

6.1 Introduction/Key Findings

6.2 Universal Testing Machines

6.3 Servohydraulic Testing Machines

6.4 Hardness Testing Machines

6.5 Impact Testing Machines

6.6 Non-Destructive Testing Machines

6.7 Y-O-Y Growth trend Analysis By Type

6.8 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Material Testing Market – By Material

7.1 Introduction/Key Findings

7.2 Metals and Alloys

7.3 Plastics

7.4 Rubber and Elastomers

7.5 Ceramics and Composites

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Material

7.8 Absolute $ Opportunity Analysis By Material, 2024-2030

Chapter 8. Material Testing Market – By End-User

8.1 Introduction/Key Findings

8.2 Automotive

8.3 Construction

8.4 Education

8.5 Aerospace and Defence

8.6 Oil and Gas

8.7 Energy and Power

8.8 Others

8.9 Y-O-Y Growth trend Analysis By End-User

8.10 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 9. Material Testing Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type

9.1.3 By End-User

9.1.4 By MaterialFactor

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type

9.2.3 By End-User

9.2.4 By MaterialFactor

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type

9.3.3 By End-User

9.3.4 By MaterialFactor

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type

9.4.3 By End-User

9.4.4 By MaterialFactor

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type

9.5.3 By End-User

9.5.4 By MaterialFactor

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Material Testing Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Ametek Inc.

10.2 Applied Test Systems LLC

10.3 Illinois Tool Works Inc.

10.4 Labquip

10.5 Mistras Group Inc.

10.6 Mitutoyo Corporation

10.7 MTS Systems Corporation

10.8 Shimadzu Corporation

10.9 Tinius Olsen Ltd.

10.10 Wirsam Scientific

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Material Testing Market was valued at USD 662.92 million and is projected to reach a market size of USD 985.65 million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.83 %.

Innovations and advances in technology, Sustainability, ecological issues, and Personalization for a range of uses.

Based on Material, the Global Material Testing Market is segmented by Metals and Alloys, Plastics, Rubber and Elastomers, Ceramics and Composites, and Others.

North America is the most dominant region for the Global Material Testing Market.

Ametek Inc., Applied Test Systems LLC, Illinois Tool Works Inc., Labquip, Mistras Group Inc., and Mitutoyo Corporation are the key players operating in the Global Material Testing Market.