Matcha Market Size (2024-2030)

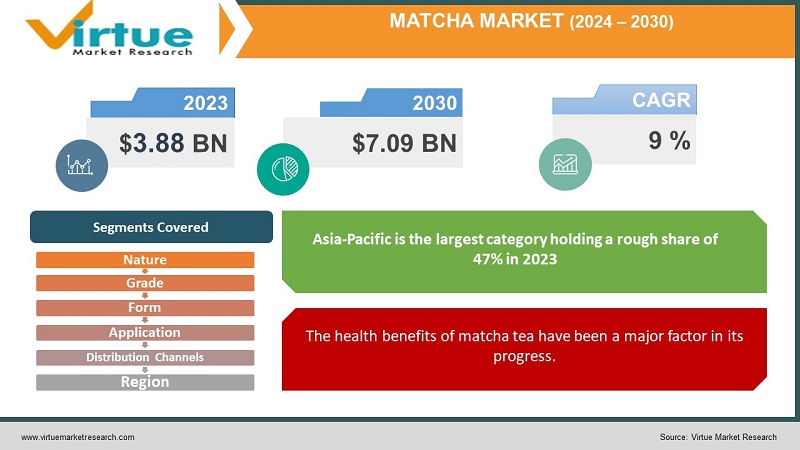

The global matcha market was valued at USD 3.88 billion and is projected to reach a market size of USD 7.09 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 9%.

Matcha, a kind of green tea, is made by finely powdering young tea leaves. Matcha, a Japanese green tea powder, is made from the leaves of the Camellia sinensis plant. Matcha is prepared by processing the stems and veins of green tea plants that have been cultivated in the shade for three to four weeks before harvest. This market has had a limited presence in the past since production was mainly limited to Asian countries. Presently, with economic growth and global operations, this market has seen notable progress. In the future, with a growing focus on market penetration, increasing awareness, and quality, this market will see good growth.

Key Market Insights:

Three nations that will account for almost 90% of the matcha industry by 2023 are India, China, and Japan.

The US matcha market's size is $88.7 million.

Japan's matcha market is the second biggest in the world, valued at $897.1 million.

The Chinese matcha industry is worth over $1.2 billion.

6.21 percent of eateries have matcha on their menus. As such, to increase this percentage, organizations in the market have been focusing on their expansion by spreading awareness and concentrating on product innovations.

Matcha Market Drivers:

The health benefits of matcha tea have been a major factor in its progress.

Matcha is high in a class of plant compounds called catechins, which are naturally occurring antioxidants found in tea. Free radicals, which are substances that can harm cells and cause chronic sickness, are stabilized in part by antioxidants. Secondly, it is well-recognized that this tea improves brain function. Matcha has been shown to improve response time, memory, and attention. There's also caffeine and L-theanine, which are compounds that can improve several aspects of brain function. Thirdly, studies conducted on animals have shown that the elements in matcha may stop cancer cells from spreading. Moreover, some research suggests that matcha may help shield the liver from toxins and reduce the risk of liver disease. More research is needed to draw firm conclusions on this particular use. Aside from this, the nutritional composition of this tea is recognized to enhance heart health with frequent drinking. Additionally, because this tea has a high content of ECEG, an antioxidant that promotes metabolism and fat burning, it may aid in healthy weight reduction.

Diverse applications have been promoting its usage thereby helping in market expansion.

The culinary industry has been working on product innovations for a broader consumer base. Over the years, there have been many changes in the standard of living. A greater percentage of people prefer to experiment with their food. To fit with this trend, many creative activities are continuously done in food and beverages. Matcha is currently used to provide color and flavor to foods like matcha lattes, green tea ice cream, mochi, soba noodles, and wagashi, a type of Japanese delicacy. Secondly, tea is a popular beverage in many countries. Hence, companies in the market have been launching different flavors with spices for a better taste. Apart from this, important players in the industry have been expanding their operations worldwide for more sales. Moreover, matcha contains methylxanthines, which promote balanced, clean skin and improve blood circulation. It deeply nourishes the skin and helps to prevent wrinkles, acne, and breakouts. Owing to these benefits, the skincare product business has been using this component in a variety of lotions, moisturizers, and balms.

Matcha Market Restraints and Challenges:

Consumer awareness and price volatility are the main issues that the market is currently facing.

