Mass Timber Market Size (2025-2030)

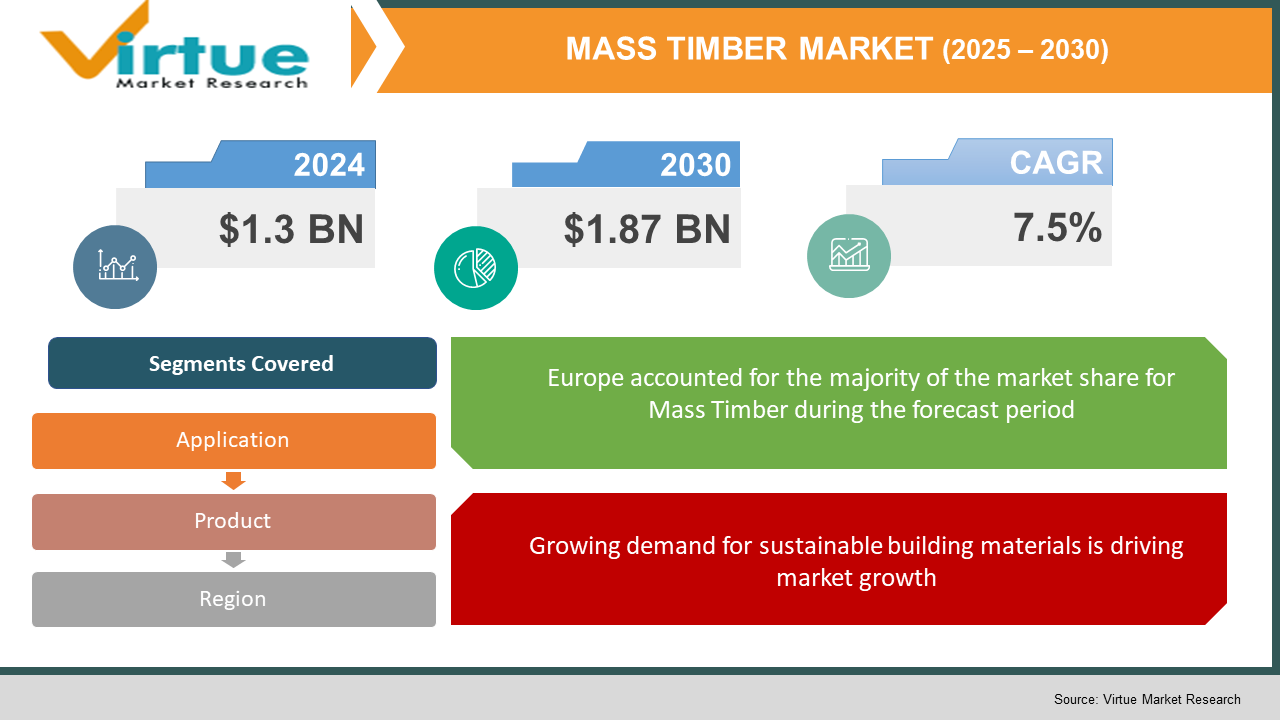

The Global Mass Timber Market was valued at USD 1.3 billion in 2024 and will grow at a CAGR of 7.5% from 2025 to 2030. The market is expected to reach USD 1.87 billion by 2030.

The Mass Timber Market revolves around engineered wood products, including cross-laminated timber (CLT), glued laminated timber (Glulam), nail-laminated timber (NLT), and dowel-laminated timber (DLT), used for structural applications in construction. With increasing awareness of sustainability and the demand for eco-friendly construction materials, the mass timber market is experiencing significant growth. It is recognized for its strength, versatility, and lower carbon footprint compared to traditional concrete and steel structures. Mass timber is widely used in residential, commercial, and industrial construction due to its cost efficiency, lightweight nature, and ease of prefabrication, making it a preferred choice for developers focused on sustainability.

Key Market Insights:

-

The market for cross-laminated timber (CLT) is expected to grow at a CAGR of 8.2%, reaching over USD 1.1 billion by 2030 due to its increasing adoption in multi-story buildings and skyscrapers.

-

North America is witnessing a rapid surge in demand, with the United States and Canada leading mass timber adoption due to government incentives and relaxed building codes favoring wooden high-rises.

-

The residential construction sector accounted for over 50% of the total market share in 2024, as demand for green and energy-efficient homes increases.

-

The industrial sector is emerging as a new opportunity, with mass timber being used for warehouse and logistics facility construction, contributing to an estimated CAGR of 6.5% in this segment.

-

Prefabrication in mass timber is gaining traction, reducing overall construction time by up to 35% and making large-scale projects more feasible.

-

The cost of mass timber structures is becoming more competitive with traditional construction materials, with cost reductions of up to 10% expected by 2030 due to economies of scale and technological advancements.

-

Advancements in fire-resistant coatings and adhesive technologies are enhancing the durability and safety of mass timber structures, driving further adoption in commercial construction.

