Master Data Management Market Size (2025-2030)

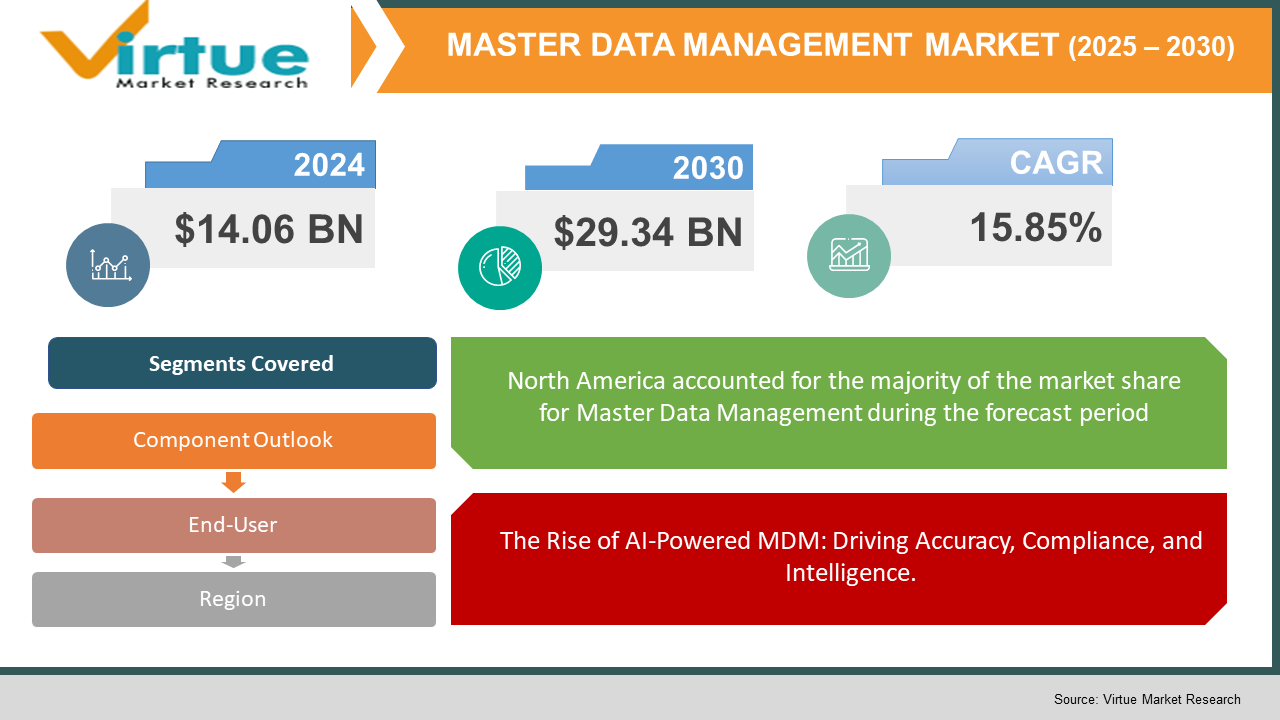

The Master Data Management Market was valued at USD 14.06 billion and is projected to reach a market size of USD 29.34 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 15.85%.

Through the ability to combine, clean, and synchronize vital data across several systems, Master Data Management (MDM) solutions are revolutionizing organizational data governance, compliance, and analytics. To guarantee data accuracy, consistency, and real-time accessibility, businesses are implementing cloud-based and AI-enhanced MDM platforms. The need for automated MDM solutions that improve decision-making, regulatory compliance, and customer data integration is being driven by the quick digitization of corporate operations in sectors like retail, healthcare, and BFSI. Businesses are increasingly depending on AI-powered data governance and cleansing solutions to cut down on duplication and maximize operational effectiveness.

Key Market Insights:

- A recent report by Forrester found that 78% of enterprises using MDM solutions experienced a significant improvement in data accuracy and decision-making, enabling seamless cross-departmental collaboration.