One of the biggest barriers to the market is limited knowledge. Therefore, the manufacturing and production capacities can be confined only to those countries where this has cultural significance. Besides, very few food outlets are known to offer this ingredient on their menus. Secondly, associated costs can be a hindrance. Growing and harvesting require advanced technologies and agricultural practices. Additionally, skilled expertise might not be available to carry out the end-to-end operations.

Matcha Market Opportunities:

E-commerce has been a boon for the market, providing many possibilities. By enlarging this channel, companies in this sector can reach more customers globally. Apart from this, the tourism sector has been creating awareness by hosting events as a part of their travel package where education is given about the health benefits, brewing techniques, types, and applications to create a better understanding.

MATCHA MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

9% |

|

Segments Covered |

By Nature, grade, form, application, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Marukyu-Koyamaen, Ippodo Tea Co., Tsuji Rihei Honten, Gion Tsujiri, Giontsujiri, Honten, Aiya, Encha, MatchaBar, ITO EN, DAVIDsTEA |

Matcha Market Segmentation:

Matcha Market Segmentation: By Nature:

- Organic

- Conventional

Based on nature, the conventional category is the largest in the market owing to its higher production over a shorter duration. With the aid of various chemicals and pesticides, the crops are modified for a greater yield. Besides, a lot of farmers are involved in these practices, contributing to better revenue. However, the organic segment is the fastest-growing type because of the increasing emphasis on our environment. Organic crops are known to have a better nutritional profile and reduce the risk of chronic illnesses. With the various initiatives that are being taken by governmental bodies through schemes and investments, this segment has seen a drastic rise. Furthermore, the rising demand for this produce due to awareness has created a need for more cultivation.

Matcha Market Segmentation: By Grade:

- Classic

- Ceremonial

- Culinary

The classic part is the largest based on grade. The proportion in this category is more than 56% in 2023. Classic-grade matcha is made from leaves that are collected early. Its strong flavor makes it ideal for adding to foods and drinks. Another popular application for the classic grade is smoothie-making. Additionally, this is a well-liked option because it comes in a variety of flavors. The category with the fastest growth is culinary grade. Culinary matcha is the most often used matcha tea grade for baking and cooking because of its delightful flavor, which goes well with both savory and sweet meals. This matcha's enhanced flavor profile makes it especially suitable for mixing with other commonplace products. Numerous recipes, such as cakes, puddings, and lattes, can be made using it.

Matcha Market Segmentation: By Form:

- Powder

- Liquid

The powdered form is the most dominant form. This is because of the fame of matcha tea. The main use of matcha is as a tea, which is usually consumed twice a day in many households. Hence, most of the companies in this industry are involved in the production of this segment due to greater profits. The liquid category is anticipated to be the fastest-growing owing to many innovations in the culinary industry. They are used in various beverages, food items, snacks, and other eateries to impart a unique taste.

Matcha Market Segmentation: By Application:

- Regular Tea

- Food

- Personal Care

- Matcha Beverages

Based on application, the regular tea segment has the largest share, with a share of more than 56% in 2023. This is because of its nutritional properties. Consumer preferences have been changing. Most of them have been looking for healthy choices for good health. Besides, this tea has been consumed for many decades in South and East Asian countries, thereby holding historical importance. As such, the demand for this tea also has a constant upsurge. The food category is the fastest-growing owing to the increasing number of food outlets. Chefs in the industry are experimenting regularly to gather more customers. The use of match is being explored in numerous desserts, chocolates, and smoothies. Smoothies are one such choice that has gained immense recognition over the last few years. Matcha is used as a main ingredient in many varieties. Additionally, they are used as flavoring and topping agents.

Matcha Market Segmentation: By Distribution Channels:

- Supermarkets and Hypermarkets

- Specialty Stores

- Convenience Stores

- Online Retail

Supermarkets and hypermarkets are the largest category of distribution channels. This is due to its easy accessibility and availability. Because there are more of these establishments in neighborhoods, customers may be able to get the essential beverages more easily. This allows the consumer and the store owner to communicate directly and allows for a visual inspection of the items to confirm contents, expiration dates, and other essential information. Furthermore, people who have no access to or are unaware of using the internet choose to buy their products in person. Online retail is the distribution channel in this market that is growing at the fastest rate. The main reason for this is convenience. Food products are delivered to the clients' homes. People may also enjoy a greater variety of flavors, both domestic and foreign, with more ease. Additionally, discounts and free delivery are offered via online orders.

