Mass Spectrometry Market Size (2025-2030)

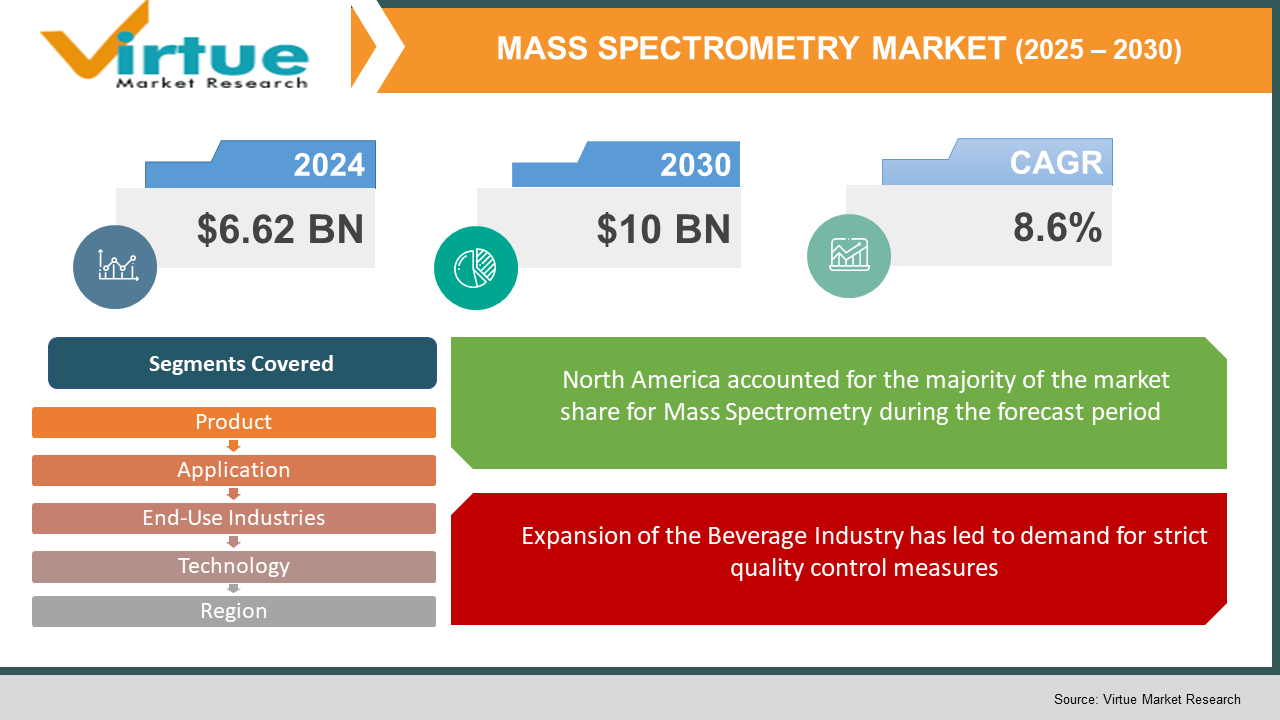

The Global Mass Spectrometry Market was valued at USD 6.62 billion and is projected to reach a market size of USD 10 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 8.6%.

Rising research and development (R&D) in the pharmaceutical and biotechnology sectors, advances in proteomics, and the increasing uses of mass spectrometers across several businesses drive this growth.

Key Market Insights:

- Technological Advancements are the main reason for market growth. Ceaseless inventions, such as the integration of artificial intelligence (AI) for data analysis and the development of high-resolution mass spectrometers like Orbitrap and Q-TOF systems, have enhanced the delicacy, speed, and resolution of mass spectrometry instruments. The incorporation of AI in mass spectrometry enhances data analysis, leading to faster and more accurate results.

- Pharmaceutical and Biotechnology Research and Development (R&D) has paved the way for market growth. The swell in medicine discovery and development activities necessitates advanced logical tools, positioning mass spectrometry as a critical element in these processes.

- Environmental and Food Safety Testing has been on the rise recently. Growing concerns over environmental impurities and food safety have led to increased acceptance of mass spectrometry for precise discovery and analysis of impurities.

- Advancements in Proteomics Research have been noticed. Ongoing developments in proteomics are expanding the operations of mass spectrometry, particularly in identifying and quantifying proteins, thereby driving the market growth.