Global Mass Timber Market Drivers:

Growing demand for sustainable building materials is driving market growth:

The shift towards sustainable construction materials is a major driver for the mass timber market. The construction industry contributes significantly to global carbon emissions, prompting regulatory authorities and developers to explore greener alternatives. Mass timber, primarily cross-laminated and glue-laminated timber, offers an environmentally friendly solution by reducing reliance on concrete and steel. The carbon sequestration capability of timber plays a crucial role in mitigating climate change, as trees absorb and store carbon throughout their lifecycle. Mass timber construction emits significantly lower greenhouse gases during production and assembly compared to conventional materials. Many governments and municipalities are implementing stringent environmental regulations that encourage the use of sustainable materials, further pushing the adoption of mass timber. Additionally, the growing preference for LEED-certified and net-zero buildings has driven developers to explore mass timber as a primary construction component. The rising demand for bio-based, renewable, and recyclable materials aligns well with mass timber’s properties, making it a favorable choice in modern architecture.

Advancements in construction techniques and prefabrication is driving market growth:

The rise of prefabrication and modular construction methods has significantly contributed to the mass timber market’s growth. Mass timber elements can be pre-engineered and fabricated off-site, reducing on-site labor requirements and speeding up construction timelines. This advantage makes mass timber an attractive solution for high-rise buildings, commercial spaces, and institutional projects. Innovations in digital design tools, such as Building Information Modeling (BIM) and computational design, have streamlined the planning and implementation of mass timber projects. These tools enable architects and engineers to precisely calculate load-bearing capacities, structural integrity, and fire resistance of mass timber buildings, ensuring compliance with safety standards. The development of hybrid construction, where mass timber is integrated with steel and concrete elements, is also driving wider adoption by addressing limitations in structural applications. The ability to manufacture large panels and beams with precision enhances efficiency and reduces waste, further strengthening the case for mass timber in modern construction.

Government incentives and regulatory support is driving market growth:

Governments and regulatory bodies worldwide are actively promoting mass timber as part of sustainable urban development initiatives. Building codes and zoning regulations have been evolving to accommodate mass timber in taller structures, breaking traditional height restrictions for wooden buildings. North America, particularly the United States and Canada, has introduced amendments in construction codes to allow mass timber buildings up to 18 stories high, paving the way for expanded market adoption. Additionally, many governments offer tax benefits, subsidies, and funding programs to encourage the use of renewable building materials. The European Union has stringent environmental policies supporting timber-based construction, with initiatives such as the European Green Deal emphasizing carbon-neutral building practices. Countries like Sweden, Germany, and Austria have witnessed a surge in mass timber adoption due to proactive government policies. Public-private partnerships are further fueling growth, with large-scale infrastructure projects incorporating mass timber to meet sustainability targets.

Global Mass Timber Market Challenges and Restraints:

High initial costs and limited supply chain infrastructure is restricting market growth: Despite its advantages, mass timber construction remains costlier than traditional building materials due to high initial investment costs. The production and processing of engineered wood products require advanced machinery, specialized adhesives, and skilled labor, all of which contribute to higher upfront expenses. Unlike steel and concrete, which benefit from well-established global supply chains, the mass timber industry still faces supply chain limitations, including restricted availability of high-quality raw materials and processing units. Transporting large timber panels can be challenging, as the supply chain infrastructure for handling and shipping mass timber components is underdeveloped in several regions. Additionally, reliance on sustainable forestry practices means that production cannot be rapidly scaled without impacting environmental balance. The time-consuming nature of approvals and certifications for mass timber buildings further adds to the cost burden, making it less competitive in price-sensitive markets.

Fire safety concerns and regulatory barriers is restricting market growth: Although mass timber structures are designed to be fire-resistant, safety concerns persist due to traditional perceptions of wood as a combustible material. Fire resistance testing and compliance with stringent building codes remain significant challenges for market expansion. While innovations in fire-retardant coatings and self-extinguishing designs have improved safety, regulatory authorities in some regions still impose restrictions on the height and scale of mass timber buildings. Strict fire codes can limit the use of mass timber in commercial and high-rise structures, especially in regions where traditional concrete and steel construction dominate. The slow adaptation of regulatory frameworks and the need for extensive testing before approvals are granted create hurdles for mass timber adoption. Educating stakeholders, including architects, developers, and fire safety officials, about the fire-resistant properties of mass timber is crucial to overcoming these regulatory challenges.

Market Opportunities:

The growing popularity of hybrid construction, where mass timber is combined with traditional materials like steel and concrete, presents a significant opportunity for market expansion. Hybrid construction enhances the structural strength and load-bearing capacity of mass timber buildings while maintaining sustainability benefits. As urbanization and infrastructure development increase globally, demand for high-performance, sustainable materials is expected to rise, creating a favorable environment for mass timber adoption. Furthermore, innovations in bio-based adhesives and treatments that enhance durability and resistance to environmental factors are making mass timber more appealing for long-term construction projects. The Asia-Pacific region, particularly China and Japan, is emerging as a key growth market due to increasing investments in green buildings and government-led initiatives to reduce carbon footprints in construction. With more architects and engineers exploring mass timber for creative and eco-friendly architectural designs, the market is poised for rapid expansion in the coming years.