Matcha Market Segmentation: Regional Analysis:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

Based on region, Asia-Pacific is the largest category, holding a rough share of 47% in 2023. Countries like China and Japan are at the forefront. The success of this region is mainly because of its cultural and historical significance. Matcha has been used in households, especially as a popular tea beverage, for many years. As such, the demand is enormous. Secondly, most of the companies involved in this industry are present in these regions. Marukyu-Koyamaen, Tenfu Group, Tea Valley, Gion Tsujiri, and Ippodo Tea Co. are the prominent ones involved in bulk manufacturing and production. Furthermore, the weather conditions, like temperature and rainfall, are ideal in these regions, resulting in a higher yield. North America is the fastest-growing, with countries like the United States and Canada being the top ones. This region holds an approximate share of 25%. The primary reason for this is the expanding food and beverage industry. People are keen on exploring different cuisines. This can be used for various beverages and desserts and as toppings for a few food products. Besides, online retail has been helping the population access these products, thereby increasing the demand.

COVID-19 Impact Analysis on the Global Matcha Market:

The outbreak of the virus hurt the market. This created disruptions in the supply chain, transportation, and logistics. Import-export trade activities were affected by this. An economic downfall was observed in many countries. Most of the funding was shifted towards healthcare applications like vaccine development, hospital necessities like beds, ventilators, and oxygen tanks, and research work about the virus. All launches, collaborations, and investments were delayed or postponed. Besides, even though there was health consciousness, this was a lesser-known type of green tea. This caused losses to the market. Most of the companies and manufacturing units were closed temporarily to prevent contamination. Furthermore, many restaurants, hotels, and other food chains were closed due to the guidelines. As per a report by Food Circle, there was a 15% decrease during the pandemic in the food industry. Post-pandemic, the market has started to recover because of the uplift of rules and relaxation of regulations. Online retail helped with the recovery.

Latest Trends/ Developments:

The companies in this industry are motivated to increase their market share by utilizing a range of strategies, such as joint ventures, acquisitions, and investments. Businesses are also spending a lot of money to improve existing formulations while maintaining competitive rates. This has resulted in an even larger expansion.

Sustainability has been a top priority in this business. Ethical and local sourcing are being prioritized to accomplish this. Growing an organic crop of pesticide-free leaves is becoming more popular. Furthermore, many firms have been pursuing certifications from organizations to guarantee that environmental regulations are fulfilled. In addition, eco-friendly packaging methods have gained prominence since they minimize waste production and have minimal environmental impact.

Key Players:

- Marukyu-Koyamaen

- Ippodo Tea Co.

- Tsuji Rihei Honten

- Gion Tsujiri

- Giontsujiri Honten

- Aiya

- Encha

- MatchaBar

- ITO EN

- DAVIDsTEA

In July 2023, Butter & Me unveiled a plant-based matcha vanilla body cleanser. The products are all multifunctional and whole-body, making it simple to apply them for self-care from head to toe. The decadent chocolate body scrub removes dead skin cells and leaves a refreshing smell.

In June 2023, the Matcha Cloud Kitchen, Tokyo Matcha Bar, said that it would be offering its monsoon specialties, allowing customers to savor delectable hot beverages in the comfort of their own homes. Tokyo Matcha Bar's exceptional beverage selection makes it the perfect accompaniment for the monsoon season as it works to introduce Mumbai to the flavors and customs of Matcha.

In December 2022, MatchaKo introduced the first premium matcha drink that is non-GMO project-verified, vegan, and certified organic. Made with the best ingredients and ceremonial-grade matcha imported from Japan, this is a shelf-stable matcha drink that has fewer calories than other sweet beverages available on the market.