- According to a study by IDC, organizations that implemented AI-powered MDM solutions reduced data duplication by 35% and improved operational efficiency by 28%, streamlining business analytics and reporting.

- A Harvard Business Review study revealed that 80% of companies investing in cloud-based MDM systems reported faster data integration and compliance adherence, improving regulatory risk management and enterprise-wide transparency.

- Deloitte’s Data Analytics Report stated that enterprises leveraging automated data governance and AI-enhanced MDM solutions saw a 40% increase in process automation efficiency, optimising enterprise-wide data workflows.

Master Data Management Market Drivers:

The Rise of AI-Powered MDM: Driving Accuracy, Compliance, and Intelligence.

Enterprises are increasingly recognizing the importance of centralized and standardized data management to drive business intelligence, operational efficiency, and compliance. As organizations grow, they accumulate large volumes of structured and unstructured data from various sources, leading to inconsistencies, redundancies, and integration challenges. MDM solutions enable companies to establish a unified, single source of truth by consolidating customer, product, financial, and supplier data across multiple systems. This ensures data accuracy, eliminates duplication, and improves enterprise-wide reporting. Organizations that invest in AI-powered MDM platforms can automate data validation, governance, and integration, reducing manual errors and increasing workflow efficiency. Regulatory compliance is another key factor driving MDM adoption. With stricter global data privacy regulations, including GDPR, HIPAA, and CCPA, businesses must ensure accurate, consistent, and traceable data governance. By implementing multi-domain MDM solutions, enterprises can achieve better data control, improve decision-making, and enhance customer experience, while also ensuring seamless integration with analytics, CRM, and ERP systems.

With the increasing use of AI over the world companies are looking to integrate AI into their master data management systems as a way to improve efficiency. This has also led to a greater demand for the rise in Cloud-based data management systems.

As enterprises undergo digital transformation, there is a growing shift toward cloud-based MDM solutions that offer scalability, real-time data access, and seamless integration with AI-powered analytics. Cloud MDM platforms enable secure, flexible data governance, allowing businesses to manage multi-source data efficiently without requiring extensive on-premise infrastructure. Artificial intelligence and machine learning are further enhancing automated data management, enabling organizations to detect anomalies, enforce data quality standards, and optimize decision-making. Businesses are adopting AI-powered MDM platforms to streamline data cleansing, deduplication, and classification, ensuring higher accuracy and operational efficiency. Industries such as healthcare, BFSI, and retail are leveraging cloud-native MDM solutions to enhance customer experience, regulatory compliance, and enterprise-wide analytics. As organizations seek cost-effective, scalable, and AI-enhanced data management strategies, cloud-based MDM adoption is expected to rise significantly.

Master Data Management Market Restraints and Challenges:

With these MDM systems, there is a problem with integration as legacy systems can be defensive and the initial costs are rather high.

Notwithstanding its advantages, the MDM market is beset by issues such as organizational opposition, complicated data integration, and expensive implementation costs. Small and mid-sized businesses find it expensive to implement an enterprise-wide MDM strategy since it necessitates a large investment in software, IT infrastructure, and qualified staff. Legacy data silos are another issue that many firms face, which makes it challenging to integrate contemporary MDM systems seamlessly. To guarantee a seamless deployment with the least amount of operational disturbance, businesses must invest in thorough data transfer and governance structures. Concerns about data security also present difficulties, especially for cloud-based MDM systems where businesses need to provide strong encryption, compliance, and access control protocols. Strong leadership, automation driven by AI, and cross-functional cooperation are necessary to overcome these obstacles and create MDM frameworks that are scalable, safe, and prepared for the future.

Master Data Management Market Opportunities:

The growing adoption of AI-powered data management solutions presents a significant market opportunity. Businesses are increasingly leveraging machine learning algorithms to automate data cleansing, anomaly detection, and governance enforcement. As organizations generate massive amounts of structured and unstructured data, the need for self-learning AI models that optimize data quality, consistency, and compliance is rising. Companies offering AI-enhanced, predictive analytics-driven MDM platforms are well-positioned for growth.