MASS TIMBER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

6.1% |

|

Segments Covered |

By Product, application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Stora Enso, Metsä Wood, Mayr-Melnhof Holz, and Structurlam |

Mass Timber Market Segmentation:

Mass Timber Market Segmentation By Product:

• Cross-Laminated Timber (CLT)

• Glued Laminated Timber (Glulam)

• Nail-Laminated Timber (NLT)

• Dowel-Laminated Timber (DLT)

Cross-laminated timber (CLT) dominates the mass timber market due to its exceptional strength, dimensional stability, and versatility in construction. CLT is widely used in mid-rise and high-rise buildings due to its fire resistance, seismic performance, and ease of prefabrication, making it the most preferred segment in mass timber construction.

Mass Timber Market Segmentation By Application:

• Residential

• Commercial

• Industrial

The residential sector is the most dominant application for mass timber due to the rising demand for eco-friendly housing solutions. With increasing consumer preference for sustainable homes, timber-based structures offer energy efficiency, cost savings, and aesthetic appeal, driving their widespread adoption in residential construction.

Mass Timber Market Regional Segmentation:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

Europe dominates the mass timber market, accounting for over 40% of global revenue in 2024. The region's leadership is driven by strong governmental policies supporting sustainable construction, a well-established timber processing industry, and widespread adoption of CLT and Glulam in commercial and residential buildings. Countries like Germany, Austria, and Sweden are at the forefront, with significant investments in mass timber infrastructure.

COVID-19 Impact Analysis on the Mass Timber Market:

The COVID-19 pandemic initially caused significant disruptions in the mass timber market, leading to supply chain issues, labor shortages, and project delays. These factors slowed down production and affected project timelines, creating challenges for manufacturers and developers. However, as the world moved into the post-pandemic period, the mass timber market experienced a strong recovery. Governments and developers increasingly focused on green recovery strategies, prioritizing sustainable and eco-friendly construction methods. This shift in focus led to a resurgence in demand for mass timber as an environmentally sustainable material. Additionally, there was a notable increase in investment in modular and prefabricated construction, which further bolstered the growth of the mass timber market. The market demonstrated resilience, with demand for mass timber in infrastructure projects rising as companies and governments looked to adopt more sustainable building practices. Despite the earlier economic disruptions, the market’s ability to bounce back highlights the growing importance of sustainability in the construction industry.

Latest Trends/Developments:

The mass timber market is experiencing significant advancements with the integration of smart building technologies. Timber structures are now incorporating IoT sensors that enable real-time monitoring of structural health and energy efficiency. These sensors help track the condition of the building and provide valuable data to optimize maintenance and performance. Furthermore, the application of artificial intelligence (AI) in timber design and production is enhancing material efficiency and reducing costs. AI tools help streamline design processes and improve the overall production of mass timber, making it more cost-effective and sustainable. In urban centers, the expansion of high-rise mass timber buildings is gaining traction. Landmark projects are setting new standards for sustainable construction, proving that mass timber can be used for tall, innovative structures without compromising environmental goals. These developments showcase the growing potential of mass timber in transforming the construction industry toward more sustainable practices.

Key Players:

-

Stora Enso

-

Metsä Wood

-

Mayr-Melnhof Holz

-

Structurlam

-

Binderholz

-

KLH Massivholz

-

Hasslacher Norica Timber

-

XLam

-

Schilliger Holz

Chapter 1. MASS TIMBER MARKET – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. MASS TIMBER MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. MASS TIMBER MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. MASS TIMBER MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. MASS TIMBER MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. MASS TIMBER MARKET – By Application

6.1 Introduction/Key Findings

6.2 Residential

6.3 Commercial

6.4 Industrial

6.5 Y-O-Y Growth trend Analysis By Application

6.6 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 7. MASS TIMBER MARKET – By Product

7.1 Introduction/Key Findings

7.2 Residential

7.3 Commercial

7.4 Industrial

7.5 Y-O-Y Growth trend Analysis By Product

7.6 Absolute $ Opportunity Analysis By Product , 2025-2030

Chapter 8. MASS TIMBER MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Product

8.1.3. By Application

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Application

8.2.3. By Product

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Application

8.3.3. By Product

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Application

8.4.3. By Product

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Application

8.5.3. By Product

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. MASS TIMBER MARKET – Company Profiles – (Overview, Packaging Product Portfolio, Financials, Strategies & Developments)

9.1 Stora Enso

9.2 Metsä Wood

9.3 Mayr-Melnhof Holz

9.4 Structurlam

9.5 Binderholz

9.6 KLH Massivholz

9.7 Hasslacher Norica Timber

9.8 XLam

9.9 Schilliger Holz

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Mass Timber Market was valued at USD 1.3 billion in 2024 and is expected to reach USD 1.87 billion by 2030.

Key drivers include the growing demand for sustainable construction, advancements in prefabrication, and government incentives promoting timber-based infrastructure.

The market is segmented by product into CLT, Glulam, NLT, and DLT, and by application into residential, commercial, and industrial

Europe is the dominant region, accounting for over 40% of the global market due to strong sustainability policies and advanced timber processing facilities.

Key players include Stora Enso, Metsä Wood, Mayr-Melnhof Holz, and Structurlam