Mass Spectrometry Market Drivers:

The rising frequency of Chronic Diseases is a cause of concern and has resulted in increased demand for advanced diagnostic tools.

The increasing prevalence of chronic conditions has propelled the demand for advanced individual tools, with mass spectrometry playing a vital part in biomarker discovery and disease diagnosis.

Expansion of the Beverage Industry has led to demand for strict quality control measures.

The burgeoning beverage industry requires strict quality control measures, where mass spectrometry is employed for accurate analysis and characterization of compounds, guaranteeing product safety and consistency.

Technological Advancements in Mass Spectrometry have resulted in the enhancement in its efficiency and accuracy.

Due to ceaseless inventions, such as the development of high-resolution instruments and integration with artificial intelligence (AI), have enhanced the delicacy and effectiveness of mass spectrometry, driving its adoption across various industries.

Expansion of Environmental Testing operations is considered a key mass spectrometry market driver.

Growing concerns over environmental adulterants have led to increased application of mass spectrometry in analyzing pollutants like PFAS and microplastics, thereby propelling the market growth.

Mass Spectrometry Market Restraints and Challenges:

The High Cost of Instruments is a major market restraint as small-scale industries would find it difficult to afford mass spectrometry instruments.

The substantial investment needed for mass spectrometry instruments can be a hedge for small and medium-sized enterprises (SMEs) and academic institutions with limited budgets.

The complexity of the operation makes it necessary to have skilled personnel to handle it, which can be a hurdle for the market.

The sophisticated nature of mass spectrometry necessitates a professional labor force for handling operations and data interpretation, posing a challenge for the mass spectrometry market due to the limited specialized labor force.

Data Analysis Complexity poses a challenge as it requires advanced tools for correct interpretation.

The sophisticated nature of mass spectrometry generates vast quantities of complex data, thereby increasing the need for advanced software tools and expertise for accurate interpretation of complex data.

Disruptions in the supply chain have led to delays in the production and distribution of mass spectrometry instruments.

Events like the COVID-19 epidemic have exposed vulnerabilities in the global supply chain, leading to delays in the production and distribution of mass spectrometry instruments and consumables.

Strict and complex regulatory compliance can be a hindrance to the smooth functioning of the spectrometry market.

Navigating through the complex and evolving rules and regulations requires significant resources in order to deal with it. This can pose challenges for the mass spectrometry market participants.

Mass Spectrometry Market Opportunities:

Mass Spectrometry is seeing a rising application in the field of Clinical Diagnostics.

Mass Spectrometry is opening new doors in the area of personalized medicines and clinical diagnostics. It is particularly used for the early detection of diseases and in monitoring the effectiveness of the treatment. This development presents a significant opportunity for the mass spectrometry market to grow in the healthcare sector.

Developing nations are increasingly adopting mass spectrometry due to advancements in analytical technologies.

In developing regions, there's an increasing investment in sophisticated analytical technologies. As industries in these areas modernize and align with global quality standards, this trend creates new prospects for market expansion.

A massive rise in the concerns related to food safety globally due to increased health awareness presents a major opportunity for the market to grow.

The growing emphasis on food safety, both from consumers and regulators, has intensified the need for advanced analytical methods. Mass spectrometry's ability to precisely identify contaminants makes it an essential tool in maintaining food quality and safety standards.

Technological advancements and miniaturization are considered as an opportunity for the mass spectrometry market.

Continuous innovations in mass spectrometry technology, including the creation of compact and user-friendly devices, are broadening its applications beyond traditional laboratory settings. This progression is creating new opportunities in areas such as field analysis and point-of-care testing, potentially reshaping how and where these tools are used.

MASS SPECTROMETRY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

8.6% |

|

Segments Covered |

By Product, application, end user industries, technology, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Thermo Fisher Scientefic, Inc., Agilent Technology, Waters Corporation, Bruker Corporation, PerkinElmer Inc., SCIEX (A Danaher Company), Shimadzu Corporation , JEOL Ltd., LECO Corporation , Advion, Inc. |

Mass Spectrometry Market Segmentation:

Mass Spectrometry Market Segmentation: By Product

- Instruments

- Consumables and Services

The instruments segment is the dominant one whereas Consumables and Services is the fastest growing segment.