MASTER DATA MANAGEMENT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

15.85% |

|

Segments Covered |

By component outlook, end user, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Informatica , IBM Corporation , SAP SE , Oracle Corporation , TIBCO Software , SAS Institute Inc. , Reltio , Stibo Systems , Talend , Microsoft Corporation |

Master Data Management Market Segmentation:

Master Data Management Market Segmentation: By Component Outlook:

- Solutions

- Services

The solutions segment dominates the MDM market as enterprises increasingly adopt AI-driven data governance platforms, cloud-based MDM suites, and real-time data validation tools. Businesses require centralized, automated, and scalable MDM solutions to ensure data accuracy, consistency, and compliance across multiple domains. Companies are leveraging self-service MDM platforms integrated with predictive analytics, machine learning, and multi-cloud architecture to streamline workflows and enhance decision-making.

The services segment is growing as organizations seek expert consulting, integration, and managed services to ensure seamless MDM implementation and optimization. Businesses require customized data migration, governance framework design, and real-time monitoring services to enhance their enterprise-wide data strategy. Companies are also adopting managed MDM services, which provide continuous monitoring, AI-enhanced data quality management, and regulatory compliance tracking.

Master Data Management Market Segmentation: By End-User:

- BFSI

- Retail

- Healthcare

- Government

- Manufacturing

The BFSI (Banking, Financial Services, and Insurance) sector is a major adopter of MDM solutions, leveraging them for customer data integration, risk management, and regulatory compliance. Financial institutions use multi-domain MDM platforms to ensure data accuracy, fraud detection, and real-time transaction monitoring. With increasing data privacy regulations such as GDPR and CCPA, BFSI organizations rely on MDM solutions to enforce data governance, improve customer insights, and automate compliance reporting. In the retail industry, MDM plays a crucial role in product information management, customer experience enhancement, and omnichannel marketing. Retailers integrate AI-powered MDM solutions to unify product catalogues, optimize supply chain data, and personalize customer interactions.

The healthcare sector depends on MDM to manage patient records, clinical data, and regulatory compliance. AI-powered MDM platforms help eliminate duplicate patient records, enhance interoperability between healthcare providers, and improve decision-making in medical research. With increasing emphasis on telemedicine and digital health, hospitals and pharmaceutical companies are integrating MDM solutions for real-time access to medical histories and drug inventory tracking. In government agencies, MDM solutions support citizen data management, fraud prevention, and policy enforcement. Public sector organizations use secure, cloud-based MDM platforms to streamline administrative records, enhance public service efficiency, and improve inter-departmental data sharing. Meanwhile, in manufacturing, businesses implement MDM solutions to centralize supply chain data, optimize equipment maintenance schedules, and improve operational efficiency.

Master Data Management Market Segmentation: By Region:

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

North America leads the MDM market, driven by high adoption of AI-powered data governance, regulatory compliance requirements, and digital transformation initiatives. The U.S. and Canada are at the forefront, with enterprises in BFSI, healthcare, and retail investing in cloud-based MDM platforms to enhance data security and analytics-driven decision-making. Similarly, Europe is experiencing strong growth, where companies are focusing on multi-domain data integration and GDPR-compliant MDM solutions to ensure data privacy and operational efficiency.

Asia-Pacific is the fastest-growing MDM market, with businesses in China, India, and Japan investing in AI-driven MDM platforms to manage large-scale enterprise data, improve supply chain visibility, and enhance customer experience. South America and the Middle East & Africa are emerging markets, where industries such as banking, government, and telecom are adopting cloud-based and AI-enhanced MDM solutions to drive digital transformation and regulatory compliance.