Chapter 1. Global Matcha Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Global Matcha Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Global Matcha Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Global Matcha Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Global Matcha Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Global Matcha Market– By Nature

6.1. Introduction/Key Findings

6.2. Organic

6.3. Conventional

6.4. Y-O-Y Growth trend Analysis By Nature

6.5. Absolute $ Opportunity Analysis By Nature , 2023-2030

Chapter 7. Global Matcha Market– By Form

7.1. Introduction/Key Findings

7.2. Powder

7.3. Liquid

7.4. Y-O-Y Growth trend Analysis By Form

7.5. Absolute $ Opportunity Analysis By Form , 2023-2030

Chapter 8. Global Matcha Market– By Application

8.1. Introduction/Key Findings

8.2. Regular Tea

8.3. Food

8.4. Personal Care

8.5. Matcha Beverages

8.6. Y-O-Y Growth trend Analysis Application

8.7. Absolute $ Opportunity Analysis Application , 2023-2030

Chapter 9. Global Matcha Market– By Distribution Channels

9.1. Introduction/Key Findings

9.2. Supermarkets and Hypermarkets

9.3. Specialty Stores

9.4. Convenience Stores

9.5. Online Retail

9.6. Y-O-Y Growth trend Analysis Distribution Channels

9.7. Absolute $ Opportunity Analysis Distribution Channels , 2023-2030

Chapter 10. Global Matcha Market– By Grade

10.1. Introduction/Key Findings

10.2. Classic

10.3. Ceremonial

10.4. Culinary

10.5. Y-O-Y Growth trend Analysis Grade

10.6. Absolute $ Opportunity Analysis Grade , 2023-2030

Chapter 11. Global Matcha Market, By Geography – Market Size, Forecast, Trends & Insights

11.1. North America

11.1.1. By Country

11.1.1.1. U.S.A.

11.1.1.2. Canada

11.1.1.3. Mexico

11.1.2. By Nature

11.1.3. By Form

11.1.4. By Distribution Channels

11.1.5. Application

11.1.6. Grade

11.1.7. Countries & Segments - Market Attractiveness Analysis

11.2. Europe

11.2.1. By Country

11.2.1.1. U.K.

11.2.1.2. Germany

11.2.1.3. France

11.2.1.4. Italy

11.2.1.5. Spain

11.2.1.6. Rest of Europe

11.2.2. By Nature

11.2.3. By Form

11.2.4. By Distribution Channels

11.2.5. Application

11.2.6. Grade

11.2.7. Countries & Segments - Market Attractiveness Analysis

11.3. Asia Pacific

11.3.2. By Country

11.3.2.2. China

11.3.2.2. Japan

11.3.2.3. South Korea

11.3.2.4. India

11.3.2.5. Australia & New Zealand

11.3.2.6. Rest of Asia-Pacific

11.3.2. By Nature

11.3.3. By Form

11.3.4. By Distribution Channels

11.3.5. Application

11.3.6. Grade

11.3.7. Countries & Segments - Market Attractiveness Analysis

11.4. South America

11.4.3. By Country

11.4.3.3. Brazil

11.4.3.2. Argentina

11.4.3.3. Colombia

11.4.3.4. Chile

11.4.3.5. Rest of South America

11.4.2. By Nature

11.4.3. By Form

11.4.4. By Distribution Channels

11.4.5. Application

11.4.6. Grade

11.4.7. Countries & Segments - Market Attractiveness Analysis

11.5. Middle East & Africa

11.5.4. By Country

11.5.4.4. United Arab Emirates (UAE)

11.5.4.2. Saudi Arabia

11.5.4.3. Qatar

11.5.4.4. Israel

11.5.4.5. South Africa

11.5.4.6. Nigeria

11.5.4.7. Kenya

11.5.4.11. Egypt

11.5.4.11. Rest of MEA

11.5.2. By Nature

11.5.3. By Form

11.5.4. By Distribution Channels

11.6.5. Application

11.5.6. Grade

11.5.7. Countries & Segments - Market Attractiveness Analysis

Chapter 12. Global Matcha Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

12.1 Marukyu-Koyamaen

12.2. Ippodo Tea Co.

12.3. Tsuji Rihei Honten

12.4. Gion Tsujiri

12.5. Giontsujiri Honten

12.6. Aiya

12.7. Encha

12.8. MatchaBar

12.9. ITO EN

12.10. DAVIDsTEA

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global matcha market was valued at USD 3.88 billion and is projected to reach a market size of USD 7.09 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 9%.

Health benefits and diverse applications are the main factors propelling the Global Matcha Market.

Based on Distribution Channels, the Global Matcha Market is segmented into Supermarkets and Hypermarkets, Specialty Stores, Convenience Stores, and Online Retail

Asia-Pacific is the most dominant region for the Global Matcha Market

Marukyu-Koyamaen, Ippodo Tea Co., and Tsuji Rihei Honten are the key players operating in the Global Matcha Market.