Instruments are the core mass spectrometry devices used for molecular analysis. At the same time, the consumables and services category includes essential reagents, kits, and maintenance services that support mass spectrometry operations.

Mass Spectrometry Market Segmentation: By Application

- Proteomics

- Metabolomics

Proteomics is the dominant segment and Metabolomics is the fastest growing segment.

The Proteomics field focuses on the study of proteomes and their functions, and the metabolomics field involves the analysis of metabolites within biological systems.

Mass Spectrometry Market Segmentation: By Technology

- Quadrupole Liquid Chromatography-Mass Spectrometry (LC-MS)

- Others

LC-MS is the dominant segment and Hybrid mass spectrometry segment is the fastest growing.

The LC-MS technology holds a significant market share and is widely used. Whereas the other sections include time-of-flight (TOF), ion trap, and Fourier transform mass spectrometry.

Mass Spectrometry Market Segmentation: By End-Use Industries

- Biotechnology and Pharmaceutical Companies

- Academic and Research Institutes

- Others

The Biotech and Pharmaceutical segment is the dominant one and the academics and research segment is the fastest growing.

Biotechnology and Pharmaceutical organizations use mass spectrometry for drug development and quality control processes. Mass spectrometry is also employed in various research applications in these settings, and the others section includes environmental testing, food and beverage analysis, and clinical diagnostics.

Mass Spectrometry Market Segmentation: By Region:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

The North American region leads in market share, primarily due to its advanced healthcare infrastructure and substantial Research and Development (R&D) investments. Europe is a growing market second to North America, the growth in this market is driven by stringent regulatory standards and a strong presence of pharmaceutical companies. Asia-Pacific region is the fastest-growing region, attributed to an expanding biotechnology sector and increased healthcare spending. MEA and South America are emerging markets as they are adopting mass spectrometry technologies for industrial and research applications.

COVID-19 Impact Analysis on the Global Mass Spectrometry Market:

The COVID-19 epidemic underlined the significance of mass spectrometry in virological exploration and vaccine development. The need for rapid and accurate analysis of viral proteins and metabolites led to increased embracement of mass spectrometry ways. Post-pandemic, the market is anticipated to continue its growth line as healthcare systems strengthen their logical capabilities to prepare for coming health crises. Researchers developed mass spectrometry-based assays for rapid SARS-CoV-2 spotting, enhancing testing capabilities during the epidemic. The critical need for COVID-19 therapeutics and vaccines led to a swell in demand for mass spectrometry in the medicinal and biotechnology sectors.

Latest Trends/ Developments:

Artificial Intelligence (AI) algorithms are being incorporated to better data analysis, resulting in fast and more precise outcomes. The development of smaller, movable mass spectrometers is expanding the possibilities for on-location analysis.

There is a growing focus on sustainable practices, including minimizing solvent use and reducing energy consumption in mass spectrometry processes. Scientists are creating extremely small, high-performance spectrometers, which makes this technology more extensively available and adaptable for various uses.

Associations such as the Jackson Laboratory are expanding their mass spectrometry capabilities, backed by substantial funding, to further delve into complex diseases.

Key Players:

- Thermo Fisher Scientefic, Inc.

- Agilent Technology

- Waters Corporation

- Bruker Corporation

- PerkinElmer Inc.

- SCIEX (A Danaher Company)

- Shimadzu Corporation

- JEOL Ltd.

- LECO Corporation

- Advion, Inc.

Chapter 1. Mass Spectrometry Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Global Mass Spectrometry Market– Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Mass Spectrometry Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Global Mass Spectrometry Market- Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Mass Spectrometry Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Global Mass Spectrometry Market– By Product

6.1 Introduction/Key Findings

6.2 Instruments

6.3 Consumables and Services

6.4 Y-O-Y Growth trend Analysis By Product

6.5 Absolute $ Opportunity Analysis By Product, 2025-2030

Chapter 7. Global Mass Spectrometry Market– By Application

7.1 Introduction/Key Findings

7.2 Proteomics

7.3 Metabolomics

7.4 Y-O-Y Growth trend Analysis By Application

7.5 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. Global Mass Spectrometry Market– By Technology