COVID-19 Impact Analysis on the Master Data Management Market

The COVID-19 pandemic accelerated digital transformation, increasing demand for cloud-based MDM solutions and AI-driven data governance. As businesses shifted to remote operations, enterprises prioritized real-time data integration, security, and compliance management through advanced MDM platforms. Industries such as healthcare, retail, and BFSI faced massive data surges, requiring automated data cleansing, deduplication, and synchronization to ensure business continuity and decision-making accuracy. Organizations investing in cloud-native and AI-powered MDM post-pandemic reported improved operational resilience and efficiency. With continued emphasis on data-driven strategies, MDM adoption remains crucial for businesses aiming to streamline digital operations, ensure regulatory compliance, and enhance enterprise-wide analytics in a post-pandemic landscape.

Trends/Developments:

Organizations are adopting AI-driven MDM platforms to automate data validation, anomaly detection, and compliance enforcement, improving overall data quality. Companies like Microsoft, IBM, and Informatica are investing in cloud-native MDM architectures, enhancing real-time data processing and cross-platform integration.

With increasing concerns over data security, regulatory compliance, and fraud prevention, organizations are exploring blockchain technology for MDM solutions. Blockchain-powered MDM platforms provide tamper-proof data records, enhanced traceability, and decentralized control, ensuring greater transparency and data integrity across industries such as BFSI, healthcare, and supply chain management.

Key Players:

- Informatica

- IBM Corporation

- SAP SE

- Oracle Corporation

- TIBCO Software

- SAS Institute Inc.

- Reltio

- Stibo Systems

- Talend

- Microsoft Corporation

Chapter 1. MASTER DATA MANAGEMENT MARKET – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. MASTER DATA MANAGEMENT MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. MASTER DATA MANAGEMENT MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. MASTER DATA MANAGEMENT MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. MASTER DATA MANAGEMENT MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. MASTER DATA MANAGEMENT MARKET – By Component Outlook

6.1 Introduction/Key Findings

6.2 Solutions

6.3 Services

6.4 Y-O-Y Growth trend Analysis By Component Outlook

6.5 Absolute $ Opportunity Analysis By Component Outlook , 2025-2030

Chapter 7. MASTER DATA MANAGEMENT MARKET – By End-User

7.1 Introduction/Key Findings

7.2 BFSI

7.3 Retail

7.4 Healthcare

7.5 Government

7.6 Manufacturing

7.7 Y-O-Y Growth trend Analysis By End-User

7.8 Absolute $ Opportunity Analysis By End-User , 2025-2030

Chapter 8. MASTER DATA MANAGEMENT MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By End-User

8.1.3. By Component Outlook

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Component Outlook

8.2.3. By End-User

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Component Outlook

8.3.3. By End-User

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Component Outlook

8.4.3. By End-User

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Component Outlook

8.5.3. By End-User

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. MASTER DATA MANAGEMENT MARKET – Company Profiles – (Overview, Packaging Type, Portfolio, Financials, Strategies & Developments)

9.1 Informatica

9.2 IBM Corporation

9.3 SAP SE

9.4 Oracle Corporation

9.5 TIBCO Software

9.6 SAS Institute Inc.

9.7 Reltio

9.8 Stibo Systems

9.9 Talend

9.10 Microsoft Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

MDM ensures data accuracy, consistency, and governance by creating a single source of truth for enterprise data. It helps organizations eliminate duplicates, improve decision-making, and comply with data regulations across multiple departments.

Industries such as BFSI, healthcare, retail, manufacturing, and government rely on MDM to manage customer data, optimize supply chains, enhance compliance, and improve operational efficiency.

AI enhances data cleansing, anomaly detection, and automated governance, enabling businesses to improve data quality, detect inconsistencies in real time, and optimize workflows with predictive analytics.

Cloud-based MDM offers scalability, remote accessibility, and real-time data synchronization, making it easier for enterprises to integrate multi-domain data, reduce IT infrastructure costs, and ensure seamless data management.

North America and Europe dominate the market due to strong regulatory compliance requirements and digital transformation efforts, while Asia-Pacific is the fastest-growing region, driven by rapid cloud adoption and expanding enterprise data needs.