8.1 Introduction/Key Findings

8.2 Quadrupole Liquid Chromatography-Mass Spectrometry (LC-MS)

8.3 Others

8.4 Y-O-Y Growth trend Analysis Technology

8.5 Absolute $ Opportunity Analysis Technology , 2023-2030

Chapter 9. Global Mass Spectrometry Market– By End-User

9.1 Introduction/Key Findings

9.2 Biotechnology and Pharmaceutical Companies

9.3 Academic and Research Institutes

9.4 Others

9.5 Y-O-Y Growth trend Analysis End-User

9.6 Absolute $ Opportunity Analysis End-User , 2023-2030

Chapter 10. Mass Spectrometry Market, By Geography – Market Size, Forecast, Trends & Insights

10.1. North America

10.1.1. By Country

10.1.1.1. U.S.A.

10.1.1.2. Canada

10.1.1.3. Mexico

10.1.2. By Product

10.1.3. By Application

10.1.4. By Technology

10.1.5. End-User

10.1.6. Countries & Segments - Market Attractiveness Analysis

10.2. Europe

10.2.1. By Country

10.2.1.1. U.K.

10.2.1.2. Germany

10.2.1.3. France

10.2.1.4. Italy

10.2.1.5. Spain

10.2.1.6. Rest of Europe

10.2.2. By Product

10.2.3. By Application

10.2.4. By Technology

10.2.5. End-User

10.2.6. Countries & Segments - Market Attractiveness Analysis

10.3. Asia Pacific

10.3.1. By Country

10.3.1.2. China

10.3.1.2. Japan

10.3.1.3. South Korea

10.3.1.4. India

10.3.1.5. Australia & New Zealand

10.3.1.6. Rest of Asia-Pacific

10.3.2. By Product

10.3.3. By Application

10.3.4. By Technology

10.3.5. End-User

10.3.6. Countries & Segments - Market Attractiveness Analysis

10.4. South America

10.4.1. By Country

10.4.1.1. Brazil

10.4.1.2. Argentina

10.4.1.3. Colombia

10.4.1.4. Chile

10.4.1.5. Rest of South America

10.4.2. By End-User

10.4.3. By Technology

10.4.4. By Application

10.4.5. Product

10.4.6. Countries & Segments - Market Attractiveness Analysis

10.5. Middle East & Africa

10.5.1. By Country

10.5.1.4. United Arab Emirates (UAE)

10.5.1.2. Saudi Arabia

10.5.1.3. Qatar

10.5.1.4. Israel

10.5.1.5. South Africa

10.5.1.6. Nigeria

10.5.1.7. Kenya

10.5.1.10. Egypt

10.5.1.10. Rest of MEA

10.5.2. By Application

10.5.3. By Technology

10.5.4. By Product

10.5.5. End-User

10.5.6. Countries & Segments - Market Attractiveness Analysis

Chapter 11. Global Mass Spectrometry Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Thermo Fisher Scientefic, Inc.

11.2 Agilent Technology

11.3 Waters Corporation

11.4 Bruker Corporation

11.5 PerkinElmer Inc.

11.6 SCIEX (A Danaher Company)

11.7 Shimadzu Corporation

11.8 JEOL Ltd.

11.9 LECO Corporation

11.10 Advion, Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global mass spectrometry market is experiencing significant growth. In 2024, the market was valued at roughly USD 6.62 billion and is projected to grow to 10 billion by 2030 at a compound annual growth rate (CAGR) of 8.6% from 2025 to 2030. This growth is driven by amplifying research and development activities in the medicinal and biotechnology sectors, advancements in proteomics exploration, and the rapid expansion of biomedical research.

Hybrid mass spectrometry technologies, such as triple quadrupole, quadrupole time-of-flight (Q-TOF), and Orbitrap instruments, dominate the market. The hybrid mass spectrometry section accounted for over 60% of the market profit.

There are various sectors where mass spectrometry is applied, and these are: Life Science Research, Drug Discovery, Clinical Diagnostics, Food Testing, and Environmental Testing.

The COVID-19 epidemic has had a multifaceted impact on the mass spectrometry market. While there were disruptions in global supply chains and a deceleration in industrial projects, the epidemic also stressed the essential part of mass spectrometry in healthcare. Mass spectrometry approaches were vital in COVID-19 testing and vaccine development, leading to increased demand for affiliated instruments and expertise.

The following are the factors that are considered the key market drivers – Technological Advancements, Increased investments in Research and Development area, Concerns related to the environment and food safety. These drivers, among others, are propelling the expansion and embracement of mass spectrometry technologies across various sectors.